Why so many people have apparently gone crazy about cryptocurrency?

How can an investor invest in Bitcoin and other cryptocurrencies, such as Ethereum, Ripple and Litecoin?

Cryptocurrencies are based on Blockchain. Blockchain is based on the idea of decentralization, which uses dispersed payment technology in the public book. If it turns out that it is as efficient, scalable and secure as its supporters claim, it can seriously disrupt the existing payment systems currently operated by banks, just as the internet has disrupted traditional media, communications and advertising. The main idea of Blockchain is that once powerful intermediaries become unnecessary in making transactions, concluding transactions and transferring money. It is no longer necessary to use a bank or other payment service provider. There are four basic ways to invest in cryptocurrencies.

1. Mining

Many cryptocurrencies operate in accordance with the "proof of work" principle. This means that they need miners who verify cryptocurrency transactions. Miners are paid for verifying transactions in their cryptocurrency network. To start mining, you need equipment with high-performance processors to perform the necessary calculations. When choosing your equipment, pay attention to such issues as efficiency, price and electricity consumption. You can also dig using cloud mining pools. It is not easy to start mining from scratch. But gaining the necessary experience and knowledge will translate into regular income in Bitcoin or another cryptocurrency.

2. ICO

ICO (Initial Coin Offerings) sounds similar to Initial Public Offerings (IPO). However, they differ significantly. Unlike IPOs, ICO does not offer any rights or claims to any underlying assets. In the case of the first public offering, the investor is partially the owner of the company through shares or purchase of coins that can gain value in the case of a successful business. However, because projects funded through ICO are usually the initial stages, many of them do not have MVP (Minimum Viable Product). This means that there is always a high risk that the company will collapse and investors will lose money. In addition, because ICOs are not regulated, there is no redress if the money was unknowingly lent to dishonest business. Nevertheless, ICOs have attracted a lot of money - about 3,675,135,293 USD - for 234 issues in 2017, according to coinschedule.com.

3. Trade on the cryptocurrency market

To start trading, you first have to choose the cryptocurrency market, which are many around the world. Equipped with a cryptocurrency wallet, the customer can buy and sell real cryptocurrencies. Buying, storing and then selling to earn a profit works in a similar way as investing in stocks or commodities. However, trading in cryptocurrencies involves risks that do not arise in the case of investments in traditional asset classes. Many cryptocurrency markets are located in risky jurisdictions, without bodies controlling them and guaranteeing entrepreneurs' rights.

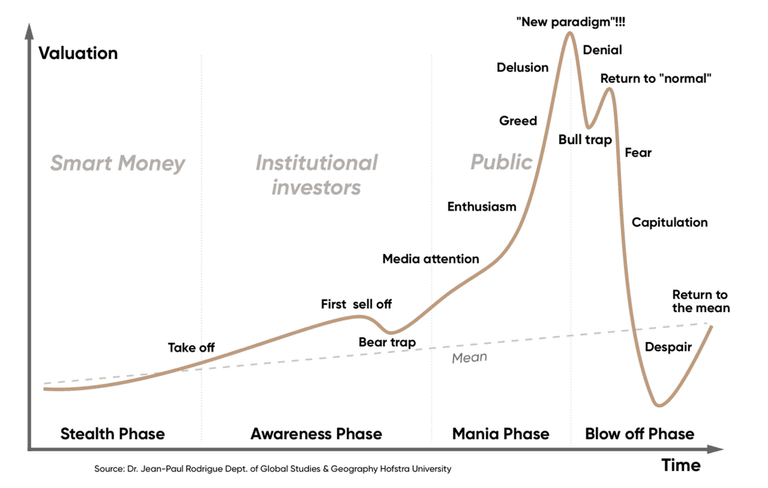

While no one is able to predict market price movements, many say that there is a huge potential for Bitcoin to be worth $ 100,000 or more. One of the reasons is limited supply, although the recent "fork" of Bitcoins to create Bitcoin Cash somewhat undermines the certainty that it will remain so. If you believe the rules, there can be only 21 million bitcoins, of which almost 20% are dead bitcoins (trapped in lost cryptographic portfolios). Others say that Bitcoin has all the characters of a classic bubble, comparing it to silver in the 1880s, dot.com in the late 90s, or mania for tulips in the Netherlands in the 30s of the 16th century. Over the centuries, investors have observed spectacular collapse in the markets when the speculative bubble burst.

This is the classic bubble chart:

There is no doubt that cryptocurrencies are extremely risky compared to more traditional asset classes. First of all, they are always prone to hacking. When the now-defunct stock exchange Mt. Gox was hacked in 2014, about 850,000 bitcoins were lost. The decentralized nature of cryptocurrencies can therefore be both a curse and a blessing.

4. Trading in cryptocurrencies using CFD contracts

Trading CFDs (Contracts for Difference), you do not own the cryptocurrency itself. But you can replace it when prices change. There are two investment options, a long or short position. Long position means that the user buys for one price and then sells for a higher price. He uses the price increase. A short position means that investors can also benefit from falling prices. First, selling at one price, closing the contract circle, and then making a profit by buying later at a lower price. This can be done using CFD contracts. Many brokers give the opportunity to trade CFDs in cryptocurrencies, but it is important that the investor chooses an adjustable broker. For example, Capital.com, controlled by CySEC, offers Bitcoin, Litecoin, Ethereum and Ripple trading. Capital.com is known for its easy-to-use, intuitive platform available on desktops, iOS and Android. Everything you need to join the world of cryptocurrencies is a smartphone. Capital.com provides a leverage for cryptocurrencies up to 1: 5. This means that when buying CFD for 1 BTC, you can exchange 5 BTC. What's more, you can open the position on Bitcoin for as little as $ 20, because you can start trading even with BTC 0.01. Big spreads and no commission on trading is also a plus. You have to remember that everyone trades at their own risk. Once you start trading, you can lose all your invested capital. We will end this section with one more good cue, which applies to cryptocurrencies as well as to other assets.

🚫Do not trade in any way with money that you can not lose!

If you see value in what I am doing, follow me, leave me a comment, give me a upvote and share it with others!

Thank you!

Great post :) Thanks for sharing

Thanks @misschipmunkdiva But i think you don't even read it so how you know its great?

You drop a comment after few seconds that this post was published...

Coins mentioned in post: