For any currency to be viable, be it a decentralised cryptocurrency issued by a computer program or a traditional "fiat" currency issued by a government, it must win the trust of the community using it.

Let's look at cases, where traditional fiat money has failed.

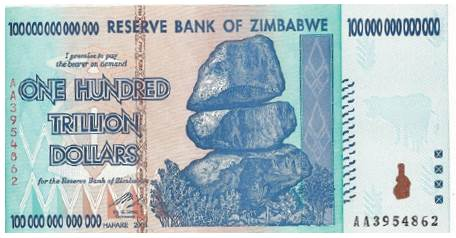

One recent example of failure is in Zimbabwe, whose defunct multi billion denominated notes are a grim reminder of things can become with money. To start with, in Zimbabwe, the government was struggling to raise money to fight a war in the Congo and pay for a number of infrastructure projects that turned out to be fraudulent. There wasn't enough money coming in, but soldiers needed to be paid to keep the military in control, a number of key supporters of the government needed to be "paid" or the sitting party wouldn't be able to win future elections. So, rather than try to come up with money but cutting other projects or raising taxes they simply printed out more money.

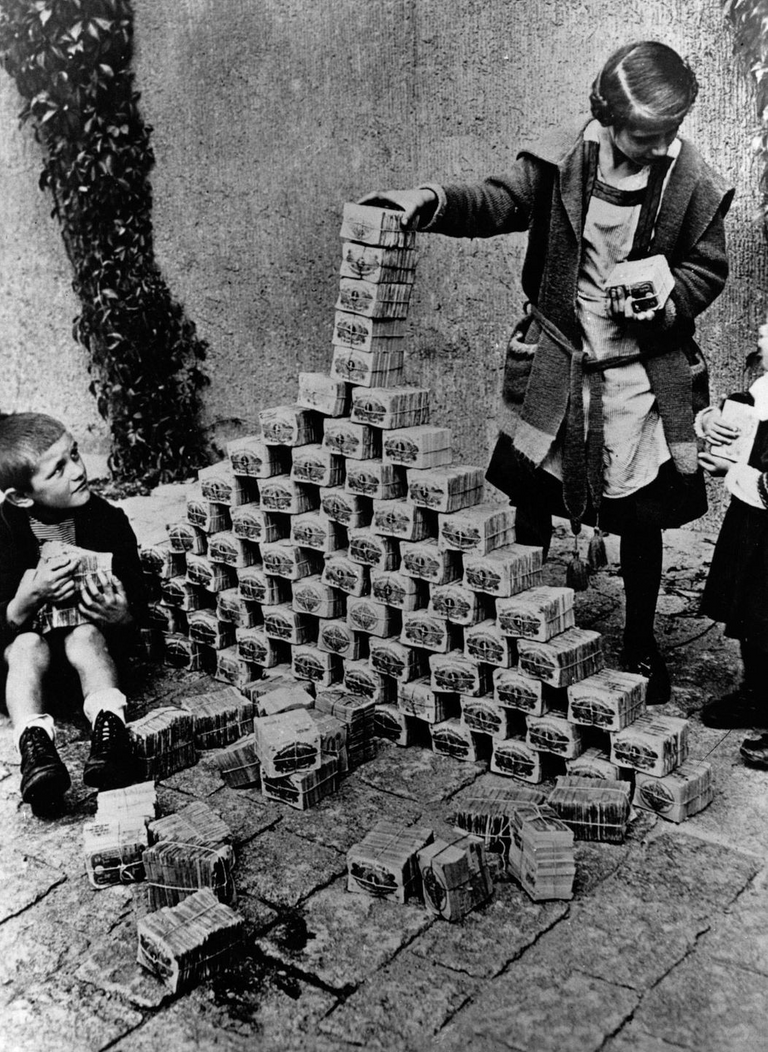

Another example, way back in 1920s - Weimar Republic Hyperinflation. The German Government back then, in the middle of a military conflict and also relucant to upset its citizens by raising taxes, instead started printing more money to cover its debts. This resulted in inflation soaring beyond anyone could have imagined - Children would arrange stacks of worthless 50mn mark notes into playhouses.

Brazil underwent a period of hyperinflation between 1987-94, fuelled by supply shocks - Oil & Capital related.

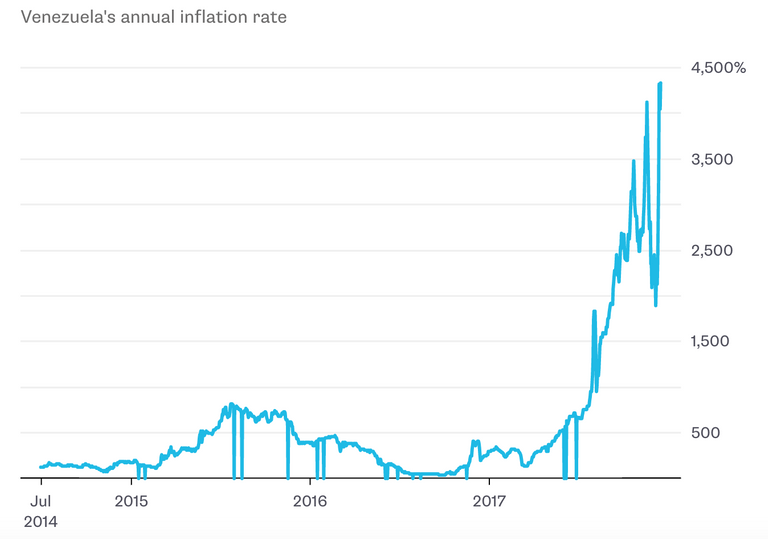

Another recent example of hyperinflation is Venezuela.

Looking at the above examples, it would be too simplistic to say that over printing of money causes hyper inflation. Hyper inflation is not just a pure monetary policy related phenomenon. It takes much worse than printing excess money.

To create the situations that give rise to hyperinflation, history teaches us that a massive supply shock, often burdened with external debts denominated in a foreign currency, is required and that social unrest and distributive conflict help to transmit the shock more broadly.

From a common man's point of view, if his earning potential (in fiat terms) doesn't increase as rapidly as the hyper inflating currency, he / she is doomed. Unexpected inflation in a short span of time can also redistribute income from savers to borrowers, which could either hurt or help the economy, but is likely to hurt older people living on fixed incomes. At hyperinflation levels of 4000%, like in the case of Venezuela, inflation is like a hurricane which will wipe your savings in a flash.

Expectations that saving will be worthless deters people from investing, causing a recession and leading to capital flight. Nobody really knows how much their paycheck will be worth by the time they go to the store to spend it, so the entire labor system is thrown into chaos. Hyperinflation is probably one of the reasons why Venezuela, the country with the world’s largest oil reserves, now has starving children.

Few people have pitch Bitcoin as the future currency while few pitch it as "Store of Value" or rather digital Gold. However, looking at Bitcoin's volatility in the last 6 months, it won't be an exaggeration to say that you can lose (or gain) value on your holdings in the time it takes to complete a transaction.

Despite all this, bitcoin is a fascinating technology due to its ability to easily transport value across international borders and store value outside of the traditional banking system. Its value at an ideal state, wouldn't be driven by the failure of your government / central bank to run the economy. So can this lead to Bitcoin serve as a hedge against hyperinflation?

An example of this can be seen in Latin America, where at least two new cryptocurrency funds have opened up in 2017 to cater to rich Latin Americans. Scarred by the hyperinflation that has ravaged the economies of Brazil, Argentina, Bolivia, Peru in the past and now Venezuela. The region’s tech-savvy middle class, began adopting bitcoin a few years ago to protect their savings from rising consumer prices and currency controls.

It will be interesting to note similar such trends in other weak economies globally in the future.