Bitcoin has gone through multiple cycles of boom and bust since its inception. 2017 was the year, when it touched $20k and then crashed ~60-70% from its ATH in Q1 2018. The mainstream news is full of opinions about why Bitcoin is a bubble, with people claiming that it has no intrinsic value among other reasons.

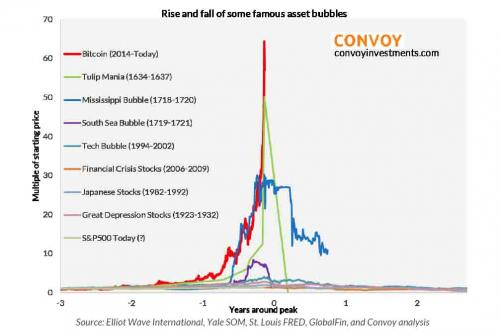

Lets look at the rise and fall of some famous Asset Bubbles

![]

Bitcoin rose over 20x in 2017, 64 times over the last 3 years (2014-2017) and superseded that of the Dutch Tulip's climb over the same time frame (3 years). In a way, BTC now the biggest "bubble" in history , having surpassed the Tulip Mania which prevailed between 1634-37.

Crypto pioneer Mike Novogratz went on to say that "This is going to be the biggest bubble of our lifetimes", despite saying this he has already invested 100s of millions in this space.

Let's look at another parallel drawn here: BTC vs NASDAQ Tech Bubble

Referring to this chart, even though the time scale is not same, the patterns looks very similar to each other. NASDAQ took years to reach that peak, BTC on the other hand rose 20x in one year.

The charts both begin with a steady rate of ascent, followed by a break where the slope shifts upward and the growth just takes off. At the peak, they both show the same double peak pattern, the first one taller than the second. And then they begin their fall back to dust.

By the time NASDAQ reached the end of its decline, almost all of the gains accumulated during its rise had been lost.

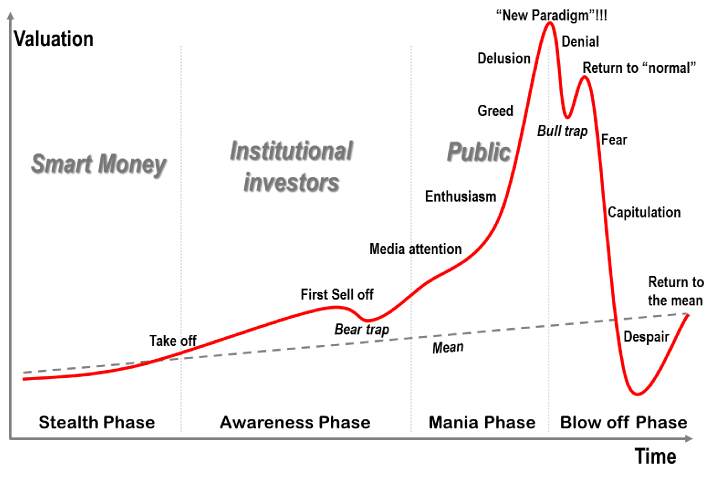

Let's look at another chart from Dr. Jean-Paul Rodrigue’s research on market booms and busts. He explains the pattern by breaking the lifespan of a bubble into four stages.

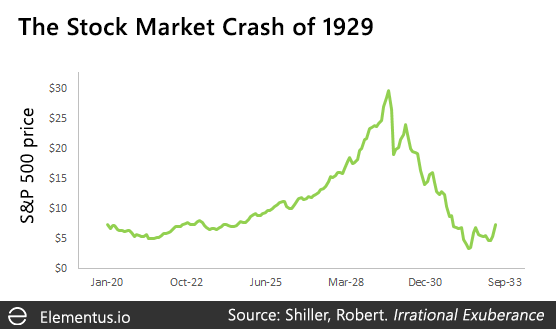

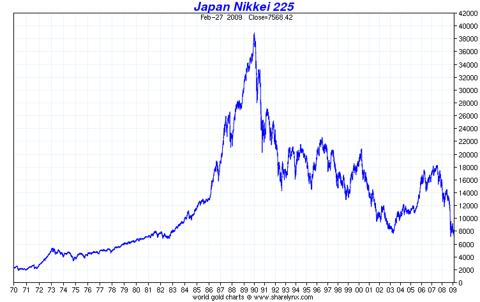

The chart looks very similar to the above charts. The timespan and size of various bubbles varies, however they seem to follow a very similar pattern. I have added more similar charts below:

![]

![]

So now coming back to the real question, is BTC going to dust following a similar pattern to other asset bubbles in history, or is it going to stand the test of time and eventually evolve into a strong steady asset class with widespread adoption?

Bitcoin has always been a volatile asset, even if we remove 2017 from consideration, its movement has been erratic to say the least.

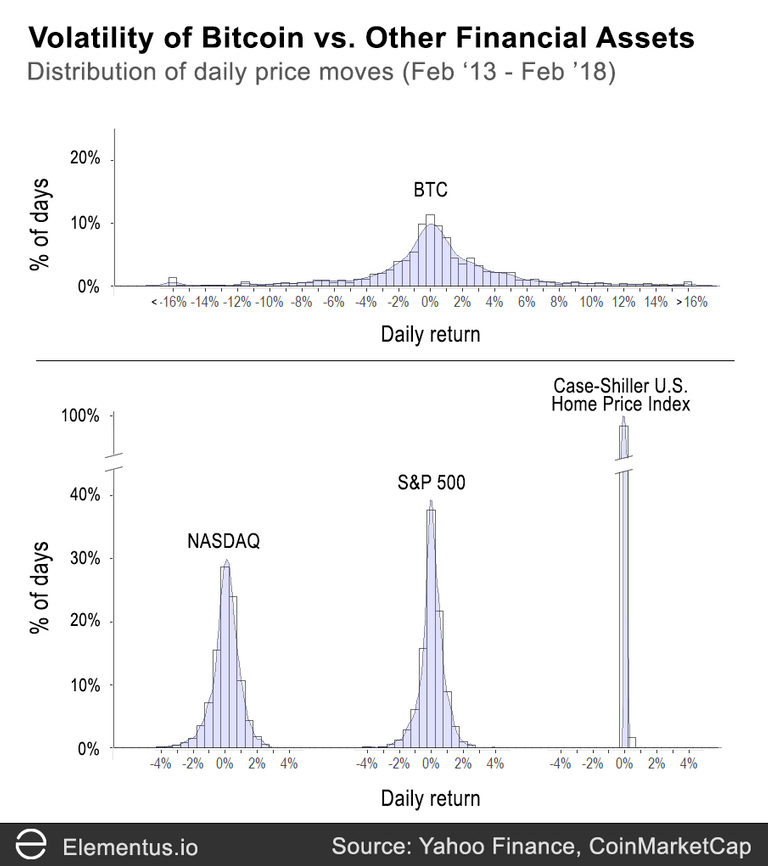

The daily volatility of each market:

Bitcoin: 4.80%

NASDAQ: 0.89%

S&P: 0.76%

Case-Schiller: 0.04%

On an average, Bitcoin's price fluctuates 5x as much as NASDAQ, 6x as much as the S&P 500, and over 100x as much as the U.S. housing market.

So, is Bitcoin a bubble?

Bitcoin looks and feels a lot like other asset bubbles from the past. And it has all the hallmarks of a bubble -- speculative buying, fear of missing out, a sudden frenzy of interest from the general public.

The recent price decline is big (60%), even by Bitcoin standards, but not out of the range of "normal" given its past fluctuations.

Bitcoin is a highly volatile asset, far more than the traditional financial markets, we are accustomed to following. We should be careful applying the same intuition to make predictions about its future price.