Digital asset exchange Huobi, announced it will be launching a new stablecoin project called HUSD. Huobi Global is a subsidiary of Huobi Group that is one of the worlds biggest digital financial service providers. Huobi group provides its customers with digital asset trading and digital asset management services. They have millions of customers worldwide. Huobi Group is expanding at a rapid pace by rolling out new digital asset exchanges, like: Huobi Australia and Huobi UK, introducing their own digital asset wallet (Huobi wallet), launching a mining pool (Huobi pool) and creating an over the counter (OTC) platform.

By launching HUSD, Huobi Global will provide users with a comprehensive solution for using stablecoins.

What is a stablecoin?

A stablecoin is a cryptocurrency asset that is backed by a ‘stable’ asset like a fiat currency or gold. For instance, it can be pegged to the U.S. dollar value or the value of gold. Stablecoins were initiated to reduce the volatility in the cryptocurrency market. Because it is a relatively new market that is making its way to becoming a new asset class, the market tends to have large value discrepancies. The goal of the stablecoin is to keep the value steady at all times, preferably at $ 1, when it’s pegged to the U.S. dollar.

Tether surrounded by negativity

I have been in this industry for almost 2 years now and since the start, I have been hearing rumors about Tether being at least sketchy for not disclosing financial information like transparency reports and regular audits. During these past two years, I have never felt comfortable in exchanging BTC or any other altcoin for Tether.

Lately, the rumors about Tethers ‘instability’ fired back up again after Tethers parent company and founder Bitfinex was being called out for apparently banking at an insolvent bank. Rumors they later shut down by announcing the name of the bank they are currently dealing with.

As USDT has been listed on all major digital asset exchanges with trading pairs available for all the major cryptocurrencies it is sometimes considered a necessary evil to hedge into USDT.

To grow the cryptocurrency industry into a reputable new asset class, changes need to be made. While we thrive on decentralization and transparency, a coin that is considered a stable alternative for Bitcoin or any other cryptocurrency needs to be transparent in essence.

As Huobi Group CEO Leon Li said: ‘It’s no secret that community concerns have driven strong demand for stablecoins across the crypto space’

Listing of additional stablecoins

To help the community by giving them more choices, Huobi has listed 4 new stablecoins on their digital asset exchange Huobi Global. Paxos, Gemini Dollar, TRUEusd and USD//Coin.

A short overview of the 4 stablecoins newly listed on Huobi Global:

Paxos Standard Tokens (PAX) are pegged to USD where 1 PAX = 1 USD. Paxos has its entire token supply backed by USD in 1:1 ratio and all funds are safely stored in an FDIC-insured bank. Paxos is an ERC20 token which can be stored safely on a hardware wallet. Paxos is regulated by the New York Department of Financial Services. Audits will take place on a monthly basis which account for a much sought-after transparency.

TrustToken’s TrueUSD (TUSD) is the first asset-backed token that is released on the TrustToken platform. TUSD is backed by the USD on a 1:1 ratio. TUSD is also an ERC20 token and is already listed on all the major cryptocurrency exchanges. TUSD has been in existence since March of this year and it has managed to keep it’s peg to the USD during this time (with the exception of a few short-lived excesses). TrueUSD’s marketcap has seen a steep increase in value.

USD//Coin (USDC) is a product of Circle, which is the company that made headlines at the beginning of this year by acquiring digital asset exchange Poloniex for 400 million USD. Besides being listed on Poloniex, USDC is listed on other major exchanges like OKEx and Huobi Global. ERC20 token, USDC solves some fundamental stablecoin issues like the need to be legitimate, trustworthy and build on an open system.

Gemini Dollar (GUSD) is an ERC20 stablecoin that is also regulated by the New York Department of Financial Services. It was initially launched by Gemini Exchange founders, Cameron and Tyler Winklevoss, as a transparent alternative to Tether. GUSD is pegged to USD on a 1:1 ratio. The corresponding amount of USD based on the GUSD circulating supply is deposited in the State Street Bank and Trust Company and the funds are audited on a monthly basis by BPM LLC, a registered auditing firm.

A recent popularity research report by ‘The Block’ shows that Paxos is in the lead as the invasion of new stablecoins continues.

An introduction into HUSD — the universal stablecoin

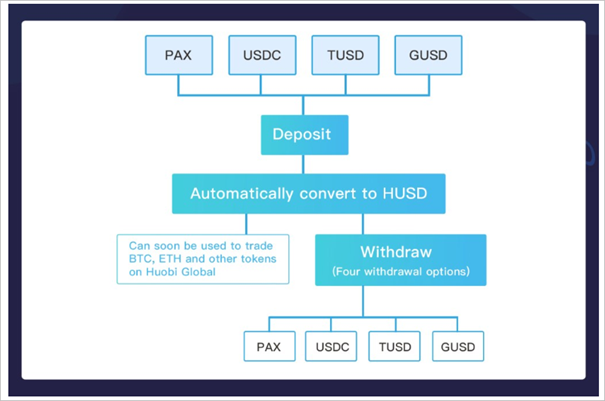

To help grow the cryptocurrency community and let users have more choices in stablecoins, Huobi Global announced a new product, called HUSD. It is a universal stablecoin that represent the 4 newest addition stablecoins.

After users deposit PAX, GUSD, USDC or TUSD into their Huobi account it will directly convert into HUSD. When users request a withdrawal of HUSD they can choose which of the 4 stablecoins they want to withdraw.

Huobi proposes 3 benefits to HUSD:

It will be safer and convenient and additionally it will mitigate the risk of holding stablecoins.

It will be a more stable store of value as Huobi will take the risk of a highly fluctuating stablecoin.

Users can convert stablecoins without additional transaction costs.

Huobi will regularly audit the participating stablecoins. If one doesn’t meet Huobi’s high requirements and standards they will be cut from the program.

Concluding remarks

As a trader of digital assets, it concerns me that there was not a reliable transparent stablecoin. Either a stablecoin lost its peg to the U.S. dollar or it has been receiving countless attacks from cryptocurrency industry people. The addition of more stablecoins to choose from is a welcoming addition to any exchange. The fact that Huobi has launched a product that will further decrease the risk traders take when hedging into a stablecoin is a very good thing in my opinion.

One concern I have with HUSD is whether it will be immune to users arbitrage trading it. It will be very profitable if a user can deposit for instance USCD that is worth 0.99 USD at the time of deposit and withdraw PAX that will we worth 1.10 USD at the time of withdrawal. Won’t this cost Huobi Global too much money?

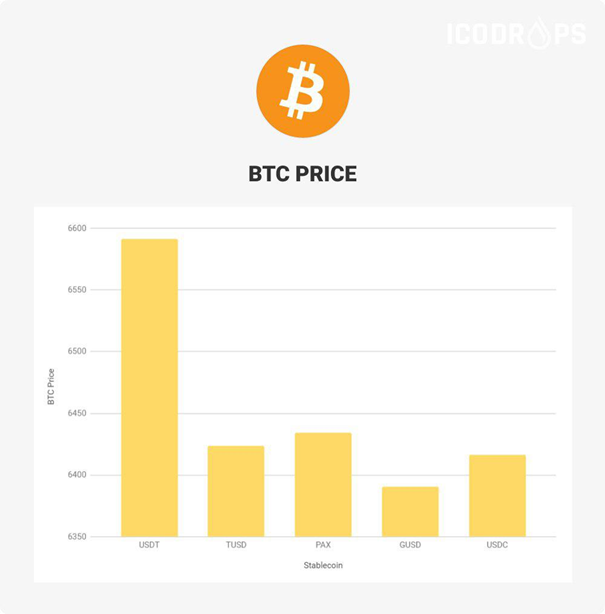

Another interesting data overview from IcoDrops shows various stablecoins that might have regained their stablecoin to USD peg as 1:1 still have not synced fully with the BTC price. There are still discrepancies between the different stablecoins and the Bitcoin price as shown in the graph below.

Image courtesy of IcoDrops.com

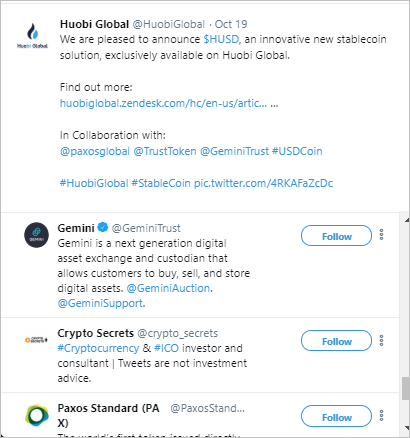

Three out of four stablecoins that partake in HUSD have already expressed their confidence in the product on Twitter.

Disclaimer: This article is not intended as investment advice. It is just my personal opinion about digital asset exchange Huobi Global and Huobi NEXT. You should always do your own research. Huobi Global rewards me for writing this article and supports me for ventilating my own personal opinion.

If you do not have a Huobi Global/ NEXT trading account yet, you can use this link to register.

Subscribe to my channels Steemit, Medium and Twitter if you like my articles and would like to read about blockchain and cryptocurrency topics and projects. You can also read my articles on LinkedIn.

If you have any questions about this article, please comment in the comment section below. Thank you!

LindaCrypto

very nice article. All the points arranged and very informative. Really this kind of a stable coin is the need of the hour. Specially after tether falling down remarkably from 1USD standard price before a couple of days. But stable coins are the backbone of crypto to crypto trading. Welcoming the step taken by HUOBI. Thank you and wish you all the best.