The Peer to Peer exchange industry took a big hit when regulators forced KYC on the two biggest platforms and even cracked down on cash trades at Localbitcoins. In my recent article I described the critical need for Peer to Peer exchanges for the crypto industry as a whole as well as for our freedom. In todays article, I want to take a deeper dive into the KYC-less emerging platform Localcoinswap, where you are still able to make cash trades without the need to fill in a bunch of forms.

Localcoinswap is the best candidate to fill the gap

In my opinion: Localcoinswap, HodlHodl and Bisq are the only relevant Peer to Peer cryptocurrency trading platforms to serve as a proper alternative to LBC and Paxful. I am very excited about the decentralised character of Hodlhodl and Bisq, they are a huge win for the industry, but the extra resilience comes with an expense on usability. With a new crypto bull-run ahead, the market will certainly be in need for an easy to use Peer to Peer cryptocurrency trading platform.

Localcoinswap is more similar to LBC and Paxful and easy to use. This means that traders can easily migrate to avoid KYC or to be able to continue to make cash trades. You can bring your LBC reputation to Localcoinswap and the team is currently working to implement the ability to advertise a trade without the need to store the full reserve in the Localcoinswap wallet. This eliminates most of the risk when you want to advertise all the trades on LCB and Paxful on Localcoinswap too.

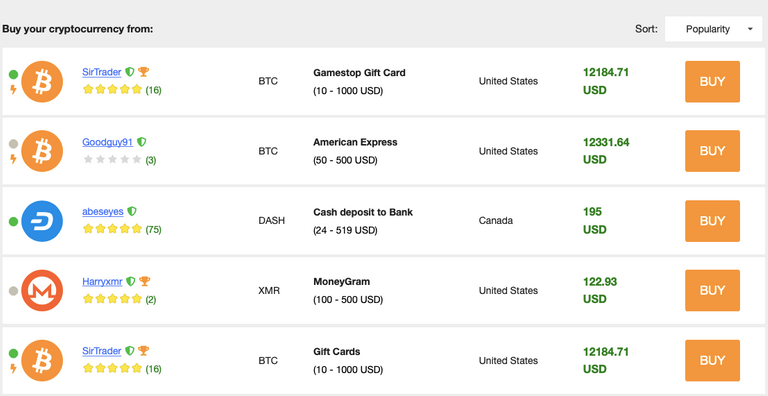

As you can see: The User Interface is similar to LBC and Paxful, advertising and trading works almost the same

The need for Peer to Peer exchanges will not decrease anytime soon

KYC is spreading over the crypto industry as wild fire and governments are trying hard to maintain their control over the monetary system. It is becoming harder and harder to buy cryptocurrencies without giving up your privacy.

Bitcoin ATM’s and Peer to Peer trading platforms are the only private onramps left. Combined with a very probable crypto bull-run upcoming and increasing failure of fiat currencies it is not hard to see that a platform like Localcoinswap will be in big demand.

You can easily monetise your involvement

Whether you are a trader, a marketeer or an investor: You can monetise your involvement in multiple layers that reinforce each other. In other words: If you help the platform to succeed you can make good money in the process!

Cryptocurrency LCS:

LCS is the native cryptocurrency of Localcoinswap. Trading fees on the platform will be paid out to LCS holders in the form of dividends. Every quarter dividend tokens will be paid out. With the tokens you can claim your share of the fees from the previous quarter. The same currencies are paid out as wherein the trades took place. The hard launch of the platform was last februari and this week will be the 2nd quarterly payout. The platform is still very young.

The volume increased 1385% compare to the last quarter and the dividend is about 6 cents per 1000 shares. Sinds the share price is only 2 cent at the time of writing, the dividend at the moment is just over 1%. Not bad at all for a startup! The dividend is depending on the volume, an increasing volume means an increasing dividend. An increasing dividend will eventually push the token price up.

Referral program

There is a referral program available: When you refer someone you will receive 10% of the trading fees the referral makes and he will get 10% discount on his fees. When you own LCS tokens the commission can increase up to 30%, depending on the amount you own.

The triple sided sword

A Peer to Peer trader can catch more trades and ensure his future as a trader by advertising on Localcoinswap (instead of or beside other platforms). By using the referral program to invite his current customers and fellow traders he can earn an immediate extra income. By holding LCS tokens he can increase his referral income and benefit from the extra volume he and his referrals brought in.

A marketeer can promote the platform to his audience and earn commissions. By holding LCS he will earn more and benefit from the new users he brought in through an increased dividend. When he want to cash out he can do this privately and more profitable within the platform. This will add extra liquidity and make the platform more useful. This in turn will attract more users and eventually increase the token value too.

An investor can make nice gains on the token price and dividends when he believes in the project and he turns out to be right. When he want to increase his stack or take profit he can do this on the platform to get a better deal and preserve his privacy. Furthermore, his LCS holding will increase his referral commission, so he will earn more by bringing in fellow investors. By adding liquidity to manage his stack and inviting fellow investors he will increase the platform volume and thus the value and dividend of his tokens.

As you can see: The effect of holding the token, using the referral program and trading on the platform reinforce each other.

Big risk / huge reward

Yes, investing in Localcoinswap is risky. However, the possible reward is huge. Because volume is the most important feature (if it is hard to find a suited trade, the platform is not useful) the platform will probably make it big time or become irrelevant. Somewhere in the middle is very unlikely.

Because LBC left a huge gap by prohibiting cash trades, a new bull-run is likely to start soon and the incentive to promote the platform and be involved (the earlier described of the triple sided sword) I think Localcoinswap makes a good chance to become one of the relevant Peer to Peer crypto exchanges. What does that mean?

Last quarter the weekly volume was around 38.000 Dollar. Let’s compare it to the bigger Peer to Peer exchanges:

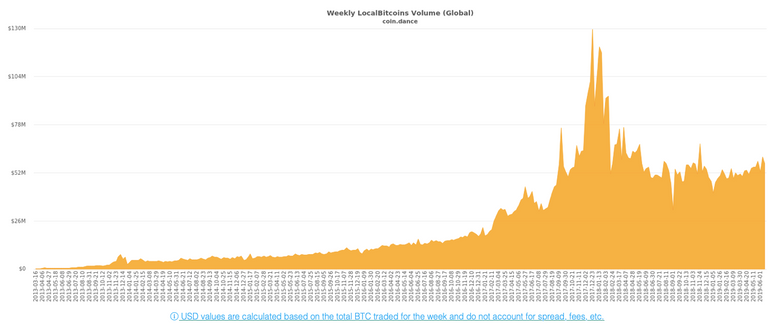

Localbitcoins

The tradingsvolume on LBC is around 52 million Dollar per week. When Localcoinswap can manage to become the market leader and beat LBC, the volume will have to increase a staggering 1368 times. This means that the dividend will also multiply by around 1368 times, depending on the amount of promotional discounts. Obviously, the token price will follow too. Of course, it will be very hard to beat LBC and it may be not likely. I really see this as the jackpot scenario.

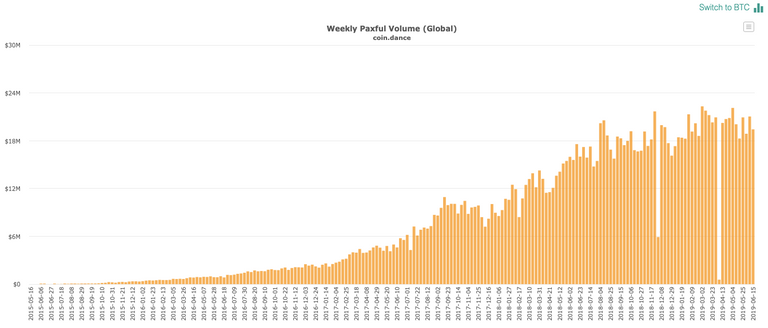

Paxful

The weekly volume of Paxful is around 20 million Dollar. To reach this figure the volume on Localcoinswap have to increase 526 times. Imagine how much dividend that would be and how high the token price would rise. This scenario is still very far away too, but it is certainly possible!

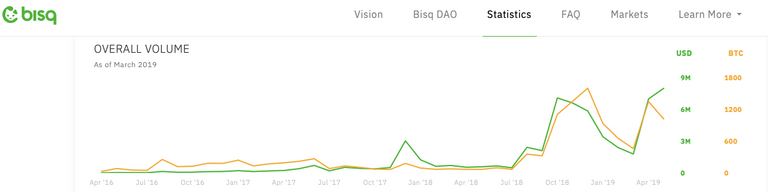

Bisq

Bisq is a smaller and less-known Peer to Peer exchange that have grown quite fast lately. The volume last month was 8 million dollar, that is about 2 million a week. If the volume on Localcoinswap can reach parity with Bisq it have to rise more than 52 times higher. This would lead to a dividend of more than 50% of the current token price. This will obviously rocket the LCS price. Bisq is among the smaller platforms, so parity with them not even that unlikely.

The current valuation:

The token price is around 2 cent at te moment of writing. It just tanked 95% from the 40 cent ICO price and might be bottoming out. The market cap is only around 1 million, thus there is still a lot of space to grow. The token is only available on Hotbit and ForkDelta and the volume is still very low.

When you want to buy a bigger amount of LCS it is better to buy them on Localcoinswap. Even if you pay a premium of 5 or 10%, you will probably be better off because if you buy for a few hundred dollars on normal exchange you will push the price up much more than 10%. The low volume is also a risk to consider, the tokens you buy might not be saleable in the future.

Disclaimer:

This is my own view on the market, it is not trading or investment advice. When you plan to get involved in Localcoinswap in any way, you should do your own investigation, check all the facts yourself and make your own decision. You are always responsible for your own actions.

Do you like this post? UPVOTE and RESTEEM!

Something to add? LEAVE a COMMENT!

Is localcoinswap using multisig or some type of noncustodial escrow?

Hodhodl does it so while it can still be used in the USA they blocked IP but even then the bitcoin still there as you control of the sigs...

Bisq uses the DAO + multisig to do this...

Bisq is really the best choice but sadly the least used :(

Fees are important.

The large adoption will happen only if the fees can be lowered as much as possible.

Thank for sharing this information.

This post has received a 10.00% complementary upvote from @swiftcash 🤑

@michiel purchased a 88.49% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com

You got a 15.15% upvote from @spydo courtesy of @michiel! We offer 100% Payout and Curation. Thank you.

This post has received a 91.11 % upvote from @boomerang.

You got a 38.09% upvote from @spydo courtesy of @michiel! We offer 100% Payout and Curation. Thank you.

Congratulations @michiel! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!