Bitcoin goes on Wall Street on 18.12.2017 which is big news for bitcoin and possibly great news for its price. At the beginning of this year bitcoin cost about 1.000 USD and now it is already over 10.000 USD which is growth of 1000% leaving any other investment far behind. Apple grew 47 % since 1.1.2017, Amazon 54 %, Tesla 41 %, Google 28.5%, Gold 11%, ExxonMobile -8%, Boeing 72 %, Bank of America 25% and S&P 500 did 17%. Moreover, bitcoin price correlated with other stock much less than they did with each other which means that bitcoin is a great way to diversify your portfolio so that if stocks go down it might be mitigated by price of bitcoin and vice versa. That is quite a lot of reasons to have bitcoin as a part of your portfolio even though it is hard to evaluate risk of holding bitcoin. Imagine that you have a fund with 10 % of bitcoins, if bitcoin goes to 0, you lost 10% of your fund, if it grows next year the same way it did this year, you almost doubled your fund. There is much greater risk than holding bitcoin for a fund manager, not holding bitcoin and explaining your clients why others did.

This graph compares rise of price of bitcoin since january 2017 to other companies mantioned above.

What is the future?

Chicago Mercantile Exchange is one of the biggest futures market and they will list bitcoin futures in a few weeks. Futures are contracts that are made at present at current price and are closed at some future day. It is used for example if oil producer fears that in a few months price of crude oil will go down, he enters into contract with someone who will need the oil in future but expect that the price will rise. It means that both sides exchange risk of changing price for current rate that both parties accept. At the end of the contract, one of them will be much happier, the oil producer if price went down, the oil importer if the new price is higher than the one accepted at the beginning of the contract. It can be also viewed as a bet on the future price of an investment.

Bitcoin futures will be created as an index based on dollar prices on major exchanges like GDAX and Kraken and at the end of the contract it will be processed in dollars without ever using bitcoin itself. Price of bitcoin futures contracts and bitcoin itself is tightly connected because if bitcoin is cheaper that futures contract, anyone will prefer to buy bitcoin itself until the price of futures is same or close and vice versa. It means that Wall Street will get big influence about the price of bitcoin. The question is: How many people will be buying and how many selling? There are lot of people on Wall Street who are skeptical towards bitcoin or even hostile. On the other hand, it is hard to see an investor that will be betting against something that gained 10 times its value in a year and over 10.000 times since its inception 9 years ago.

How big should bitcoin be?

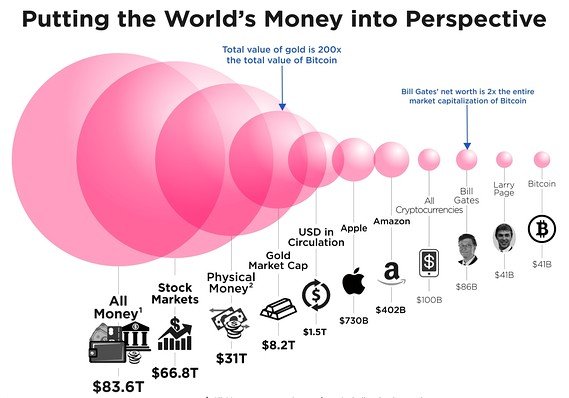

What is the right price for bitcoin? 10.000 USD seems quite lot for 1 BTC but since bitcoin is virtual currency we can easily imagine that if there is 1000 times more bitcoin the price will be 10 USD. The correct way to look at bitcoins price is look at market capitalization (which is price times amount) which is just under 200 billion USD. Apple’s market cap is 790 billion USD, Google 660 billion USD, Microsoft 570 billion USD, Amazon.com 460 billion USD, ExxonMobile 350 billion USD, Bank of America 250 billion USD and Boeing 150 billion USD (source: https://markets.ft.com/data/dataarchive/ajax/fetchreport?reportCode=GMKT&documentKey=688_GMKT_170929).

This old picture from July shows you how quickly is bitcoin climbing and what is still ahead.

The closest thing we can compare bitcoin to is gold with its 8.2 trillion USD market cap. What are advantages and disadvantages of gold and bitcoin?

Gold

limited amount

limited amount

stable value

stable value

long time trust

long time trust

physical entity

physical entity

hard to divide

hard to divide

hard to transfer

hard to transfer

hard to store

hard to store

Bitcoin

limited amount

limited amount

easy to divide

easy to divide

easy to transfer

easy to transfer

decentralized

decentralized

easy to store

easy to store

still in development

still in development

volatile

volatile

unknown risk

unknown risk

big competition

big competition

limited amount of transactions

limited amount of transactions

We can see that bitcoin’s main disadvantages over gold is that it is relatively new technology with potential risks that were not discovered yet while it removes lot of shortages of gold. It is hard to see why should be gold more expensive than bitcoin. Only situation where I would prefer gold over bitcoin is post-apocalyptic society without internet and with zombies but short of that is bitcoin better technology. Main issue that holds bitcoin price down is mistrust of the public. Value of bitcoin is based on economical laws it uses and therefore it is much harder to see why it should cost that much. Also, there are lot of other cryptocurrencies with great properties which could overtake bitcoin’s leading role. Bitcoin average transaction fee is about 7 dollars which prevents it from massive application for smaller transactions.

Correct market capitalization should be somewhere close to gold which would give us growth of 40 times its current size. But it also means that future growth will be much slower than so far and 1 million USD for 1 BTC is unrealistic.

Is bitcoin a tulip?

Have you ever heard about a tulip mania? It refers to one of the biggest economic bubble in history. 1636 price of bulbs of tulips started to rise to extraordinary heights. At its peak, single tulip bulb cost about 10 times annual income of a craftworker. In February, next year the tulip bubble started to collapse. It was one of the first speculative mania and therefore people didn’t expect that rising prices could fall as quickly. Tulip also lacks important properties to be good store of value like durability or scarcity. It also lacks properties to be good payment system since it is not easily divisible and one tulip doesn’t necessarily have to be equal different one. Bitcoin has all these properties and much more. Bitcoin is no tulip and quick rise in price doesn’t mean it must be a bubble.

Caution

Bitcoin is still very young technology and with quick rise of price rises also risk. Don’t invest anything you cannot afford to lose. It could be 0 tomorrow and price will necessarily fluctuate and if you buy at a peak, it can take a while to recover even if it will rise in long term.

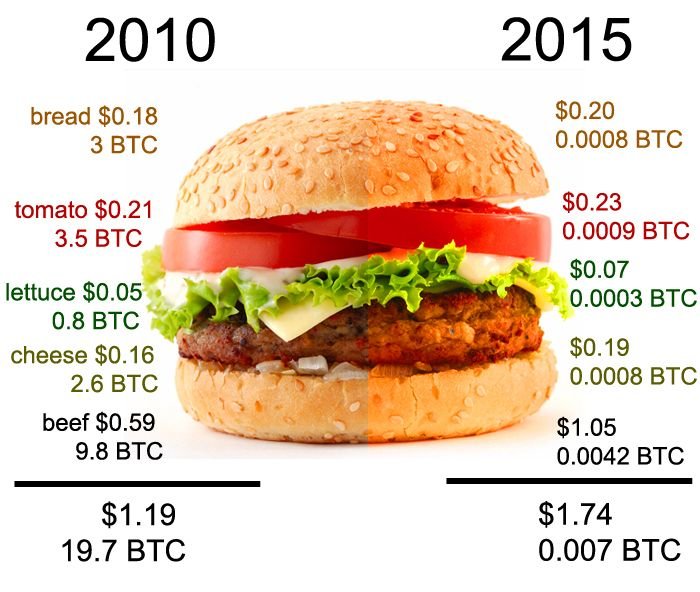

Bitcoin revolution

Bitcoin’s rapid rise is only part of the picture. Very important peace is fall of the dollar. Cheeseburger that cost 3.65 USD in 2010 cost 4.83 USD only 5 years later making it 32% increase. Prices of all ingredients changed differently but all were rising compared to USD. The price of dollar keeps falling because FED keeps printing new money, in 2016 the amount of USD rose by about 6%. The inflation is different for each product, last few years inflation in price of consumer goods was quite low while most of the inflation manifest itself in growth of stock market and it might play significant role in price of bitcoin. Low interest rates make traditional banking basically irrelevant for savings making only viable option stock market, gold which are too big to be easily moved and bitcoin which still small enough so that the price can be quickly changed by new demand.

| Cost of your burger in: | 2010 USD | 2010 bitcoin | 2015 USD | 2015 bitcoin |

|---|---|---|---|---|

| wheat bread | $0.18 | 3 BTC | $0.20 | 0,0008 BTC |

| tomato | $0.21 | 3,5 BTC | $0.23 | 0,0009 BTC |

| iceberg lettuce | $0.05 | 0,8 BTC | $0.07 | 0,0003 BTC |

| ground beef | $0.59 | 9,8 BTC | $1.05 | 0,0042 BTC |

| american cheese | $0.16 | 2,6 BTC | $0.19 | 0,0008 BTC |

| egg | $0.14 | 2,3 BTC | $0.18 | 0,0007 BTC |

| bacon | $0.26 | 4,3 BTC | $0.33 | 0,0013 BTC |

| cheddar cheese | $0.94 | 16 BTC | $1.07 | 0,0043 BTC |

| ground chuck | $0.73 | 12,2 BTC | $1.09 | 0,0044 BTC |

| butter | $0.39 | 6,5 BTC | $0.42 | 0,0017 BTC |

| TOTAL: | $3.65 | 60 BTC | $4.83 | 0,0193 BTC |

Source of prices: https://www.eater.com/2015/9/8/9232795/consumer-price-index-cpi-hamburger

@originalworks

The @OriginalWorks bot has determined this post by @petermail to be original material and upvoted(1.5%) it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!