Tyler Jenks, Tone Vays, Blog Prezesa, Alessio Rastani. Their current view on the Bitcoin market in a nutshell for those who have no time to watch their excellent video analysis.

Tyler Jenks [27 July 2018]

Tyler thinks Bitcoin will try one more upswing from this little formation (last 4 daily candles), we've got a down channel for the last 3 days. On the weekly nothing has changed the SAR, BB are still pretty much the same. RSI has risen a little but to Tyler it only means that it has longer way to fall. Is it possible that this is the ultimate bottom of the Hyperwave at 5700? Yes it is possible, Tone has given it 5% or a 10%. Tyler don't believes it's not a probable bet, not even reasonable possible bet but it is possible so he gives it 10% and maybe as high as 20%. source

Tone Vays [27 July 2018]

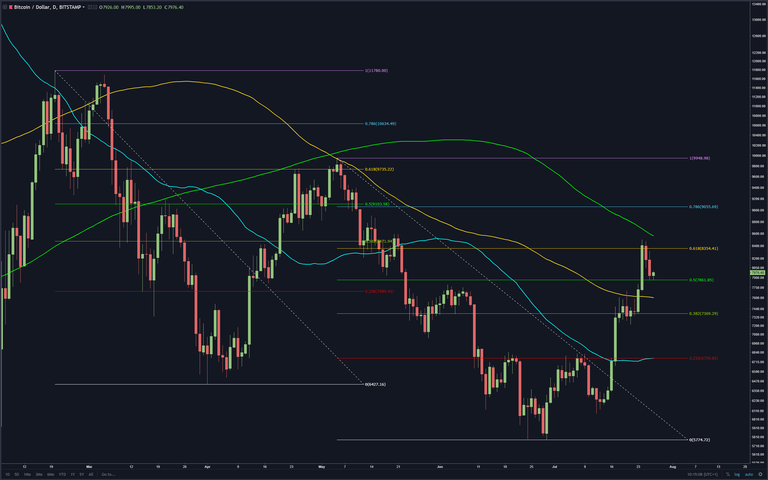

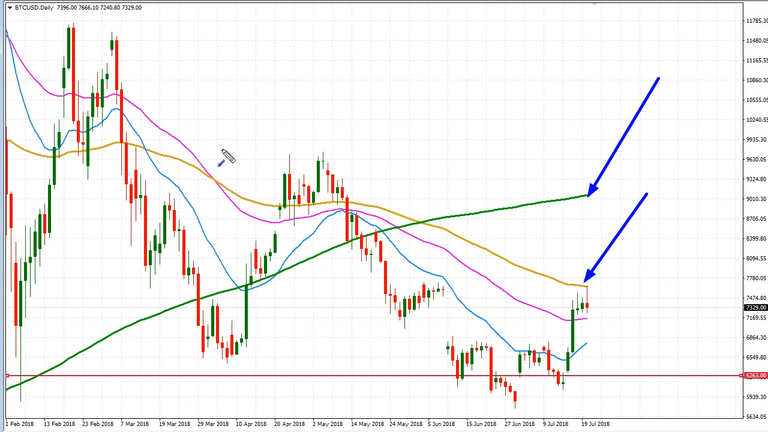

We pulled back down a little bit on the SEC news about the EFT's. Weekly chart it still is a bounce into the Death Cross and until it can clear that and then clear the prior high from April, Tone is still sceptical about this entire rally. However those that were trading the sequential and saw the the 9, could have at least play the 1 to 4 candle correction. Tone didn't play it because it was too risky and he didn't like the risk to reward ratio so he stayed with his overall bearish trend on the weekly chart. source

Daily topped on a 9 and this wasn't a reversal candle and normally we could have 1 to 4 candle correction and then we could be moving back up but it's also close enough to the 200-day moving average trending down. If on Monday we break above the green line on 8400 and then above the 200-day moving average that may be an opportunity for a bullish trade but it may be short lived because again on weekly at 8700 level is where we're gonna get the Death Cross. So even though the daily chart is turning bullish your weekly chart is gonna run into some major resistance. source

Tyler Jenks [26 July 2018]

If Bitcoin went above 10100 and then 11100, Tyler's two important levels, he would at that point become an intermediate and maybe even a long term bull. source

Until that happens, his Hyperwave analysis says that nothing has changed. We're still in the same formation and we're going to come down to about 5100 which is his Phase 2 line and all the bounces we've had so far have one thing in common, they all have lower highs and lower lows, so in his view, we're ready for the next move down, which is going to take us to at least 5100 level or Tone's 4975. He's assuming we're going to get 4 or 5 touches of this Phase 2 line and we'll actually break down through it only to come back and close above it. If this line holds, we'll get a massive bull market but his Hyperwave theory states that there is only about 25% chances that it will hold and if it doesn't, we'll go all the way down to a 1000 because there's no other support. source

We're going to get a Death Cross and it won't change the Hyperwave targets because it has formed itself long before the Death Cross and there are few Golden Crosses within the original Hyperwave to. Phase lines are telling us where the bottom is going to be and the only one left is the Phase 2 line which will get tested few times before we'll know if it holds. source

- SAR (Stop and Reverse) is showing us a second positive day of this week [POSITIVE] source

- We've broken above the middle line of the Bollinger Bands and we need to close above it but right now we still have 3 days to go. [NEUTRAL to POSITIVE] source

- Moving Averages are a [NEGATIVE] because the long term 30 weekly MA is no longer moving up and is heading for a Death Cross with short term MA. Long term MA is a very strong resistance that first needs to be overcame to get to the bull market and he doesn't see it at the moment. source

- RSI is moving upwards now but he believes is very bearish because now we have to drop down from 50 all the way down to 30 to become oversold. There was a time recently that we only had to drop down 8 points from the 38 but it's long gone now and we've got much longer way to drop to become oversold. [NEGATIVE] source

- MACD is still [NEGATIVE], we're nearing the crossover and after that maybe we'll get two positive histogram bars. source

He doesn't believe we're get ETF's this year, he thinks the earlies we'll see it, it will be around April next year and there be a pop in the price of Bitcoin, if we lost another ~500 of these other cryptocurrencies this pop will be substantial, if we hadn't it will take more than the announcement of the ETF's to move the price up substantially. So we need to clear out the undergrowth and then we're ready for the bull market. source

Blog Prezesa [23 July 2018]

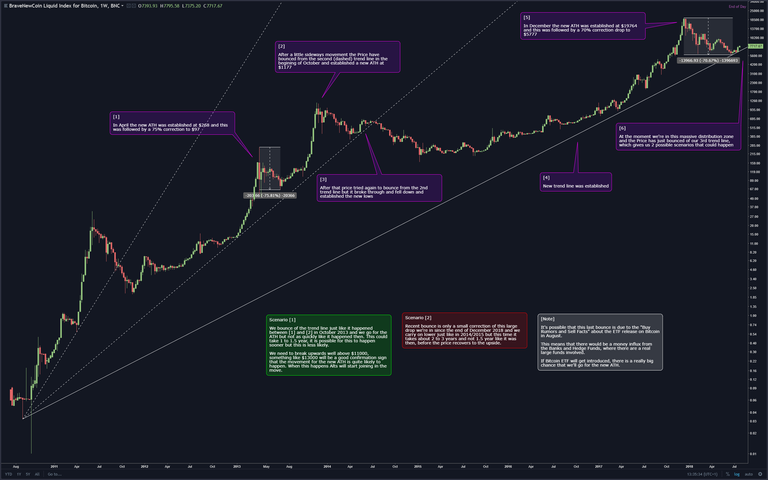

Overview

He thinks that this bounce we are in since the 16th of July is probably only a correction bounce, although quite strong but in his view it will probably be a short lived and we'll soon continue moving downwards again.

The rest of the Altcoins in comparison to Bitcoin are looking quite weak at this moment. It seems that most of the traders have moved to trading Bitcoin. It's worth mentioning that in 2015 when this last bubble started forming, only Bitcoin was gaining in the beginning and nothing else, and then Dash joined in, then again nothing for a while and in the end the rest of the Alts also joined in. So now that only Bitcoin is gaining and the rest are more or less stuck in their price levels, seems like a normal behaviour for this market. First Bitcoin is gaining and then when there is a lot of cash already pumped into it, it's spilling over the rest of the Alts. So this could a possibility in the trend direction change.

Bullish Scenario

We bounce of the trend line just like it happened between [1] and [2] in October 2013 and we go for the ATH but not as quickly like it happened then. This could take 1 to 1.5 year, it is possible for this to happen sooner but this is less likely.

We need to break upwards well above $11000, something like $13000 will be a good confirmation sign that the movement for the new ATH is quite likely to happen. When this happens Alts will start joining in the move.

Bearish Scenario

Recent bounce is only a small correction of this large drop we're in since the end of December 2018 and we carry on lower just like in 2014/2015 but this time it takes about 2 to 3 years and not 1.5 year like it was then, before the price recovers to the upside.

Note

It's possible that this last bounce is due to the "Buy Rumors and Sell Facts" about the ETF release on Bitcoin in August. This means that there would be a money influx from the Banks and Hedge Funds, where there are a real large funds involved. If Bitcoin ETF's get introduced, there is a really big chance that we'll go for the new ATH.

Alessio Rastani [22 July 2018]

Bullish Scenario

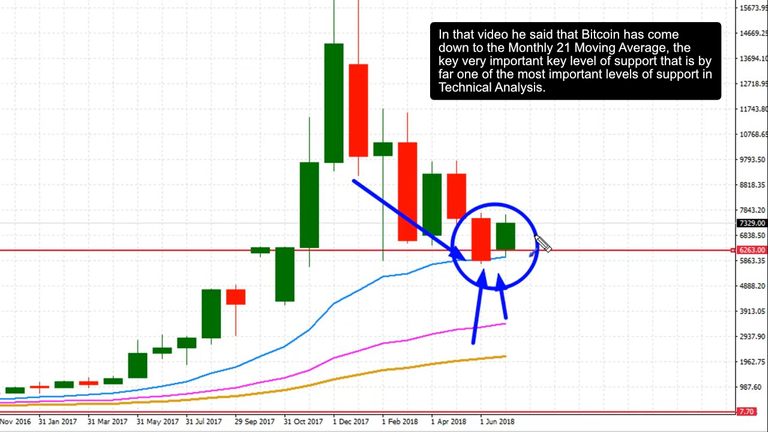

Reason 1

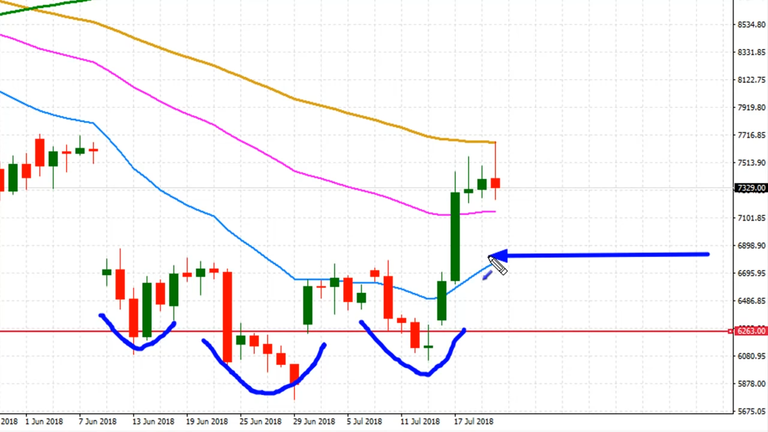

In the video from July 8th he said that he believes that Bitcoin has finally bottomed out and as long as Bitcoin remains above 6000 level it will remain bullish. He disagrees with that this is just another small correction on the way to the lower levels below below the 6000.

In that video he said that Bitcoin has come down to the Monthly 21 Moving Average, the key very important key level of support that is by far one of the most important levels of support in Technical Analysis. So far Bitcoin managed to bounce from this level.

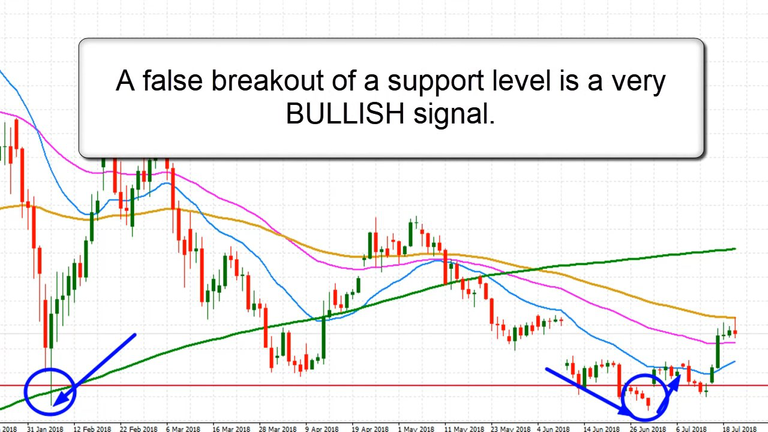

Reason 2

What we experienced then was a False Breakout, meaning that Bitcoin came back to this previous level of support from the 2nd of February and it took that level out and immediately went back above it. A false breakout of a support level is a very BULLISH signal. s

Reason 3

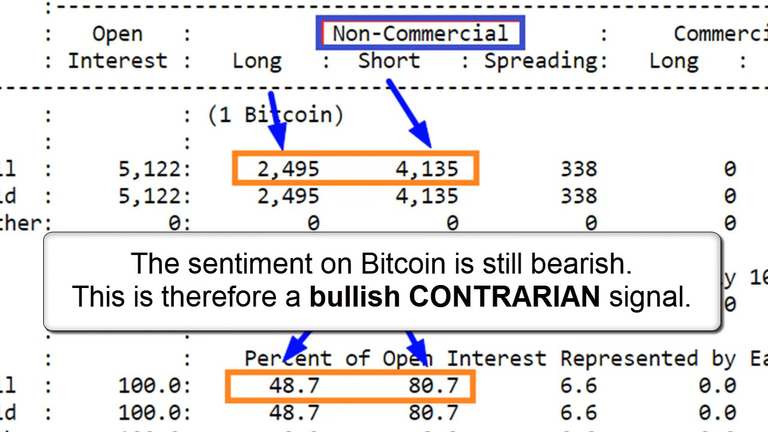

According to the last Commitment of Traders report from the 17th of July 2018 there were 4135 Shorts in contrast to 2495 Long positions held by the "Dumb Money". That means that the majority of the Bitcoin traders out there have still been bearish, that means that the sentiment on Bitcoin is still bearish. This is therefore a bullish contrarian signal.

Reason 4

This would include many patterns that show up on the charts, like for example the Head and Shoulders reversal pattern.

Bearish Scenario

Evidence against the bullish scenario include the Daily 100 EMA and 200 SMA resistance levels. Previous heights in Bitcoin at 10,000 and near the 11,000 to 12,000 levels.

Huge warning sign that something is wrong would be if a Bitcoin falls below 6800 levels.

If Bitcoin falls down to 6000 levels, this would be a red flag, a warning that would mean that Bitcoin has 75% to 80% probability of dropping much lower to 5000 or even 3000 levels.

Fatetrader

So far this recent bounce looks very much like the previous one from the 5th of May. In both cases price has bounced of 200 day moving average reaching just slightly over Fibonacci's Golden Ratio 0.618 level.