Bitcoin is often referred to as a Decentralized Peer to Peer Currency, however, with one company now dominating the Hardware used for Bitcoin mining and just a handful of Mining Pools where these miners are distributed, can we really call Bitcoin Decentralized?

We won’t get into the history of Bitcoin mining, its a interesting topic and deserves a separate article however this is basically what happened:

- CPU Miners secured the Bitcoin Network

- GPU’s were then utilized for Bitcoin Mining making CPU Mining unprofitable

- ASIC’s (Application Specific Instruction Chips) were developed making GPU Mining obsolete also.

- One Company became to dominate the ASIC industry and wiped out all it’s competition but a few.

The details of how Bitmain became to dominate the market are not important but the fact that they have is important and a little worrisome.

What is AsicBoost?

Bitcoin Magazine explained this technology exceptionally well in an article entitled ‘Breaking Down Bitcoin’s “AsicBoost Scandal”: The Solutions’ back in April of 2017:

Bitcoin miners construct blocks of data. These blocks include transactions, some random data (a “nonce”) and more. >Once constructed, a miner hashes his block, which is a mathematical trick that scrambles and compresses all the data into a short and random string of numbers: a hash. If this hash happens to start with enough zeroes, the block is valid and it can be submitted to the network. If it’s not valid, the miner will have to try again, for example by changing the nonce.

To construct and hash a block, miners have to invest a tiny bit of computing power, hence, energy. In effect, this means that any time a miner finds a valid block, he must have statistically invested much more energy for all of the invalid blocks he also constructed.

A valid hash is therefore quite literally proof that a miner did a specific amount of work, which is why this process is called “proof of work.” This proof of work is what makes Bitcoin relatively immutable. The only way an attacker can rewrite history is to have access to specialized hardware and invest real energy to redo all the work.

AsicBoost allows miners to take a “shortcut.” Instead of blindly hashing as many variations of a block as possible, AsicBoost lets miners reuse a certain calculation in the hash process across several tries. This saves some 15 to 30 percent of energy.

AsicBoost can be used in two ways: overtly and covertly. Overt use would be obvious to anyone; it’s easily detected by looking at the blocks a miner produces. Covert use, however, is much harder, if not impossible, to detect. Only covert use is largely incompatible with SegWit.

Bitmain AsicBoost Debacle

Back in April 2017 a post made to the Bitcoin mailing list talked of a ASIC manufacturer exploiting a previously known weakness in the Bitcoin Proof-of-work algorithm which would allow them up to 20% more efficiency when mining Bitcoin. The manufacturer in question turned out to be Bitmain, the company admit trialing AsicBoost technology but deny implementing it in anyway. The concerns were that if a company such as Bitmain used a patented technology such as AsicBoost it would not only give them a 20% efficiency boost and thus outperform every other SHA256 ASIC Miner on the market but also stop others from using the same technology, which of course would lead to an ever bigger dominance by Bitmain over the Bitcoin network thus a more centralized network.

This debate was finally made irrelevant as when Segwit was implemented late last year it blocked the used of AsicBoost ‘Overt’ usage.

Halongmining’s DragonMint T1 Miner

Halongmining acquired the patent for AsicBoost from it’s developers Little Dragon Technology LLC. According to the Halongmining website they were given the license on the understanding that:

“AsicBoost would be opened up to everyone to use, under some form of defensive patent license, in the hopes it can help protect decentralization of Bitcoin mining. Whilst this was being arranged, we were unable to announce our intended use of AsicBoost technology until the patent holder fully opened the patent for all to use under defensive licensing terms which occurred on 1st March 2018.”

With this understanding it would ensure no single manufacturer has the upper hand in miner efficiency and thus support decentralization.

Unlike Bitmain, Halongmining are implementing the ‘Overt’ use of AsicBoost rather than ‘Covert’ use, the simple reason for one being deemed fair over the other is because ‘Covert’ AsicBoost is harder to detect in Blocks, whereas ‘Overt’ AsicBoost is easily detectable in Blocks produced. Which would allow for said manufacturer to ‘covertly’ dominate the network. So it is for this reason Segwit blocked the ‘covert’ usage of AsicBoost only.

The DragonMint T1 Miner is due for release in May 2018, orders are already being taken and the units are promising 16TH/s at 1480W for $2729.

A video was posted of a DragonMint T1 Miner on the manufacturers website to try and quell the initial skepticism from the public that this was a scam:

______________-

Antminer S9 Vs DragonMint

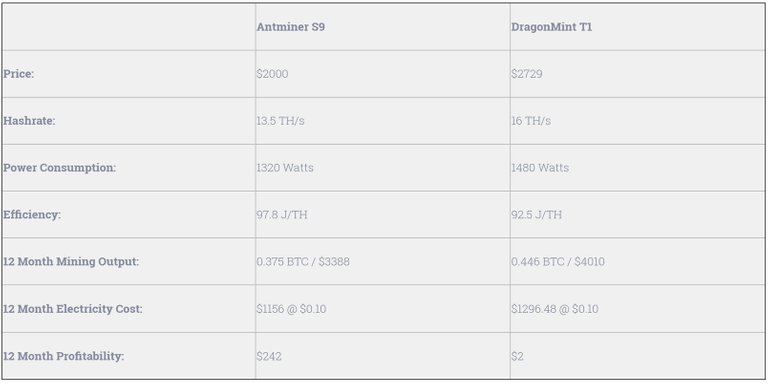

Bitmain’s Antminer S9 has been on the market for sometime now however up until now there has been very little competition for it. For the sake of this comparison we will use the 13.5TH/s version of the Antminer S9:

As you can see neither are particularly profitable even at the over ambitious electricity rate of $0.10. It’s also worth noting that these values don’t take into account the mining difficulty changes which occurs every 12 days or so. In the unlikely event that the hashrate declines over the next 12 months these profits could be higher, but the likely reality is that the network difficulty will increase significantly over the coming 12 months and therefore profits will be far less than the ones listed above, but regardless the percentage difference in profitability between the two miners will remain.

So it would seem although the DragonMint T1 is a promising new addition to the market, it doesn’t beat Bitmains existing offering. Halongmining will need to reduce the price of these miners before they can be a real competitor to the Antminer S9.

We hope they do as Bitmain have far to much power over the Bitcoin network and we need more manufacturers in the game, it seems this year we may begin to see potential competitors for Bitmain as giants like Kodak and Samsung begin getting involved in the mining space, but as of yet nothing can compete, not even the AsicBoost enabled DragonMint T1.

What a shame.

This article first appeared on our Website

That’s prolly why so many Bcash people are affiliated with mining. bcash doesn’t have segwit thus can asic boost

Valid point

As you wrote, it is not clear if DraginMint is real or scam but also with the slightly higher hashrate these will not do the job anymore.

Many mining farms are located in regions with power cost as low as 1 cent or little more; this still gives a pretty bad ROI based on your calculations.

There are no rumors yet if Bitmain is working on the next generation of Antminers. This development could improve profitability by a boost of Hashing/power consumption ratio.

The central question remains: what happens to bitcoin mining once it is no longer attractive to mining businesses. We have seen a massive increase in transaction cost, it might be that very soon, transaction fees are the only income stream for miners, and thus transaction cost will skyrocket once more. Ultimately this might kill Bitcoin as BCH, and other Altcoins are going to be even more attractive to the big players in the mining business.

It will be interesting to see how this develops. However 'in theory' the whole mining profitability issue should always find a state of equilibrium. If it becomes unprofitable to everyone then the hashrate will drop, the difficulty will drop and thus profitability goes up. Bitcoin value can also increase to increase profitability, but of course manufacturers set pricing of hardware accordingly, so margins will always be tight to end users. I don't really see it will increase the adoption of alternative currencies such as Bitcoin Cash, the automatic balance of profitability applies to all POW cryptos.