SUMMARY

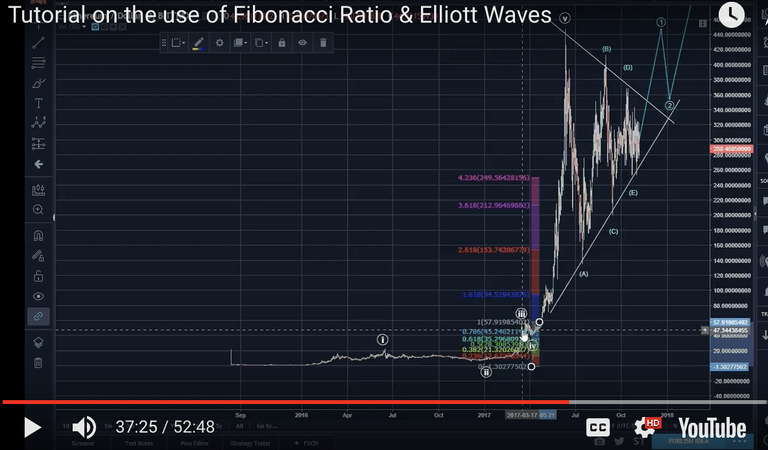

This video contains a detailed tutorial on how Fibonacci ratios are used to determine the target heights of each of the waves in an impulse and the requisite a,b,c retracements. It's a lengthy video and viewing it with a pencil and paper for notations is recommended. Also, all items covered in this video except some of my personal assessments are contained in the book Elliott Wave Principle by Frost & Prechter. This book is highly recommended to always have on your desk for study.

The take home also is to fully understand that these guidelines were made specificy for equities. We know by now that cryptos have certain wave-personality traits of its own e.g. extended 5th waves, "hurry up & wait" syndrome, propensity for expanded flat corrections, etc. Thus, these fibonacci guidelines are not always applicable to cryptos and so some care must be taken for variance. I hope this is helpful and as always, I wish you MASSIVE profits!

Please review these Tutorials on Laddering! and Buy/Sell Setups!. These books: Elliott Wave Priniciple & Technical Analysis of Stock Trends arehighly recommended!

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTS Wallet - d2e60e9856c36f34

BTC Wallet - 15ugC4U4k3qsxEXT5YF7ukz3pjtnw2im8B

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LefeWrQXumis3MzrsvxHWzpNBAAFDQbB66

Legal Mumbo Jumbo: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.**

hi ever body

To investors in the currency market here are some tips that may avoid you big loss and give you a lot of profit

1 - Avoid margin buying and short selling because the burden of losing it exceeds your capital and lead to bankruptcy if you missed your expectations.

(Do not trust your expectations very much, because they may let you down)

2 - Do not believe the rumors, because the effect is imaginary and not real.

(Rumors of how much money was wasted, and lost of times)

3 - Do not risk everything you own, when you decide to sell or buy.

4 - Do not rely on one income method, invest to create another source of income (do not put eggs in one basket)

"hi ever body," I like that. Mistakes are lovely.

A good method is know what you are willing to lose. For example, for every $100 you make you make if you are willing to lose 25% or $25 for every $100 then you will be in a good position. In this will you won't have to risk losing the whole $100. Always keep a ratio of losing to winning.

Well said, wise minds , thanks for sharing.

In other words: 'Do not try to make money'

lol

Good advices though ;-)

Wonderful Haejin, thank you. What if the 4.236 extension of ETH wave 3 is showing us the eventual target of wave e, following extended 5th. In the quantum, the target is both 5 and e, and the pattern is the emotional charge. A particle in two places, and a wave in between.

I think you've got it! But allow for variance as precision hits to fibs are not always.

Thanks, Coach.

Following your blog is the highlight of my day.

I wish you MASSIVE profits!

so if I am reading this 'interaction right' --- you both predicted the breakout for Eth going from the $300/$400's ... to where it's sitting now; in the $600-700 range -- ?

@haejin, thanks a lot.. been waiting for this.. the video seems to have not been uploaded yet..

It's done uploading now. Try it again please.

thanks ..its done

There are so many beautiful posts. I like your post.

I love your post

you are a great

my post upvote and reply my comment

Thanks for sharing!

thank you for another gift to the community <3

I've been blessed with health, wealth and a wonderful life. I'm giving back.

Thanks @haejin!!! I'll be coming back to this video quiet often

Thanks for the video

A lot of time and effort went into this video

Thanks so much @haejin

Yes, lots of time and effort goes into the posts. It' s my way of giving back to the community. My blog's aim is to help and do no harm.

You're the man Haejin thanks a lot!!!!!

Like your user name!

wow, now that's some golden advice and explanations, as usual I should say. Thank you so much once again for the time you dedicate to us, your followers. Resteemed & upvoted

I wish you MASSIVE profits!

awesome tutorial...i will watch it over numerous times....alot to learn adn digest but the way you explain is very informative....and also repeating that the fibonacci levels accuracy between equities and crypto is very important. with you tutorials with the books to reference is awesome thank you for spreading knowledge which is wealth...

i wish you godzilla profits!!!! tm

tt-dogg out!!!

For more about Sacred Geometry you guys can check out:

Just for the fun of it watch this too:

@haejin For relative fibonacci please use "Trend-Based Fib Extension", it will make your life easier.

Thanks!

thank you so much!!!

wow, I love the ending and how wave 5 went beyond fibonacci scale...twice :D Also....looking forward to 25k bitcoin :) :) :) thanks @haejin

Laddering is a good ratio keeping your losing and winning picks in check. I like it! :)

Do retractments have any relationships to each other?

ie. if price finds support at 61.8% , more likely than not its going to make a move upward.

or

If it retracts to 50% then more than likely will go down 80% and then correct. etc

Great tutorial, but like mentioned you need to watch it multiple times to really get it. Funny to see how defensive the forecast was only 1 month ago.

When using the Fib Retracement, does the top (end of wave 5) always start with 0.00 and end with the start of wave 1 on 1.00 , and not vice versa? Below I tried it on XRP USD, and found only only starting with 0 (zero) on wave 5 works. Would be great to get this confirmed by you @haejin or someone! Thanks!

PS. this tutorial is Invaluable! I wonder why most of your (new) readers did not take a look at this yet

Wow, I'm beyond grateful for these fruits of knowledge on what is the tree of wisdom. Everyday i challenge myself to rewatch as many as i can because this is where the true workings of your genius are! Thanks for everything because it's extremely difficult to find someone so willing to share their understandings on such complex and misunderstood topics in market theory.

Watching this 3 months displaced, dead-shot accuracy with the 19k around end of 2018..Shewww

Your BTC projection was spot on! Thank you so much for all this invaluable information and knowledge that you're providing. Reading the Elliott Wave Principle by itself can at times be a bit complicated, but your guide videos provide a great complement.

Sir am so so happy that finally i found you.i have been hearing alot about you and how kind you are.someone introduced you to me.when i was feeling sad that am.not earn a good upvote from.my post.he said if i get closed to you and if am lucky you might be supporting me.please sir take me along.this is one of my link.am following you please follow me back

https://steemit.com/entertainment/@tpassion/one-of-nigeria-entertainment-finnest-david-adedeje-adeleke-history

Bitmain Antminer S9 Bitcoin Miner, 0.098 J/GH Power Efficiency, 13.5TH/s

ASRock H110 Pro BTC+ 13GPU Mining Motherboard CryptoCurrency

ASUS GeForce GTX 1060 6GB Dual-fan OC Edition VR Ready Dual HDMI DP 1.4 Gaming Graphics Card (DUAL-GTX1060-O6G)

MSI GAMING GeFroce GTX 1080 Ti 11GB GDRR5X DirectX 12 352-bit VR Ready Graphics Card (GTX 1080 TI AERO 11G OC)

Support us we support u also so us should support as we upvote you

A free pdf copy of The Elliott Wave Principle by Prechter & Frost can be downloaded here.

http://www.elliottwave.com/Free%20Reports/Elliott%20Wave%20eReader

Super, thanks for sharing, i <3 Fibonacci !

If you are receiving this message, you have been flagged for responding to a known scammy piece of shit. Enjoy your dwindling rep. Here is how @haejin supports the community.

P.S. - His 21k followers are complete bullshit and most are inactive and have been for months.

I just love to see how Fibonacci Ratio & waves come together. I still think is fair to share subjectiv information via #d.tube.