Source: Blog

If you have been following the Bitcoin price recently (Nov 2018), you might have noticed some price movements that you haven't exactly anticipated. I want to show you how to keep a cool head in the midst of statements like these:

"Bitcoin was an extremely clever idea. Sadly, not every clever idea is a good idea."

Benoît Cœuré, Executive Board Member, European Central Bank

I will get to this statement later on. Lets first look at three points anybody can easily do to try to figure out where the price might be moving, what the movements might look like and why it's not magic or luck, when you speculate correctly on a price movement.

1. History repeats itself

The first thing you learn in Technical Analysis (TA) is that history repeats itself. If you start following price movements more regularly, you will notice boom and bust cycles happening over and over again, always following a similar pattern. Bitcoin follows a certain pattern as well. Let me show you a tweet of Peter Brand, author and trader of classical charting principles:

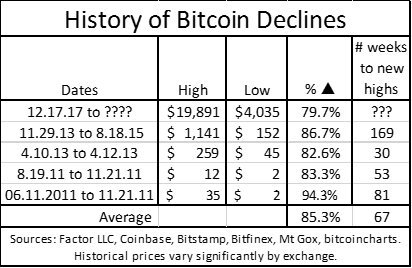

As you can see, massive declines in Bitcoin's price are nothing new, therefore, no reason to kill yourself just yet. Certainly, the fact that prices are below the break even point for miners is a massive problem, however, Bitcoin's consensus algorithm will evolve just as the use of renewable energy, or unused energy surpluses, will increase. Lets also not forget how many banks there are, that are using electricity, paper, gasoline and other resources. All the branches and most of the people would be replaced by a mostly electronic system. To support my argument, let me show you two weekly charts of Bitcoin's price on Bitfinex:

Can you tell which chart is from 2017/2018 and which one is from 2014/2015? I'll give you a hint: it doesn't matter, because history repeats itself. Bitcoin's price rose to new heights after the bear market 2014/15, chances are, it will happen again.

2. Inflationary vs. Deflationary Systems

In order to understand why Bitcoin is competing with banks, you have to understand how the central bank system works, as compared to how to Bitcoin network works. By understanding both concepts, you will understand why people like Benoît Cœuré or Jamie Dimon are wrong, and why Warren Buffet actually might be right.

Most fiat money systems work the same: A central bank sets a certain interest rate, banks lend the money from the central bank and lend it to their customers. Right away, the problem becomes evident: How can the bank pay back that initial interest? The bank will have to earn money that the central bank gave to other banks. Just like a pyramid scheme. Now, whereas pyramide or ponzi schemes are fraudulent, I do believe that the intentions of most (or at least some) participants in the banking sector are good. However, the system is prone to boom and bust cycles, the divide between rich and poor is growing, and the dollar is backed by nothing but trust in the system.

Source: GoldTelegraph

Most fiat currencies that have existed have collapsed at some point, or experienced excruciating hyperinflation periods. Another problem is, that when banks become bigger and bigger, they start increasing leverage, and products that might have been of lesser value, are being repackaged and sold as higher value products. The 2008 financial crisis was fueled by so called CDO's, which are, among others, mortgage backed securities, bundled together and sold as a package. I recommend the movie "The Big Short", and this scene explaining CDO's. Now, banks would not be banks if they didn't trade derivatives on everything, so those crappy CDO's were highly leveraged, in something called a CDO squared. When the underlying mortgages defaulted, the CDO's collapsed, and a lot of people lost their money. An important and often overlooked issue, which was the topic if the movie "Margin Call", was that some banks invested in CDOs sold most of their positions in a fire sale after finding out they were garbage, knowing that they would potentiall ruin their customers. Unbelievably, no one went to prison.

My point is: Banks have lost our trust. The world is yearning for a more sound system. Bitcoin arose from the financial crisis, and has so far persisted. The key difference: there will never be more than 21 million Bitcoin. The system cannot be inflated by anyone, the amount of new coins that are mined is predetermined. That means, as long as people keep using Bitcoin, it is virtually impossible for it to lose its value. Fiat currencies on the other hand, will automatically lose value once new money is printed, which needs to happen in order to keep the pyramide scheme running, as explained before. Of course, it is not a given that Bitcoin will continue to be used, so far however, even with the latest price decline, interest in Bitcoin is still there.

3. Fundamentals

Remember Warren Buffets comments on Bitcoin?

"Probably rat poison squared"

Source: CNBC

Given how banks blatantly scammed people and got away with it, it is evident who the rat in this scenario is. I want to point out another quote of Warren Buffet

"Just looking at the price is not investing"

Source: GFM Asset

I think it is a good idea to follow his advice, however, he is underestimating the people investing and hodling Bitcoin. He thinks people only invest due to the Greater Fool Theory. The premise of most people investing in crypto is, that crypto will either substitute or greatly complement fiat currencies in our daily lives. Due to their nature, which I explained before, they will increase in value, whereas the currencies in inflationary fiat systems will lose value. Warren Buffet has not commented on the technology, or the evolution thereof. He is known to be an investor focussed on fundamentals, however he is clearly disregarding it in this particular case. It is certain, that he is trying to secure his bets (he recently invested in JP Morgan, half of his holdings are banks), which is why I would not weight his comments on Bitcoin too much.

Bitcoin has been funcional for 99,9% of the time, it survived and beat every correction so far, and is continuing to gain relevance all over the world. I recommend reading an article or watching a documentary about the great depression in order to get some perspective. Remember: history repeats itself. With the alt right gaining traction in many countries, trade wars emerging and inflationary risks rising, things are starting to look similar to the 1920s and 30s, but this time around, there is a new asset class looking to disrupt the way we do banking.

---

Check out my other posts below. **Thanks for reading**

[How To Explain Bitcoin To A Child](https://steemit.com/cryptocurrency/@nate.french/how-to-explain-bitcoin-and-money-to-a-child)

[How To Explain Bitcoin To Your Parents/Girlfriend/Friend](https://steemit.com/cryptocurrency/@nate.french/how-to-explain-blockchain-to-your-parents-girlfriend-friend)

[Useful Links For Bitcoin, Virtual Currencies, Finances and Trading](https://steemit.com/cryptocurrency/@nate.french/useful-links-with-screenshots-for-bitcoin-virtual-currencies-finances-and-trading)

[Useful Links For Bitcoin, Virtual Currencies, Finances and Trading PART2](https://steemit.com/beyondbitcoin/@nate.french/part-2-useful-links-with-screenshots-for-bitcoin-virtual-currencies-finances-and-trading)

[How To Apply For A Job - Body Language And First Impressions](https://steemit.com/business/@nate.french/how-to-apply-for-a-job-body-language-and-first-impressions)

[Building A Career - How To Deal With People + Do's and Don'ts](https://steemit.com/business/@nate.french/building-a-career-how-to-deal-with-people-do-s-and-don-ts)

[Sales Sales Sales - Things I Learned At Tesla And Enterprise](https://steemit.com/money/@nate.french/sales-sales-sales-things-i-learned-at-tesla-and-enterprise)

[The Steemit Community And Its Weird Traits – 3 Ideas](https://steemit.com/steemit/@nate.french/the-steemit-community-and-its-weird-traits-3-ideas)

[Happy Tuesday - Landscapephotography - Croatia - Krka - Waterfalls - Paradise](https://steemit.com/landescapephotography/@nate.french/happy-tuesday-landscapephotography-croatia-krka-waterfalls-paradise)

---

*The information in this Blog is for educational purposes only and is not investment advice. I am not a financial advisor. Please do your own research before making any investment decisions. Online And Cryptocurrency investments are a volatile and high risk in nature. Don't invest more than what you can afford to lose. Links to products in this blog might contain affiliate links. The author has a stake in several cryptocurrencies.*

Amazing summary and reasoning! I am impressed by the simplicity of the narrative for some quite difficult subjects...

Thank you so much! The topics are indeed difficult, it took me more than a decade to fully understand what is happening. Thankfully, I had the fortune of learning about the economy early on through great teachers!

Greetings! I am a minnow exclusive bot that gives a 4X upvote! I recommend this amazing guide on how to be a steemit rockstar! I was made by @EarthNation to make Steemit easier and more rewarding for minnows.

Congratulations, your post received 29.90% up vote form @spydo courtesy of @nate.french! I hope, my gratitude will help you getting more visibility.

You can also earn by making delegation. Click here to delegate to @spydo and earn 95% daily reward payout! Follow this link to know more about delegation benefits.

You got a 2.44% upvote from @booster courtesy of @nate.french!

NEW FEATURE:

You can earn a passive income from our service by delegating your stake in SteemPower to @booster. We'll be sharing 100% Liquid tokens automatically between all our delegators every time a wallet has accumulated 1K STEEM or SBD.

Quick Delegation: 1000| 2500 | 5000 | 10000 | 20000 | 50000

Resteemed to over 19400 followers and 100% upvoted. Thank you for using my service!

Send 0.200 Steem or 0.200 Steem Dollars and the URL in the memo to use the bot.

Read here how the bot from Berlin works.

#resteembot #bestofresteembot #winwithresteembot #resteembotvip

Become one of our VIPs for 1 month free resteems and upvotes.

Byteball is doing a airdrop on Steemit, where you can get 10 $ - 160 $ for free. More infos here.

@resteem.bot