Invited by Deribit to write a strategy on the option to protect the encrypted digital currency mining machine.

Stakeholder Statement: I am involved in the trading of encrypted digital currency mining and related derivatives. The content of this article is mostly an older version of the strategy that I have used in the past. It does not guarantee future validity and does not constitute any investment advice. Nor do credit endorsements and recommendations for any institution.

Mining basic concept

Everyone has heard of bitcoin mining, and many people have gained considerable wealth through bitcoin mining. There will be no pies in the sky, and everything that is high-yield will be accompanied by high risks. The mining behavior of encrypted digital currency can be understood as a process of charging the fixed input of the mining machine + the input of electricity, in exchange for encrypting the digital currency.

The core elements here are: the price of the mining machine and the price of the encrypted digital currency, the power and electricity cost of the mining machine, the calculation power of the mining machine and the total network computing power, the number of mining incentives, and other costs of mining operation and maintenance. .

The price of the mining machine itself and the electricity bill are the cost. The encrypted digital currency obtained is the income. The expenditure for purchasing the mining machine is a one-time fixed expenditure. As the mining behavior continues, it is continuously diluted financially, and the electricity bill is a continuous expenditure.

The revenue component is the percentage of the calculation power of the mining machine to the total calculation of the entire network multiplied by the block reward. At present, the reward for one block per 10 minutes for the BTC main network is 12.5 BTC, which will be halved next year. This is a factor that cannot be changed. The total amount of computing power of the whole network is affected by factors such as the actual rate of return of mining. Someone joins and withdraws. This is also a factor that cannot be controlled.

In terms of mining, the factors that can be controlled are the type of mining machine (power calculation) and electricity cost (power). The price/performance ratio of the mining machine is, in the final analysis, the reaction in the power/power ratio. That is, the unit power consumption, the more the computing power is provided, the better. This is related to the design of the mining chip, each generation is progressing, and now is the 7 nm era. Of course, the latest mining machine prices are usually more expensive. Therefore, the mining machine that is not the higher the power/power ratio is more economical because the mining machine may be too expensive and uneconomical.

Taking into account the power/power ratio and the price of the mining machine and the electricity bill, the core indicators can be summarized into an indicator that all businesses are concerned with: the return cycle. Because the output of the mining machine is an encrypted digital currency, it is discussed in two cases.

The first is the currency standard. For example, if we spend 10 BTCs to purchase a batch of BTC mines, we need to mine for a long time to generate 10 BTC benefits. It is relatively easy to clear all the money here, and it does not involve fluctuations in the price of the currency.

However, because the mining itself consumes electricity, and the electricity bill is denominated in French currency, it is impossible to involve no fluctuations in the currency price at all. Here comes a concept that when the monthly BTC sold is not enough to pay for the electricity consumed by the mining machine of the month, we have reached the mining machine price. This is possible and happened.

When the difficulty of mining the whole network increases, the return period of the currency standard will be lengthened. If the price of the shutdown price is encountered, the difficulty of mining will decrease rapidly, because the mining machine participating in the competition will be less.

The second is the legal currency standard. For example, we spent 100,000 US dollars to buy a batch of BTC mining machines, and we can get 100,000 US dollars of mining profit. We call this the legal currency return cycle.

The most volatile factor here is the price of the currency. The mining is calculated at the beginning of mining for 6 months, and the net income can be 100,000 US dollars. It is assumed that the price of the coin has remained stable, so it is also called the static return period.

However, the price of the currency will not only fluctuate, but the volatility will not be small. When we start mining, if the price of the currency continues to fall, then the cycle may be longer and longer, especially when the price of the coin is high, and the price of the mining machine is usually high. Even worse than buying a BTC at a high level, miners must also pay a monthly fee for electricity bills. Once the mine price is broken, the mining machine becomes worthless.

Whether it is the currency standard or the legal currency standard, there is a fact that the grid will not accept Bitcoin to pay for electricity, because the grid will not bear the risk of falling currency prices. This risk is borne by the miners.

It will be tempting to return to this book in a few months, but in reality the price of the currency seriously affects the financial future of the miners. When the price of the currency rises, the income of the miners is very substantial, and the cost may be recovered soon. However, if the timing of the entry is poor, it is very likely that Davis will double-kill, the price of the obtained currency will fall, and the mining machine held will also fall in price. Even if it wants to take out the mining machine, it is difficult to recover the cost and the loss is heavy. This situation is dubbed "mine disaster."

Hurricane rushed into the myth of mining wealth, and finally lost a lot of confusion, there are many people. Does the miner only pray that the price of the currency should not plunge, is it completely passive? More than 95% of miners are in such a passive situation without any fuss. It is no different from gambling, which is very undesirable!

In fact, it is not necessary. As Bitcoin has gone through ten years, it has developed a small-scale derivatives market. There are long-term, interchangeable, futures, options and so on.

Hedging basic concept

Holding a mining machine can use the forward or futures to hedge the price, thus hedging the risk of currency price fluctuations and achieving the effect of improving financial security.

Here are three different preferences:

Pure legal currency standard investor

The pure legal currency standard investor has no "belief" on the encrypted digital currency, purely in order to earn more legal currency. There are two types of such investors, one is optimistic about the future of the currency price, and the other is that the price of the currency is not judged or pessimistic.

The first kind of optimistic about the future of the currency, assuming that it spent $100,000 to buy a mining machine, short-selling $100,000 worth of bitcoin futures while buying the miner. Thus, when the number of coins produced by the mining machine reaches the delivery quantity of the futures, the short position of the currency + futures can generate $100,000 in cash. Calculate the proportion of electricity bills. If electricity costs account for 20% of the cost of mining, you need to short-sell $120,000 in bitcoin futures. After the amount of coins thus dug reached the delivery demand of the futures, the investor reached the "safe margin of the legal currency." This practice sacrifices the possible gains from the sharp rise in the currency price during the current cycle. After reaching the margin of safety, the price of the currency rises. He can obtain it by selling coins.

The second is an investor who does not judge the price of the coin or is pessimistic. Such investors need to calculate the approximate total output of the mining machine's work life cycle and carry out hedging. Suppose a batch of mining machines can produce about 200 bitcoins in the life cycle of being eliminated. Then he shorted 200 bitcoin futures positions at the beginning of the period. The future cash flow of the entire investment is determined. In this way, the rise and fall of the future currency price has nothing to do with him, and very pure currency to earn more French currency.

Both types of investors are pursuing the proceeds of the legal currency, not the currency, the difference is the degree of optimism about the future of the currency. Both of them are advantageous when the futures premium is raised and the mining machine's static return period is relatively short. Others don't have to choose time.

Pure currency standard investor

Investors in the pure currency standard use coins to measure the price of the mining machine. When they use 10 BTCs to purchase the mining machine, the safety margin of the return is when the mining machine digs 10 BTCs. The risk of such investors on the price of the currency is mainly that the electricity bill does not accept bitcoin pricing, so it is necessary to prevent the damage caused by the price of the mining agency. Such investors need to short all futures in the life of the mine, and optimistically only hedge back all the electricity expenditures in this cycle.

Interestingly, when the pure currency standard investors hedged the risk of falling currency prices, they even expected the arrival of the mining machinery price. Because the only relevant factor of the currency standard at this time is the difficulty of mining. The lower the difficulty of mining, the better, and after reaching the shutdown price, a large amount of computing power to withdraw from the competition is beneficial to such investors.

Similarly, futures prices are more favorable when they rise.

a coin who pursues the margin of safety of the legal currency

The practice of this type of investor is closer to the optimist in the first class of legal currency holders, pursuing the margin of security of the legal currency. The specific method is to short the miner's cost + the equivalent of the electricity bill in the bitcoin futures. During the return period, all the French currency investments were recovered without any accident. The difference is that after the margin of security of the currency, Bitcoin is not for sale, purely squatting.

Such investors can also be considered as people who are very optimistic about the price of the currency. The financial security margin of such coins is relatively high, but because the mining machine has a life cycle, this is not a once-and-for-all. This is related to the elimination cycle of the mining machine.

These three types of investors, based on their own different needs, can use derivatives to hedge against unwanted risks and leave the risk part they want. Profit comes from taking risks, but you can choose to avoid some of the uncontrollable risks, which is what financial derivatives mean.

Currency Financial Derivatives Foundation

One problem with the choice of financial derivatives is that the maturity date of futures contracts may not be far enough. If our return period is up to one year, the futures contract is usually only three months away.

One approach is to keep rolling and shifting to the month. This is related to the term structure of the futures. There is no difference between the practice and the traditional hedging. They all make a fuss about the cruve of the term structure.

In addition, the currency circle is now popular with a "sustainable contract", which can be understood as a contract that can never be renewed. This type of contract is essentially a swap contract that encrypts digital currency and legal currency. I should have been inspired by BitMex and have achieved great success. It can also be used as a hedging and does not require rolling.

Which is better to use perseverance and futures?

In fact, you don't have to think about it, because the financial derivatives of the currency market also follow the "no risk arbitrage impossible assumption". Generally speaking, it is impossible to obtain a higher return than the risk-free rate purely through the combination of derivatives. It can be proved by the counter-evidence method: if there is a simple derivative portfolio that can get an abnormal return, there will be a lot of money to smooth out this arbitrage space.

According to my observation of the currency market derivatives market, this law is weak and effective in the currency circle. There are indeed some opportunities for risk-free arbitrage. In some months, the income is even high, but it will still be effectively smoothed out. Its efficiency is far lower than the derivatives of the stock market bond market, but it is still effective.

There may be some people who may raise objections. Some “cross-exchange arbitrageurs” use the same currency at different exchanges to price different prices, and reclaim the repayments to earn bricks and gains, and get far higher than the risk-free rate. I did this kind of thing with my friends many years ago, and at first I thought I got a risk-free income. Along with a huge redemption crisis of bitfinex, I realized that this transaction is not a risk-free arbitrage, but a credit that keeps on doing more exchanges. It can be said that the cds of the airline exchanges are constantly being gambling. no problem. Each time the income is limited, and the entire principal may be lost after the risk event, it is completely contrary to the principle of trading. It is a typical “roller in front of the road roller”.

In summary, because of the weak validity of “no risk arbitrage does not exist hypothesis”, the effect of choosing a perpetual contract and a futures contract is similar. There is no one scheme that is significantly better than the other, and there is information on futures premiums and discounts. A more intuitive explanation is that there are also arbitrageurs between the perpetual contract and the futures contract, and there is not much meat.

Here is the credit problem of the currency exchange, which is unavoidable. There are conservative and aggressive options for the hedger. Conservative investors can choose CME's bitcoin futures, and ICE will also push bitcoin futures. This is completely risk-free and safe. The problem is that the leverage ratio offered by such exchanges is very low. If it is a little more aggressive, you can choose a currency exchange with better credit, or take the risk of diversifying multiple exchanges.

It is important to note that even the most conservative approach to using CME contracts and hedging all outputs in the mine life cycle is not a purely risk-free financial investment. In this most conservative program, all price fluctuations and credit risks are completely hedged, and there are still risk factors outside the price: frequent failure of mining machines, power outages, mine fires, floods in hydroelectric power stations, and so on.

Or the truth: the role of derivatives is to hedge the risk of hedging, derivatives are not omnipotent.

Excluding those force majeure factors, the yield of the most conservative hedge hedging strategy is highly correlated with the period of the French currency's static return period. It is indeed a (funded standard) financial security margin and the comprehensive rate of return is high. s Choice.

Advanced Financial Products Derivatives

A notable feature of the currency market is that the price fluctuation of the currency is relatively large. In addition to the gains from mining, there are still many people who want to make a spread transaction through the price fluctuation of the currency. I use the characteristics of the volatility of the currency to make a variety of strategies. I don't evaluate the effectiveness. As far as I am concerned with the knowledge system, the benefits of price fluctuations, in addition to band trading, are more concentrated and stable. The option contract is the condensation of price fluctuations.

(Reference: https://zhuanlan.zhihu.com/p/24993138)

(Popular version: https://zhuanlan.zhihu.com/p/19962890)

If we buy a put option and then hold the corresponding currency to make delta neutral, then by constantly adjusting the delta dynamically, the greater the volatility, the greater the gain we can get. The gains are fluctuating throughout the process, and the cost is the premium of the option. Because there is no white earning money, the more volatile the variety, the more expensive the option will be (high impield vol), the option seller is impossible to be white.

Options can “squeeze out” the benefits of volatility, so the option fee itself is the solidification of price volatility.

The fluctuation of the currency is very large, so the option of the currency is very expensive, which is very reasonable.

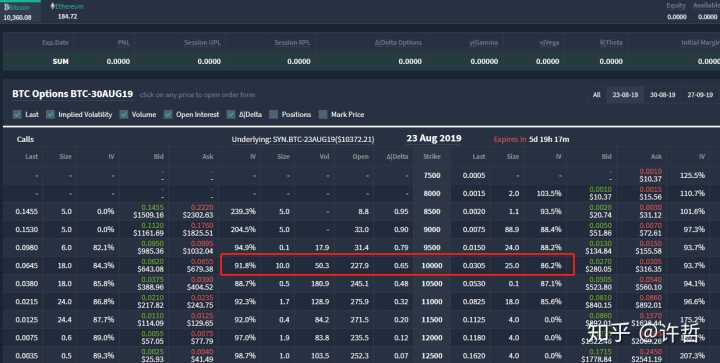

At the time of this writing, the implicit volatility of bitcoin flat-value options is as high as 90%, and in some cases more than 100%. This is an unusually high implied volatility. Therefore, in order to earn the price fluctuation of the currency, it is reasonable to make an option for the empty currency.

Of course, the option to make empty coins is a risk. Combined with our portfolio of mining machine assets, the situation is different. Not only can you obtain stable French currency income, but you can also have additional volatility gains.

The structure of the income is complex and inaccurate. In the author's strategy of using the option to protect the mining machine, the income obtained is 20% more than that of the purely protected mining. Overcharged three or five fights are always beaming.

The easiest way is to cover the call. The difference is that the way we hold the long position here is not to buy coins, but to mine. Suppose we can dig a BTC every week, the price is now 10300, and the weekly call option with a strike price of 10,500 is worth $120. Then we short this call option. There may be two situations:

One is that when the settlement, the price of the currency rises more than 10,500, then the currency is delivered at 10,500, and the legal income is obtained, and an additional $120 is charged. This short-selling currency is more than $120 more than the current futures.

In another case, the price of the currency did not rise to 10,500 at the time of settlement. At this time, the currency is still yours, and the white fee is 120 dollars. Next week, the mining machine will also produce new coins, and in the following week, we can short two call options. In any case, you can earn a $24 permuim.

If the currency is still not delivered in the second week, then in the third week, our first two currencies are still short, short three call options, and $360 permium.

If it is delivered, it will be the same as the delivery of futures.

Continuously doing this strategy, regardless of delivery or not, can get a certain permium income, and quite expensive.

Take the recent price of the Deribit exchange as an example. Usually, the options near the ATM, about 0.04 to 0.06 btc, continue to accumulate permium, considering that sometimes delivery is not delivered, and in the worst case, every time, It is also possible to earn an additional btc by a btc option permium income in about 20 weeks. If it is not delivered, then 1+2+3+...+6=21, you can get an extra btc in 6 weeks. The reality is definitely based on the two.

By carefully recalling the definition of an option, you have the right to sell or buy a subject at a price in the future. Specific to Bitcoin options, call options mean that you have the right to get a bitcoin in the future. What is the Bitcoin mining machine? In the future, you have the power to assign a new bitcoin. Holding a mining machine and selling a call option is an arbitrage in a sense.

This simple strategy has two obvious flaws.

One is that during the continuous decline of the currency price, we can only earn at least the option fee, and we cannot get the full compensation.

One is that during the rapid rise of the currency price, we must deliver the currency at the strike price, and we cannot get the extra income from the rise in the currency price. (the same for futures hedgers)

Are there any perfect solutions to these problems, and can even earn more extra income in the midst of fluctuations?

The answer is yes. There are better strategies to strengthen the profitability of the mining machine, but this is the trade secret of the author and will not be made public.

Conclusion

Getting profit is risk-taking. It is meaningful and absolutely necessary to control some risks, although it is impossible to eliminate all risks. As a special asset, the mining machine, when combined with derivatives, can provide a good margin of safety for people with different purposes.

Whether you are: the believer of the currency, you want to securely get some coins as a configuration person, a pure legal currency financial investor, or even a risk-averse type of legal currency investor.

Combining mining machines and making good use of derivatives can help.

This article does not constitute any investment advice.

Congratulations @pengseung! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!