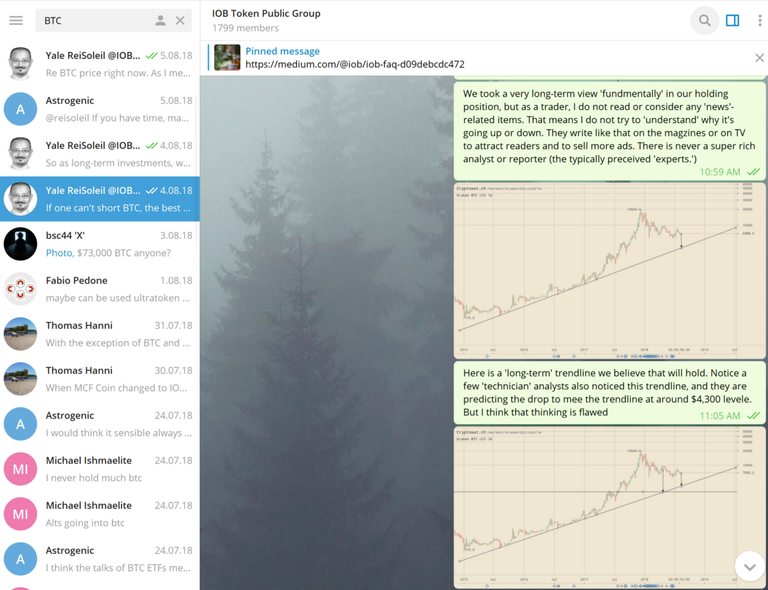

I had not been planning to get into this topic this early but the recent crash made lots of people very nervous, especially the ones holding lots of ETH now.

At the last post, BTC was around $7,486. Now it’s about $1,500 lower and seemingly fell through its supports along the way.

BTC Aug 14 1-week char

$1,500 certainly is a lot by any measures. But on a grand scale of the weekly log chart, it is (just) a small portion of the consolidation.

However, as the horizontal lines I used for trading indicates, we’re at a critical juncture. Any further vicious fall in the next few days may make our ‘worst nightmare’ that I discussed on our Telegram (link) channel come true.

The down arrow pointed to the close of the uptrend line. If you are wondering, it’s currently at around $4,251. Bad.

“Is this a buying opportunity?”

No. Not yet.

Our Telegram members know the rule: Don’t try to catch the falling knife!

“Where is the bottom?”

Yes, you need to wait.

Wait till the knife has fallen onto the floor and stopped wiggling.

That’s when you pick it up. For us swing traders, that’s when you even consider picking the reversal entry point.

Not anytime before that.

That means you don’t wish and hope for certain things.

Let’s look at the literally bloodied ETH below:

ETH Aug 14 1-week chart

ETH is clearly in trouble. I hope our Telegram members know that and have not added any new positions (bought) since our last discussion.

ETH has been in a clear downtrend since May, and it just recently broke its major support around $405.

Now pay attention to the circles I drew on the chart. Circle 1, 2 and 3 all had a panic drop bar but closed successfully at the top 25% portion of its length. That’s a major reversal indication. (Not necessarily a buying (entry) point yet. That will be discussed at a later post.)

If the current weekly bar closed at it’s low like now, we have to be very careful. It indicates a drop to test the downward trendline at $195. I’ll be a little nervous for the long positions at that point. However, if it closes at the top of the current bar height (the top short horizontal line), we may see a good buying opportunity soon.

The same is true to BTC, at a much more ‘comfortable’ level for now.

BTC Aug 14 1-day chart

“Where to buy?”

The arrow on the BTC chart above pointed to a classical reversal buying opportunity. This reversal pattern has been successfully used in our trading programs for over ten years.

“Are we f**cked?”

Not yet. But the next few days are important to know where the market is going.

For a trader, it is very important NOT to assume anything. You patiently trade according to what the market is telling you to trade, both long and short.

However, due to the limitations of crypto trading infrastructure, short trading for a swing of a few days is not that easy or cheap. The CME BTC futures are best used for a large position hedging on a limited basis.

This is why IOB thinks it’s important to develop its Smart Trading™ and Smart Exchange (SmX™) to facilitate arbitraging, hedging and market swing catching.

“How about me, a long-term holder?”

I said above, and keep reminding our traders, we do not make predictions. They are ultimately wrong and give your irrational influences on your trading positions.

But as a long-term holder, we do have faith in BTC, and we think there is a good chance the ‘near-term’ of the next 16–24 months might look something like this:

Final words:Do NOT let your long-term outlook influence your trading. No Second Guess while trading.

*********************************************************************************************************

*Disclaimer: This is not a recommendation to invest, nor can this be considered an investment advisory service. No money changes hands that will benefit IOB as a result of this post. Full disclosure: We long BTC and ETH at the time of the publication.Originally published at iob.vc on August 14, 2018.