When talking with anyone interested in trading bitcoin, the question inevitably asked is, “How much is bitcoin worth?” It’s a tough question to answer. Here are 3 ways to consider when evaluating what bitcoin is worth.

AS AN ASSET/COMMODITY

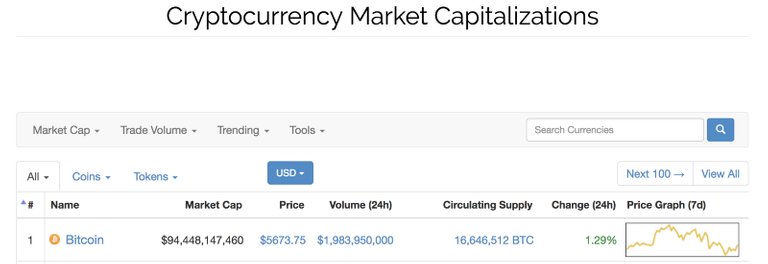

If you want to take a stab at valuing bitcoin coming from the context that it’s a commodity, one way might be to estimate it as a percentage to the total value of gold. The market cap of all the gold currently mined today is about $8T. Gold is a good commodity to compare against because it’s not consumable and it is used mainly as a store of value. Gold was a store of value for a generation. Today, everything is digital, and bitcoin could be a store of value for the future generation. If bitcoin garnered 10% of the total value of gold, then the market cap of bitcoin could rise to $800B. To date, bitcoin has a market cap of about $100B.

This is one way FundStrat Global Advisor co-founder Tom Lee is attempting to value bitcoin, though he uses 5% of gold. This might be one way to value bitcoin.

AS A TECHNOLOGY/NETWORK

Lee also explains the network effect and Metcalfe’s Law. Value is established in this way: the more engagement, the more value gets created. As more and more people use bitcoin, the higher the value because of the network effect. This focus on bitcoin as a technology or social network conveys the strong opportunity for non-linear growth.

7 NETWORK EFFECTS ON BITCOIN:

1. Speculation — every speculative dollar that trades in bitcoin increases the value

2. Merchant Adoption — every new merchant that accepts bitcoin increases the value of the network

3. Consumer Adoption — every time a new consumer can buy something with bitcoin the value increases

4. Security/Incentives — as the speculators as well as merchant and consumer adoption raise the price, miners’ and nodes’ incentives are increased

5. Developer Mindshare — as the moat around bitcoin increases so does the value

6. Financialization — as more financial products, like options on cryptocurrency and insurance get created, there is more value added to the network

7. Adoption as a World Reserve Currency — this one is off in the future, but as other fiat currencies collapse, the value of bitcoin increases. We’re already seeing that from events in Venezuela and countries in Africa.

This comes from work done by Trace Mayer.

All of these “network effects” are working in concert, together creating more and more value for bitcoin.

AS AN ALTERNATIVE CURRENCY

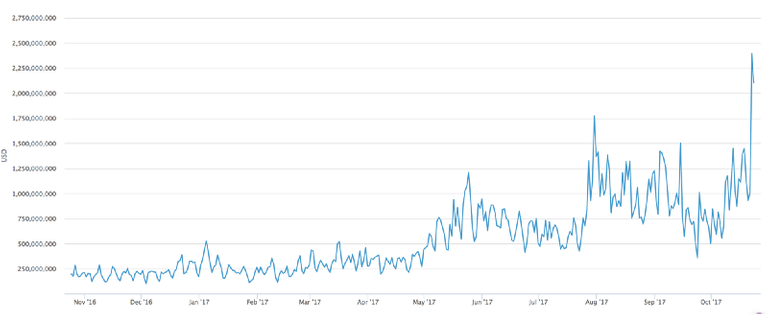

The historical average over the past 5 years has shown a relationship between daily transaction volume and the market cap (price) of bitcoin. On average, the market cap of bitcoin = 50 x daily transaction volume.

https://blockchain.info/ch…/estimated-transaction-volume-usd

Yesterday, we did about $2.1B in transactions, which means a market cap (price) supported by history for bitcoin would be $105B. Right now, bitcoin has a market cap of $94.5B, so this suggests upward movement in bitcoin price, which is supported by the higher daily transaction volume.

Follow the daily transaction volume and that should be an indicator of the price of bitcoin. This might be one way to value bitcoin. Watch the daily transaction volume over time.

KEY DRIVERS OF VALUE

As bitcoin continues to get used in a variety of ways, it’s value will continue to grow. In developing countries, like Venezuela and Zimbabwe, which are fighting high inflation, bitcoin is stronger than their national currency for a medium of exchange, a store of value and a unit of account.

Bitcoin is also used more and more in the international payments and remittance space. This is estimated to be a $500B industry. More and more users of bitcoin come online because it’s cheaper and faster than using other legacy remittance and payment systems like Western Union and others.

Finally, more and more vendors are offering it as a payment system. Expedia takes bitcoin. Overstock.com take bitcoin. Rumors are spreading that Amazon will take bitcoin. All of these are key drivers to push up daily transaction volume.

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Please do your own homework.

If you enjoyed this article, like it to help others find it! For more, join us on Facebook and Twitter and if you want to receive the latest weekly updates on Investing, Entrepreneurship & Personal Finance, feel free to subscribe to our NEWSLETTER.