The U.S. Securities and Exchange Commission (SEC) has delayed making a decision on two bitcoin exchange-traded fund (ETF) proposals. After rejecting the Winklevoss Bitcoin ETF last year, the Commission once again 'disappointed' many crypto enthusiasts with their delayed decision on Bitwise and VanEck Bitcoin ETF Proposals.

Most people, without any factual evidence, believe that a Bitcoin ETF will propel its price higher. Therefore, they are understandably upset.

A headline from ccn.com reads: "SEC Continues Lazy Crypto Streak by Postponing Bitwise Bitcoin ETF."

"This time, the helpless victim waiting on the sidelines is Bitwise, which initially filed for its ETF two months ago in January. A section of the Securities and Exchange Act of 1934 states that the SEC can postpone a decision-making process by up to 45 days on specific filings. This 45-day period can then be extended to 90 days granted the SEC finds reasons for the extension and then publishes those reasons publicly."

We understand the SEC is not totally against cryptos, as Commission Chairman Clayton said, he was not against digital currencies but “ha[d] concerns over the potential for manipulation and wants to ensure investors are protected.”

IOB agrees with that.

A Quick Look at Bitwise's Proposal

No problem with that.

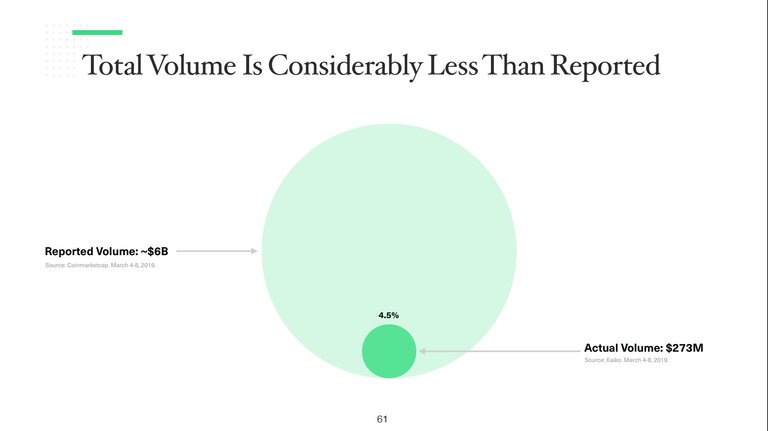

And this is true too. (Note the chart is very similar to our PoET presentation :-))

The Bitwise presentation state that "Only Ten Exchanges Have Actual Volume." That's where I see the problem starts. No. many of the "Ten" do NOT have actual volume.

It went on to claim that "The bitcoin market and Bitwise’s specific proposal are uniquely resistant to manipulation, and the regulated and surveilled futures market is significant," without the sufficient factual data to back it. Bitwise believes that Bitcoin "Is

Uniquely Resistant To Market Manipulation" partly because it "is the first digital commodity in the history of the world." This assertion makes me scratch my head.

On the issue of custody, it shows a "unique" way because it uses both a public and a private key in a section titled "What Makes Custodying Bitcoin Unique?" Why is it "unique?"

IOB's Take

We understand and sympathize the SEC's concern:

“The Commission finds it appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider this proposed rule change.”

As reported on ccn.com:

The SEC Chairman had expressed that he was not pro- or anti-crypto but underscored that he has serious concerns about market manipulation. He also said there definitely “may be a case where a bitcoin ETF could satisfy our rules.”

In his own words:

“What I’m concerned is if it can be reasonably demonstrated that the underlying trading is generally not manipulated, it’s happening on reliable venues with good rules, and that custody is something we can feel comfortable about. I think this technology has and is already demonstrating pretty significant promise. But it’s demonstrating significant promise in the places where it’s consistent with our approach to capital-raising in the past.”

We just need to be a little bit more patient. And we believe the long-term value of the Bitcoin is not resting on an ETF.

Source Link:https://sip.iob.llc/#/post/4028e2a769c8eef30169d00ca75e004a

Congratulations @iobteam! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!