Bitcoin has been losing market share to altcoins at an accelerating rate as we see more and more pumps not only among smaller altcoins, but also among the largest ones. These pumps are often driven by four different catalysts:

The announcement of partnerships. Often it doesn't matter how large the company is they are partnering with, how relevant it is or the scale of the partnership (exploratory or full colloboration).

Not a new catalyst, but being added to another exchange is becoming an even larger pump catalyst now that the altcoin market has become so frothy. Even speculation about being added to an exchange (e.g: Ripple to Coinbase) is enough to send a cryptocurrency soaring

Hard forks or airdrops - any event that encourages one to hold a cryptocurrency at a certain block. NXT is a perfect recent example of this

Coin burns or reduction of overall supply (artifical or real) - Ripple locked some of their supply in escrow. Despite this being an artificial decline in supply, it has (in part) driven some of this rally as it has fueled confidence and is the #1 viewed post on Ripple's site for 2017. Tron's coin burning is another perfect example.

These four catalysts drive astronomical returns even when it doesn't make sense. However, all good things come to an end and I suspect that soon, altcoins will flee to Bitcoin. Note that almost all altcoins must be bought with Bitcoin - the opposite is true too (altcoins are sold for Bitcoin). This exodus of altcoins to Bitcoin will occur, in my opinion, after one of three potential catalysts:

A hard fork announcement for Bitcoin with a ton of buzz. Doesn't have to be Bitcoin Cash or Segwit 2x (the original) in terms of size - even something like Bitcoin Gold can cause a frenzy with enough hype and buzz.

The Lightning network becomes increasingly deployed. All of a sudden the narrative will become "once altcoins only advantage against Bitcoin, speed, becomes compromised, what do they have? Nothing - Brand is everything." That's my speculation on how the crypto investor community will think - and I suspect people will think this EVEN IF Lightning doesn't really solve Bitcoin's problems. Note that crypto investors have already illustrated how flippant they are - just back in October, everyone was talking about how altcoins were going to die and Bitcoin was taking back its dominance. Now Bitcoin is going to die because it is slow and expensive. Just wait - the narrative will change, as it always does.

More financial instruments are made surrounding Bitcoin or more institutional hype comes. While an ETF still seems a long way off, we may see a more mainstream product for Bitcoin options than LedgerX. Note that the financial instrument is not the important part - the important part is the idea of institutional investors jumping in. In other words, any headlines that suggest this could easily send Bitcoin soaring - How many times have you heard "get in before Wall Street does!"?

When any of these catalysts occur, Bitcoin will become the predominant cryptocurrency that capital flows to (both from altcoins and from outside the crypto market). The cryptocurrency market as a whole is overvalued right now, but I suspect either way (the bubble further inflates or it pops), Bitcoin will overperform altcoins.

What are your thoughts on the declining dominance figure? I know there will be a wide variety of passionate opinions, so feel free to let me know.

Let me say first that I’ve been following your YouTube channel and I think is top notch. Keep on the good work man. I even liked your recent post about RaiBlocks, it was honest, and for me, that’s all that matters.

I agree with you that most altcoins right now are overvalued, but I think Cardano is not one of them. If anything, Cardano is only slightly overvalued right now (as I write this, ADA is trading for $1.20, something closer to $1 would be a better price IMHO) and I think that when next major release of the project is out (expected for Q2), the price could reach a support level of about $2.

This year started with a huge influx of new people wanting to buy cryptoassets for the first time (myself included) and I think coinmarketcap.com has become somewhat misleading lately. Of the top 10 coins, six have much higher circulating supply (in the billions) than the other four (in the millions), the other four being the staple coins listed on coinbase and most exchanges that accept fiat. People new to crypto initially only care about this top 10 coins, and the metric they use to compare this coins is not volume or marketcap, but price. I think this gives the high supply coins a advantage in that their price feels more accessible and reasonable to the average buyer. Cardano benefits from this advantage, and as soon as Cardano get listed in coinbase and the other mayor exchanges (and I think is a better candidate than Ripple for that), or if archives some kind of important partnership, I see people seeing it as the new Ripple and reaching a marketcap in the top 3.

The main reason I think Cardano’s current price is justified is because of the amazing level of human capital and talent in the Cardano team. Charles Hoskinson, the leader of the team, is like the John Hammond character in Jurassic Park, in that he “spared no expense” in recruiting for this project. People like Philip Wadler, one of the principal designers of the Haskell programming language and a long time wizard of the functional programming world (please check his homepage and tell me you're not impressed: http://homepages.inf.ed.ac.uk/wadler) is designing the language for dapps, among other things. I really need to stress this point about Cardano, I haven’t seen this concentration of sheer talent in ANY other crypto project. The daedalus wallet alone has 9 developers, that’s more than total the number of developers for at least 80% of the altcoins. This is one of the better design wallets I’ve seen in this space and is just getting started.

Everything about Cardano is beautiful, well designed, well thought out and planned. The documentation is excellent, and the YouTube channel of IOHK (the main company behind the project) is very well produced, I’m yet to see anything like this for any other project in this space, and I invite anyone interested in the technology and plans for Cardano to watch the whiteboard sessions, they are surprisingly engaging and noob friendly.

Charles said in a recent interview that his goal for Cardano is to be the first cryptocurrency to reach o trillion dollars in market cap. For that Cardano would have to be priced a about 39$. I believe Cardano has a fair chance of reaching this goal within the next 3 years, and it will prove to be a great long term value investment.

Human capital is valuable and their team is remarkably impressive, but if you told me today that Bill Gates was making a cryptocurrency that was more in the concept stage, I wouldn't pay over $10b for it. I mean that's a unicorn. Your explanations for why it is undervalued explain more why its price is justified, but not that its valuation is which are two separate deals. Ideas can only be worth so much without execution and testing of scale, security, governance, etc.

Just added you to my steemvoter rules for an automatic upvote. Thanks for your work. Really enjoy hearing your thoughts. I listen to you and @cryptoverse daily.

While this means a great deal to me Bill, be cautious - I don't want you to upvote content you don't like from me. I have no issue if you take away an upvote just because the content isn't something you are on board with.

I completely agree that it's now bitcoin's time. Altcoins are now in bubble territory, and I believe that when the crash comes, instead of completely cashing out profits, some people will just keep everything in Bitcoin. It's easier, more practical, and avoids taxes when cashing out.

However, we have thought about this in advance. We need to give time to the mass market to realize this. Altcoins will keep pumping for at least two weeks or one month. Then bitcoin will go crazy. And alts will crash.

Also, you said @cryptovestor that every single coin is overvalued right now. I agree as well because there are no real usecases yet, for any coin... except steem!

Steem already monetizes websites, like steemit, but also Dtube, utopian.io etc... Many people already make a living on steemit. Steem has no competition, there is no other product in the world that does the same thing as steem. You can't really compare it to anything else, and that's why I believe that its valuation can be correct, even undervalued in my opinion. Especially if we take into account Smart Media Tokens which are coming out soon.

Why would people cash out with BTC when the fees are so high and transactions are so slow. Makes way more sense to cash out with LTC or ETH, that's what I do...

LTC and ETH are still altcoins and will probably feel the crash as well.

Not sure about that, many exchanges have also ETH pairs and many people actually buy ETH first instead of Bitcoin because of fees or transaction times

Something that I think is often overlooked is that a lot of new people have no clue what the transaction fees are.

That's what a lot of people do, at least those that don't keep their funds on exchanges (which everyone should be doing).

The fee's and slowness of BTC are just too much to make it a good resource to use and this isn't changing anytime soon.

I agree - people will want to keep money in the crypto market, so Bitcoin will remain the number one option for them to go to. As silly as it sounds, Bitcoin is genuinely the "flight to safety" asset in this field. This euphoria for alts could definitely go on longer, but I don't pretend to know when such things can end so I just take action when I have high confidence an event will happen (altcoins moving to Bitcoin).

I don't like being a shill, but Steem is definitely one of the better ones. It's still got a long way to go though as it is far too abused. Most people would be willing to do what they currently do for Steem for much less money, meaning it is paying out way too much. More importantly, however, is that the reward pool tends to pay far too much relative to the value the content brings to the blockchain (as defined by new users, investors, and views).

Given this, Steem unfortunately is currently a platform that gives more than it takes. This ecosystem will continue to work while we are in a bubble, but when the bubble pops, a lot of content creators will suddenly get slammed by declining Steem value (Steem will go down regardless of whether or not it makes sense just like all other cryptocurrencies). This will be a crucial event in Steem's future.

I hope that the continued development on Steem is able to successfully curb major issues to the platform like abusive self voting, vote buying, disproportionate rewards relative to the value of the post (while subjective, there are some obvious cases that simply should not happen) and many other forms that I won't list here.

Lots of people will lose their ass on altcoins when the correction comes.

https://steemit.com/crypto/@hvlyarmedtrader/the-most-important-video-for-ripple-xrp-investors#comments

If the main goal will be just cashing out through bitcoin when the bubble pop will seem imminent, then the bitcoin crash won't wait for much longer. I know that's not what you said, but if they are not evangelical abot their altcoin and they just wait for the right opportunity to cash out, they will have the same relationship towards bitcoin - it's just that the time to cash out from bitcoin will come a bit later.

I agree 100% with what you say about Steem. Very few people in this environment focus on actually creating value.

yes...

For once more, you speak out the word of logic. The voice in the back of our heads that tells us: "Is X coin that much valuable that deserves a 10 times increase in just 2 days? Does this market cap really represent the issues that this X coin tries to solve, or the new benefits it provides to humanity in this period of time? Does this new alliance/team formation with company X or the new listing in an exchange platform make the coin so much more valuable?" We need to ask all these questions before we place any bets, and more importantly before we miss lead this wonderful technology into a rapid fall.

While I do believe that there are a number of reasons for the existence of about the top 200+- crypto currencies, I am afraid that at the moment most of the market cap is represented by people that have absolutely no clue in what they buy. People that are hoping to catch the next 10x and make huge profits. Don't get me wrong, I my self consider a "wise" strategy to invest 10-20% of a portfolio in many different alt coins, due to the increasing potential of huge incomes, but please please please: always do some basic, 30 minutes research, to find out why and who developed any of the coins in your portfolio.

A final thought on how this could lead to a sudden fall: big players with lots of money invested in this market not only follow the news, but actually deeply understand the uses and practices of each coin. While it is very hard to actually count that into a number (price), it is much easier to get a feeling of an approximate evaluation. So when these people understand that any crypto is very overpriced, they will cash out lots of money and create (willingly or unwillingly) panic which will lead in an even bigger decrease in market cap. Then, as soon as the price returns to the level that represents the real value, they will buy them back.

I don't know if we got a week, or a month, but I feel that we are getting closer and closer. If this happens, I believe that market cap of cryptos will drop 30-40% and bitcoin will rise again to 50% market dominance; thus, maintaining the same price or small increase. I am NOT a financial advisor, and you should all make your own research before you take action into investing.

Why don't we start using crypto currencies as actual currency rather than just using it to buy and sell. It is decentralized and worth nothing but what you want it to be worth so why don't we use it for it's intended purpose? Fluctuating prices hurts it as a currency because I don't want to buy something with 10 coins and then the next day the item is worth 3.

Probably because there is limited reason to use them as one since they just keep going up and its so volatile that you can't price anything in them. Aside from privacy, limited reason to use them for right now.

I don't understand much about Steemit yet but sure like your videos and all content you provide us. Thanks for your hard work!

Welcome to the club - most people don't, even those who have been here a while. Glad to have you over here and thank you for the kind words.

Somebody asked me in my blog why people even talk about bitcoin - implying, obviously, that it is a dead coin - which is an interesting sentiment against the odds.

If you measure crypto in crypto terms rather than those of commodities, you can say that Bitcoin already has a very good use case - it is the coin for trading and keeping value, like you said. In most cases than not, you will need to buy it and hold it to make other purchases. This is the "cash" of trading. Ethereum has a similar application, albeit on a noticeably smaller scale, and it is also the platform for ICOs. So there is another useful coin. Steem, in its weird symbiosis with the actually used product called Steemit, is probably another one although you are encouraged to hold it rather than use it, which does not constitute a pure "use case" in my book.

Everything else is reflective of what this market has been in the past couple of years - buying promises and hypothetical use cases.

That said, I noticed that in the past few months, markets have been moving not just in unison with partnerships, but also in unison with "solutions" to problems. I feel like the rise of XRB, for example, was preceded by the cryptokitties and subsequent talks of scalability. Somewhere around the same time, there was a bit of a rise in decentralized exchanges after issues with Bittrex and Coinbase. Substratum has really jumped on the net neutrality repeal controversy to make a good case for itself, and it is working.

The more I research social media, the more I notice this pattern, and it helps to make good buys. If you want to make money, look for "problems" everyone is talking about or starting to talk about, and buy something that is still in its infancy but promises to resolve the issue.

Now I remember you said that for scalability to be a relevant problem, there must be adoption first. True. But cryptomarkets are clearly not running on actual problems and solutions to them. They are running on "perceived problems". So if everyone starts saying quantum resistance is an issue (seems to be a growing "problem" trend), then whatever promises to solve the issue (or may already have something done for it) will rise like a rocket.

Just my two cents. I guess that's one reason I got interested in Hshare a few days ago that I asked you about. I did some digging around, so please take a look at my analysis (link) if you are interested. I would still love to hear your sobering thoughts on this particular coin for near future.

You nailed this so well on the head that I almost want to buy a ton of Steem Power just so I could provide more value with my upvote: Perception, not reality. I'm doing my best to get used to that, but coming from stocks it can be difficult. But I'm getting there with time.

I am sure cryptomarkets will get as boring as stocks one day. Then the lessons we will have learned from you will be of real value.

I think a transition from perceived to real problems and from perceived to real solutions will be key: that's when the 95% of the market players will fail, and the 5% will thrive into next Amazons and Googles. That will also be the time that will decide the losers and the winners among us, investors.

Until then, I am buying promises of solutions to yet irrelevant, non-existent or hypothetical problems.

Thanks for your reply! I hear you're busy.

Financial bubbles today do not "pop" like they used to. They fade gradually over time. There are a lot more warning signals today when capital starts to shift from one place to another. The bottom is not just going to suddenly fall out like how it did with the subprime crash or the various financial "event" crashes before it. This is especially true with these digital assets that move at the speed of light. Even the most casual retail investor is a lot more connected to the financial world than how it was in the early 90s and early 2000s. I know this because I was there. I remember every crash from the dot com to 2008 housing crash. You are mimicking the exact behavior of the old school popular CNBC bears that would give the same types of analysis with the U.S. dollar, stocks, and bonds. We're in a bubble! Stocks are in a bubble, bonds are in a bubble. Everything is in a bubble.. and not only was everything in a huge bubble, but that bubble was on the verge of popping! Now everyone needs to buy precious metals like gold so that they could hedge themselves from the imminent collapse that was always just around the corner.. every passing year, no matter how many years that growth would just keep trucking along and prove them wrong. Marc Faber, Peter Schiff, Jim Rodgers.. They used to call these guys the horsemen of the apocalypse. lol. All the gold bugs warning everyone that the bond yield curves were flattening(which they are), U.S. government debt was going to imminently default, and that there would be this massive exodus from stocks and bonds into the only thing that had "true" value.. Gold. I listened to these people for years and put tens of thousands of dollars into silver and gold bullion. You know what? Nothing happened. The apocalypse did not come. My investment actually depreciated. Jim Rodgers today is starting to evangelize Bitcoin now. At least he admitted that he was wrong. I'm still waiting on Schiff ;).. The reality is that people slowly shifted money away from the things that were depreciating in value and into the things that were appreciating. Nothing "crashed". It just faded from one place and into another. It's hilarious when you see financial news on TV, the DOW goes down a couple of points and everyone calls it a "crash". People move their money in a timely manner. Maybe it's bonds one week, maybe it's stocks. Then there is Bitcoin. Everyone saw that this was actually storing their value most effectively and went there. People trusted it.

Did they go to gold? Why not? Because this would have been the obvious, clear and safest choice seeing that it was historically THE established hedge, right? I mean it's just the most logical choice. Why did Bitcoin win out over gold? Why would people flood to an entirely new and unproven asset? Because this is what the market decided and they reacted to it. I was a huge metals stacker in the early 2000s and when Bitcoin came into the scene, was highly skeptical of it. I told myself that there is no way that the US Dollar price of 1 BTC would be higher than the spot price of a single gold bullion. Boy was I wrong. Social proof is a very powerful influencer.. and the people decided.

Those doom and gloomers did not foresee so many things in terms of rapid technological and financial development. Bitcoin made way more sense than gold as a viable medium of exchange in hyper-inflated countries like Argentina than gold did. It was fast and efficient.

Now I'm hearing the same kinds of gold purists talk this way about Bitcoin. That eventually, people will tire of the altcoins and go to the one true place where there is real value. Bitcoin. It all just sounds so familiar to me. :) Just replace "gold" with what you are saying is Bitcoin. The one true coin! You see what I'm getting at here? It didn't matter how much further established Bitcoin is, this doesn't mean everyone will default to this.

All those doomsayer financial prophets are pessimistic by nature, which greatly affects their outlook, especially when they see a lot of green, but after a couple of years, it become more of a desire to realize a self-fulfilling prophecy than to look at the contrarian evidence that proves them wrong. The VIX is at an all time low right now. There has never been more investor confidence. We're in uncharted growth territory right now and there is no way to accurately call a bubble at this moment. Just because there's a lot of green on that board, doesn't mean it's all speculative frenzy buying driven solely by those catalysts you mention.

I think you will be waiting along with Schiffs dad.... I remember my first introduction to bitcoin when all the YouTube stackers we making fun of it by presenting an empty coin slab and calling it rare. One guy recognized its potential and hit the mining hard, think his name was davincij15. It's sad to see Jim Richards waste his tweets on bitcoin bashing but I guess he has nothing better to do. It just goes to show you that the people that have the ability, whether gifted or learned, to recognize shifts like these, are properly rewarded. I can't stand it when people point at early adopters and complain about their winnings and call it unfair.... Not only was money put on the line, but so was reputation and to some that has more value.

It's very common behavior with these older financial gurus. They can be very stubborn and set in their ways. I respect a lot of these people, including Richards, but it takes some humility to admit that you were wrong, especially after being a believer in something for decades. Got to put ego aside and fame makes it tough for a lot of them.

I heavily disagree with this assessment, but I respect the time you put into it and I know this is something you've thought a great deal about over time. My issue with it is that bubbles aren't due to information disconnects - Most people know that Bitcoin and cryptocurrencies are a bubble, even many ardent believers like Andreas Antonopoulos. The reasons bubble form is due to human nature and I don't think ANY technological innovation will change that, not even the internet. In fact, I think it magnifies it. Most people are lemmings. They buy into the hype and they sell into the dump. It'll happen, that I have zero doubt of. But unlike many other gold bugs and other naysayers, I'll dabble for two reasons:

So many new people know about Bitcoin because of its price. Even when it pops, we will have thousands of developers in blockchain just because of it and they won't want to leave.

At the end of all this, once true markets develop that offer products with utility, I don't see how we have more than 3 - 4 functioning cryptos with appreciable use. We have 3 - 4 main credit card companies (Visa, MC, Discover, Amex), 1 main payment system (Paypal), and I'm sure I could think of other industries that have settled on 1 - 4 main players. I just don't see room for more than 3-4 cryptos maintaining today's elevated market caps, and the ones that do would likely go through a crash before reestablishing themselves.

The bottom line is that neither little old grandmothers nor I want to convert our cryptos into one of the 1'000's of cryptos out there used by any particular company. We want something like Paypal, with a single system that is universally adopted. This is not just for ease of use, but also to maintain the value of crypto's (remember, one large impetus for their creation was all the QA being done by central banks).

There is one way I could see having more than single digit cryptos in the long run ... if each country or region has their own crypto unit, pegged to their local currency. But if this occurs, they are weaker as a store of value impervious to central bank manipulation.

Ultimately, I'm hoping that 3 - 4 cryptos rise to the top over the next half decade, and I am lucky, insightful enough to have purchased one of those four.

This is a good point, but it's still confined to the old financial paradigm. It isn't a sure thing that just because the credit markets today ended up consolidating to 3-4 choices(Visa, MC, Discover, etc), that we would use that evidence to judge what the financial structures of tomorrow will most likely be. It's a little too "zero sum" thinking. Remember, one of the goals of crypto is to bank the unbanked. Today, even with the juggernaut financial institutions that Visa, MC, Discover have, there remains millions of people on this earth that are not their clients. My guess is that the competitive pool will increase to a much bigger size than what we are used to. That's what decentralization always does. Increase market competitors and offer more choices to the consumer. It doesn't have to follow the 3-4 winners on top and everyone else dissolves prediction, just because this is the way "it's always been". In the original post, Crypto Investor writes:

"These four catalysts drive astronomical returns even when it doesn't make sense. However, all good things come to an end and I suspect that soon, altcoins will flee to Bitcoin. Note that almost all altcoins must be bought with Bitcoin - the opposite is true too (altcoins are sold for Bitcoin)."

On what basis does it "not make sense", and how can we possibly know with certainly that those 4 catalysts are the primary drivers of all the growth in that space. It may be that those things spark those runs, but there are plenty of investors that are now coming into the space that don't care about Reddit posts or even look at the internet community following these things.

The big assumption here is that this will remain the same going forward. It might have been that altcoins and Bitcoin always had an inverse relationship with each other, but if you look at the trends going forward, you can clearly see that the relationship between the two are starting to slowly decouple from one another. This can be difficult to admit if you've spent a great deal of your crypto life evangelizing Bitcoin as "king". Again, it's this trap of zero sum thinking. We cannot foresee a major game changer coming down the road that will throw all of this analysis out the window. The past is great tool to speculate on the future, but it should be recognized that variables change constantly that make those old models obsolete. and a reassessment based on new information not known before must occur internally. One other thing that crypto investor may not realize here as well. Fiat is ALSO a position.. and it may be the case that fiat will be paired to more alts in the future, with exchanges dealing with a variety of positions that you can go in an out of. I can see all of this floating against each other in a much bigger and open market. Fiat to BTC, BTC to ADA, Stellar to fiat, Crypto to gold, Ripple to USD, to Yen, whatever. I can see the old credit monopolies being replaced by a much bigger list of lenders, all offering multiple tiers of financial services to meet very specific needs. Decentralization opens up markets, it doesn't limit them to a few.

"The bottom line is that neither little old grandmothers nor I want to convert our cryptos into one of the 1'000's of cryptos out there used by any particular company. We want something like Paypal, with a single system that is universally adopted."

^Grandma might not necessarily be expected to even know this. There are lots of projects working on under the hood universal wallets. Think about Bread(BRD) for example. I can see this type of project evolving into a one click payment solution that converts to anything. Atomic swaps under the hood. Today, apps like RobinHood made it so easy to invest. Any kid can buy and sell a position in a stock now. This was unheard of in the 90s.

Basically, my outlook for the future is more optimistic here. Sure, there WILL be losers in this competitive space, but I personally feel that there will be a lot more winners that we realize, and I hope we all come out on top. Cheers! :)

I am definitely guilty of focusing in on one of the original applications when I bought Bitcoin over 4 years ago, that of a currency not able to be manipulated by the central banks. Your point about grandmothers is excellent, companies will have to build a LOT of front end architecture that makes exchanging coins user-friendly for mass audiences. Cheers to you too !

I could see there being a few just based on the fact that the infrastructure is just starting to be built. The only way to get a monopoly in cryptos is a coin that works for everyone. Not going to happen.

I don't think it will be that few, just because there are use cases beyond "currency." But in terms of currency, yes there is limited room for success. Part of what I like about crypto is that it is so much simpler than having to deal with USD, EUR, JPY, GBP, etc. But if you got 50 different spending currencies, then I guess that's not really the case. Probably will be a mainstream currency and a privacy currency that will operate side-by-side and become adopted as a side option to existing centralized solutions.

Thank you for annother awesome video, I have been following you from the begining and love your approach to this market.

I totaly agree with you on the altcoin evaluation insanity. Like you said, alot of the businesses behind these altcoins do not have a working product, they do not have revenue streams. I would like to see more transparency with regards to accounting on these companies considering the insane amounts of money raised with ICO’s. Don’t get me wrong, it’s OK to invest in an ICO if you believe in the team and the project they propose, but to have coins 6 or 12 months after their ICO that have done nothing and the value has gone up makes me wonder what are people thinking?

I personally believe that at the moment most of the new money that is coming into the market is dumb money and therefore they seek quick and large gains. Now, if we look at the insane 30-40x pumps that some of these altcoins have on regular terms, it is logical that that money goes towards these coins. Think about it, you gamble on 5 or so altcoins and 1 of them hits a 10x run and you double your money. That is the though process, I know alot of people that think like that and have made money from that type of investing. More worrying, these pumps are driven mainly by roumours and weak news, like you pointed out in your ripple assesment, which I believe only proves even more how dumb that new money really is.

Now, as I see it, this cannot last. I think in 2018 ICO’s will become regulated and also eventually the new money will slow down. I agree more with the whole market cap going down scenario, because many of these altcoins are hugely overpriced at the moment and as time goes by they will prove their inability to make good on their promises. We are allready seing many projects that have not kept up with their roadmap, so I expect them to be downgraded soon. Also, it would be nice to see the market filter out some of the scams.

Thanks for the thoughts dadandburried - hits the nail on the head in many cases.

“The way any of these crypto currencies should be priced is based off the utility they provide the world. The same way that companies are priced. They should all be based on some sort of reality.” Based on this rationale, one would think you'd be a proponent of XRP, but I know from your other posts that you are not. As a trader, I couldn't agree more with your Exodus prediction, but as an investor, I don't see alt coins (specifically XRP) and Bitcoin being mutually exclusive. To the contrary, I don’t believe that one can exist without the other during the migration from FIAT to crypto. While I would like to see the world become unbanked, the reality is that it IS banked. It has been for hundreds of years and unwinding this system-with trillions of dollars at stake and a more immeasurable amount of global power and influence-will not happen quickly. If it happens at all, it will be a transition, and a volatile, and perhaps violent, one at that. Most argue that XRP is tied exclusively to FIAT (via their focus on serving banks). But technically speaking, XRP is currency agnostic. It is a settlement system and currency exchange and Bitcoin is a currency. Other than ideology and bias,** there is nothing prohibiting XRP serving as liquidity solution for Bitcoin.** In reality, based on both the Ripple and Bitcoin ledgers, XRP is already working in this capacity. To transition the world from FIAT to Bitcoin requires a bridge (maybe several). While I understand the sentiment towards Ripple, they understand what so many idealists are unwilling to accept: banks do exist and hold the FIAT we have all relied on to conduct commerce our entire lives and the generations that came before us. They are not going to simply let go of it without a fight. Brad Garlinghouse has been very open and articulate about this fact and developed a practical strategy to create a viable company that has one foot in the old world and one foot in the new world. While it’s easy to hate these people, and conveniently label them as part of the problem, in all practically-no matter how bitter a pill it is to swallow-even the most passionate bitcoinista would reluctantly admit (if they are being honest) they need Ripple (or something like it) for this grand experiment to ultimately succeed. Not from a technical standpoint, mind you; of course there are other possibilities, but form a political standpoint. The banks and powers that be need to trust someone in this space, and that someone cannot be a loose affiliation of developers and anarchists spread around the world. “The greatest trick the devil ever pulled was convincing the world he didn’t exist.” Maybe the devil, in this case, is Brad Garlinghouse and the world is Jamie Dimon.

Dang, it's about time someone did their homework. Impressive to say the least. The issue I take with banks is fractional reserve lending with debt-based fiat.

I really don't dislike Ripple like most people do - as in, I don't care about the politics. I'm not afraid to dabble in Ripple and trade it, but I wish it was a public company required to disclose WAY more info than they currently do. But they are definitely one of the better teams out there and I can tell they are committed to offering a real product, which I like. It's just that, again, I'd rather buy some stock in Ripple than XRP. To me it's like a hybrid between a cryptocurrency and stock investment, and I'd rather just separate the two in most cases.

As a relative newbie who got into the space around October I'm now properly scared. For me investing into altcoins was the most logical way to make profit because putting 250$ in bitcoin aint gonna make me rich.

Now I've built up a bit of capital <10.000$ and it looked like it would be the year of alt coins. But this video scares me as I understand what you are saying but right now this is my best bet for profit. I wonder now when I should cash out to bitcoin then.

This is really quite hard to ponder. All I've experienced in this market is rockets and mooning and pumps and hypes and money just flowing in. And I'd like to keep what I made.

Currently everyone else is pretty much bullish on the market and it makes me feel like we are going to the moon in 2018.

Now I'm in doubt because well if most youtubers and other people are so positive and you @cryptoinvestor are that guy yelling in the streets with most people ignoring you predicting sort of an apocalypse. I simply find myself not wanting to believe what you say.

And if so many people are positive on it then how far can they push this bubble in front of them because in the end as long as people just keep putting in more money then we are all set to keep going the way we are.

I'm very much in doubt about what to do next because yeah most of my money is in alt coins. Because my small investments might as well have been on my bank account if I had put that into bitcoin when I entered the cryptospace.. it would still be about the same amount now.

Your dilemma that you are dealing with right now is exactly how bubbles happen, so I hope you can remember it as a useful exercise with investing. Altcoins are a bubble within a bubble - Cryptocurrencies are a bubble, but altcoins are like a super bubble (which seem to be correcting a bit now at least). I can't help you with this. There is much more money to be made in altcoins, that I won't hide from you. There is also far more money to be lost. Nothing will teach you this but experience. I hope you don't ever gain it though!

Remember to always think with logic then emotion. Always look to take profits when there is a surge. Little by little take away from your position because it's better to miss out then to lose it all. Forget about how much you COULD make and think about how much you made now. Look back on how far you've come and remember that you never made money if you didn't sell.

One could say the "never made money if you didn't sell" makes sense, but what if I already made money by selling my fiat?

I could not say it better. I am currently experiencing same thoughts, for me it is too good to be all true.

I'd say cash out your initial investment, plus a little interest earned? and let the rest ride. Its all a confidence game. I bought my first .1BTC when it hit $900 the first time. I knew I was getting in at an all time high but if I didn't own any I couldn't learn what it was. Being honest with myself built my confidence because I got out of it exactly what I wanted, knowledge. I understood what it was and that it was and still is the best form of money available. Just stick to your principles and learn as much as you can.

These are my 3 cents which fit in your view:

Regarding the first catalyst for bitcoin turning bullish again: there is already a hard fork in the making: bitcoin private (https://bitcoinpvt.org) In fact it already pumped zcash classic, because you'll get BTPs if you hold bitcoin OR ZCL at the time of the fork. (see also https://coinmarketcap.com/currencies/zclassic/). The fork is timed in a couple of weeks. Unlike Bitcoin Gold (which is a joke) it could gain some serios traction (50 contributors, ZN-SNARKS, 2MB, segwit, yadah yadah)

From a TA perspective it looks like a HS was prevented - but i'm not a TA expert - which is also slightly bullish.

Sooner or later a ripple or raiblocks or tron is gonna implode just by it's own weight without having bitcoin doing anything significant.

Btw. thank you for promoting STEEM. A lot of people still thinking its a scam, which is sad. Despite the recent price action, the numbers (new users, posts, comments) are exploding.

Thanks for the thoughts humbrie. I'm not sure Bitcoin private will do the trick as there isn't too much buzz about it (some humming though - never know). I can understand why people think Steem is a scam - the money seems to come from thin air and an absurd amount of it gets paid to posts that provide nearly zero value (which is disappointing). I like being part of this ecosystem, but I can only hope in the long-term it attracts more high quality contributions and fairer payouts. I believe there is a chance though - many passionate individuals fighting for this very idea.

I agree with you that most coins are overvalued including Bitcoin. Also really enjoy your videos. Look forward to your next one. However, with many coins being overvalued in terms of usability and speculative, but with many newer coins promising more functionally than Bitcoin in the future, it seems psychologically easier to buy 10 units of a more promising cheap coins than 1/10000 of a Bitcoin. Bitcoin was a first mover and has name recognition but being Gen 1 has been limiting. Many altcoins with billions of coins available will at most be worth a few dollars with most over time, but they allow for more people to own full coins, which is psychologically enticing. Especially people that are looking for the next big thing (Gen 3 vs Gen 1). The more the price of Bitcoin rises the more intimidating it will be for new investors and individuals who would prefer to own whole coins instead tiny fractions. Unlike Bitcoin early adopters, a lot of people investing in Ripple, Cardano, etc, do not have a problem with banks or fiat money. Seems easier to think the price of a coin can rise from $0.10 to $1 than for a coin to go from $16k to $160k. Lets see what happens, but the high price of a Bitcoin for some is intimidating, especially with the fork situation (19 forks in 2017 and already 4 in 2018). Maybe instead of increasing its dominance again, Bitcoin continues to shrink down to 20% dominance or lower over time.

We seem to share some of the same opinions.

I had a discussion with some of my friends about the state of the space (in terms of price), and we all agreed that we wouldn't be surprised at a huge crash when the market cap hits the trillions.

The psychology I'm seeing in the market seems to align with conversations that I've had with newbies. Many of them mention low price without consideration of supply, market capitalization, total supply, and other figures. There is a massive hype train behind many of these projects, and people seem to forget FAST about things. I'm reminded of this every time I go to the mall and ask random people about what they think.

Back to the hype train.

Ex: We're on the ripple hype train now. Before that it was Cardano. Before that it was IOTA. Before that it was NEM. Before that it was LiteCoin.

Am I bullish long-term on crypto-assets? Of course. However, I do understand that MOST of these crypto-assets may not be here in the long-run!

Many, if not ALL of these crypto assets are over-valued. Like you said, some of these projects have been going on for YEARS with no product.

This leads us to the question, how do we even value a crypto asset?

A few people working on that last question, which makes me happy. Definitely follow Chris Burniske - he turns up most of the valuable insights from people attempting to answer that question (along with his own attempts).

I think the reason for the current situation is the fact that we have a lot of new players in the game and they are not prepared to pour 10-20k in one go at the beginning. On top of that we have an element of psychology here.

When I first started investing myself I wouldn't really buy any of the big coins, because I used to think, that If I purchase let say Dash for $1k and it grows by 20% I'll have only $1200 but if I spread that 1k and buy 4-5 cheap coin in bulk for 0.05 and the price goes to 0.10 I'll have a 100% return and we've seen this in the past with Ripple, Verge and now Tron.

Smaller investors (usually newbies) prefer altcoins because they are exciting, they move a lot, BTC was up and down in last month or so but not as much, we had some big dips but in general it was't that bad.

I feel that people look at BTC and they think it's a "boring coin" they want those "fast and furious " coins that will get them "lambo" very fast. But we will see in time. My prediction is that BTC dominance will stay at around 35-45% as long as the stream of new people buying crypto will keep flowing steadily into the cryptosfere.

I hear a lot of people comparing cryptocurrency market caps to company market caps. "Ripple's market cap is higher's than Goldman Sachs!" You mentioned in your video that this was a legitimate way to check if a coin is overvalued. While I agree with you in that every single coin is overvalued in this market, do you think the comparison is accurate? To me coin market caps represent the value of the economy that the cryptocurrency revolves around, not the value of the company/organization that created the crypto asset.

Take for instance Publica (https://coinmarketcap.com/currencies/publica/). They've done nothing and they have a market cap of ~35M, so definitely overvalued. But what they're really doing is trying to create a whole publishing economy of its own. If they succeeded, don't you think the market cap would be much higher?

The main word in your sentence is "if". Let me put it to you this way: if you went to 100 angel investors and pitched them this idea, how much money do you think you would raise? Probably 0, or if some of them liked you, they would take a 50-100k punt. But you would never ever get 35M... without anything but a 350 dollars site. If they manage to build the platform, if it works, if it gets adopted, if it generates revenue for everybody involved, then you have a business. But, as you can see, there are alot of iffs.

Think about it, in the real world you first have to build something before it has any real value. An ideea is worth nothing...

Let me give you annother one: TokenCard TKN has a market cap of 65M and, not only have they done nothing, not only have they not delivered on their roadmap, but there are currently other similar products that work perfect and therefore nobody even needs it at this point. Yes, they promise some really nice tech, but it's just promises. So, I ask you, what is going on?

Oh I completely agree in that coins are overvalued. What I'm saying is that I don't think it's accurate to compare the market cap of a coin to the market cap of a security like a stock since coin market caps represent entire economies. I think that in general, coin market caps have the potential to be much larger than stock market caps.

It's not a fair comparison at all, no. Obviously if it's a currency, then it needs to be large enough to support the $ volume of transactions done on the network (as opposed to being the accumulated size of fees on the network like Paypal). In addition, there are some expectations of future value. In stocks, we actually have a way to estimate future value. In cryptocurrencies, it is difficult to mathematically calculate them, but it is the same concept: You take the future perceived value and calculate present value with a discount rate. The discount rate increases the higher the risk is. In other words, with your example, the less likely it is they create a publishing economy (which when they have done nothing yet, is pretty low), the higher the discount rate is. The concept applies regardless of whether or not we can actually accurately estimate the inputs.

AUDITED FINANCIALS

I agree with your opinion about the valuation of alt coins. In the last couple of weeks I invested my time to ask most of the companies that I'm invested in, if they are going to publish audited financials. I got no for an answer in all cases except from a token called Hedge (HDG). I understand that this market is not regulated as the traditional markets, however in my opinion this is a huge red flag for what's going to happen in the future.

THE WALL STREET INVESTOR.

The Wall Street Investor is sophisticated, they won't just through their money in the first project that they "think it's amazing". They would want to see P&Ls, Balance Ssheets and Cash flows together with notes and comments about the future plans. How many of this projects are ready to do this? How many of these projects are going to get the big Wall Street bucks?

THE CRYPTO INVESTOR

Most of the investors in this market are relatively new to investments. I've noticed that in most cases they have put their money into a project and they haven't read the whitepaper (in many cases probably they haven't event visited the company's website)!!! In my opinion this is a huge risk for the market.

I would really want to hear your thoughts in a future video about the lack of reporting in the crypto market.

I think you should start mentioning in your videos that not all lengthy posts make money for people. It's the idea that is discussed that will make people hit the like button. I think people took your comment on the lengthy post that maid money as bible and try to right their own book instead of a comment!!!

Yeah it's difficult to keep up with all these, but actually quite a few high value contributions so I'm fine with it - I think anyone who scrolls through this comment section won't be disappointed with the amount of info they'll find. I am happy that I attract people who have such thoughts.

I've been following your channel since you sold most of your Bitcoins at 10,000$ and shifted to Altcoins instead (Nov 28).

Since then you had to take a lot of shit from everyone because Bitcoin went up to 20K$, and the overall Altcoin market cap went down.

I believe and hope you've stuck to your guns as Bitcoin is now at 15K$ (multiple of 1.5) and the Altcoin markt cap went up from 140K$ (Nov 28) to now 510K$. That's a multiple of 3.64.

And don't anyone tell me one could have held on to Bitcoin till 20K and only then switch over to Altcoins. Nobody can foresee these kind of peaks.

This channel teaches me how to think counterintuitively. Keep up the good work!

I did capture the altcoin boom of late December because I had mostly altcoins when everyone was hyped over Bitcoin. Happy to hear I could help!

This market is completely crazy! I'm even afraid of what might happen in the near future.

It is no longer about who has a better crypto, but about who has a better marketing.

We have seen almost no developments in technology and the markets are crazy. How can a re-brand, or listing in a new exchange increases the price of a crypto at 100%?

We are losing a bit of the notion of reality. Let's enjoy it while it lasts, because there has never been such a distribution of wealth, but we are being driven by greed.

As for bitcoin, of course it is still the currency with the most recognition and security of all. But what matters is no longer the technology, but the easy gains. So I fully agree, that as soon as we see a new bear market in the altcoins, there will be a race to bitcoin, even because they have to go through bitcoin before going to FIAT.

I wish everyone could make a lot of money with the cryptos, but as you know, for some to win, some will have to lose. So take some profits off when you can, or at least activate a stop loss so you do not get caught off guard.

Don't bother trying to predict perfect timings on this market, there is a lot of variables that we can't know for sure if and when they influence price.

1- It only takes one personality, or 2 or 3 youtubers talking about something, the price of that coin is going up 200% in 3 days. And once one youtuber finds a cool coin (looking at you raiblocks), every other youtuber will talk about that, and the word is out, and the coin will be up 5x or 10x.

2- Announcements are made without a lot of time to antecipate.

We have absolutely no way to predict these kind of things. But I guess it can be wise (yet ridiculous) to get notified on every news and videos about coins, and if you can spot it early on, one can try and place some of their holdings on it, just for a quick profit afterwards. Like Verge.

Take Verge per example, with McAfee

So my guess is to play it safe in this market, don't let yourself get affected by the FOMO especially, and just keep focused on making consistent, somewhat safe profit.

Yeah I don't go for perfect timings for that exact reason. I just move capital around as I see things change. That's why I was way early on altcoins, which eventually had their day. Now I'm going big on Bitcoin and I wouldn't be surprised to see that go against me for a month or two as well. But I think there will be a time that comes to pass when those funds move from altcoins to Bitcoin, so I commit to that now. We'll see what happens eventually.

I made an hypothetic TA on a possible apocalyptic crash of BTC/LTC/ETH, check it out ! (it will recover after that if it happens, I'm sure of that).

https://steemit.com/bitcoin/@adri1202/btc-ltc-and-eth-apocalyptic-hypothesis-i-ll-hodl-no-matter-what-and-btfd-if-some-conditions-are-met

I also think alts goes up because BTC goes down, BUT, when BTC will explode again (and it will in some weeks), alts will crash for some time, then investors will diversifie their investment in alts, maybe just to grow their BTC capital by trading on BTC pairs while BTC continues to go up.

What has also to be taken account of is the fact that some alts have a tech that BTC has not and will never have, of course all alts that are only some random currencies wannabee will crash (besides LTC/ETH/BCH imo) but when a tech, an app, or some specific currencie use (like THC, you can laugh but it can be usefull and away of BTC volatility) will stay and grow.

Like in the 'internet bubble', a lot will try, few will succeed, but overall the crypto world will go up and up. The real game changer will be smart contract on BTC, ETH will be in trouble, and some independent alts, even with an good and original tech, will take a hit because the BTC smart contract token will have a better reputation and will seem safer (true or not, it's what investor will think that counts).

This makes me beyond happy.

I had a conversation with my friend at work today and described to him the exact same 2 possibilities that you just described. He is extremely skeptical and is hodling for the long run, which is okay because he tends not to scare out on crashes.

The one exception I did present, and I would love to hear your thoughts on, is that of ETH.

While I do think that ETH will go in a downwards direction, I feel it will still hold a strong position. People really appreciate ETH, and with all the application its getting, a lot of people are in it for many different reasons.

Personally I'm still pretty bearish on the entire market, and am sitting out in fiat for a while, however I do hold some ETH as an alternative currently. My plan is to push it to BTC shortly and see where we go from there.

Thanks for the upload! I'll make sure my buddy gets a watch on it.

Cheers

I'm still bullish on ETH - nothing has changed since my last video. I do think it is overvalued like other cryptocurrencies, just not as much and has plenty of potential catalysts to send it soaring in the future.

Thanks for the response. I feel pretty aligned on these thoughts.

There has been no lack of excitement in the market for the better part of 3 to 6 months. Fun times!

Cheers

The dominance figure doesn't represent what you mentioned in the video. BTC is the gateway from FIAT into crypto. This gate will be the primary reason why BTC will hold its value, at least until more Alt-Coins get accepted at exchanges for FIAT to Crypto.

Presently the Fee structure around BTC is severely hindering small investors; which is why ETH has been pumped somewhat. The only real risk to BTC dominance as I see it is ETH since it's one of the only other cryptos where ppl are allowed to exchange for FIAT.

I think overtime this will change; I wouldn't be surprised to see Ripple get mass adoptions given that it's currently supported by big banks.

Is it possible BTC gets dethroned? Maybe; but not in 2018. Will the whole crypto bubble pop? Absolutely not. All capital inflows would need to stop and currently there is 0 sign of that happening, if anything it's increasing.

Crypto is a market just like any other with Supply and Demand. Crypto Supply is limited by design; and with more capital coming every day that will only cause the price to rise which is what we are seeing now.

When my dad (who is 60 and has never touched a PC in his life) asks me about what BitCoin is... that says something. He asked me how to buy a few thousand dollars worth.

The problem with this assessment is that while many crypto investors might jump into ETH before BTC to send between exchanges, they quickly move it to BTC to buy their favorite altcoin. BTC is also what they move it to when they sell that altcoin. The fees in an exchange are separate from the fees of the actual blockchain, hence why this occurs.

I've mostly used Bittrex/HitBTC and they have ETH pairs for almost everything; i cant say more for about any other exchange.

I've a huge problem with the current market situation: Coins less than one Dollar. Why? Because people buy them like crazy. Take a look at CoinMarketCap. You have anyway a tab open ;) and scroll down the list. The most gainers are all Coins which are or were a week ago <1$. Here are some examples: Ripple, Cardano, NEM, Tron, Stellar, Verge ...

Why this is a problem in my opinion? There a lot of new people in the space that don't understand that price is as unimportant as the name of a coin.

Here's an example with IOTA. The price you see on CMC is in MIOTA (Mega IOTA, which are 1.000.000 IOTA). Imagine CMC would show you the price for one KIOTA (1.000 IOTA) which would be around 0.004$ or for one GIOTA (1.000.000.000 IOTA) which would be ~4000$. That are huge price jumps but it doesn't matter! The value for IOTA itself stays the same. The only thing that matters is the market cap, which is a combination of price and supply.

The newbies wanna catch the new BTC and imagine/hope their coin can go up to the same price as BTC. I have this opinion because I read more often stuff like: "Ripple to 100$???" or "ADA to the mooooon 1000$!!!!" which makes me wanna cry. (These are just two randomly picked examples, I don't dislike these coins). That means that they would be at a many TRILLION USD market cap. Probably in ten years if everything goes perfect. But I see 95% of them crashing again as people realise they are overvalued. At least I hoped so. BUT I also didn't see XRP ever reach 1$ and here we are at nearly 4$. So I might be wrong, no one can see into the future. I just want to point out that the price is irrelevant and that it scares me so many people don't get it.

Not even the market cap is what really matters. It is just a multiplication of the hyped price that the fraction of the coin-holders is currently willing (and able) to sell for and it does not reflect the real value at all.

Yeah, exactly @monoxid. The only use for the market cap is comparing with other cryptocurrencies. Crypto market caps really shouldn't be compared with other assets. Also, getting sick of people saying '$X billion just came into the market' when people don't understand that the market cap =/= total capital invested. Unfortunately, these are just the problems we face with an onslaught of uneducated people rushing into the market. We've all got to painstakingly point them in the right direction at the end of the day!

what do you mean with "market cap =/= total capital invested"? i think i have an idea but i'm not sure with it...

@mrdupin

People always seem to confuse the market cap as being equal to the total capital invested. So will say things like "$10 billion just left the market in an hour!" or "There is now $200 billion more invested into crypto!" when the actual totals for the real capital invested are much lower. This is because not everyone bought the coins they hold for the current market price.

However, as time goes on and the bull market begins to ease off, or even reverse slightly, these numbers should begin to converge. As there will be people who bought in at higher prices than the market price which will mean the market price is closer to the average entry price per unit for hodlers.

It's safe to say that this isn't the case right now. Especially when some coins make triple digit gains in a day.

Hope this clears what I meant up a bit more!

Ok thank you, first time i think about that! This brings a new perspective for me and my investing behavior.

It means that not all who hold a certain coin have bought it for the current market price. They probably bought it for much lower price, therefore the total capital invested does not equal the market cap.

Yes, this type of mentality is ridiculous and disappointing to see. Really is a sign that many average Joes are joining the market.

Ripple is a scam.

https://steemit.com/cryptocurrency/@ka82/xrp-ripple-should-be-1-in-coinmarketcap-com

So many people are going to lose their ass on ripple, its literally created its own microbubble.

https://steemit.com/crypto/@hvlyarmedtrader/the-most-important-video-for-ripple-xrp-investors

Not scam but it is ridiculously overpriced and is not even a real crypto.

XRP is not created based on a closed system of mining-rewarding ecosystem...In the ripple website it's saying and I'm paraphrasing that it's beneficial for institutions to become a validator because they transact on the ripple network...we're dealing with 3 independent entities in ripple, i.e. ripple network, XRP token, and validators....XRP are under escrow of ripple company and regardless of what multi-sig wallet they put them in it can be created at will without any PoW, PoS, hybrid PoS/PoW or DPoS protocols.

True true, it takes balls to move against the market.

I would go back into BTC too, but I already sold all of my speculative shitcoins.

I will think about selling my PivX, Ark and Metal.

Hi @cryptovestor ! I'm a huge fan of your style and content. I got into crypto because of your videos. Thanks :), it's been an excellent journey so far. Hit me up if ever you need some data visualised for a bigger analysis or post or something :), i'd be glad to help!

What will happen at some point, is that many people who were formerly enthusiastic about bitcoin and many altcoins, will realize that it's mostly a bubble inflated by market manipulation, that the original purpose - an alternative way to exchange value - is not being fulfilled very much (either because the bubble will be that much inflated or because someone will invent more efficient way to exchange actual value).

And then, they realize that they have to exchange their cryptocurrencies for some less volatile fiat currency sooner than all other people realize the same and the bubble pops. Because the goal of most people participating in this market is not to find an alternative for fiat currency, but to get rich, preferably quickly, preferably in fiat currency measures.

What happened last time is that all the other alts rose with BTC because there was so much money flowing in AND alt traders felt the BTC market was overheated so they fled to good buys in alts. BUT, BTC kept going and going and the alts finally got cannibalized as alt HODLers got FOMO and had to jump back in until we hit $19k per BTC. That is another possible scenario as BTC climbs to close to either $35k or even $50k in the next wave.

I referenced you in my post on a similar subject: total market cap passing $750B and resteemed this post.

https://steemit.com/cryptocurrency/@gmikeyg/nem-eats-ltc-and-stellar-lumens-total-crypto-market-cap-passes-usd750b-without-a-hiccup

BTC pairs are not the only game in town anymore. There are almost as many ETH trading pairs on most of the up and coming altcoin exchanges.

Great substantive analysis as always, @cryptovestor. I generally agree, perhaps with ETH being the one exception. The fact that the largest exchanges don't support fiat trading only compounds the likelihood of this alt bubble popping.

I have a coinbase account and I use blocktrades as my exchange conduit. I go from STEEM to Ether. Once in a while STEEM to Litecoin.

I can then sell those cryptos directly from coinbase.

So I am totally confused when you say people have to use BTC as the "middleman" so to speak.

I'm pretty sure he meant that as a significant portion. People even come from fiat to those cryptos directly, however, the point that he is bringing out is not something to be ignored. Nor should yours.

But BTC as a share of total crypto market cap is shrinking not expanding. I see no reason for this trend to reverse. BTC is now subject to going short in the futures markets, and "knowledgeable" investors are looking for pure plays.

Yes but a fair share is coming from the bitcoin conduit, the dominance chart does not show that once conversion takes place from BTC to altcoin and it will come back once the reverse happens

Hello Crypto Investor, I have been watching you since you had 20k subscribers on YouTube, your growth has been incredible, congratulations! I agree that any of those three catalysts will cause bitcoin to pump, but, in your previous videos you said that you expect bitcoin to see another flash-crash to $10k or even lower before pumping back up, and that it could be a good opportunity for those of us who couldn't take advantage of that first crash because we didn't have cash. I still think that's gonna happen, so, I'm waiting to buy bitcoin when it does. Do you still think this way? Thanks a ton.

I like the fact that you dont get hyped by the success of altcoins and remain critic. This makes me re-thing and consider that it may not go the way I wish.

However I hope you are overly pessimistic and altcoin market will continue to grow because there are a lot of interesting projects which could change the future! :)

I think Bitcoin will slowly fade away, small pumps will allow the big whales to sell off some of their bitcoin stash. We've seen how the mempool gets completely overflooded.

Bitcoin technology is like an old T-Rex dinosaur, and altcoins are like new nimble little genetically modified Velociraptor clones which are far smarter, flexible and more superior and which have been getting bigger and taking over the reign, move over old grandpa! Ok, so maybe I've been watching too much Jurassic park... now that I think about it, didn't the old T-Rex beat the genetically modified one? Hmm, maybe I've changed my mind... Bitcoin will come back to bite the clones as it is the original pure-breed with the biggest teeth ;)

I feel like Bitcoin has too many issues. The transaction fees are horrendous and the network is flooded, stalled so much. What about coins like Manna which are a proof of breath concept that is going to gain a lot of traction isn't it worth investing into that? Altcoins are so diverse and rich that not all of them can lose traction since they can vary dramatically from coin to coin.

Hi there Investor,

I was just watched the video, and one point that you made I do not like. You compared GOLD to BTC. Why I have a problem with that?

You said that gold does not have value set in the real world. Why this is false - gold is the best electrical conductor and is used in constructing fine electronics. Everything, from CPUs to mobile phones, all use gold. And the absolute lowest price for gold would be the median price for mining it around 1000 USD per troy ounce. On other hand BTC does not have any application in the real world.

I agree in the fact that gold does indeed have real usage value in the world, but no its not the best electrical conductor, both silver and copper is better conductors, and the best is actually structured graphite. Why they use gold in electronics is due to it being a pure and stable metal not easily effected by corrotion. It makes for very good contact surfaces and can sustain harsh environments like outer space. So its used as an outer layer on conecting points and surface coating. :)

SIlver may be, I am not sure, copper is surely not a better conductor than gold. And yes graphene is the best so far discovered superconductor, but until we can produce it en masse, it will not be a viable substitution to gold.

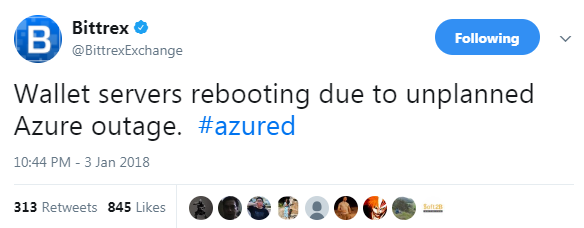

I'm not sure, but I thought in a past video you said you traded on bittrex. I trade on bittrex and for the past several days over half my wallets have been offline.

I'm freaking out a little (appx. 25% of my crypto portfolio is on bittrex), but no one else seems to be. At least not that I can find with google.

Should I be worried? And if not, I'd love to see a quick video on it to alleviate my fears.

Thx. Love your stuff.

Which coins? I'm holding BTC, ADA, LTC & SALT on Bittrex and they're all functioning fine.

Really? My SALT has been offline for days, which I just confirmed here:

https://bittrex.com/status

Also Siacoin, Golem, and ZCash. In addition Ardor has been "preparing for swap" that should have been completed days ago.

From Bittrex:

Derp. I now see that both SALT and ADA have been down since yesterday, both flagged as "routine maintenance". So yeah - definitely a tad unnerving that "routine" = "down for days" in Bittrex-land.

Sounds dumb, but its probably because of the holiday season and staff taking time off. A lot of exchanges have reduced services during this time.

I don't know about that. Things really got worse after the holidays.

If I were you I would switch towards Binance as soon as you can: low fees with their personal token, a lot of new cryptocurrencies are added there sooner than on Bittrex, overall more stable in my experience so far.

With this said, I still trade on Bittrex (I just love first blood) and they are not doing anything shady, you can trust your money are safe there, probably their network is just overwhelmed by the new investors excited by the altcoins rising this quick and for this reason they are having problems with withdrawals and deposits.

@cryptovestor : While we're on the exchange topic - if you're reading this - I very much would like to have your opinion on Binance and/or Kucoin. You seem to stick to Bittrex and Gdax while others like Datadash seem to have switched ; is it just the force of habit, or do you have some reasons to be cautious about those ?

Reply or not, thanks for your contributions - you really helped me to understand a lot of things and to keep a healthy distance with this market's exuberance. Cheers.

Congratulations @cryptovestor! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPWhat makes you think everyone will cash out into BTC? what about ETH and LTC?

I think momentum can return to BTC if the narrative changes enough. However, I think a lot of traders and investors are in a cycle of moving back forth between BTC and alt coins to try and maximize their gains.

I totally agree that this altcoin bubble is crazy. However I can imagine having bitcoin share market dominance with Litecoin.

People are getting more and more interested into altcoins and so they have to buy it with bitcoin or ether. They probably don't like btc or ether because it is slow and expensive or clogged. And when they see that smaller exchanges where you can find those altcoins are using litecoin as a trading pair, they will like using it and might trade back to ltc. Also if a bigger exchange accepts litecoin as a trading pair it could make it take off.

Anyway not saying it will, but I know that I prefer using litecoin recently, so I'll keep a good share compared to bitcoin.

Bitcoin has been the king of crypto forever now, because historically it always has been, fiat on ramps, and such. With the last couple weeks we've seen Bitcoin slowly dropping, where we have now seen ETH no longer following Bitcoin in price, but climbing on its own (just shy of $1000 as of writing this comment). Whether or not it's realistic in the short term (a month or several) or the long (6-12+ months), what signs should we look for for something like ETH to become the new king of crypto?

You make some valid points. One thing I disagree with is your bitcoin assessment. I've been in the crypto world for about a month. As a rookie my first purchase was bitcoin, like your brothers, in order to buy alt coins. However, that was the first and last time I've bought bitcoin. The transaction fees and time turned me off immediately, especially for a low budget investor like myself. Ethereum is my current asset of choice for buying altcoins, as many altcoins have a direct ether pairing. If Bitcoin can address their current flaws, that can all change. For now, bitcoin is dying in my opinion. Again, I am very new to this space so it is my humble opinion! Anyways, keep up your great videos! You were one of the first people I listened to on youtube. I like your more bearish view of the market, you don't hype all the time like most of the crypto youtubers.

Hey there...

Welcome to the ride, then :)

I think this may be of some interest in your case, which is quite similar to mine (I'm a rookie like you, only been there since end of october and, to be honest, I lived somewhat of a different story than yours, but that would make a whole other post) :

You make several excellent points, and I generally agree with them. BUT there is one very important point that I think you are missing and that is that crypto's current $750 billion market cap is nothing. There is an enormous amount of money that is going to flow into crypto in the next few years and I think a $10 trillion market cap for the entire space in 5 years is not at all unrealistic.

Granted, this is a long term view. If you are speaking to the short term only and expect to see an alt coin pullback and a Bitcoin bull run, you're probably right. But from a "Crypto Investor" standpoint as opposed to a "Crypto Trader" standpoint, I think anyone who is diversified between BTC and the Top 50ish Alt Coins is going to do just fine in the long run. Sure, some (plenty?) will go to 0, but the winners are going to win BIG.

Thoughts?

If you're able to short Alt coins for next 3 months, would you do it?

Pragmatic and useful, as always. Thanks you.