With all the social problems created and also on an economic level, the current COVID-19 crisis has also had a positive impact on the world. European immobility, which has long relied on the traditional financial system, has been called into question as the pandemic has forced the continent's inhabitants to switch to cashless payments and cryptocurrencies. Some argue that it has even accelerated the mainstream adoption of crypto and DLT-based commercial solutions globally, changing people's views of money.

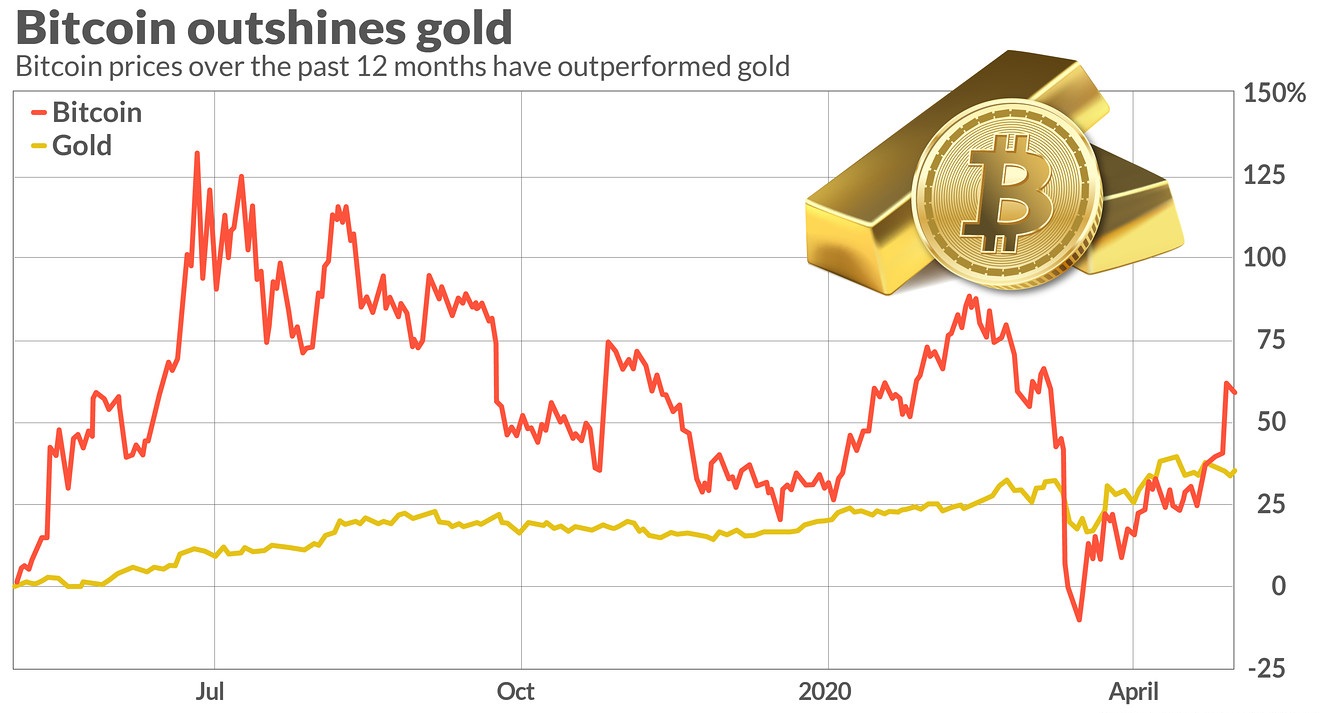

Notably, the COVID-19 pandemic has favored the narrative of Bitcoin (BTC) as a safe haven, while at the same time central banks print the FIAT currency (about $ 15 trillion) in an effort to mitigate the effects on global economies. To escape rising inflation rates, more and more people are turning to Bitcoin as a hedge against future inflation.

Meanwhile, governments are rolling out COVID-19 monitoring programs to protect public health, raising many concerns about privacy violations and the pressing grip of centralization in the process. In addition, governments have also taken another step in the erosion of civil autonomy through the development of the Central Bank's Digital Currency, initiatives promoted around the world due to the crisis caused by COVID-19. While experts see the solution for privacy protection in distributed technologies, the question of overstated promises about decentralization itself remains open.

However, the coronavirus epidemic has profoundly changed the lives of all people, creating a new "normal" that we currently live in. Yet, despite all the challenges we face from an economic, political and social point of view since the beginning of this year, the pandemic is undoubtedly promoting digital innovation, thereby accelerating the technological development of humanity by at least 10 years.

It is still too early to know when all this will end: even today, COVID-19 continues to spread rapidly.

Da Hongfei, the founder of NEO and Onchain, said:

“The COVID-19 has exacerbated inequalities for many people without access to banking, highlighting the gaps in our financial infrastructure where those with less pay more - on average the cost to send $ 200 is $ 14. Despite the pandemic, people still need to send money to family and friends abroad. As a result, remittances continued to increase in some of the larger corridors. The corridor from the United States to Mexico, for example, has seen a sizable increase in remittances since the start of the pandemic, with $ 4.02 billion sent to Mexico from overseas in March 2020, a 36% growth since March 2019. Ripple can help reduce the costs of these payments by using crypto and blockchain to make cross-border transactions faster, cheaper and more reliable. Bitso, a major exchange in Mexico, transfers nearly 10% of total remittance flows from the US to Mexico through Ripple technology that uses XRP as a link currency. Furthermore, interest in the sector has never been higher. Major companies such as PayPal and Square have bet on crypto, pushing them towards the general public. The recognition by these companies has helped to promote interest in the usefulness of cryptocurrencies, and for their ability to better serve businesses and consumers. "

Images from Bitcoin Magazine and MarketWatch

Congratulations @hjmarseille! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP