To begin with, I am a fan of Bitcoin, as well as a number of other cryptos. However, with the recent issues surrounding its ability to scale, including Ethereum being clogged for the past couple of days resulting in a sharp decline in price, it's worth visiting some of the warning signs we have seen within the crypto space over the past couple of years using posterboy, Bitcoin as our example.

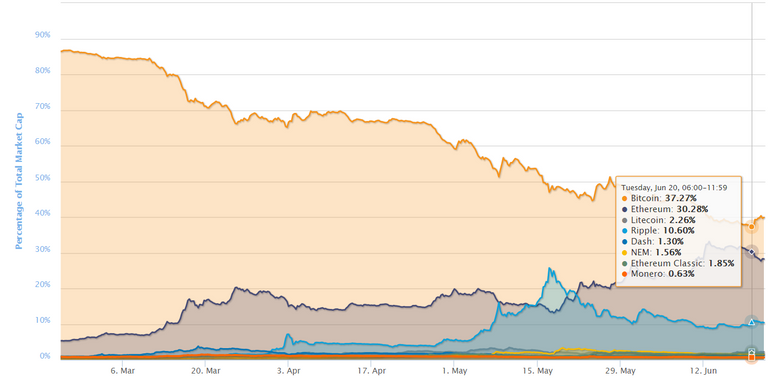

First, have a look at how quickly Bitcoin has been losing market share to the burgeoning alt coin market. In January 2017 Bitcoin represented 87% of the overall market cap. Today, it's sitting right under 40%. All it took was 5 months! Though shocking, there were signs.

I was recently viewing some "old" (circa 2016) videos on the subject. I came across one that spelled out the warning signs quite well. The video is by Amanda of the former program "The Daily Decrypt." Amanda has since left the channel is now fully behind promoting Dash. Regardless, her video was incredibly accurate regarding issues that have dragged on Bitcoin. Have a view:

Issue 1: Increase in Bitcoin's Block Size Cap

We all know about this one. However the challenge to coming to a solution for Bitcoin moving forward is still ongoing, and has been for over 2 years!

Even with confirmation that we should have Segwit implemented via a soft fork by August, it still doesn't resolve the potential Hard Fork that could come with respect to upgrading to a 2MB Block Size. This hard fork could come in November if the community cannot find common ground, which could again put pressure on Bitcoin and reduce confidence in its ability to meet the needs of the future. And as we have seen recently, when confidence in Bitcoin drops, so does confidence in all other alt-currencies, reflecting in their price.

Issue 2: Governance

Governance has been a big problem with Bitcoin, at least to some. The idea that there is no central figure to guide the direction Bitcoin takes is largely considered to be a great thing, as it is the core concept behind a decentralized currency.

However, the miners, who are largely the decision makers here, have been slow to adopt new changes required to scale Bitcoin to a level required for it to perform adequately for the recent increase in demand.

The race between the Tortoise and the Hare may have been won by the tortoise, but that's only because we're talking about fairy tales. In a world where 1 month is equal to 1 year in any other space in terms of the progress cryptocurrency is making, lethargy and in-fighting when it comes to taking decisions critical to the future of Bitcoin has likely led to its quick decline, with investments shifting to alt coins.

Issue 3: Confirmations take way too long

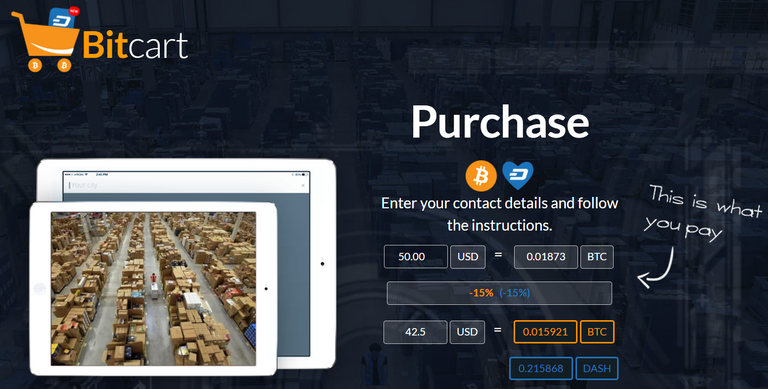

Largely due to the recent scaling issues, confirmations take forever... but even earlier when we weren't hitting bottlenecks on the blockchain, it could take up to 30 minutes to transfer funds from one wallet to another. To become considered a true currency (not just an alt-Gold), this is unacceptable. We needs speeds that equate to that of credit card payments, Paypal, and other digital wallets that are currently tied to fiat. And that means, near instant.

As a result of the slow speed of confirmations, companies like Bitcart have added other altcoins as options because of these issues.

Issue 4: Wallet Addresses Still Illegible

How many times do we read on forums of coins being sent to the wrong wallet addresses? Using incredibly illegible wallet addresses is like having to remember IP addresses for websites. It's incredibly frustrating and outdated. There have been movements towards addressing this for Ethereum with vanity wallet addresses but Bitcoin should be the first to find a way to do this. It will make adoptions far quicker, and mistakes far fewer.

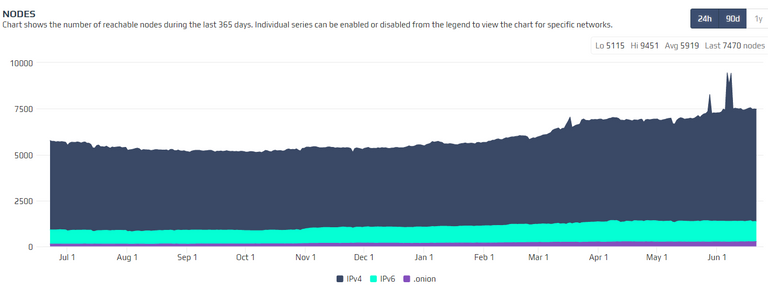

Issue 5: Number of Nodes and Centralization of Proof of Work

*Source: bitnodes.21.co

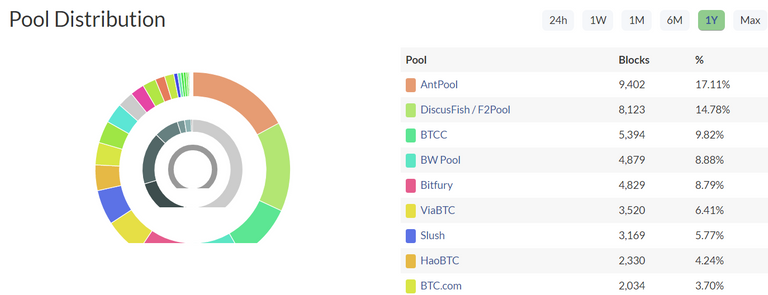

A concern last year was that the number of Bitcoin nodes were decreasing, meaning the support for transactions will decrease, and can result in a breakdown of the entire network. As of now, this isn't the case. Nodes have been on the rise as can be seen by the graph above. However, mining power continues to become further centralized with Bitcoin. Have a look for yourself.

Source: https://www.blocktrail.com/BTC/pools?resolution=1y

As a result Proof of Stake has started to become adopted to prevent this form of centralization compared to Proof of Work, which is requiring ever increasing hardware hashing power, as is the case with Bitcoin. As the hash power required to mine increases, it will become only really viable to commercial entities (Bitcoin largely is now). Only time will tell how and if the Proof of Work methodology in Bitcoin will need to be addressed.

To learn more about Proof of Work vs Proof of Stake, this is a solid article.

Are there any other warning signs we should be on top of for Bitcoin or any other altcoin which could create issues for their growth moving forward?

Image Sources:

Techcrunch.com

Coindesk.com

I didn't fully understand why bitcoin has lost a lot of its momentum but this post spells it out clearly.

Thank you.

In the future do you think BTC will be used as a mainstream currency?

Very odd. I thought I had replied to you yesterday and then my comment disappeared for some reason when I came back to it here. Anyway let me try again :)

I'm glad that you found the post helpful. Regarding Bitcoin's future, I can't really comment on if it will become a mainstream currency. I do believe that it will happen with A crypto, just not sure which. There are multiple aspects to consider when looking at currencies.

(1) Low volatility: No one would have any faith in the USD or EUR (not that there isn't dwindling faith currently) if these currencies spiked up and down constantly. BTC definitely doesn't have this yet

(2) Quick to transact: If we have to wait 30 minutes for a transaction to take place then it really doesn't substitute better models like fiat, credit cards, paypal, etc.

(3) Governance: governance is pretty stable with most fiats. BTC and others struggle with decision making process right now

(4) Vendors willing to accept it: Currency requires we have more vendors accepting Bitcoin. That number is increasing but we also have had big players retract, like Dell Computers. We need users of Bitcoin to begin demanding that vendors accept the crypto. And we need to see those payments increasing

(5) Wide spread confidence: We have so many debates about being in a bubble that will pop at any point in time. We can't have that belief for Bitcoin to be accepted as currency.

I'm sure there are more aspects but these are just off the top of my head :)

great way to summarize...

thank you for sharing

You are most welcome, my friend :)

Thank you for making me understand this subject.