There is a wealth of information out there to introduce the concept of bitcoin, I write this mainly for the community outside of Steemit for reasons two-fold. First, to make a reference point to share and educate people who want to 'get their head around it', and secondly, to attract a wider community to Steemit.

For the layman, Bitcoin is a digital asset increasingly being adopted as a medium of exchange. To understand it's attraction and value, we must first understand the limitations of our existing fiat system. This guide will attempt to bring together a comprehensive look at what Bitcoin is, how it works, what security risks to be aware of, and how to securely invest.

I was like most when they first hear of it - understanding just enough to be more curious, but not enough to make it a priority of interest. The story of Bitcoin is one of empowerment, liberation, and a movement that blindsided the powers that be. Not even the majority of activists saw this play coming, but when the penny drops and you see it for what it is, you realise the war has already been won - the people won, our oppressors lost... the future is simply the unfolding of that result.

Now to get into it...

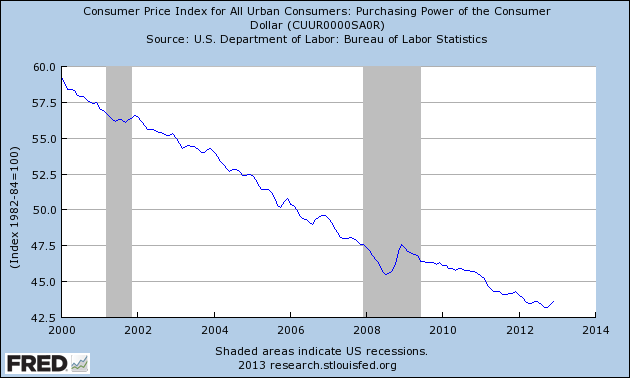

Fiat money is designed to inherently devalue over time, this is because 'interest' is added to the principal of all money loaned. Being a centralised system, the only means to pay for the added interest is to borrow more (with more interest). The result is an exponential increase in the money supply, irrespective of the goods and services in exchange - this causes inflation. Inflation appears as a rise in prices and costs, but more accurately it is a devaluation of the money. That alone is probably the more significant point to understand, also relevant is the process of 'Fractional Reserve Banking' which ultimately allows the bankers to superficially create both supply and demand via an outer layer of Commercial banks. You know the result of this, you live it, you have lived it your whole life, and you know that you're getting a little bit more fucked every year despite frugal practices. This was why, and there was no beating it... then Bitcoin came along.

So what is a Bitcoin -

Bitcoin

ˈbɪtkɔɪn

noun: bitcoin; plural noun: bitcoins

"a type of digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank."

About 95% of Fiat money is stored electronically in databases owned by central banks. (https://www.quora.com/What-percentage-of-the-worlds-money-is-digital) Bitcoin is stored on a decentralised network called the 'Blockchain'. The Blockchain is a chain of transactions (ledger) that all participants store and 'synchronise' with. When you make a transaction, this transaction (or block) goes into a "waiting pool" to be 'confirmed' and processed (AKA mining). Once it is processed, the transaction (or block) becomes apart of the Blockchain. Everyone can view basic information on all transactions that have ever taken place - how much was exchanged, and to what wallet addresses.

Wallet addresses look something like this "1PayDQpThRQM2PqAzm21vwQgKDYit6vMBQ" - also represented as QR Codes for alternative means of send/receive, consider this akin to your Bank Account number. The wallets themselves are stored on the network, they are encrypted and require 'keys' to unlock them. Think of these wallets as Bank accounts themselves, and the 'keys' as your 'pin number'. Depending on what wallet (bank account) you choose, and where the 'key' is stored, basically equates to how much security you wish to adopt or risk.

If you're like me, you don't trust third parties with your money. Look at how peoples retirement money has been looted, their accounts frozen, wages and salaries garnished by the state - all with your banks permission. You want to be your own bank, control your own account, with your own keys... and all while being 100% protected from phishing, hacking, and scamming. For this reason you want to setup up a 'Trezor' cold storage wallet.

https://trezor.io/

Unlike web based, mobile or desktop based wallets, with Trezor your keys and investments are not vulnerable to malware attacks, keyloggers or even the complete shutdown of the exchange that had your wallet and keys held for you. It has happened before with 'Mt Gox', and all exchanges are vulnerable to regulation changes that may compromise your security and digital assets. Trezor is what is called a 'cold storage' of your private keys that uses advanced authentication methods that do not expose your keys to anyone (even infected computers).

You will get the Device in the mail, it comes with a holographic seal to clearly identify if the package has been tampered with or not. Setting the device up takes a few minutes, Trezor plugs into your computer and utilises the trezor webpage only as a interface for your wallet (your wallet is encrypted and decentralised on the network, the keys to access the wallet are encrypted and stored on the Trezor). A common misunderstanding is that your Bitcoins are stored on the Trezor, all Bitcoins are 'in the cloud' so to speak, spread out in encrypted accounts called wallets - what matters is where the keys to these wallets are stored, and are you the sole person who has ever had them.

Now if this all sounds a little too risky, do consider the greater risk you currently take with fiat money. Unlike falling victim to identify theft and stolen credit card data (hell, even ransomware attacks), the only way to lose your bitcoins is by failing to take the responsibility yourself to have security measures in place. Besides using Trezor to safeguard your personal bank, there is a backdoor to gain access to your wallet via the use of a 24 word pass praise. This is to allow you to recover your wallet on another Trezor device if you misplace your original Trezor. Desktop Wallets like 'Electrum' have this feature to create a 12 word pass praise, however since the pass praise is initially displayed on computer monitor, you can not be certain that hidden malware has not screenshot the information and sent it somewhere (some malware are designed to sit silent until a desktop wallet application has been downloaded, and then begins screen-shotting). Trezor displays these words on the device itself, and you are instructed to write this pass praise down and store it offline. When you plug your Trezor in, it will display a number pad 1-9 (order mixed) on the Trezor screen. The computer monitor then displays the corresponding number pad without the numbers displayed. This means when you enter your pin, it is not displayed on the computer system. Compare this to the trust in the less secure methods of spending fiat money online - it just makes sense to get one.

So how to get Bitcoins? It's not hard... pretty much the same fashion as how you get cash. Start a business that takes bitcoin as payment, use an crypto-exchange or bitcoin atm to deposit fiat money for bitcoins, or write a 'Steemit' article and shamelessly plug your bitcoin wallet address in it. These are all small yet significant upgrades to how you have always went about transacting and earning.

When it comes to using an exchange, there are many around - probably one or more in your own country. Coinbase is very popular, but there are many. I live in Australia so I use CoinTree (https://www.cointree.com.au/?r=3195) and BitTrade Australia (https://btradeaustralia.com/). After verifying your details, you can deposit money and purchase bitcoins. The bitcoins will be calculated at the current market rate and sent to the bitcoin wallet the exchange provides. As soon as the bitcoins land in your exchange wallet, send them to your Trezor wallet - Do not store them in the exchange wallet, use the exchange as an acquisition medium only, and your Trezor wallet for storage. Your Trezor does not need to be plugged in to receive bitcoins, again, it stores the keys to your encrypted wallet which is decentralised. Exchange wallets are vulnerable to phishing attacks, regulation changes, and in the worst case... going insolvent and taking off with peoples coins. I'm happy to give trust in their service to acquire and exchange, but not to hold and store - they are prime targets.

So why would you buy Bitcoin anyway? For starters, the transaction fees are considerably lower than services like Western Union. The transaction time is down to a few minutes as opposed to several 'Business days' (and getting faster now with the activation of SegWit - https://cointelegraph.com/news/bitcoin-launches-segwit-max-keiser-raises-interim-price-to-10000). Furthermore, the supply of Bitcoins is capped at 20,999,999 period - no more printing cash out of nothing by the Fed and causing inflation. Last but not least, transactions are two parties only (no intermediary's) and decentralised. These very attributes make Bitcoin extremely resilient to corruption and monetary abuse in the form of orchestrated financial collapses. Investors see it as a safe haven to store value, others see it as their meal ticket to wealth and riches (and they would be right in believing so).

When considering the market potential of say oil, you observe the use of oil. When you consider the market potential of Bitcoin, you calculate how many people their are on the planet, multiple that buy how much they spend on average, and divide that by the total supply of 20,999,999. It's still early days, but it could skyrocket again at any moment. As for altcoins like 'Bitcoin Cash', 'Ethereum', 'Dash', 'Neo' and about 700 more... well, this is where your own speculation comes in. Simply put, what is of value is of most value... Bitcoin has proven to be the most stable and growing cryptocurrency, and the fact that it was also the first demonstrates that it has a loyal supporter base (despite the fact that some altcoins are technologically more sound). Bitcoin has already integrated with a wide range of business world-wide, it has ran the gauntlet of regulation attempts to suppress it, it has survived market manipulation to try discourage fence-sitters - but the reality can not be hidden anymore.

Tomorrow you will wake up and that money in your wallet will be worth a little less, you will buy a little less, and work a little more. You remember this rat race, your parents did it too, and theirs... you really want out? Maybe some of you like working harder for less each year. I tell ya tho, It felt good buying bitcoins... just to be a part of the next big revolutionary change. Over the centuries of wars started by these bankers in a bid for control through violence, I am proud of the peoples answer to it. Non-violent, genius, and effective... Bitcoin is more than a digital currency, it is a message to the banking elite - one they have heard loud and clear. All they can do now is desperately appeal to the world in a bid to support their efforts at entering the cryptocurrency market themselves with the likes of 'Ripple'. No olive branch this time, we got em on the ropes - they lost before they even saw the threat.

To view realtime update of the Crypto Market.

https://coinmarketcap.com/currencies/views/all/

75 places to spend your bitcoins online.

https://www.shopify.com.au/blog/10480345-75-places-to-spend-your-bitcoins

Daily News on Bitcoin/Altcoins.

https://cointelegraph.com/tags/bitcoin

Multicoin Exchange.

https://changelly.com/

Bitcoin Documentary - The Rise and Rise of Bitcoin

http://movieocean.net/watch/7eed23-the-rise-and-rise-of-bitcoin-2014.0dNhRE?pass=ac40be

Bitcoin Documentary - Banking on Bitcoin

http://movieocean.net/watch/7f42e7-banking-on-bitcoin-2017.Zkje9A?pass=080186

If you would like to donate, details are as follows

Bitcoin: 388eHVMUdDn9EqCnytFdQabwZsW8ybVmdo

Litecoin: MSarwkbtjEScboVDppYhzcgohCUHYDVeNg

Bitcoin Cash: 1MUCiWHfcSzxZ1cxBr88kStPQrEpE4aRks

Ethereum: 0xF4dD42BC37516f729133658726E3034cC4c9B0A8

Dash: XsnuT8rXCz98utSbGBiMqySkR7FsbjX9gw

Thank you for your time reading, please share if you wish.

we will see bitcoin 10,000 dollars

Yes I believe so too, certainly before the year is out.

Nice - a real article, self-written, not plagiarized, and with a lot of useful info.

Thanks, upvoted and followed!

Hello! I want to motivate you to post the steemit! I sent you some money in your wallet!

Thanks Andy, I try to when I get the time (and have something worth sharing).

Loved the part about inflafion. If a wage raise doesn't exceed the inflation rate it is actually an economic pay cut!