Being "in a bubble" is not the same as being "in bubble territory."

After the crash of the housing bubble in 2007–08, the Fed and other central banks blew massive bubbles in everything from bonds and real estate to student loans and money in general.

After the crash of the housing bubble in 2007–08, the Fed and other central banks blew massive bubbles in everything from bonds and real estate to student loans and money in general.

Everything Bubble, including Money Bubble

Indeed, we even have a money bubble – as a direct result of the coordinated money-printing programs in the US, the EU, Japan, and other countries.

In many ways, the money bubble is the cause of the many other bubbles. With so much easy money at their disposal, it’s been very easy for the financial pirates to blow up and over-inflate numerous secondary bubbles.As a result, almost everything nowadays is overvalued. Far overvalued. Insanely overvalued. And we know that the price of anything that is overvalued will eventually come crashing down to realistic levels. Most likely sooner rather than later. (Image source)

Which brings us to bitcoin.

Is being “In Bubble Territory” the same as being “In a Bubble”?

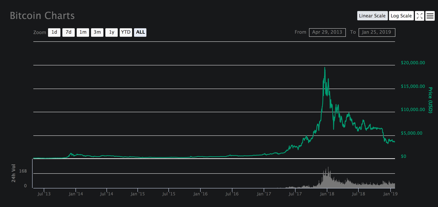

Given the increase in the price of bitcoin in 2017, some people said that it too was in a bubble. Its rapid rise (to almost $20,000) took even the most optimistic bitcoin proponents by surprise. Since then, of course, it has fallen to the $3,000–$4,000 level.

That’s a drop of over 80%. And certainly, that drop also makes it look like bitcoin was in a bubble. (Image source)

Maybe it was “Not a Bubble”

Regardless of whether or not one considers bitcoin to have been “in an actual bubble,” a quick glance at its its linear price-chart shows that it was clearly "in bubble territory." (To be clear, those two points are separate and discrete statements. Being "in a bubble" is not the same as being "in bubble territory.")

In a YouTube video (link below), Mike Maloney explained that if we look at bitcoin’s spike in “the proper way … logarithmically,” we get a totally different perspective. To clarify, let’s compare the 2 charts below.

The 1st chart shows the “linear changes.” As Mike stated in the vid, it “looks like a bubble.”

The 1st chart shows the “linear changes.” As Mike stated in the vid, it “looks like a bubble.”

Linear Chart (aka “Arithmetic Chart”) – Bitcoin, April 2013 – January 2019

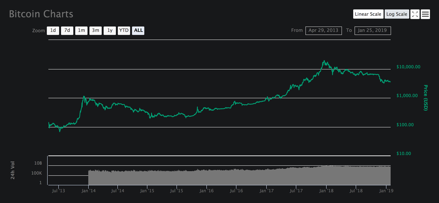

The 2nd chart shows the “the percentage changes” for the same asset over the same time frame. We do not see the bubbles and crashes that appear in the above linear chart.

Logarithmic Chart (aka “Log Chart”) – Bitcoin, April 2013 – January 2019

On the other hand, in the log chart, the percentage increase of the price remained quite steady over that timeframe. It appears as a solid asset whose price is increasing at a sustainable pace and to reasonable levels.

Mike adds that, if we look at it from this perspective, a further increase is fully sustainable and reasonable. That next increase might take bitcoin up to $50,000 or even $100,000. (Image source)

It’s been one year since the price of bitcoin peaked near $20,000. Is the price headed back there, or even beyond? Or will it soon continue its downwards trajectory? –– What do you think?

It’s been one year since the price of bitcoin peaked near $20,000. Is the price headed back there, or even beyond? Or will it soon continue its downwards trajectory? –– What do you think?  Since 2008, the bubbles in most other assets have continued to rise, inexorably and stratospherically. Bitcoin, however, has gone though booms, spikes, dips, drops, corrections, and consolidations. Maybe the bitcoin booms were not bubbles. –– What do you think?

Since 2008, the bubbles in most other assets have continued to rise, inexorably and stratospherically. Bitcoin, however, has gone though booms, spikes, dips, drops, corrections, and consolidations. Maybe the bitcoin booms were not bubbles. –– What do you think?

Watch the video at the link below

(Right-click to watch on YouTube) (Image source)

@majes.tytyty, the market is in a downtrend. So, the probability that the price of Bitcoin will go further down is higher than the probability that a new bull run will start. Yeah, we may see some rebounds, but it is still very early to think about trend reversal.

Btw, I am a cryptocurrency and FX analyst. If you want follow me and watch my analyses.

Posted using Partiko Android

McAfee is still saying he'll eat his dick.

I may have to sell what BTC I hold to pay my rent here in another three weeks. So, if I do, then of course Bitcoin will rocket up, because that's how my life goes.

I bet McAfee won't have to eat any "hot dogs" or "wieners."

I'm not so sure. There's a chance he could be enjoying a nice cockmeat sandwich come late 2020. :D

I think you are probably right about McAfee.

You know, one thing about the article above. I didn't come away with a clear understanding of what is the difference between "being in a bubble" and "being in bubble territory". Did I miss something?

Yeah, I say bitcoin wasnt a bubble. Fomo took over and nobody wanted to miss out and it rose the price hella. Then after the fomo and felm ( fear of losing money) everyone got out it went back to how it was, but people are still worried/cautious because of the lost they took.

Posted using Partiko Android

Good points. I myself have seen bitcoin go thru at least 3 bubbles, and each time, the subsequent dip / crash was inevitable ... at least in hindsight.

However, I'm not sure if those booms and busts were caused solely by FOMO and FELM. Over the past years, I've met many people who have FOMO, but that has not caused the price to rise.

I believe one of the underlying causes of the fluctuations is how the market reflects the essential value of bitcoin. For 10 years now, it has grown in value / price, simply because it has not yet reached its true value, and is continuing to move towards its true value.

To assume that such a movement will be in a straight line is simply naive. Like anything, they will fluctuate. Fiat currencies have been in a downtrend for decades, but for some reason, the US dollar is currently in a mini-boom. But we all know where it's headed. Downwards.

As Bitcoin, Steem, and other cryptocurrencies move towards their actual value, their prices will fluctuate, sometimes wildly. But we all know where they are headed. Upwards ... I believe.

Hi @majes.tytyty

I strongly believe that mentioned FOMO was obviously caused by mass media, which talked about crypto and bitcoin all the time and brought fresh blood into the market. wouldn't you agree?

We were all played by mass media.

Cheers

Piotr

I'm not sure if that is so. One reason is that I rarely follow any news in the mass media. ☺ Also, the bitcoin price has experienced several spikes, even when it was less than #10. Surely, back in those days, the spikes were not the result of a media focus or media exaggeration.

Most likely, the 2017 spike was partly owing to the fact that bitcoin is becoming better known. And, of course, once it surpassed $10,000, the media started covering it more and more. That may have played a part in the spike, but I believe it was a secondary cause.

Woah very well said. Ty for replying that to me.

Posted using Partiko Android

I'm not sure if that is so. One reason is that I rarely follow any news in the mass media. ☺ Also, the bitcoin price has experienced several spikes, even when it was less than #10. Surely, back in those days, the spikes were not the result of a media focus or media exaggeration.

Most likely, the 2017 spike was partly owing to the fact that bitcoin is becoming better known. And, of course, once it surpassed $10,000, the media started covering it more and more. That may have played a part in the spike, but I believe it was a secondary cause.

Good comment @midgeteg.

FOMO was obviously caused by mass media, which talked about crypto and bitcoin all the time and brought fresh blood into the market. wouldn't you agree?

I believe that we need at least a year for all those memories to be replaced again with greed (and more fresh blood, which didn't burn themselfs yet).

Yours

Piotr

Thanks @crypto.piotr

I agree with what you said.

Posted using Partiko Android

Hi @midgeteg

Thanks for replying to my previous comment. I always appreciate people who engage back.

Yours

Piotr

I too believe Bitcoin can reach $50,000+ and I believe there will be a next bubble in the future. How near is that? I don't know... and I can even be mistaken.

No one knows when the price will again rise. However, there were at least 2 times when bitcoin peaked and then plummeted, and subsequently stayed well below those peaks for long times.

..........

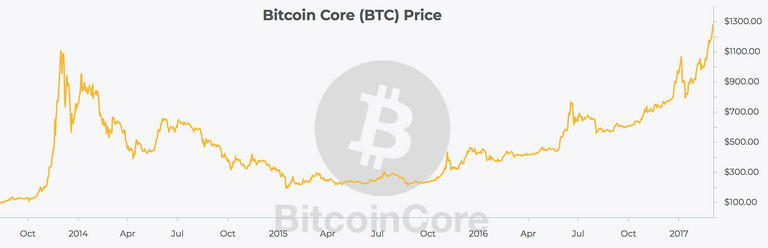

The first time was after it peaked at $200 in April 2013. It then dropped and lingered in the $50–$100 range for 7 long months, before recovering and shooting up past $200.

..........

The second was after it peaked near $1,100 in November 2013. It dropped, eventually falling to about $300. It then lingered in the $300–$500 range, until early 2017, when it finally returned to the $1,100 mark. That was more than 3 years.

..........

The next upswing might start soon, or it might start after another relatively long wait. In fact, Jeff Berwick recently opined that, while he believes the price will continue to rise into the stratosphere, it might remain around the $3,000–$5,000 level for another year or so. (Key word = "might.")

(Source)

You're very optimistic @ahmadmanga

I'm not sure if BTC can reach 50k without support coming from mass media (the way they did in 2017). And those are bored with this topic and have more interesting things to talk about.

Anyway I would love to see it happen :)

Yours

Piotr

Dear @majes.tytyty

Amazing piece of work buddy.

Don't you think that current bubbles are not really as bad as many think? When I look back at property bubble or dot com bubble or even crypto bubble I see one similar thing. Almost everyone at that time around me was talking about buying house, buying stock, buying crypto.

Basically market was always full of professionals and common people, who were the ones to panic the most. Right now there is very few amateours playing on stock market, buying bonds etc. Those are people panicing the easiest. Right now entire market is full of professionals and they do not reac the same way.

So for that only reason I would not expect Stock Market bubble to burst hard. Simply because this bubble is not really as bad as many think.

But then it's just my impression. I wonder what's your opinion.

Yours, Piotr

Excellent comment, Piotr, with a great though-provoking thesis. I'd never heard of it expressed in that way, and I've never considered it. You are correct in saying that the common people are not involved in this bubble. At least, not to the extent that they were in the dot.com and real estate bubbles.

However, that does not mean that the bursting of the bubble will be less traumatic. The fact is, as you implied, that the bubble is at the top, among the professionals. But they are the ones who own most of the stocks, and they are the ones who will dump their stocks when the market turns down. I believe they will react in the same way, once the shit hits the fan. And their reaction will be to throw much more of "their" shit at the fan.

Over the past decade or so, stocks have been bouyed by central banks' QE money-printing strategies, which allowed many corporations to buy back their own stock. That monetary morphine has resulted in an even exaggerated bubble.

And now, it's about to burst. (I'm not a stock analyst or an economist, and that's not my opinion. That's what many clear-eyed "expert" analysts say. Many of them accurately predicted the bursting of the dot.com bubble, and the bursting of the real estate bubble. 2 out of 2 is pretty good, so I'll believe them when they say Crash Number 2 is coming.)

So, even though the common people may not be actively involved in this bubble, that does not mean that the bubble is not big, nor that it will not burst, nor that they will not be affected.

It's big, it will burst, and all of us will be affected. Hang on tight!

Dear @majes.tytyty

Most likely you're right. At least to some certain degree. One need to rememeber about power of mass media and power of mass human panic.

If regular joe didn't invest in stocks then media will also hardly talk about this subject. Simply to avoid showing "boring" content. On top of that so called FUD will hardly have any impact if regular joes will not care and will not be involved.

That's obviously just a good wish :)

Very true.

Indeed. But it also means that mass media will literally not care that much about this bubble. And that's a real game changer. One must assume that mass media in current world are the biggest power. Playing with people by using fear or hope. Building dreams or crushing them.

Ok, let's put it this way. If this bubble will burst, then surely it would be MUCH MORE painful if regular joes would be involved and market would be "hot" and everyone out there would be trying to "jump into that train".

How does it sound? :)

Yours

Piotr

I see your point. And in a way, you have a good argument. Unlike the dot.com bubble and the sub-prime / real estate bubble, the current bubble does not actively involve Regular Joe.

So, when the massive financial bubble pops, Reg Joe will not lose on stocks, bonds, real estate, or other of his assets or investments.

However, I believe Reg Joe will still feel the effects, and will in fact be hurt by the effect. In a sense, it's gonna be like the 1929 crash. That resulted in primarily in the loss of the fortunes of the big, powerful investors and businessmen. But it had knock-on effects, which hurt Reg Joe for the subsequent decade.

This time, it will be the same. Or worse.

Yes, the knock-on effects on Regular Joe were terrible, because RJ was employed by the big, powerful investors. When they lost money, RJ got laid off.

This is probably a good point to mention that I do not believe austerity works to repair the economy; it works to enable the rich to buy up distressed assets for pennies on the dollar.

This is what's happening here in Argentina right now. The government is selling off the foreign reserves at great speed, nominally to satisfy the demand for dollars, thus keeping the exchange rate between the Argentine Peso and the US dollar stable. But the only people with the available capital to buy those dollars are the rich. Thus the net effect is a massive transfer of wealth from the national treasury to wealthy private individuals. The main theme of the Macri government is looting and sacking of the public treasury.

Of course this accompanied by the usual "privatization" of public assets, and we all know what that means. For more detail, you can see the article I wrote last week-

https://steemit.com/argentina/@redpossum/redpossum-mansplains-about-argentina

I guess there's nothing to worry about bubbles as long as it won't explode.

When a crypto particularly bitcoin goes down to the bottom, its only being tested how strong it is to sustain and grow stronger.

For me, its part of a process.

Indeed it is part of a process @ronel

You nailed it. Yours, Piotr

Definitely part of a process. And let's remember that insane, exponential growth is not healthy. In most cases, such growth is cancerous. So, after bitcoin's various spikes, the pullbacks are in fact very healthy, and very promising in terms of long-term prospects.

Let's just watch the process unfold.

Yep.

Spikes are also good for traders who make profits during ups and downs.

For me it is very difficult to deduce whether bitcoin was in a bubble or not, it is also very difficult to predict if it continued its downward trajectory, increase its value or stabilize at current levels, due to my little knowledge of economic behavior and the little information that I manage close to the cryptocurrencies, but I would like to see the increase in them.

What are the odds that this happens? I do not really know, but if it happens it would be beneficial for all those who handle cryptocurrencies now. In any case the information you provide is encouraging and creates a lot of expectation in people.

I also want to sincerely thank you for supporting me by delegating a sum of SP to my account, thanks to you and the initiative of our friend @crypto.piotr who is determined to grow support among members of this community.

Blessings to you!

Pr Euclides Villegas.

Nobody knows the odds, but most in the crypto sphere are 100% certain that bitcoin will eventually surpass its previous high of $20,000.

If that sucde would be great, we pray for it to happen. Although I do not own bitcoin, I imagine that that would boost steem and other cryptocurrencies. Right?

Hi @fucho80

I think that since STEEM is being traded mostly against BTC, so if price of BTC would grow then you can expect that price of STEEM will grow as well.

@Majes.tytyty correct me please if Im wrong.

Yours

Piotr

I aint gonna correct you, cuz I do not know if you're wrong. I have no idea which crypto pairs are trading at what volume.

Nevertheless, I believe that the price of most of the top cryptos will increase, like luxury rowboats in a rising tide.

Congratulations @majes.tytyty! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Dear @majes.tytyty nice work in writing this detailed post about Bitcoin price analysis. If we look at the overall Bitcoin prices last 10 years then the growth looks realistic but in the year 2017 it was all time high in fact it was at the peak.

I personally don't think that Bitcoin is a bubble but some where I feel that there was some manipulation in its price in 2017. We all know that the current price is more than 80% lower than it's the price we saw in 2017 end. Currently it's trading between 3000 to 4000 US dollar which was around 5 to 6 thousand US dollar couple of months back.

Many experts are saying it will touch 1 lakh US dollars in one year or so. I also think that it can test 100000 dollar price in future based on the developments happening in many countries. A very big community is working behind Bitcoin to get it accepted for transaction or payment purposes but at the same time few countries or not in favour of it looking at the current scenario and India and China is one of them.

I have long term goals with Bitcoin so I personally don't worry much about the price because I am pretty sure that it will show all time high again but don't know the exact time. I'll be holding all my investments for a long term which is going to be few years. In my opinion Bitcoin is not a bubble and it is a digital asset.

Thanks dear @crypto.piotr for sharing this post as I enjoyed reading this post and undoubtedly a great piece of knowledge by

@majes.tytyty

Dear @alokkumar121

This is surely great piece of comment and I wanted to read it through, but it's just so hard to read since you didn't use "enter" even once.

Perhaps you could consider using enter sometimes to separate blocks of text? it would make reading much easier :)

Yours

Piotr

Sorry for the inconvenience dear friend. I will update this comments and will be considerate in future.

Posted using Partiko Android

Thank you @alokkumar121 :)

Now I can really read it without feeling that it's a struggle :)

Yours

Piotr

I agree (altho I'm seeing it now in its revised form). As an editor, I know that it's essential to format and present any writing, properly and clearly. Otherwise, most people (including me and Crypto.Piotr) will not want to read it all the way thru. :-)

Thanks for advice dear @majes.tytyty I will be careful.

Posted using Partiko Android

Dear @majes.tyty

In case I haven't mentioned it yet, thank you for your SP delegation. Our friend @crypto.piotr sent the link to me and, I find the subject very interesting.

I have to apologize that it took me quite awhile to figure out what my answer would be as I understand most of you guys are quoting from this and that source and are closely watching the market.

So, my answer is that bitcoin is not in a bubble by simply watching the overall perception of the governments around the world. No one is making any move to advertise expressly to their citizens to "get rid" of their btc or alt coins. No one is announcing yet that btc is a huge ponzi scam or doing any move (like closing down btc or alt coins exchanges) that would massively affect its general patronage.

Secondly, if btc is just a bubble, why are there a lot of watcher monitoring its value and making a living commenting, predicting and giving their expert opinions on the topic if it does not really matter at all? Furthermore, why is everyone interested to know about these things if it runs the risk of becoming worthless anytime?

Then, there is the cyclical moves of btc whales- transfering their humongous assets from one dormant wallet into multiple wallets- which for me is not a move at all to sell out but perhaps for security or trading purposes because if they did intend to sell out, why have we not heard(even a rumor) of it when we do have a whale watch?

I think that most people who believe that btc is just a bubble are those who wanted to make a quick profit out of it- I think they call them swinger trader or opportunistic trader- I am not quite sure of the term. If anyone out there knows, please inform me. Thank you.

Lastly,like everyone, I too am sometimes confused where btc is going- up or down but as long as its higher than an ounce of gold, I am good. I don't know how the halving of btc would affect us all but,I am hoping for the best.

Kind regards

Anne

Amazing comment @nurseanne84

Probably I asked you before about droping me short message to my email ([email protected]). Right?

Would you like to keep in touch closer? I would be happy if we could support each other on steemit and establish better and more private communication channel.

I'm not really planning to spam you with emails so you don't have to worry about it :)

Cheers,

Piotr

its all right Piotr...I can always block you.hehehehhehehe But yes, I would like that very much. Happy Chinese New Year!

Good point, Anne, particularly about the many people closely monitoring the entire ecosystem. They're doing so because it's definitely an major change, and definitely worth monitoring.

On a related note, there are now 10s of thousands of people working in the field, with bitcoin and other cryptos. Most of them are very well-versed in the subject, and they know what they're doing and what they're working with.

And, most importantly, they know the potential. 'Nuff said.

Great post. The logarithmic charts were very interesting!

My feeling is that prior to the last crash the rise and falls of BTC has been a rise as the market cap increased then under the law of supply and demand the price followed upward. A correction then followed each spike with profit taking. The latest crash, however, has been a bit different story in my opinion.

The last spike was the first step towards mass adoption. That stage when just about everyone had heard of BTC and most likely knew someone holding some. This had the effect of bringing even more folks into the market, raising market cap and thus price. However it was then that things hit the wall of scalability. Transactions were taking days and fees were ludicrously high. Proof of Work was not ready for mass adoption. Once that was revealed even hard core believers pulled back.

It is my feeling that that Wall St. money is now waiting for a sign that the scalability issue has been solved. This could be in the form of low fee, easy to use and a fast transaction Lightning Network. When, and if, that happens the cash will again bloat market cap; which in turn shall raise the price to meet supply and demand.

In that ideal world it may only be some external crisis which could cause such a bear market as we have today. That could be, for example, the fear that quatum computing could crack hashes or a country like China attempting a 51% attack. However once mass adopted there will be little looking back in my opinion.

Excellent points, particularly that point re "scalability." As you say, it was the start of mass awareness and the consequent mass adoption. So, there was a major spike.

Of course, such growth is unsustainable – in various aspects. So, since then, we've had what they call a "correction." That implies that the current price is the correct price, for this time and for the time being.

It also implies that, after the correction, further growth will ensue.

Keep looking ahead!

Good post. There is no real limit to how high bitcoin can go because there is no limit to how low fiat can go. A single satoshi has more intrinsic value than all the fiat currency in the world.

Right. As we all know, the intrinsic value of fiat currency is zero. And all fiat currencies will return to that level.

From that perspective, 1 bitcoin will be worth a godzillion dollars. Of course, there are other factors to take into account, so let's just be realistic, and say that bitcoin will shoot for the moon.

LOL yes the moon is the most realistic destination.

I like the points to ponder section! Pondering is one of my favorite pastimes :)

Now, I'm certainly no economist, but I think bitcoin is probably undervalued. The amount of users is still a small sliver of the population and I think that perpetuates the situation. Most people completely misunderstand bitcoin in my experience. I mean, cryptography in general gets pretty heady pretty fast and even some programmers I know don't really get bitcoin from what I can tell. That's not to mention all the average Janes and Joes out there who's only image of bitcoin comes from movies and other media that unfavorably juxtapose it with drug trafficking, scams, and hackers stealing your money. Even people who see through that sort of thing often still think it's actually a pyramid scheme or ponzi scheme. These kinds of things breed bad sentiment, but most of the time it's just a lack of understanding I think. Over time I think more and more people will take the time to understand cryptocurrency, and as that happens the bad sentiment will start to evaporate. I don't know if that will take us to up to $4000, back to $20k, or $∞ as hyperbitcoinization takes hold on USD.

I'm just saying though that if bitcoin goes down to 1/22,000,000 of a dollar and everyone else jumps ship, I'm buy up all of them I can get my digital hands on :)

Also there's the halvening coming up, and nobody can oopsie the money printing (or maliciously manipulate it) if no one is in charge of it and it's all automated. Of course the schedule might not be ideal, but it's ongoing and bitcoin is up a downright wacky amount since 2009, so I'm more optimistic than pessimistic about the supply controls.

Right, and even if people don't fully understand cryptos, they will nevertheless end up adopting them. Just as people started using personal computers and then the internet, without understanding them to any significant degree.

Bitcoin and other cryptos will become "understandable" to the general public, and the public will begin to use them more and more. It's already happening.

Beautiful article... I can only but imagine how some persons will become crazily wealthy when Bitcoin gets to the $100,000 price mark. This would be much awaited and talked about wealth transfer!

Thanks, glad you liked it. Yes, some people will get insanely wealthy. But their wealth will be in a non-inflationary currency. Good for them, I'd say.

And, let's hope, good for the rest of us, too. The current system of fiat currency is fraudulent and criminal.

Friend @majes.tytyty

What do you think if I tell you that the BTC is inside its own bubble. But within a very large territory of thousands of bubbles.

But she will bounce to the rhythm that the supply and the demand for the same overvaluation that you mention

we set that pace. We are the bidders and claimants in this monetary world, we must know how to dance or stay seated but at the same party.

Maybe to a certain extent, we set the pace. But the long, slow train wreck of the collapsing system, the powers that be have obviously "DELAYED THE PACE" of the crash. But it will reach a tipping point, at which they will lose control. Then, the "dance" will begin.

As you can see many crypto currencies are down now, but i´m sure they will go up again, also Bitcoin

gr

@sternblitz

Stocks, real estate, bonds are up ... in fact, insanely high.

Cryptocurrencies and precious metals are down ... in fact, down very low.

As most indicators will tell us, what goes up will come down. And what is undervalued will rise in price.

Make your own calls based on that bit of common sense.

This is, frankly speaking, a great read. They keep saying BTC is a bubble yet they keep accumulating it secretly. BTC could be a bubble but I am sure it is not a bubble gum. Hahaha

We know the truth. We will hold on to it. Cheers!

If it were bubble gum, I would not be inflating it! Nor chewing it!

It's a solid asset, so I'm "feasting" on it. And my plan is to feast more, as time goes by.

Well lets just look on the bright side.

"THUNDERBIRDS ARE GO" Anything could happen in the next half hour....😁😁

Posted using Partiko Android

Your balance is below $0.3. Your account is running low and should be replenished. You have roughly 10 more @dustsweeper votes. Check out the Dustsweeper FAQ here: https://steemit.com/dustsweeper/@dustsweeper/dustsweeper-faq

Hello appreciated @majes.tytyty

Allow me to congratulate you for this excellent work.

What makes us an expert about something?

For me, it is the attention to detail. When you have the ability to appreciate those big-little things that others can not even see, then you are an expert.

I think that only experts would be able to give a reliable forecast about the behavior of Bitcoin. The reasons that make this market so unstable.

There are no eternal burbujas. A bubble is a delicate balance of forces. A minimum fluctuation would break that surface tension that sustains its integrity.

I recently read an article that talked about the "halving" of Bitcoin.

In a brilliant analysis @goldeninvestor explains how to reduce to half

the amount of Bitcoin reward to miners. Exactly every 4 years this phenomenon occurs.

It is not a coincidence that the important fluctuations that we know of the value of Bitcoin are related to the halving.

I am not an expert in this matter, I do not pretend to be one either. But I do think that this should be an indicator to consider in order to make our own forecasts.

Yours, Juan.

Of course, as you imply, there are many factors that influence the fluctuations in price. The regular halving is just one factor.

Moreover, there are both technical and fundamental factors to take into account. Anyone who looks at it from only one perspective will end up with an incomplete or distorted view.

Totally agree.

These factors can be of external or internal origin.

There are so many indicators that we should consider.

For example, our friend @crypto.piotr made reference to media advertising. Maybe it is not far from reality.

International politics can also influence. When the winds of war are blowing, markets always vary.

It would be necessary to investigate in which countries the highest bitcoin holding rate exists. Socio-political movements could affect its value.

A massive sale in a short period of time would affect even the strongest giant. It would be a change in the balance of power.

Well, I think I'm speculating a lot.

It is always a pleasure for me to exchange ideas with you.

Keep speculating ... but not with money!!

oh... no no no...!!! lol...

Thanks.

First of all Thank you @crypto.piotr for invite me here in this such a interesting article.

I read about bitcoin so many opinions that is hard to say what is right and what is not. But I'm 100% confident that BTC is not a bubble.

Here why: SUPPLY and Demand

There will never be 21 million bitcoins.

roughly 4 million bitcoins have been permanently lost and another 2 million have been stolen.

Making for roughly 6 million coins that are likely never to be recovered.

That means that when the mining eventually turns off and 21 million coins will have been created, there will be at least 6 million plus coins that are out of circulation.

Which means, the supply of bitcoin is actually about 29% LESS than the numbers we see out there.

According Investopedia.com

In the U.S., there are 13.6 million people with $1 million or more in wealth, up 283,000 from the previous year. By the year 2021, the number of millionaires will reach 18 million – a 33% increase from current figures.

So it means that supply of bitcoin is not enough for single millionaire in the U.S but wait we have the rest of the world with much more millionaires.

So my question is: Guys do you see what I saw?

As you state, the figures are clear, and they tell a story. There is a demand, and that demand is fluctuating, but it will not drop off, will not disappear.

As you state, the figures are clear, and they tell a story. There is a demand, and that demand is fluctuating, but it will not drop off, will not disappear.

I don't think it was a bubble either. I think it started as price manipulation, then FOMO happened. Once the price hit a certain peak, those who got the runaway bull going sold on the market and drove the price down. Others panicked and followed suit. It will go back up again.

It sure will. There's no reason for it to stay down or go down any further. And once the fiat currencies start their final leg downwards, cryptos will most likely rise, along with gold and silver. It aint rocket science – it's basic economics.

Cryptos could go down some more, but they'll bounce back up. There's no reason they won't.

I think that the crypto market is right now the playground of few big fish to make some easy money.

But for sure i believe that it will change in the future. Maybe not in the near future but it will change.

I am not an expert and to be honest i just follow the steem in daily basis but as they are playing with the price of steem right now they can make it with other crypto currency as well.

While i am quiet new in crypto and i dont have yet enought capital i hope the price will be going down this year much more😁 So i can also invest. This is just the same as a stock market where the money goes from the impatient people to the patiente people😉

Posted using Partiko Android

It would be nice if it goes down, cuz then we can buy some more. But remember, it is down now. So, I'd recommend that you buy even a little bit, if you can.

Don't wait for it to drop to 0.10, cuz it may not drop that far. And even if it drops after you buy some, that will mean that you can then buy more!!!.

Best of luck. Be patient.

good thoughts! There is an intrinsic value for networks! Its the value people get from interacting (transaction or communication doesn't matter is both communication/interaction) on the network. With n users the network value grows as n² or better: n log n (Metcalfe's network law). It is scientifically validated for:

...of course there are many values reflected in the price. Speculative perceived value is also a value...

but when the price exceeds the network-value, then a bubble is indicated.

There is also research in bubbles, because they are by far no financial asset phenomenon. They are universal. In systems dynamics, it is called finite-time-singularities. This is when a dynamical system matures towards a point of instability, where a small external shock can cause the pop. (pregnant women, earthquake, avalanches, epileptic attacks ...) Super-exponential profiles can be observed in many catastrophes.

But your completly right it was no open market bubble (like dot com). Simply because the market is not acsessable for institutions. They simply are not able nor allowed to buy.

Right, the 2017 spike was very different from the likes of the dot com bubble, which was to a great extent inflated by Wall St and other pirates.

I also use log chart, I think it's logical as in arithmetic chart always the last doubling looks much more than previous also if it is (when you invest money) the same.

Yes, arithmetic charts result in distortions, especially during periods of major movements.

hello @MAJES.TYTYTY, it's a pleasure for me to support you with this post, a good recommendation from @crypto.piotr, very interesting information and equally important for everyone in the community ..

Really interesting post great work! I think Bitcoin wasn't a bubble but it is potentially easily being pumped and dumped by the 1% rich. I also think the future of Bitcoin very much depends on the team behind it and the future of exploring what the blockchain can really do so u think it is worth a lot if money it's just can people believe and trust in it and will it be marketed that way? What do you think would you agree? Thanks a lot Mark

Posted using Partiko Android

P.s. nice reputation 😁😀😁

Posted using Partiko Android

I'm not sure that it was being pumped and dumped.

As for the trust, the only reason bitcoin has risen over the 10 years since its genesis block is because it has gained the trust of people. As it gains more and more trust, its value will only increase.

Exactly great point mate I agree.

Posted using Partiko Android

I'm not sure that it was being pumped and dumped.

As for the trust, the only reason bitcoin has risen over the 10 years since its genesis block is because it has gained the trust of people. As it gains more and more trust, its value will only increase.

Hello @majes.tytyty

Everything you said is completely right..!!! I consider that the increase of bitcoin faster could be unhealthy for all of us..

It is necessary a slow process on this crypto but nobody can’t stop it.

If this happens, it could bring a little increase to the others crypto’s in the future.. that’s very interesting..!!!

I’m pretty sure that Bitcoin could be cost $20,000 or $50,000 or more as you said $100,000 or $200,000 thousand dollars in the next generation..

I consider that this technology is more about education, people’ education will be the privilege to increase to Bitcoin (Blockchain Technology)

But my friend @blockshine can give us another point of view in this interesting topic

Posted using Partiko iOS

Right. Fast, uncontrolled growth is like cancer. So any major and sudden spikes are unhealthy. If the price drops and retraces, it's a much "healthier" movement.

Yeah, that’s right ...

But Prediction of Bitcoin is very difficult, and nobody knows the next movement..

Hope it is stable for best results...!!! Thanks a lot for your reply my friend..!!!

Posted using Partiko iOS

I agree, we are in an "everything bubble" and it's inevitable "pop" is due within two years or less. The effects will be global since the global financial systems are all intertwined.

I still think that "intrinsic value" for Bitcoin and other cryptos will require "use" ...if not in wide mainstream adoption, at least in a solid foundation niche market of traders and users.

More than a few people say that the bubble is popping right now. I tend to agree. Of course, the full pop and the total effects will become apparent over the coming months and years.

To my opinion it was and is a bubble and done on purpose and in the end it effects us all (it already does) and not the ones who caused it will suffer of it most.

I think the value will drop more.

Posted using Partiko Android

It could drop. After it dropped to $6,000 and hovered there, I thought it would not drop anymore. I was wrong, and eventually, it collapsed to $3,000.

We'll see where it goes from here.

Although I am not an expert I have noticed that whenever Bitcoin has made an epic rise it has sustained some gain even during bear phase to some extent. For example you take the case of 2017, we all know it started from 2400 and made an all time high of 20000. But thereafter to crashed to 3300-3600 range. But the interesting point is that it is still above 2400 and on year to year basis it has hold the gain. It is not the case with altcoins. But for Bitcoin one can not say that it is completely bearish unless it goes below the previous year high. This was the case in 2011 and 2014 also. With that being said I am sure Bitcoin is really an interesting subject as well as an asset.

By the way, thank you so much for delegating some SP.

Correct. Even though it drops after its major spikes, each time, it remains above it's support lines. That's a very positive signal.

....that 'percentage changes' graph does indeed tell a very different visual story, doesn't it?

Every picture tells a "different" story. :-)

Dear @majes.tytyty, you point is very interesting, is true that if it was just a bubble, now we could see a BTC value less than 1000 usd, but due to it have some strong interest to many important hide people, they are keeping it on a controlled value, just to be not minable easily.

You know, mining BTC was very profitable when it value was over 10k usd, now it isn't, so who have the major of BTC want to keep the ownership. This is my opinion, maybe i am wrong, but is true that now BTC mining is completely decayand the few BTC remining to be mined are too expensive in order of power energy consumption. So the only thing to do is try to get natural energy like sun or wind to make again mining profitable and i am studing about it...:))

Yes, the mining costs are an important consideration. But, if it gets more expensive to mine, that cost will be reflected in the price, at least to a certain extent. That's part of the beauty of the coin.

Hi Sir @majes.tytyty thanks for sharing and your post I share to twitter 👏

success for @crypto.piotr

Interesting topic.

The history of bitcoin is relatively short to fix a cycle exact behavior and relativante long as to identify that is not a bubble. The truth is that in their 10 years has survived who have made campaigns to discredit the cryptocurrencies, referring to them as investment insecure, unstable and illegal.

The coming years will give US evidence that the cryptocurrencies will be the monetary system which govern worldwide in the future and bitcoin will be the cryptocurrency leader.

Best regards

It's a fact that the current monetary system(s) are unsustainable and will collapse. And the strong growth of cryptos over the past 10 years indicates that they can be a viable substitute for the old systems.

Hello @majes.tytyty this message might look off from the topic but it worth it.

I wanna use this medium to thank you for the great support and the delegation you've made toward helping people here on steemit and the African. I was informed by a very good friend of mine @crypto.piotr and I confirmed you made some delegation to me and some others. Thank you very much.

I have come to say thank for the help @majes.tytyty @crypto.piotr is building a great community thanks to people like you. Cheers my friend for your support. 😎

Posted using Partiko Android

you make a good point there no one knows the intrinsic value of bitcoin.

Yet it is like the gold standard of crypto and decentralized economy.

bitcoin’s intrinsic value?I think that's around where we are now. It sure can still move a bit lower, but not much. In other words....I think we are in territory, where bitcoin (and most other crypto currencies) will spike. I even heard that some banks will (or maybe they are already doing this) be buying bitcoin as a hedge along with silver and gold. So, in my opinion, crypto currencies are just starting to influence the world. And the prices will show that influence in near future.

Hmm, your comment is a bit unclear. First, you say that it will not move much. Then, you say it will spike, followed by an assertion that cryptos are "just starting."

Please clarify.

Yes, I wanted to say it will not move much lower (even Jeff Berwick and Alessio Rastani think this way ). One word can change all the meaning. I will edit and fix this comment.

Ok, thanks for the clarification. I too believe it has reached a support line, and that it's unlikely to drop any further.

Personally, I think I'd be happy no matter how bitcoin moves. If it goes up, my holdings are worth more, and if it goes down I can accumulate more. I don't think the network is going anywhere tomorrow and bitcoin is still small.

That's an excellent strategy. Over the past few years, I've bought some precious metals. The price kept dropping. And dropping more.

At first, I was not pleased. But as it continued to drop, I was able to buy a bit more. And a bit more. I managed to accumulate a comfy little store, and when the price rises, I'll be very happy and content.

Cheers.

Thank for sharing. Best regards @MAJES.TYTYTY

Hi @majes.tytyty I know this post from @Crypto.piort

if in my opinion, the bitcoin bubbles just need patience, maybe now it's really going down, but I believe someday bitcoin will rise when everyone believes that with digital money all transactions are easy

sorry if there are words that are wrong only my opinion

Greetings from me😊

Posted using Partiko Android

With any investment or any asset growth, one needs patience.

And be sure, opinions are never inherently "wrong." In all cases, just make sure you learn the fact, just make sure you educate yourself properly, and then speak the truth as you see it.

Yes you are right thks @majes.tytyty

Posted using Partiko Android

Listen to friends:

Iran intends to unite Russia and other countries to issue their crypto currency to replace the US dollar as currency for international exchanges.

The trend to de-dollarization is already in progress. That is clearly one factor that will boost cryptocurrencies, both in the short term and the long term.

Hello good day @majes.tytyty, I have come here thanks to @crypto.Piotr. I am grateful for the support of the delegation of SP. In Venezuela, the situation is becoming more and more complex by the Internet, yet I'm still working on an ongoing basis and on the basis of each reality. You can visit my blog. Thank you, ready to continue working.

I see it going back to $20,000 and then much higher

Posted using Partiko iOS

Many of us expect it to reach that level.

Well, bubble happens when investors and traders forget to ask, how much?

The other big questions, is the value of Bitcoin based on a great substantial economic basis?

Another big question ... Is the fiat currency regime sustainable? The answer is "definitely not!"

Hmmm, maybe you can have a broader explanation or another post for the sustainability of fiat currency regime to enlighten us my friend.

That's a good idea. Over the past year, I've collected plenty of material about "De-dollarization." So, I might make a post on that topic. And of course, the trend towards de-dollarization is just one step downwards in the collapse of fiat.

🎁 Dear @johncrisologo,

SteemBet Seed round SPT sale is about to start in 2 days!

When our started the development of SteemBet Dice game, we couldn’t imagine that our game would go so viral and that SteemBet would become one of the pioneers in this field.

In order to give back to our beloved community, we’ll distribute 4000 STEEM to SPT holders immediately after Seed sale. Plus, investors in this earliest round will be given 60% more tokens as reward and overall Return on Investment is estimated at 300%!

Join the whitelist on SteemBet webiste now and start investing! Feel free to ask us anything on Discord https://discord.gg/tNWJEAD

Hey!

You are doing an awesome job with @crypto.piotr , Highly appreciated:)

.

Great article @majes.tytyty.

Bitcoin is one of the most unexpected assets that you can imagine imo. Its value comes primarily from the people that are interested in it. What we have been observing till December 2017 was exponential growth of Bitcoin popularity among "common" people. When culminating point was achieved, its price started to drop, as there were very little number of newly interested people. I think this chapter of Btc expansion is already closed and such situation will not take place in the future. Every person who could engage in Btc has already done so. Therefore, I suppose that Btc will never go beyond the level of about $10,000.

What are my expectations if it comes to the future of Blockchain technology is a rapid development of security tokens and some altcoins. Btc has the privilege of first player, but what we need right now is a mass adoption of blockchain technology in various industries. I think that there will be the second "wave" of interest from mass media, but it will be rather focused on projects like Steem or some security tokens.