Exchange trade cryptocurrency existed since 2010, but still suffers from several significant drawbacks - depending on a number of exchanges of operators, lack of trust and significant differences in prices.

The market consists of a few tens of both large and small shopping areas, each of which set their exchange rates, depending on the number of internal and external factors. Often, the difference in price between the dollar Bitcoin exchanges amounts to several percent, which is almost impossible for traditional stock markets.

For traditional markets course alignment occurs, usually for three reasons:

-On The stock market IPO companies usually occurs on one stock exchange, and they are listed only there.

-On The commodity and currency markets, the difference in rates instantly smoothed arbitrage transactions. This enables the rapid movement of funds and low commissions.

-United Or very similar trade rules provided closely matches the exchange legislation of many countries.

But the market cryptocurrency arbitration is not developed, because every exchange their input-output mechanisms, and translation as fiatnyh and cryptocurrency between exchanges can take several hours or even days, and for the withdrawal of fiatnyh money set high commissions that nullifies arbitrage opportunities.

As for the rules of trade and input-output, each of the exchanges kriptovalyutnyh installs them on your own, as their dependence on the stock exchange regulators zero or very conditional. Most of them, in the best case, registered in the offshore financial services as operators of "generalists".

And the most important aspect of reducing the attractiveness of exchanges cryptocurrency - a lack of confidence caused by the anonymity of owners of many exchanges and heat exchangers, as well as insufficient storage resources security caused by, inter alia, lack of control, regulatory requirements, and any certification equivalent. Every year there are several robberies kriptovalyutnyh exchanges, as a result of which thousands of people are losing their means cryptocurrency. And hope for their return remains elusive.

Recent break-ins and Exchange Bitfinex exchanger Shapeshift, considered among the most reliable, only confirm this sad fact.

Not surprisingly, users cryptocurrency want to minimize the reliance on operators exchanges and exchangers. Septic Exchange, which operates exclusively through reliable and transparent blokcheyn, still an unrealized dream.

Another option is to organize the direct exchange between users. It is much slower than stock trading, but security means people are dependent on them. In fact, the only representative in this niche for several years remained LocalBitcoins service, which aims to find local contractors, "residence" transactions offline. However, it gets a lot of complaints about the quality of services and opportunities for fraud.

It is obvious that the organization of the fast and reliable P2P cryptocurrency market - the task extremely difficult. It is necessary to ensure not only the convenience and privacy of transactions to the users, but also to minimize the opportunities for fraud - primarily related to "back" operations.

Chinese project BitKan (BTCKAN until recently) tries to fill this gap. It was founded in 2013 in Shenzhen - one of the young Chinese cities. BitKan is an over the counter (OTC, out-the-counter) market to trade any cryptocurrency - a cross between the classic exchanger service to search for contractors, such LocalBitcoins, and exchange cryptocurrency. OTC service was launched on BitKan the end of May 2016 but he is just starting to go beyond the Chinese market.

China has traditionally been considered the world's "kriptovalyutnoy capital". It produces the vast majority of Bitcoin and being the most intense trade any kripovalyutami. Chinese Bitcoin turnover exceeds the volume of the rest of the world several times. And service for OTC trading there will be in demand, as well as in other countries with active kriptovalyutnym community, including Russia and the United States.

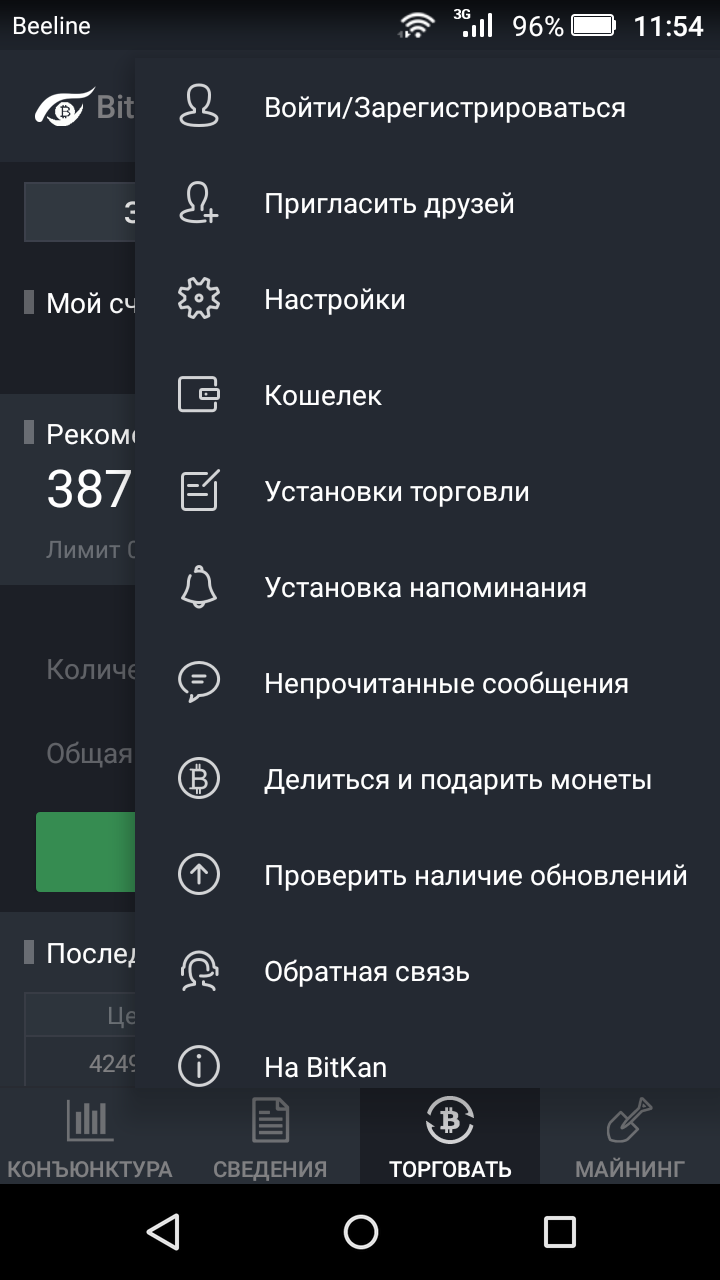

In BitKan has some interesting features. Trade is conducted only through the mobile app for iOS and Android. Applications for PC there, and through the web interface, you can only monitor and change some settings.

The mobile application interface is present in three languages: Chinese, English and Russian, but the site of the Russian language is not present. However, and transfer to a mobile application leaves much to be desired.

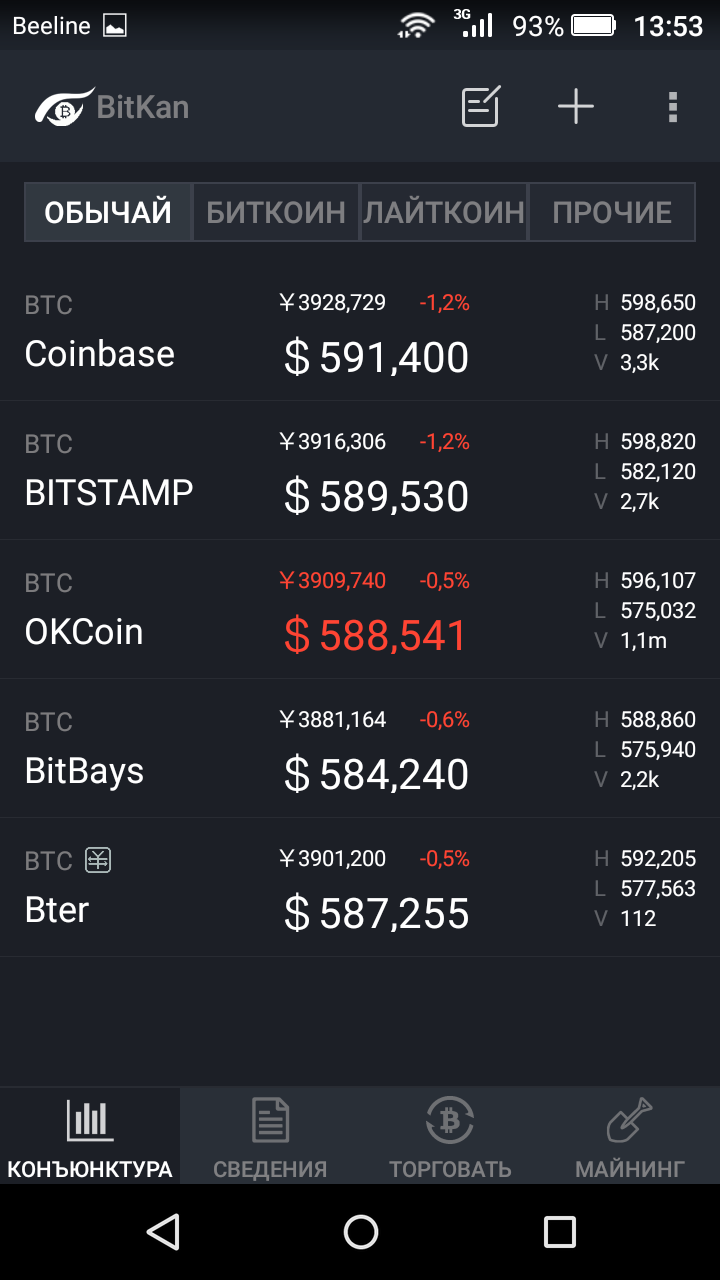

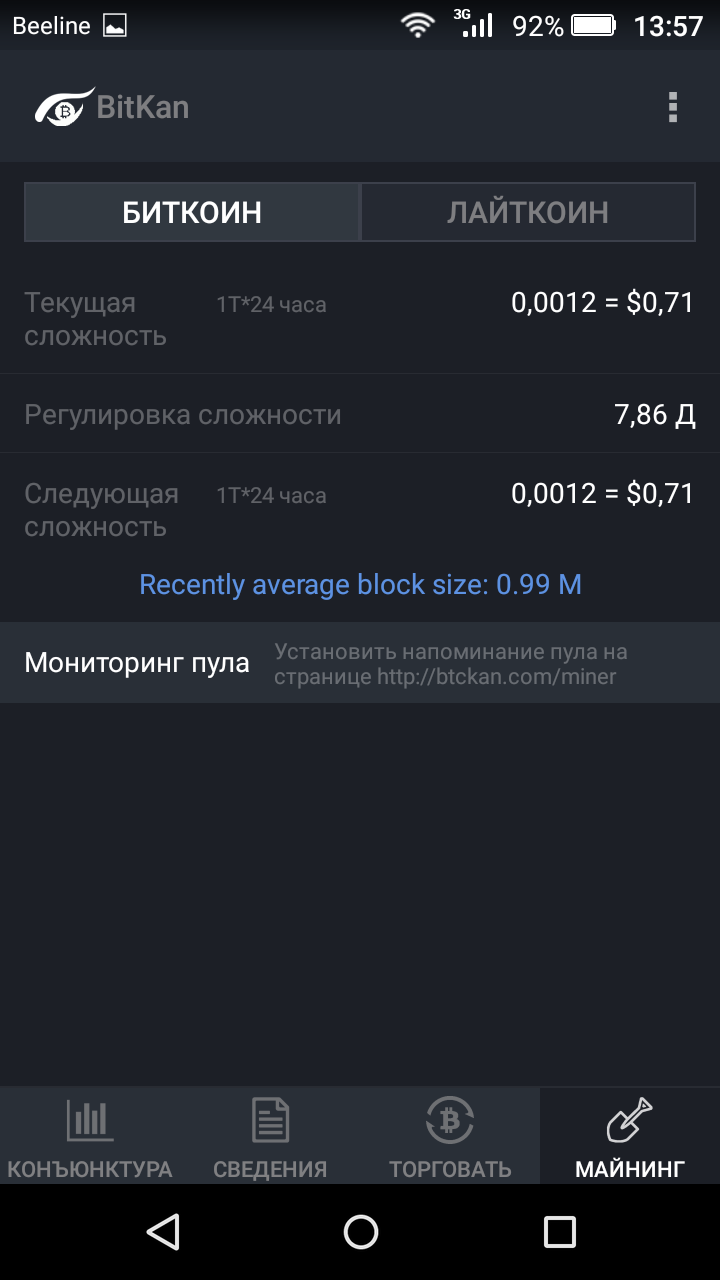

In addition to the actual trading interface, the application has a news ticker, course monitoring cryptocurrency table on the set of exchanges, as well as statistics on mining without unnecessary details.

Transactions on BitKan place online and by default take place in semi-automatic mode, without negotiation seller and the buyer. But talk to chatik they may wish. Interface messages is not very convenient - to get to come to the program messages, you need to take a few steps.

Installation and Registration

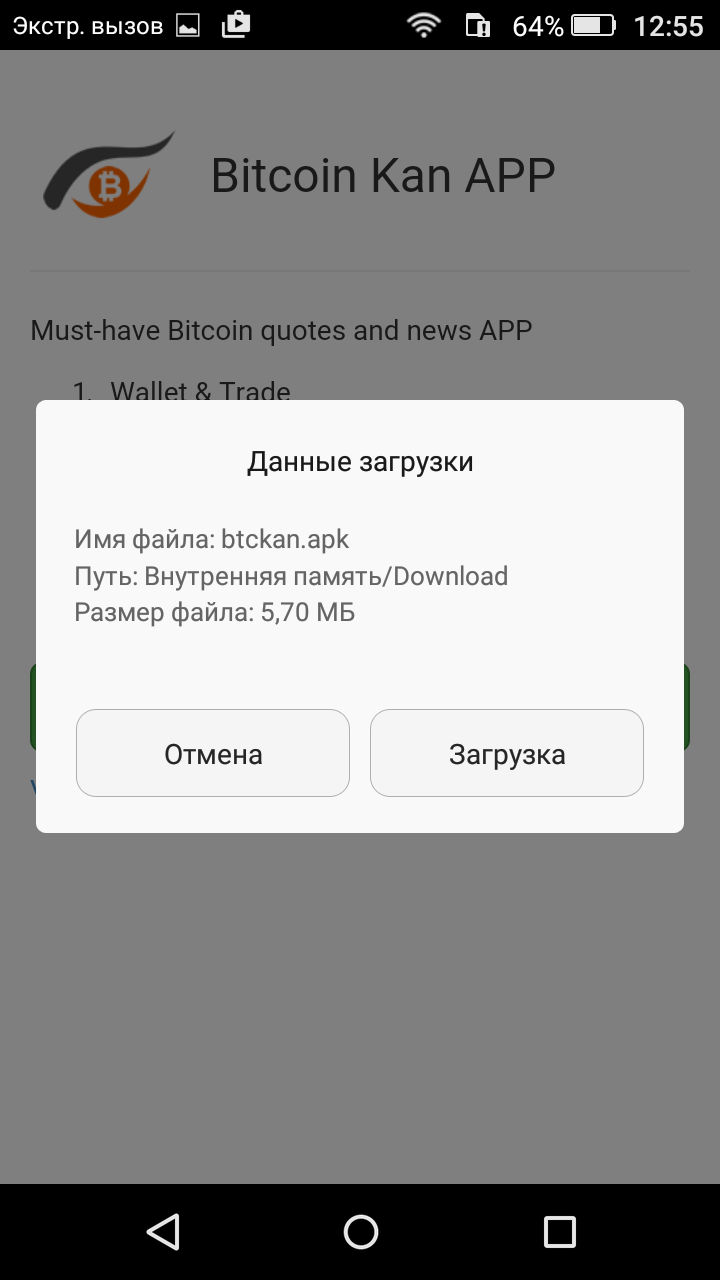

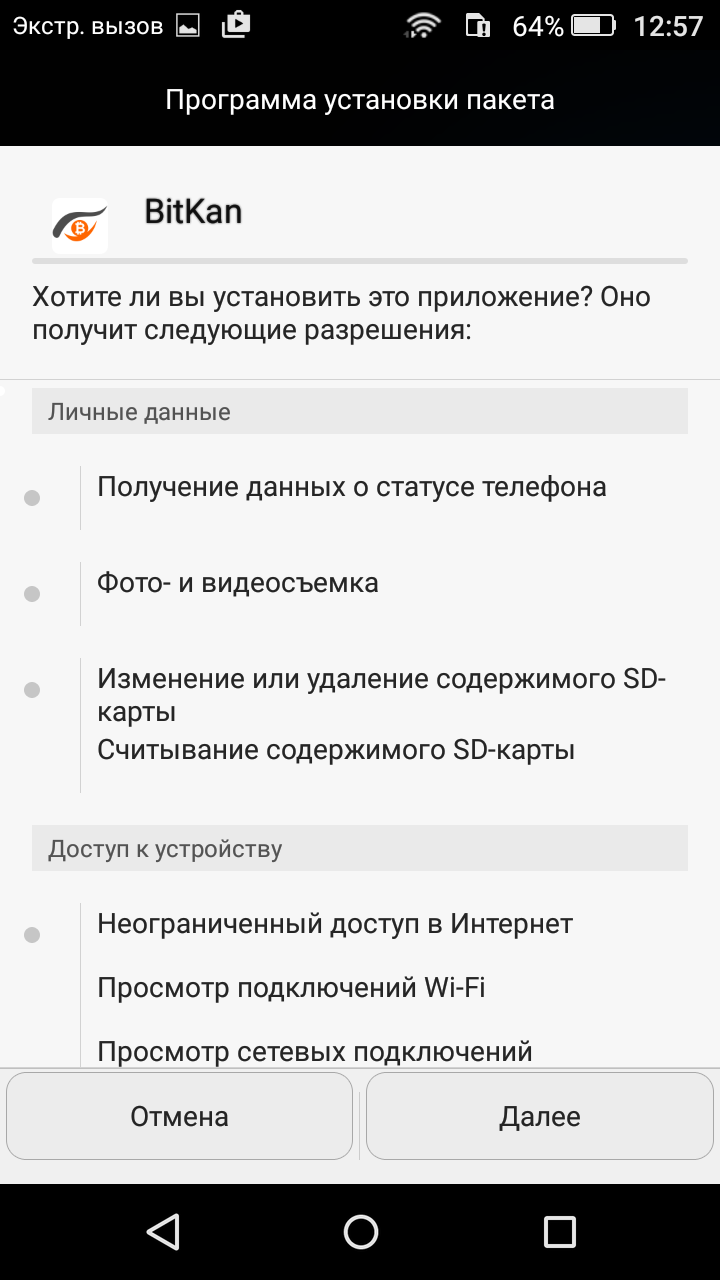

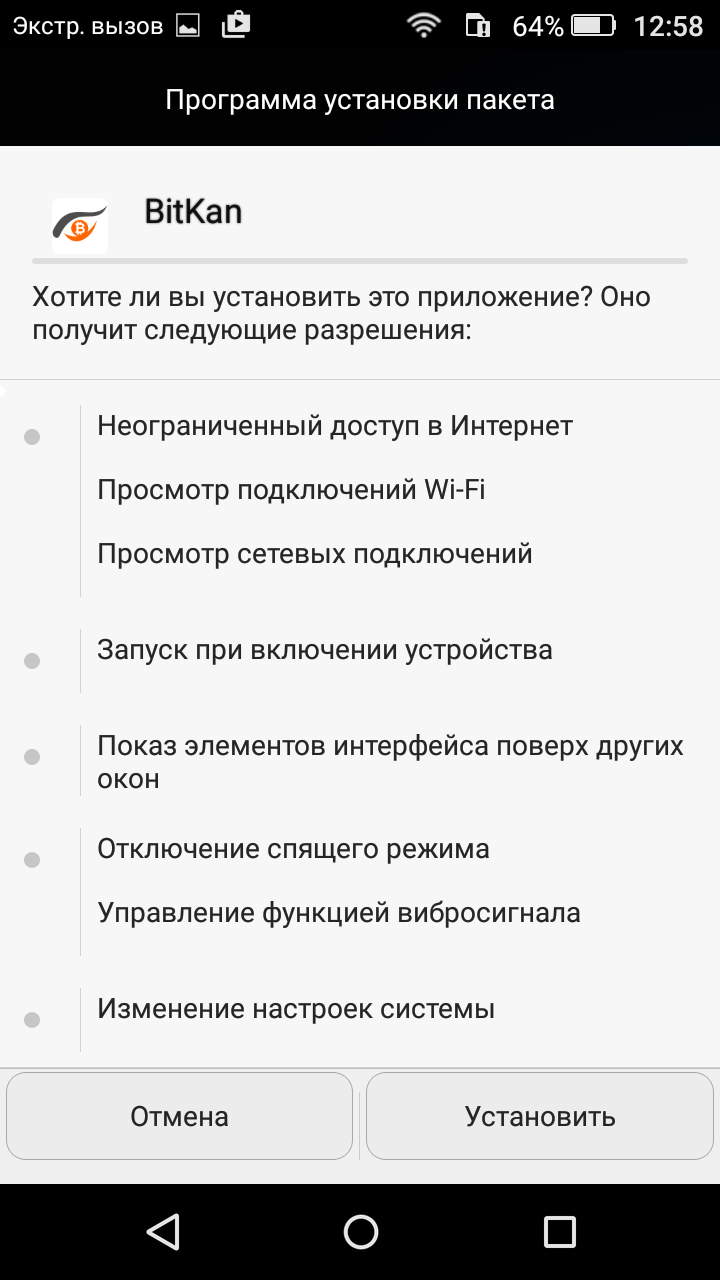

Appendix BitKan established not through the app store, and a link to the developer's site. When installing it requires a very broad mandate, which can not please users, striving for maximum security of your smartphone.

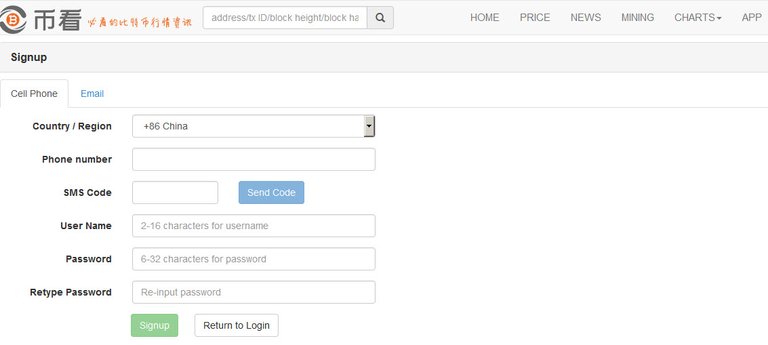

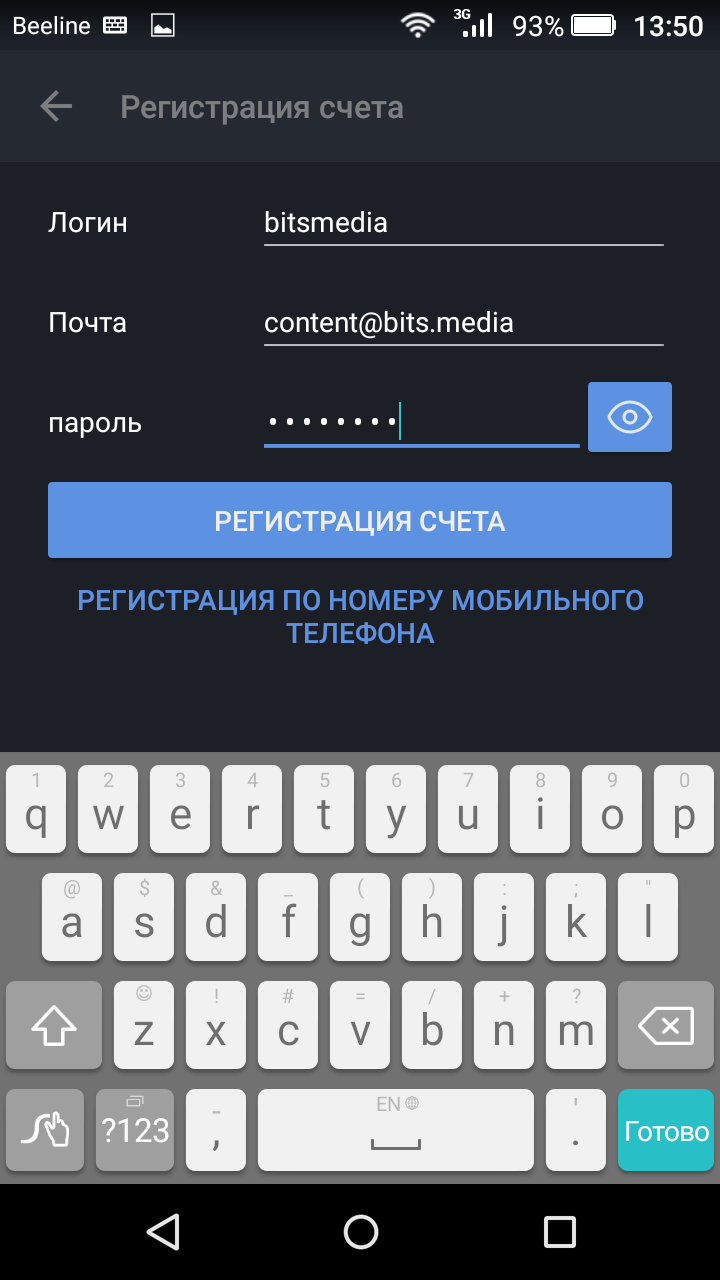

To buy or sell Bitcoins (similar - several dozen other cryptocurrency) on BitKan, you must, of course, to register. This can be done through a mobile application or through the site with a PC. But trade with the site will not work.

Probably, the developers have left registered on the site to facilitate the process - in the application it needs to go through several screens, and the site is filled with all the same. But Russian interface on the site is not, and if you have not had occasion to study the native (for service) Chinese, will have to live with the English.

The primary identifier is used login and registration confirmation can be obtained by e-mail or mobile phone. If you prefer to register for e-mail - your right, but maintain the anonymity of it does not help. For any trade you need to enter your mobile number, so it's easier just to create it.

To recover your password using the answers to the three questions, and the transaction is further protected by a PIN code of 6 digits, the creation of which the application requests the first run.

The rest of the process is fairly simple and standard, there is no need to dwell on it.

first look

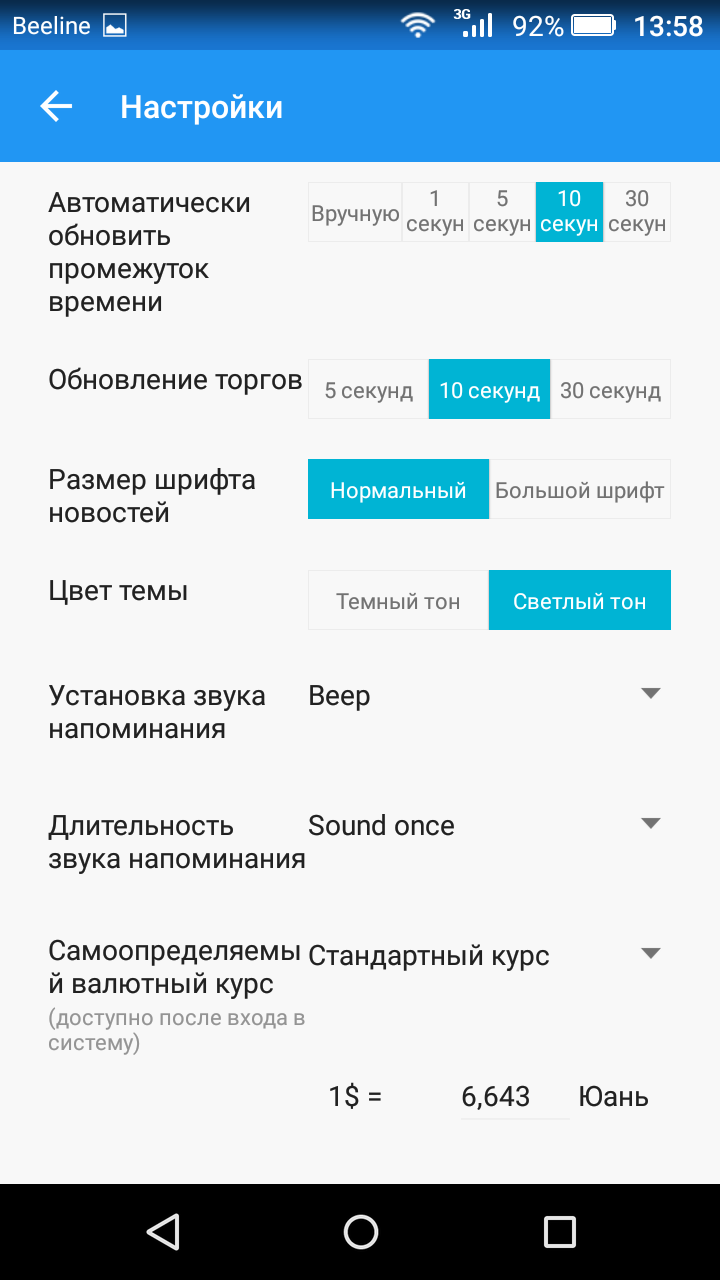

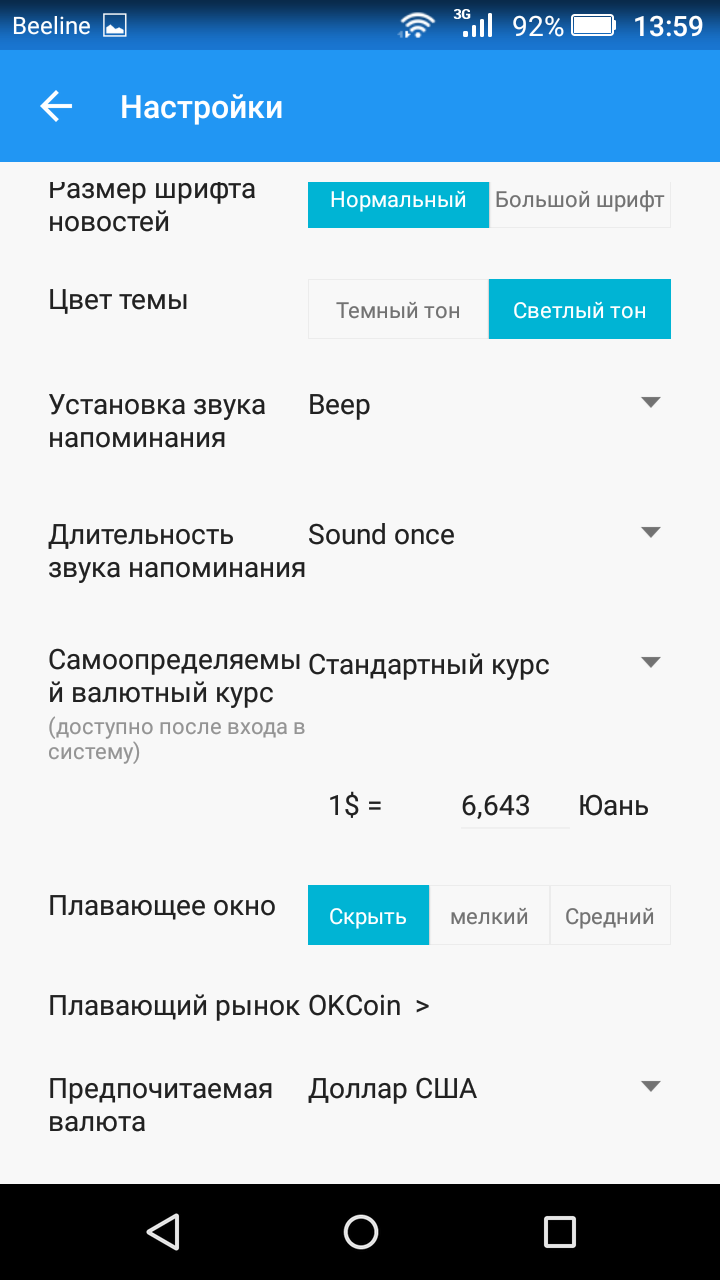

Upon entering the application reaches the finger directly to the Customize button, but they are few - mostly they relate to the interface and obtain quotations. I changed the refresh periods of quotations, as well as colors to the light, and it calmed down. If you Russified phone - then by default you get a Russian interface. But in the choice of language there are only auto-detect, English and Chinese. Therefore, I do not undertake to predict the behavior of the phone, for example, German or Spanish localization.

Not quite usual for a Russian language media interface elements first smile or cause irritation, but you can get used to them. For the nomenclature the word "environment" is hiding a table of current stock quotes and "information" - not that other, as the news ticker. On the "Mining" there is nothing interesting for miners. Perhaps in the future there will be more details on the status of the network.

begins trading

To finally start to trade - go to the "Trading" tab. For BitKan of speculation is not good. speed of execution, which is customary for kriptovalyutnyh exchanges, there is, as one party always conducts external payment. This exchanger is mobile, but not with a counterpart, and with many user-selectable.

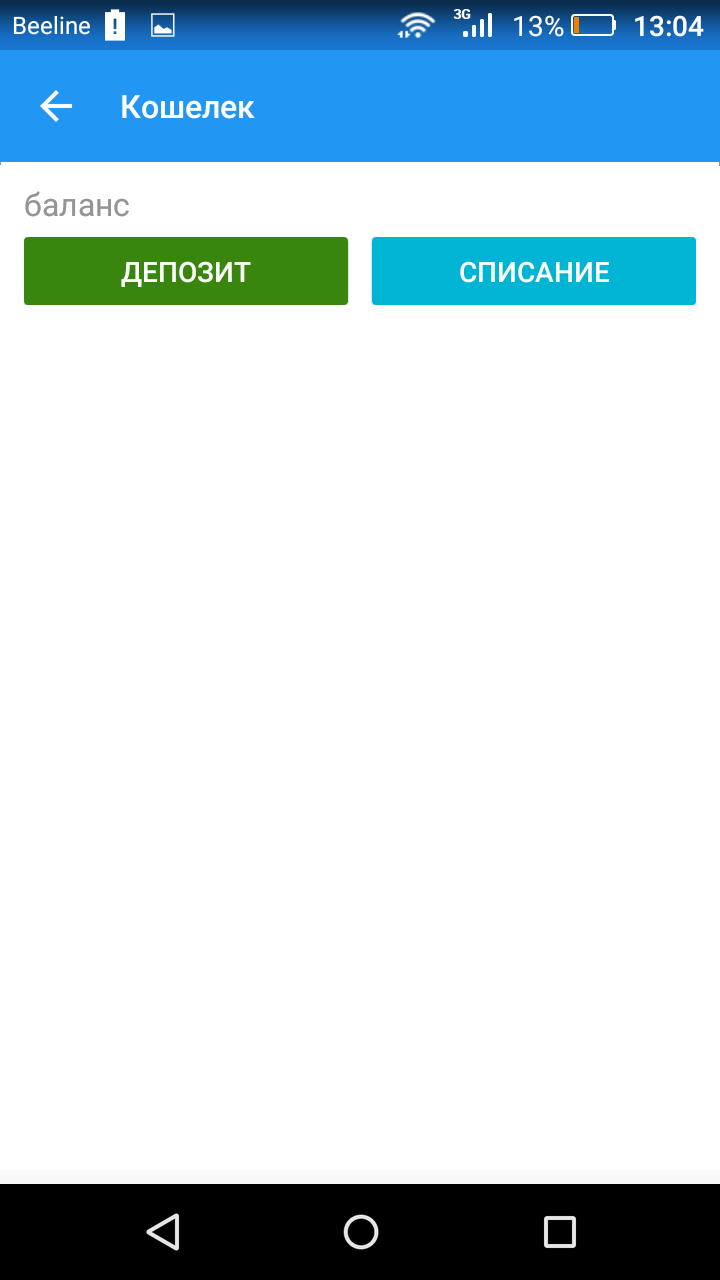

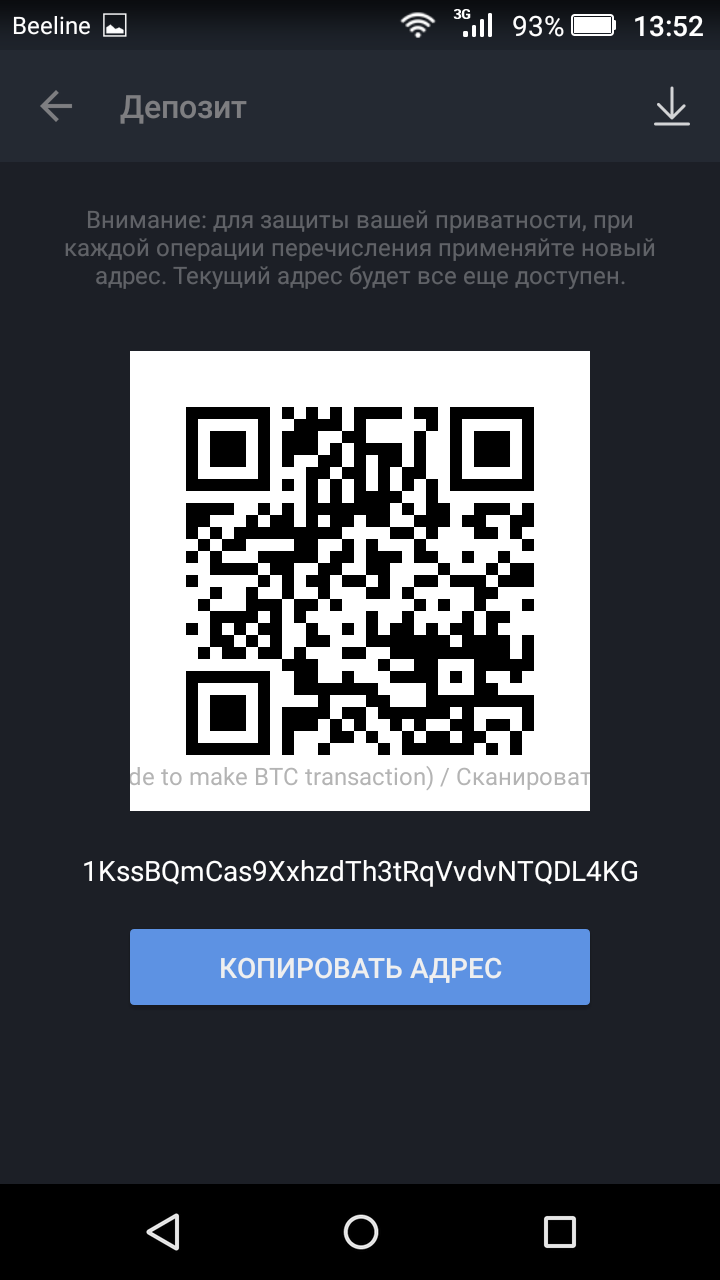

If you intend to sell cryptocurrency - then you need to first fill up a deposit, this application provides replenishment address in the form of text and QR-code.

Yes, the OTC market stores kriptovalyutnye deposits at. But fiatnye currency remain on the wallets of users when buying Bitcoins will you need to make a payment through the chosen payment system in the details specified by the seller. At the same time, coins for the amount of the transaction is blocked on the account of the seller, that is, the buyer does not bear risks. After receiving payment, the seller acknowledges receipt cryptocurrency and Bitcoin transferred to the buyer.

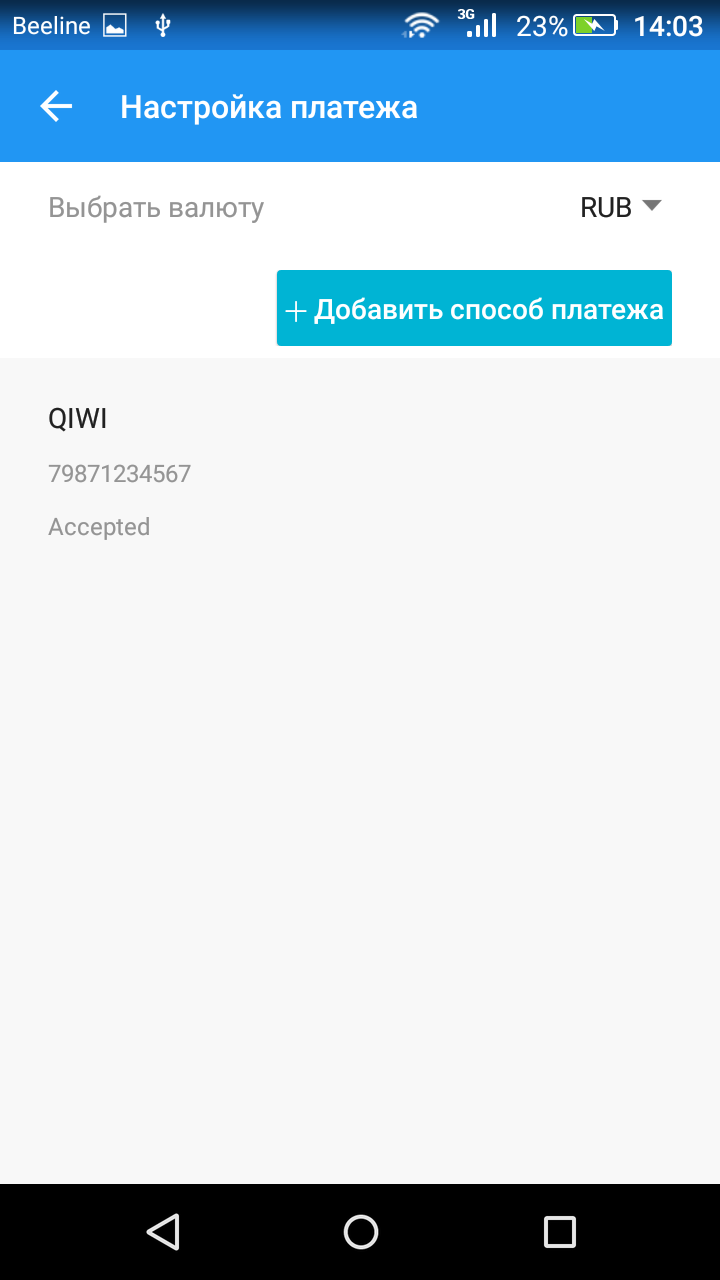

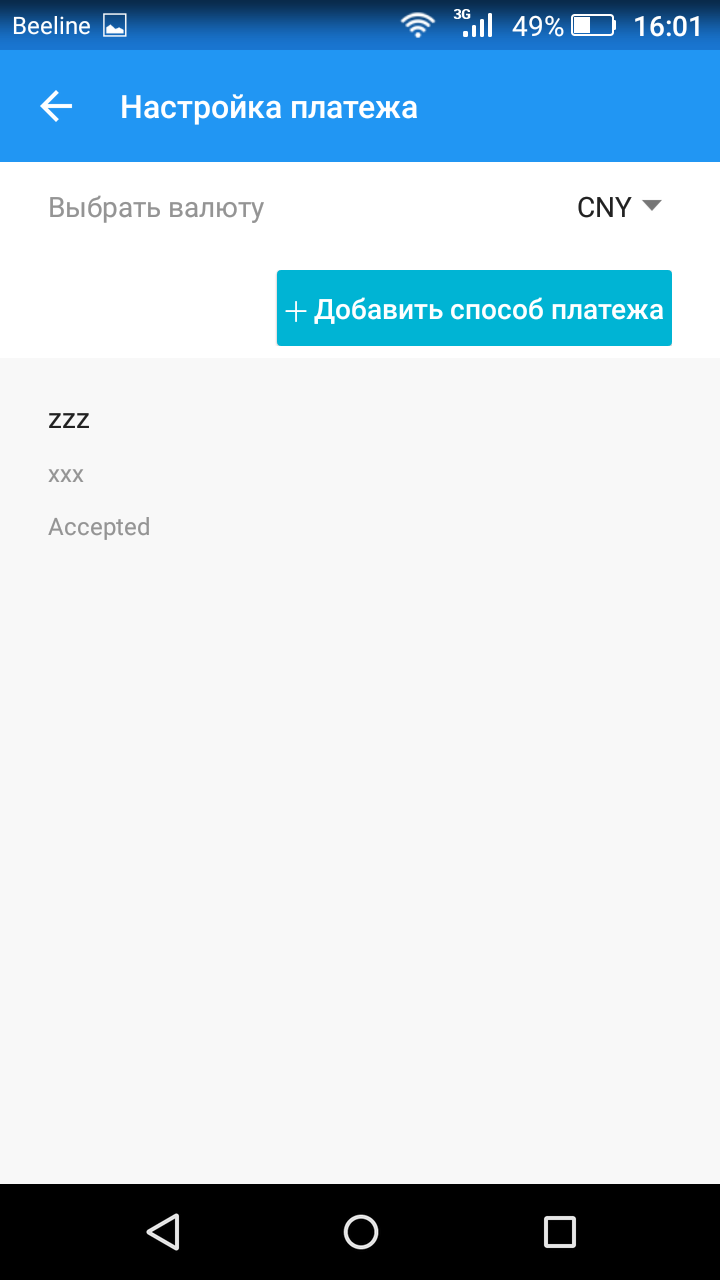

Before you start trading, it is necessary to first add fiatnyh currency payment methods - that is, identifiers purses payment systems. Stuffing can be in any form - the main thing that your counterparty knew where he had to move their money.

BitKan market maker on the so-called "dealers" or "traders". They can put a proposal to buy or sell at their own price cryptocurrency (she is not established is arbitrary and a percentage of the "official" policy platform), while ordinary users can make transactions only with traders and at prices set by traders. To become a trader, you need to write to the technical support to address [email protected] and provide the necessary information.

It can be summarized that BitKan - not fully decentralized P2P market. This two-tier structure, where users can make a deal with a small number of traders of proven service management. The administration thus acts as an arbitrator, which may apply to users who are not satisfied with anything in the transaction.

Road to Calvary

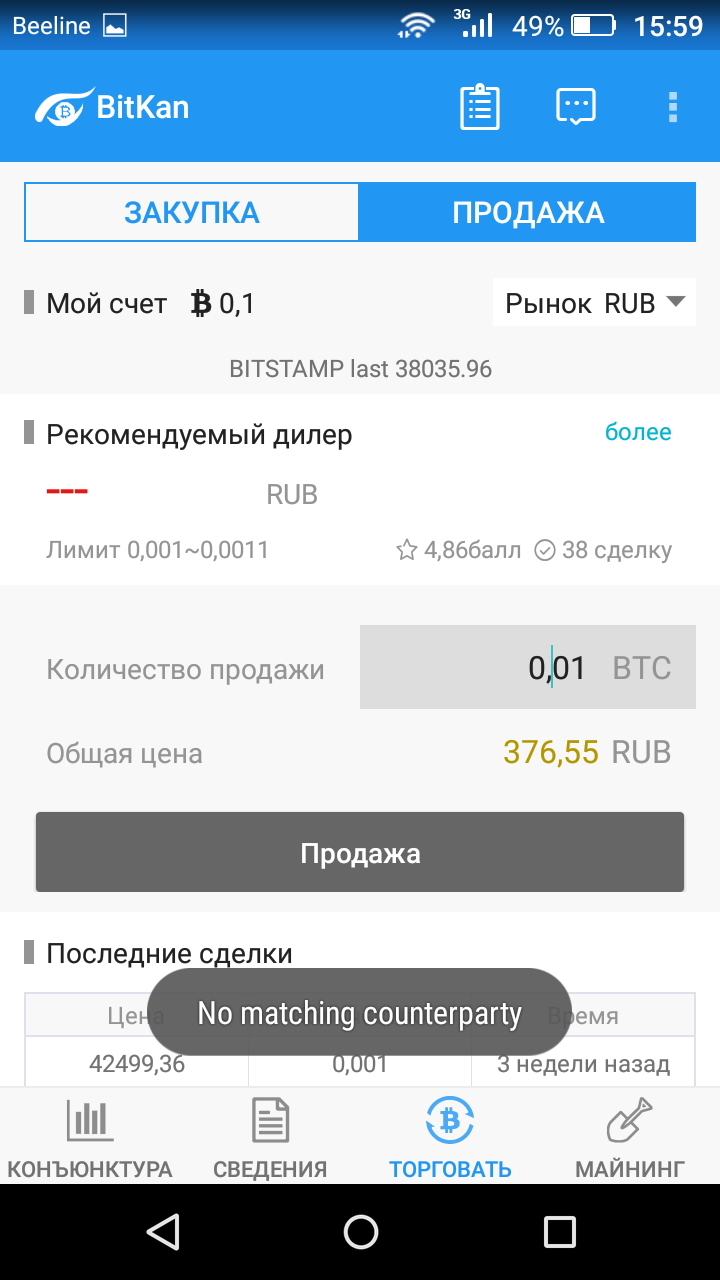

fiatnyh four currencies represented at BitKan: Chinese yuan, the US dollar, the Japanese yen and Russian ruble. As a source of quotations for the yuan, dollar and yen favor Chinese market OkCoin, but for some reason rubles selected Bitstamp, although there is no trade in rubles.

In fact, to date, sufficient liquidity, even for small amounts is available only on the yuan. For large investors, this market is not intended, but it was created primarily for the private exchange.

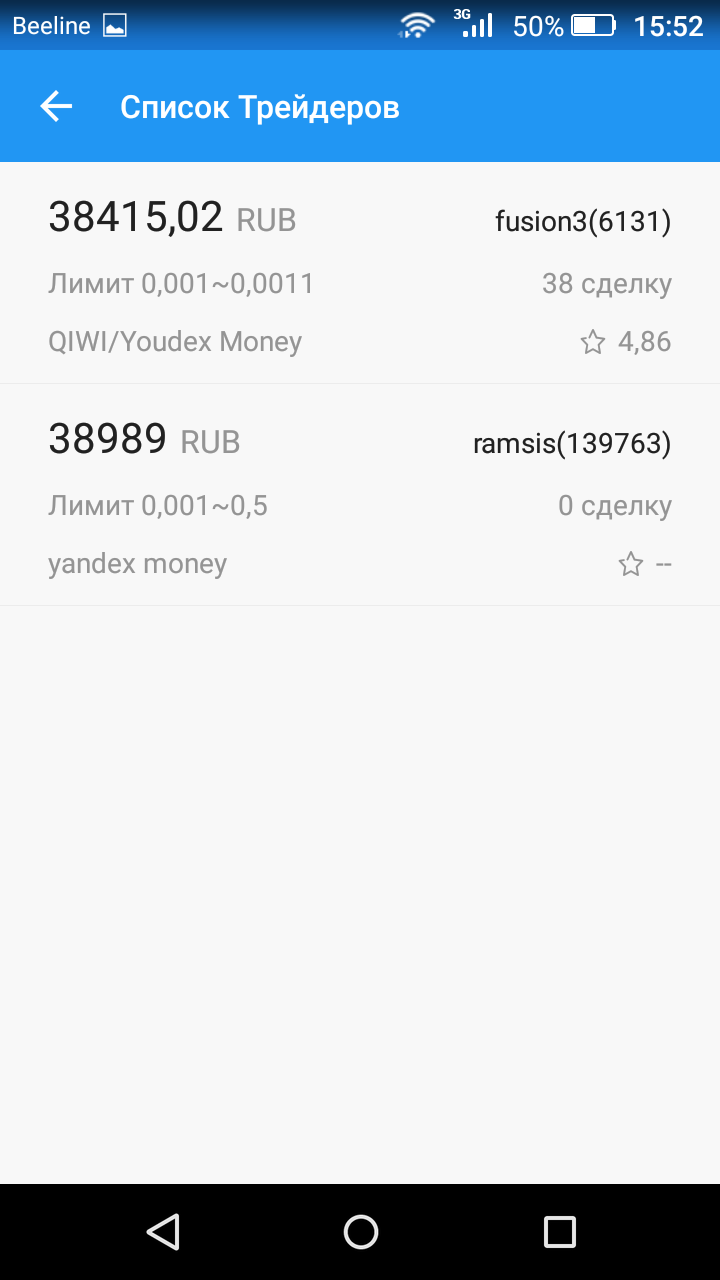

When buying or selling Bitcoins for yuan always have the option of attending online 10-15 dealers, while other currencies - usually no more than two, but also those on closer examination, as a rule, are Chinese. Sometimes such situations arise when online no dealer that trades in rubles.

Every dealer can specify the scope of the minimum and maximum amount for the transaction. Generally they range from 10 to 0.001 BTC BTC.

The spread of the buying and selling prices for the yuan is the average within 1%, while in the ruble, the gap is 3-5%.

At first I tried to sell Bitcoins for the yuan, but here, unfortunately, did not work. To trade on the P2P-market, you need to have an account in currency trading - in the bank, on the map or in any payment system, which is your counterparty.

Not finding my real payment details, contractor tried to explain in pure Chinese, later switching to English. I had to explain to him that I accept the renminbi can not. The sale was canceled due to a timeout, which for different types of transactions from 30 minutes to 2 hours.

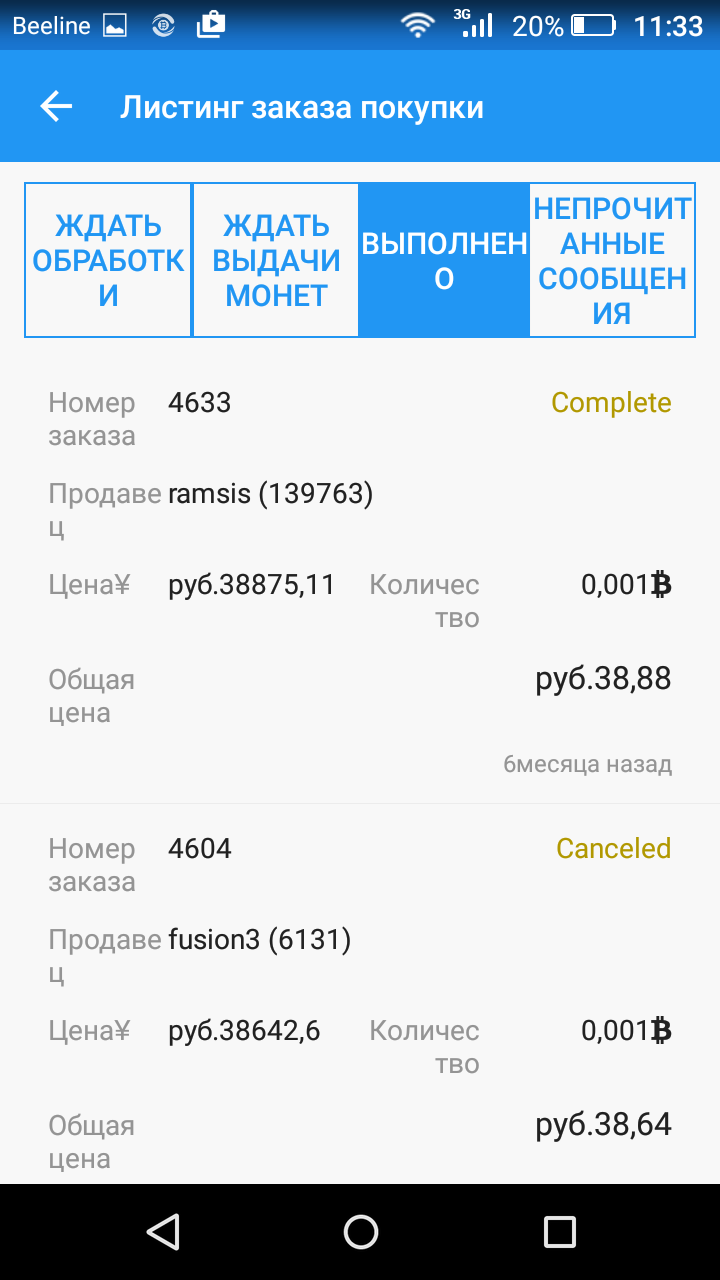

Sell and buy

We are also mainly interested in trading for rubles. On BitKan I met the Russian-speaking counterpart and met with him of the sale and purchase Bitcoins.

First, I decided to sell. This is not much more complicated than conventional exchangers cryptocurrency:

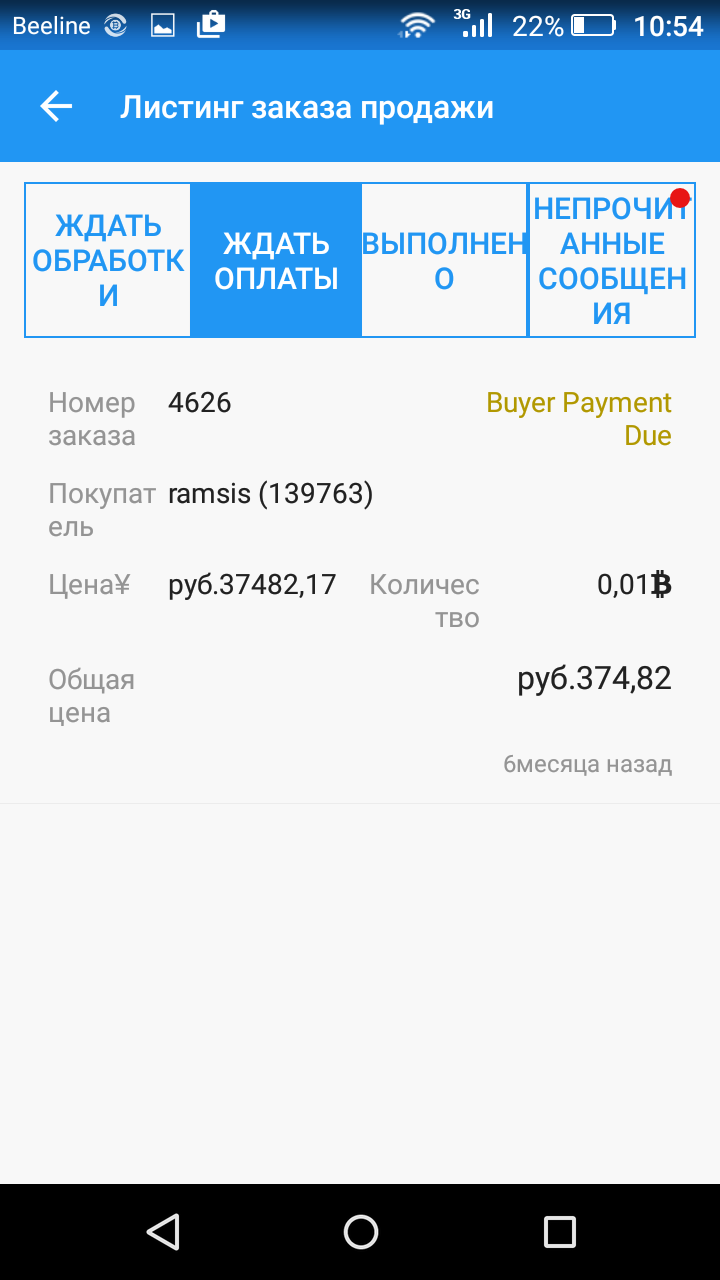

1.Vybiraem contractor from the list or settle for optimum, the proposed system, fill in the amount of sale (in this case because of the Russian format separators numbers in fractional values instead of the point should be a comma) and send the order.

- Get notified about the order, the contractor takes rubles for our contact information.

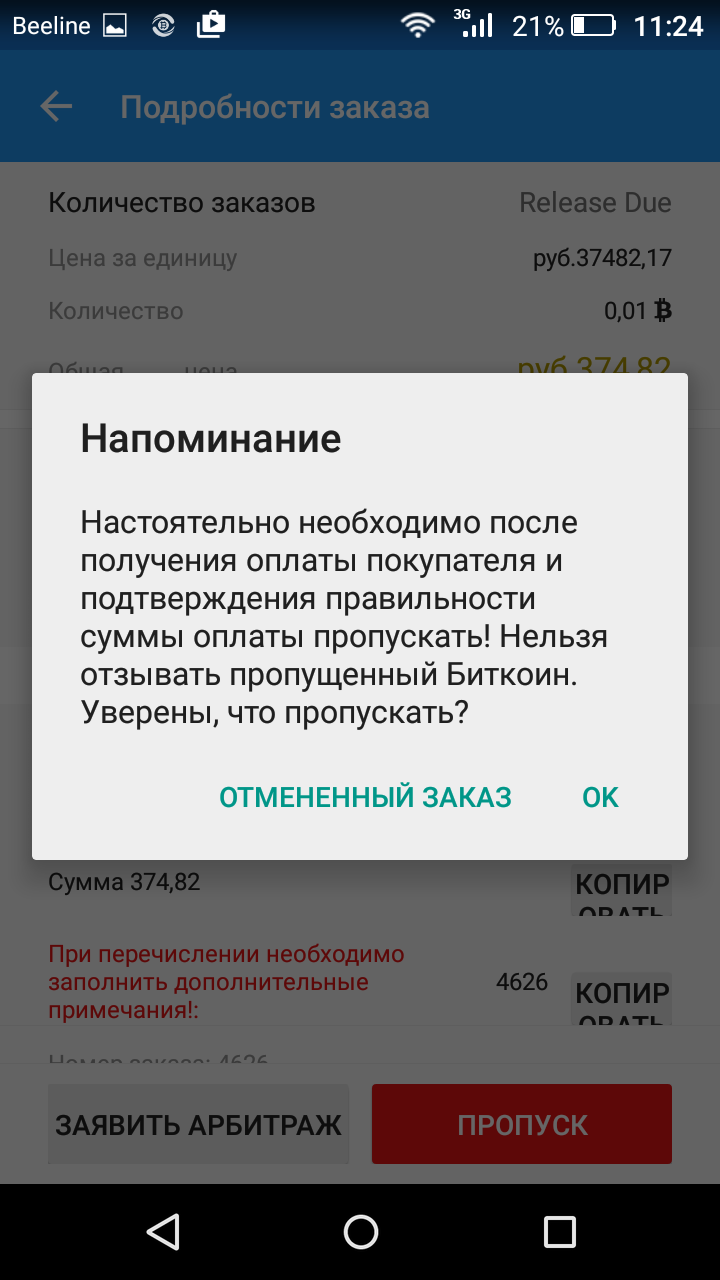

- Make for the money, confirming the order execution, accepting and very funny warning of transience kriptovalyutnyh payments.

- After confirmation, the system is urged to put counterparty rating from 1 to 5 - the rating of the dealers is based on these assessments.

5, Bitcoin our account transferred to the buyer.

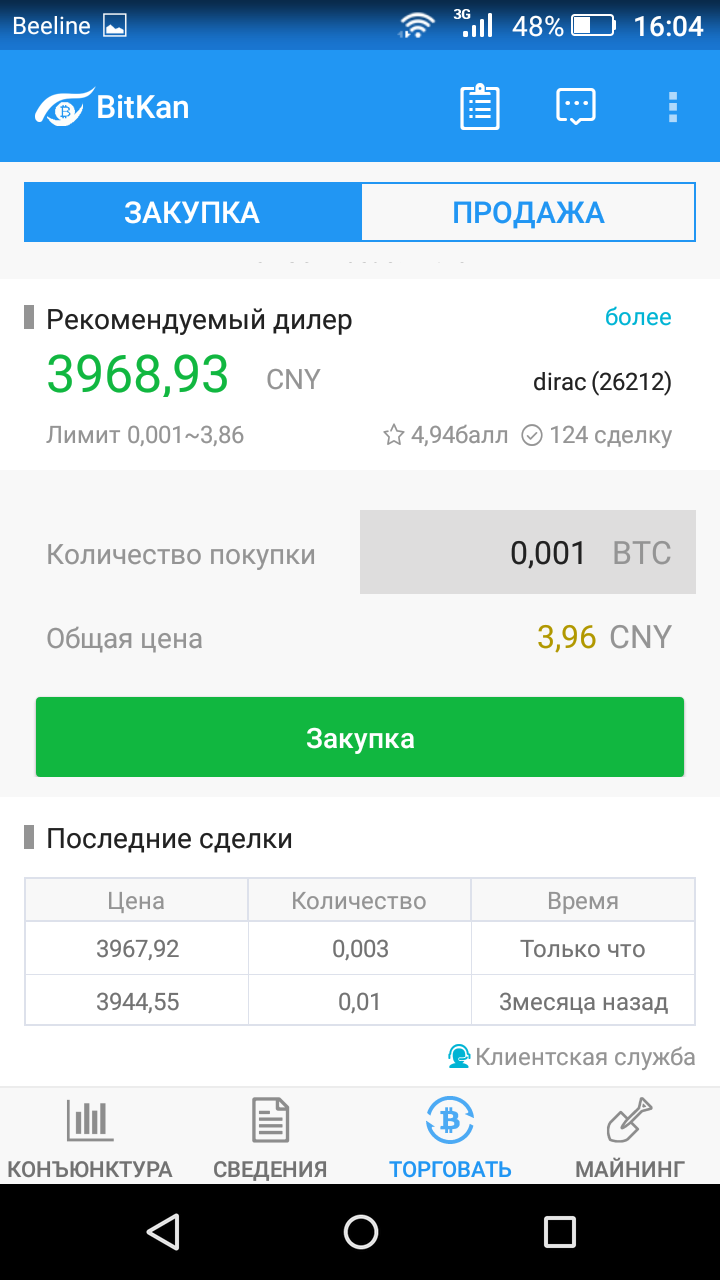

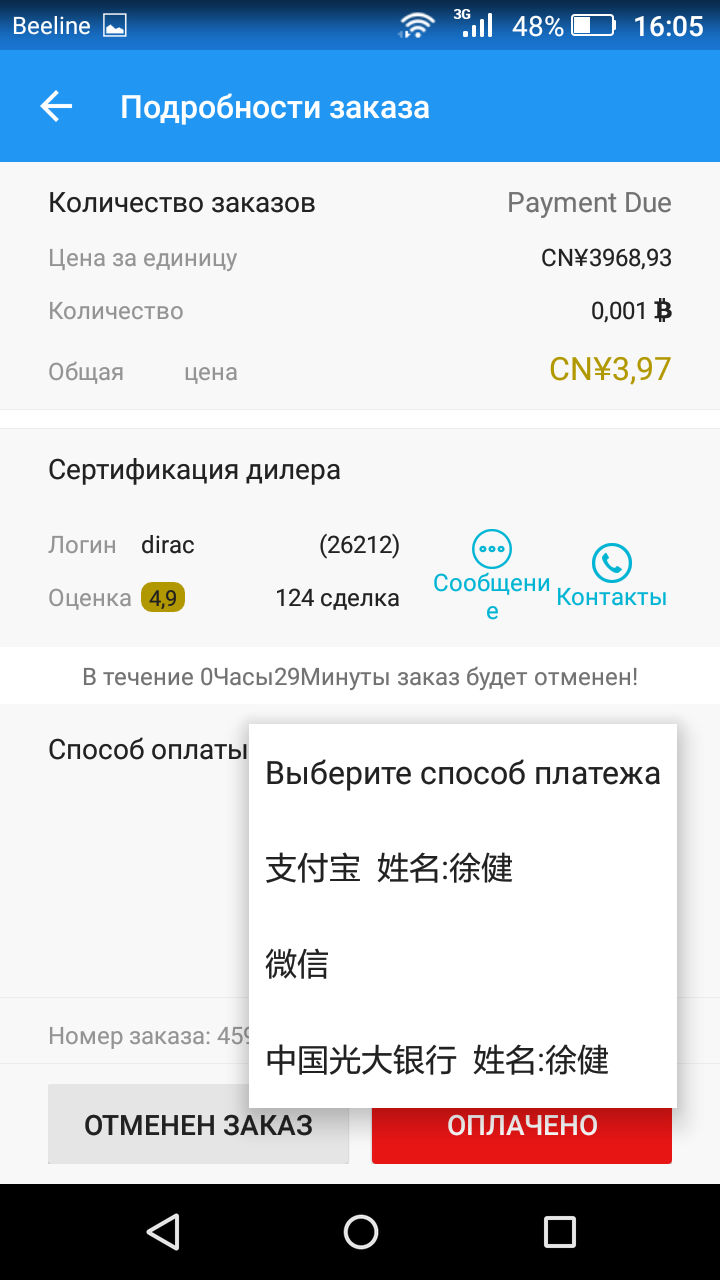

The purchase process looks similar but will now have to make an external translation has us:

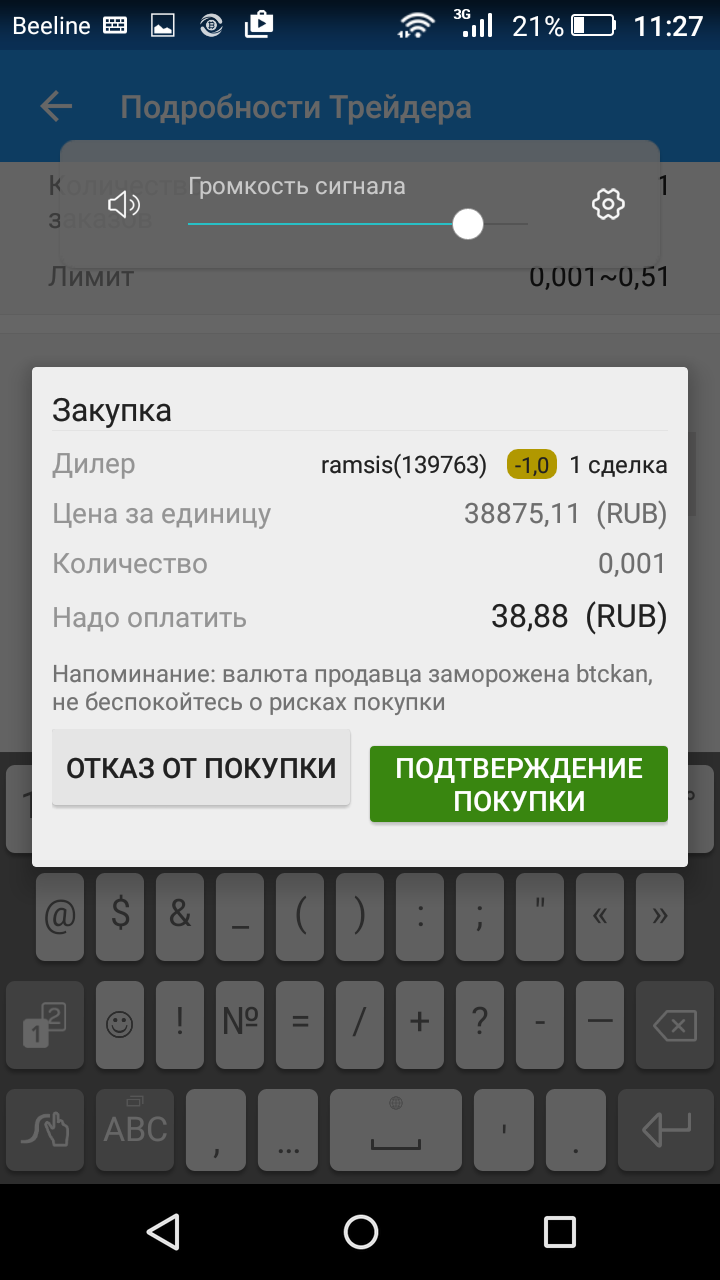

1.Vybiraem counterparty fill amount of the purchase and ship the order.

2.Perevodim rubles on the details specified by the seller.

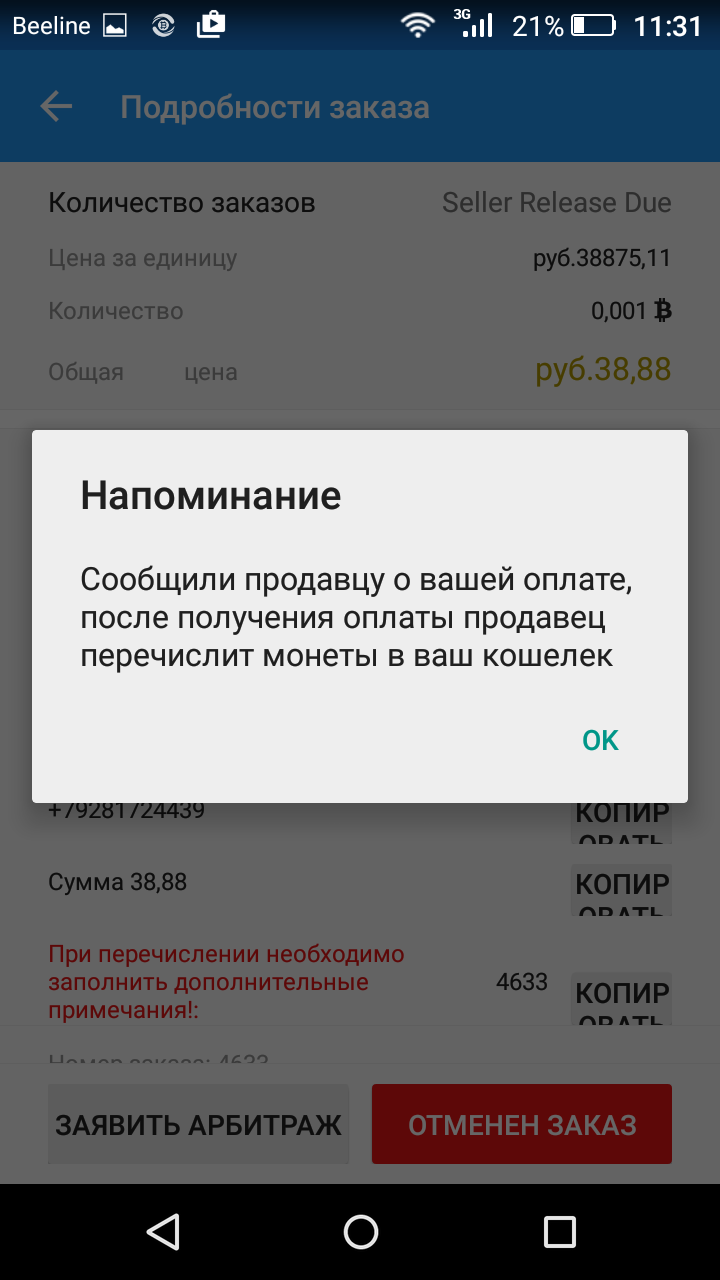

3.Nazhimaem the "Paid" and the seller leaves a message on a payment.

4.Get money, the seller acknowledges receipt and Bitcoins go to our deposit BitKan.

5.Vystavlyaem assessment of the seller and check the balance.

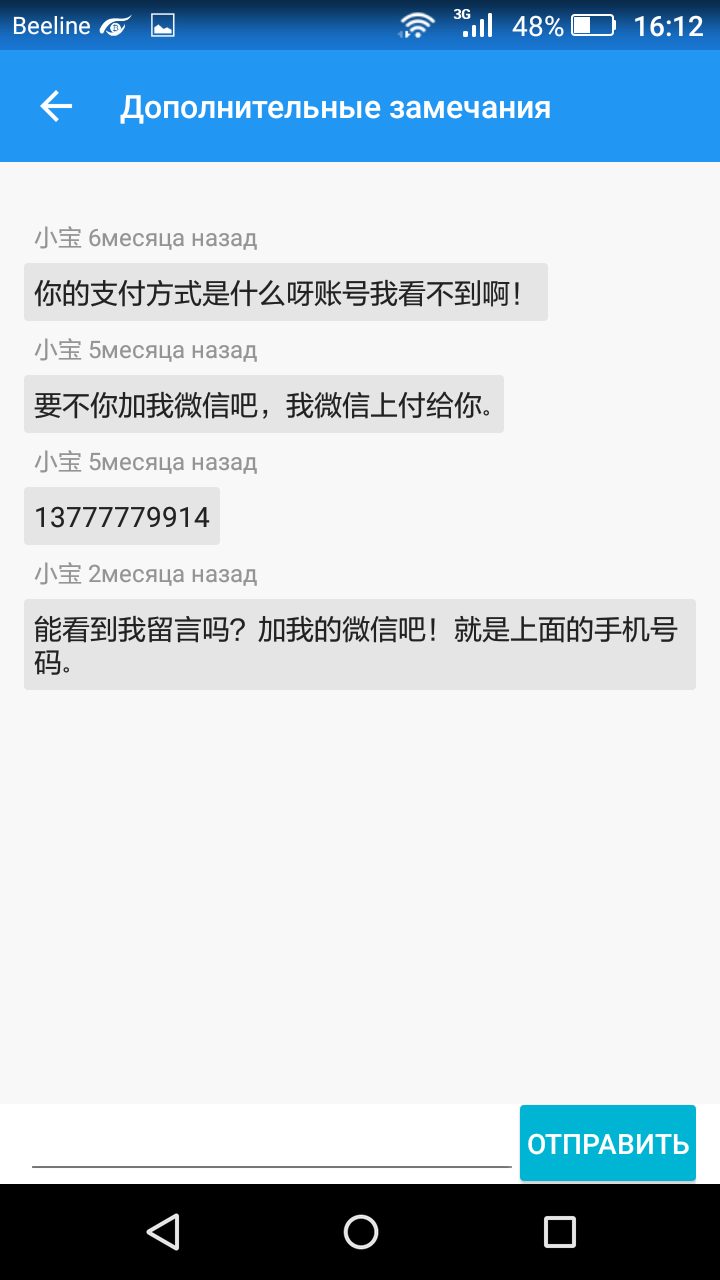

If the transaction takes place without complications, it takes a few minutes, which is fast enough for semi-automatic exchange of P2P. BitKan application interface is comfortable, except for access to messages, so dealers usually offer to use other means of direct communication.

conclusions

BitKan - a promising attempt to create a solid platform for direct trade cryptocurrency directly between users, but under the watchful eye of the administration. Interestingly focus solely on mobile users - on the one hand, are more technically advanced, on the other, it is easier identifiable.

To date, the service works well and provides the possibility of semi-automatic and safe enough trade. But if developers BitKan really want to advance into the global market, they should take the optimization of certain aspects of the application:

-Provide Liquidity in all currencies shown on the service, including through the attraction of new dealers.

-Improved Quality of the interface translation into Russian and other languages.

-Detailed Describe security arrangements kriptovalyutnyh deposit users who are in the same precarious position, as well as on stock exchanges.

-Make More convenient means for communication of users within the service.

-Produmat System formation, exhibited dealers prices.

Overall, BitKan has a future, as the direct exchange of secure services demand is great enough, and will only increase with the further spread cryptocurrency. Market sharing P2P cryptocurrency, despite its prospects, is still poorly developed.

Chinese operation and resources of Chinese miners (this spring invested in infamous Bitmain BitKan USD 1.6 million, and we see the first results of these investments) can pick up and more complex project.