Hello steemians friends, it will seem more of the same that many publish in this platform in search of votes, since everything that is published that has to do with bitcoin, cryptocurrency and trading is a winning trend. I hope you give me the opportunity and read all the writing, because as you know when collecting in SBD or STEEM and take your profits to euros, dollars, bolivares or your local currency even if you do not know directly or indirectly you are trading.

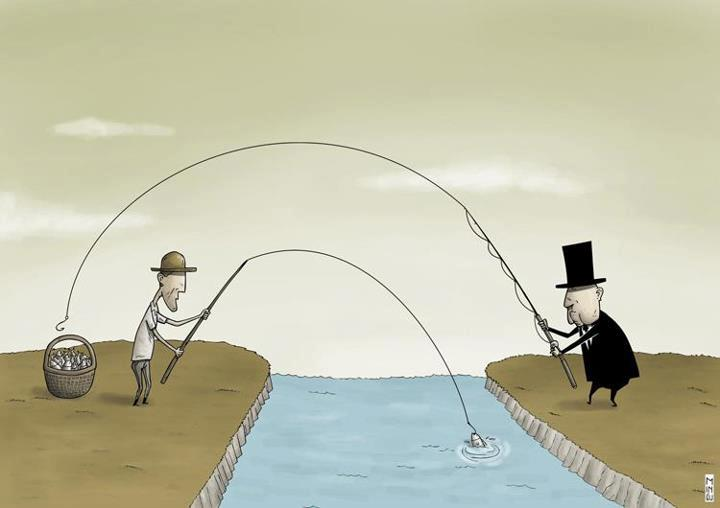

This time I'm not going to refer to analysis techniques, or to give investment signals or patterns in graphics, I want to explain a theory that I think is not being well explained by those who in investment markets become millionaires "fishing in a river "

If we want the cryptocurrencies to have a solid future and be more and more accepted within the financial models, we must give them credibility and stability, since the most notorious weakness and from which detractors and analysts cling to tip these assets is based in the volatility and excessive speculation, which is not caused by anything else, than by an immaturity in the investors (which would be us) and an excessive use of these, for the opportunity they represent, to be eaten by the big fish. Which is reflected directly in unstable and unreliable markets.

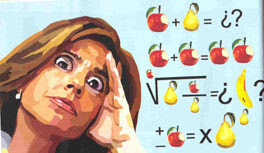

To explain myself better, an example. If we have 10 apples and they tell us that when we put them in a basket, we will get 15 that they think the vast majority of us will do?

In this example we must remember that in a basket, the apples do not reproduce in a magical way, the apples that we would be extracting more, are apples that another investor is losing in a position at the moment in which we are withdrawing them, and that depends only of luck (if we do it blindly and without knowing) that the apples that we remove are more than what we initially put or less, and may even be none.

The investment markets are speculative markets, which is not bad and it should be noted that I am not against it. The main idea should be to put 10 apples that we could have sold at x price and at the time of removing the same 10 apples and that these have a higher price than they had when placing them, THAT WOULD BE THE IDEAL.

following with the example of the apples since with pears and apples it is the best way to explain an idea according to the popular saying.

Let's imagine that it is time to harvest apples but the market fell a lot and at this moment they are very cheap for sale. If we have a large refrigerator and we can store them without spoiling or rotting, to wait for a better price for example after two months since we handle information that will have a value 10 times higher, would you expect to store them in the refrigerator?

It seems silly but it is an investment technique called "holding" is the best technique for when there is no knowledge of movement in markets, to make money relatively safely.

Not knowing about technical analysis and short-term trading or scalping as it is called in the stock markets, I think it would be the same to play Russian roulette, just a matter of luck, if you are still alive after each good trigger and if not then bad luck to you Each attempt without bullet, makes the next more dangerous.

Let's use the time we do the holding to learn technical analysis, look for theory and practice in demo accounts, which would be like learning to swim in a pool with lifeguards and when they are well prepared to go swimming in the ocean.

I've been studying trading theory, models, investment strategies, etc. for a year now. trading in demo and real accounts, and searching with a magnifying glass between the false "gurus" of the technical analysis that exist on the internet, the real men and women who have bases and apply in their practice the theory that has already been read and that even I continue to visit every day to compare patterns when I see them in Japanese candles.

If this approach seems interesting, leave me a comment and if this article has a relative acceptance I will start to share a little what I have learned since I think that if we all learn a bit of technical analysis we will help the cryptocurrencies to establish themselves in a solid way in the markets , be accepted and we have that decentralized economy of the future. I want to do my bit and against what many do is misinform to benefit momentarily, I want to contribute and that the benefit is in a better future and more free.