When it was declared on Monday that Circle would secure Poloniex, a significant part of the emphasis was on the $400 million answered to have changed hands. It was a decent piece of business for the two gatherings, ran the general agreement, and not a terrible arrangement for clients of the trade either, who may at long last experience something looking like client benefit. The repercussions of the arrangement reach out far further, be that as it may, implying at the state of U.S. cryptographic money exchanging to come.

More Compliance, Less Securities

At first glance, the #Circle-Poloniex bargain resembles a basic changing of the monitor: time to leave the past behind. As a holder of a desired Bitlicense, and the administrator of a few famous exchanging applications, Circle is everything Poloniex isn't: versatile, easy to use, and all around associated. Its obtaining of the broken-down however very much respected Polo trade is a marker of the new world that cryptographic money merchants are being crowded into, one portrayed by more consistence and less securities tokens. It's a world which looks fundamentally the same as the domain of conventional back that cryptographic money was once intended to subvert.

Its a dependable fact that one of Circle's greatest supporters is Goldman Sachs. The Poloniex bargain gives the Wall Street speculation bunch a noteworthy stake in the cryptographic money diversion however without getting its hands messy or notoriety sullied. In the event that Circle changes Poloniex and the trade thrives, Goldman Sachs benefits. On the off chance that things go astray, it's Circle's concern, not Goldman's. One reason why bitcoin was hailed as a troublesome innovation was the manner by which it redistributed riches from the 1% to the nerds, revolutionaries, and cypherpunks. Presently the pendulum has swung the other way. Not exclusively do the old protect have skin in the diversion; they're presently running the amusement.

Money Street Wades In

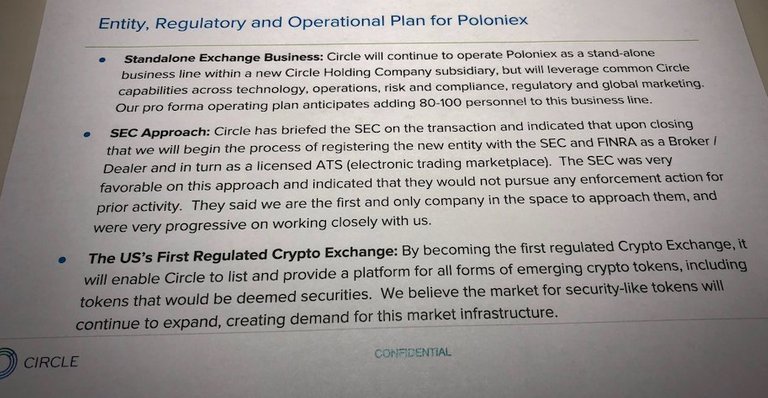

Hover's procurement of Poloniex doesn't allow it (and by augmentation its supporters, including Goldman Sachs) moment authority over the cryptoverse. There's a considerable measure of different trades out there and a ton of different nations that are outside its ability to understand. Inside the U.S, however, confirm the old young men's club of customary fund is beginning to advocate for itself in the cryptosphere. The New York Times' Nathaniel Popper shared a spilled slide from a Circle introduction which implied to indicate implicit endorsement for the takeover from the SEC.

Its essence went something as tails: "You all purchase Poloniex, get its home all together, and we won't come after you for the wrongdoings of the past". It's conceivable that this slide has been confused, with Coinbase Board of Directors part Kathryn Haun answering: "Following 12 years with the feds I'd be extremely amazed to see an announcement like that at any point made by a requirement body." What can be declared unhesitatingly is that Circle is exceptionally all around associated, and would not have gone into the @Poloniex bargain without affirmations, regardless of how casual, that its $400 million new football would not be punctured by a sudden subpoena.

Poloniex Gets a Pass

On the off chance that Poloniex has been blameworthy of any offenses, they likely relate to inability to perform full consistence – something the trade has since presented. Joseph Weinberg, director of KYC stage Shyft, trusts this to be the situation, expressing: "before, Poloniex had a considerable measure of issues with onboarding new clients and appropriately working out its KYC procedure, essentially because of the a lot of time it takes to check clients… Through this procurement, Circle will send more individuals to help deal with consistence – more representatives to manufacture and process KYC due industriousness speedier. This is a similar sort of issue conventional banks have with regards to scaling. Compliances costs continue duplicating."

The other issue Poloniex may need to address is delisting tokens that constitute securities. Administrative organizations may challenge, yet according to people in general, posting securities and inability to perform full consistence are not really real violations. It's not as though Polo has been washing a huge number of dollars a la Btc-e, the trade which the Justice Department covered a year ago subsequent to prosecuting its administrator Alexander Vinnik.

The status of #crypto tokens which may constitute securities, and hence fall foul of SEC controls, has involved some open deliberation. #Bittrex has been delisting tokens for a considerable length of time, possibly for this very reason, and #Bitfinex has additionally banned U.S. clients from exchanging tokens on its trade. In the wake of the Circle-Polo give, one legal advisor theorized that various tokens on Poloniex might be delisted, going so far as to anticipate: "You will see most Alts vanish from US trades." That appears to be impossible, yet tokens that speak to an offer in a stage – and which are in this manner qualified for profits – will in all likelihood be in danger. A few people trust that Circle's buy of Poloniex will empower the trade to begin posting security tokens, once the essential authorizations are set up.

Most extreme Oversight from Hereon In

Digital currency trades today are practically unrecognizable from the free and simple days of Mt Gox and Vircurex, when KYC comprised of an email address and passwords were put away in plaintext. Both of those trades have since been hacked into insensibility, and numerous more have fallen by the wayside. Put something aside for real players like Kucoin and Binance – which are past the domains of U.S. controllers, and don't permit fiat stores regardless – obligatory KYC/AML is presently the standard.

Because of powerful consistence techniques, combined with the straightforwardness that #blockchain gives, authorities now have more noteworthy knowledge into digital money clients – their own subtle elements, exchanges, and exchanges – than they do of speculators from some other budgetary market. On account of expanded control combined with venture from the #Goldman Sachs of the world, the eventual fate of cash appears to be not all that unique from the past.

What is your opinion about Goldman Sachs in a roundabout way picking up a stake in #Poloniex and do you think the SEC gave #Circle affirmations ahead of time? Tell us in the remarks area beneath.