There has been a lot of questions about Bitcoin’s rise over the last year. Some say it’s a bubble waiting to burst, yet others say it’s a rocket yet to take off. Well, today I’m going to dive into that and give you my opinion of what to make of all this.

To begin, I’m going to take you back a year and a quarter.

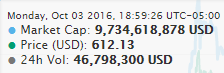

The date is October 3rd, 2016.

source: coinmarketcap.com

source: coinmarketcap.com

Bitcoin’s price is jumping around between 600$ and 700$. It’s used by mainly by tech enthusiasts, hackers, criminals, cyber punks, and crypto anarchists.

There are plenty of investors too, but they probably heard about Bitcoin from a friend who was in that list. The investors were also probably much more involved in using Bitcoin’s tech like everybody else (unlike now with many people buying solely to make a profit by buying Bitcoins like a stock and holding them in the exchange until they sell them).

What’s my point? Most people who had Bitcoin intended to buy something with them (often shady things or down right illegal things) or perhaps they intended to hold for the long term because they liked the technology behind Bitcoin. But there were very few “Wall Street” style investors.

Alright, Back to Today

Bitcoin’s price is about 9,300$, bouncing between 9,000$ and 11,000$. Bitcoin is now much more mainstream, however it's not really used for any more purchases than it was a year or so ago. A vast majority of buys are probably either Wall Street or new investors buying so that way they can turn around and sell to make a profit.

source: coinmarketcap.com

source: coinmarketcap.com

There is research being done to make Bitcoin much more usable for everyday purchases, so it seems everybody is looking up. There is, however, no guarantee they’re going to work.

So, what does this mean?

You might be wondering why I gave this recap, but now it’ll make sense.

Right now Bitcoin is a bubble. Plain and simple. I can imagine the comments section now full of people spreading hate who didn’t read the rest of this.

A year in a half ago, when Bitcoin was between 600$ and 700$ it was at a fair price for it’s adoption. However, there have been a lot of investors buying in who drove up the price increasing it nearly 20x it’s original value. If that’s not a bubble then we don’t need the term “bubble” in our financial vocabulary.

But it’s still looking up

Just a second ago I said that Bitcoin was at a fair price before all the pumps due to the fact it’s not really mainstream when it comes to transactions. Well, we’re not moving backwards in adoption.

There are plenty of potential things coming down the pike in terms of ways to transact with Bitcoin. And now with all these investors who bought in, it would probably be very profitable for the first couple of large retail companies that started accepting Bitcoin if it were made more efficient.

My point is that if some major companies started accepting Bitcoin as a normal payment method then we could very quickly move away from bubble territory and overnight with no crash.

Summary

I see 4 possible outcomes:

Adoption Theory:

Bitcoin starts getting adopted as a mainstream payment method and it will retain it’s value or start going up again.

Bubble Theory 1:

Bitcoin eventually drops down (either through a flash crash or just a slow bleed) to somewhere about 1,000$ where it’ll sit. It may or not be slowly replaced by another crypto. Investors will be mad.

Bubble Theory 2:

Bitcoin will continue to rise even though there is really no more adoption. Eventually smart investors will pull out, but people who just invest without research will get burnt in a flash crash and be mad.

Replacement Theory:

Some new coin (or existing coin that was unexpected to replace Bitcoin) will suddenly, out of the blue, replace Bitcoin as #1 and it’ll be a free-for-all crazy market. “Normal” investors will all pull out.

Conclusion

If I had to take a guess, I’d guess that Bitcoin will become adopted at some point (at least to some extent); however things aren't always black and white and we could very well see some each (or non of each, I’m no expert).

Regardless, if there’s one thing you take away from this article then make sure it’s this:

Always do your research, watch the market, know your biases, and don’t invest more that you can afford to lose.

I'm @Nathan047. I mainly post news and opinions regarding Technology and Cryptos. If that sort of thing interests you then consider following me. Also, an upvote or resteem wouldn't hurt. Thanks for reading

The way I see it, I'd say the first is 80% or more likely to happen. I'd put bubble #2 at 10%

I agree with your adoption theory, I think that's what's going to happen.

Your post was resteemed👍

upvote and resteem.