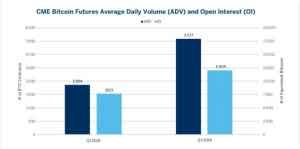

Recent news from CME Group Inc., an American financial market company based in Chicago, indicates that Bitcoin futures average daily volume has risen up by 93% over the past quarter and a 58% increase in open interest, crossing a threshold of 2,400 contracts.

This increase in Bitcoin futures indicates an interest from investors who speculate on the Bitcoin market without necessarily owning any.

The CME group explains that futures offer quick and cost-effective methods to trade in financial and commodity markets. Futures are a standardized contract that enables an investor to buy or sell a particular asset at a specific price at a future date in a predetermined quality and quantity.

The Commodities Future Trading Commission [CFTC] regulates Bitcoin futures and has been investigating whether the market manipulation has been changing cryptocurrency prices between the future contracts and Bitcoin prices.

Sources indicate that consumers no longer need to own digital wallets or handle private keys related to Bitcoin trading, as the futures are financially settled without the need to exchange Bitcoin, making them an appealing product for those investors who like to predict the market without owning any Bitcoin.

Further reports indicate that when it comes to Bitcoin futures, investors can trade anytime on the day of the week. Additionally, it indicates that the process of determining the prices also becomes simple due to the efficiency of future markets. The advantage of the price circulation is available to all the participants and is automatically updated throughout the globe. This means that players can buy and sell with a complete knowledge of the best price available like other investors in the market.

CME also reports that other players like Grayscales, Goldman Sachs, Coinbase, Fidelity, NASDAQ, NYSE, Susquehanna, Seven Cohen and other big investors are also exploring Bitcoin Futures.