Bitcoin is the Ultimate Base-Pair

If you have Bitcoin, you can trade it for anything. The main base-pair of every centralized exchange is Bitcoin. Bitcoin has the highest liquidity. Bitcoin can be traded for more physical products than any other coin. Bitcoin has branding and first market advantage. Bitcoin has the highest network security via hashpower and time per block. Everyone trusts that the rules of Bitcoin will change very slowly or not at all. It is the anchor of our crypto-ship.

Bitcoin Bitcoin Bitcoin!

I'm no maximalist, but over the years I've learned to value the attributes of Bitcoin. It may be the boring Grandpappy coin of the neighborhood, but it is also absolutely necessary for the success of the rest of the market. Without Bitcoin, the entire cryptosphere would be torn asunder and left wide open to attack. If we lose Bitcoin, we lose a lot. The security that it provides can not be overstated. It acts as a shield to the entire space and as a safe-haven against certain attack vectors.

In any case, now that a certain event has happened that seemingly doubled my assets, I find myself with a lot of Bitcoin for the first time ever. I've been using this opportunity to learn a bit more and secure my assets, as it's much easier to secure Graphene coins than it is to secure Bitcoin (due to the lack of a staking contract combined account recovery).

So I've been setting up hardware wallets, learning a bit about BIPS master-seed protocol, and just trying to learn about Bitcoin a little more in general. There's always more to learn, that much is certain.

How does a Bitcoin transaction work?

Normally when we think about a crypto transaction, we're thinking about a one to one transfer of funds. One person is giving another person money. Bob transfers one BTC to Sally. Sally transfers a million Satoshi to Fred. However, this is not necessarily how Bitcoin operates. There can be multiple inputs and multiple outputs. A transaction can be one to one, one to many, many to one, or even many to many.

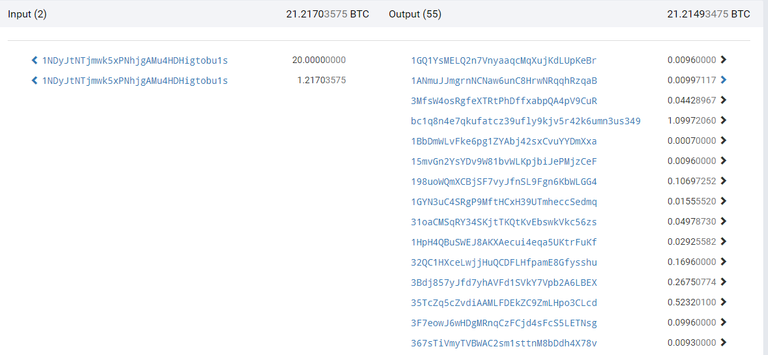

Binance Bitcoin Hot Wallet

https://btc.com/1NDyJtNTjmwk5xPNhjgAMu4HDHigtobu1s

So I found this hot-wallet that currently holds over 10k BTC. That's over a hundred million dollars worth of Bitcoin. Imagine the security they have to employ for such an account. It boggles the mind.

In any case, take a look at some of these transactions. They are pretty much all many to many relationships. Binance has access to thousands of Bitcoin wallets. When someone wants to make a withdrawal, they might have to siphon money out of ten different wallets to do it. I find this whole process very interesting, in a boring database kind of way.

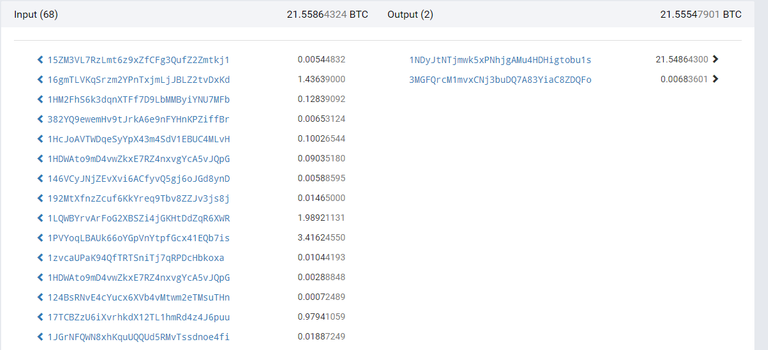

Here we see something a little different.

Instead of money flowing out of the hot-wallet, money is flowing in from 68 different accounts. These are the personal accounts of people depositing funds into Binance. All that money is getting funneled into the hot-wallet.

When you think about it, this means all the Bitcoin becomes anonymous to everyone except Binance. Centralized exchanges have a lot of power in this way, which is why governments love to regulate them so much. Bitcoin is flying everywhere and only the centralized exchanges know who owns what.

A company like Binance is setting up quite a nice little operation and perhaps even a crypto mafia. They had no problems attacking the network with user funds. They knew exactly what they were doing then they blamed it on a hack and let the 'hacker' run free because he is actually their mafia buddy. It's pretty crazy when you think about it, especially when they front that they are operating out of Malta and then when they get called out make the claim of a "spiritual headquarters". Now they operate out of dozens of countries in the shadows. They know how to work the decentralized system just enough to suit their needs. Pretty epic.

But that's not really what I wanted to talk about for this post. The focus of this post was supposed to be about Bitcoin network fees and how they are primed to skyrocket out of control soon™. If you think some magic scaling solution is coming, think again. Do you think a centralized exchange like Binance is going to dump a hundred million dollars into the Lightning Network and hope for the best? We're dreaming on that front; not going to happen. The security of the main chain has too much competition, and that competition is only going to increase over time.

So as we can see, the exchanges are wasting a lot of data by centralizing funds to their hot-wallet. What happens if Bitcoin demand skyrockets to $500 transactions? They're going to have to find ways to optimize their system.

My first idea on this front would be to get rid of the hot-wallet entirely; simply transfer funds directly from user accounts to the users making withdrawals. However, this is probably a terrible idea because the security they implement on the hot-wallet is likely pretty good, and changing up the system could add an attack vector for hackers to exploit. Also, there's not really a guarantee there that this strategy would save that much money in terms of bytes being stored on the Bitcoin network. How much data are you really saving? One input and one output (aka eliminating the hot-wallet). No, that's probably a pretty bad idea.

So I got to thinking about other chains. Take Graphene-based chains for example, all the transactions are free. In a world of $500 Bitcoin transactions, that's going to start looking pretty sexy.

Backdoor Centralized-Exchange Swaps

This is what I came up with. Instead of transferring Bitcoin, you simply transfer something cheaper that still has good liquidity. Imagine you need to get a million dollars onto another exchange because you have 100 users trying to transfer money there. Rather than sending expensive Bitcoin you could simply buy another asset on that exchange and trade it for Bitcoin.

From there you could set up logistics to get the Bitcoin into the correct users accounts because it's all behind a centralized database (using their API). Bitcoin would be transferred, but those transfers would never appear on the Bitcoin blockchain. As long as the liquidity of the trade has less slippage than the price it would take the transfer the Bitcoin on chain, this would be worth it.

Another way to do it would be to simply transfer all the Bitcoin in one lump sum directly into the exchange's hot-wallet. This way you avoid sending money to 100's out outputs to user accounts, and the associated hundreds of inputs that result from getting that money into the hot-wallet. Instead it would just be a one-to-one transaction from one exchange to another's hot wallet, and this would be way less bytes on the blockchain than doing it the other way. From here, the exchanges have to speak to each other using their APIs so they know who owns what.

Sounds like a lot of work just to avoid fees.

Indeed it is, but when fees are $500 a pop many will scramble to do whatever they can to keep their business model up and running. I expect these shortcuts will inevitably lead to an unseen attack vector that results in an exchange hack. Imagine attacking the API that tells the server who the money is supposed to belong to. This is just one possible example.

Conclusion

Bitcoin is secure, but at the cost of inefficiency. Centralized agents will always attempt to cut corners and make these systems more efficient. However, these cuts come at the cost of security. During the next crypto bubble, which I expect to come within 18 months, I also expect their to be a major exchange hack. Not only will centralized exchanges be looking to cut corners and avoid fees, but also the value of their hot-wallets will be at record-breaking all time highs. This honeypot combined with extra attack vectors can only lead to one result.

@tipu curate

Upvoted 👌 (Mana: 21/28)

That's very vague but I'm going to let that slide because it sounds like something I would say. Don't you think you're a little ahead of your time, especially considering the consensus of every network hinges on cryptography?