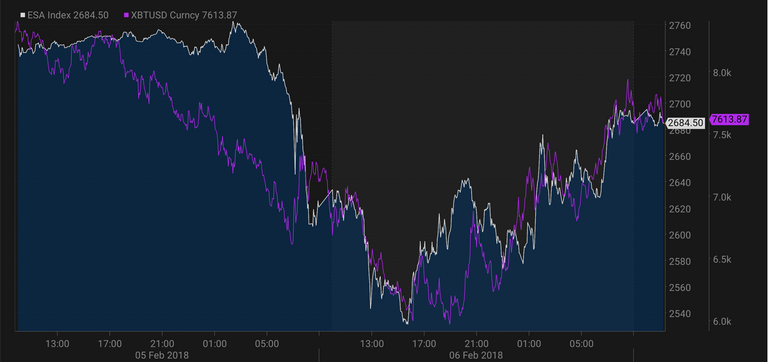

S&P e-minis are a better proxy for risk sentiment than the Dow (they are extremely liquid and trade nearly continuously during the week). The correlation between them and BTC during the risk off event on Tuesday was staggering. Watching it live on the terminal you could see them ticking down or up in complete unison. With that being said the subsequent risk off move to end the week wasn't accompanied by a selloff in BTC. I think the market is still unsure about whether BTC is a risk off or risk on asset. If institutional money gets more involved I think it should start trading more like gold. Below is a screenshot from earlier in the week and a link to a post I made about BTC being risk off or risk on.

https://steemit.com/bitcoin/@cryptsheets/cryptsheets-is-bitcoin-a-risk-off-or-risk-on-asset