Iran’s Crypto Announcement is 10x More Important Than the ETFs

Foreword

Recently, there was an article published by Forbes that detailed plans by some nations to start using cryptocurrencies in order to usurp the U.S. dollar so that they can increase their participation in global trade.

If successful, this could fundamentally change the international power structure and place blockchain technology at the center of an economic revolution.

Summarizing the Forbes Article

Here is the link to said article by Forbes:https://www.forbes.com/sites/yayafanusie/2018/08/15/blockchain-authoritarianism-the-regime-in-iran-goes-crypto/

Below, is a screenshot of the article:

The headline of the article, Blockchain Authoritarianism: The Regime in Iran Goes Crypto is a bit melodramatic, and admittedly, probably due to the conservative bias/tint in this publication, but we’ll ignore that for the time being.

Here are the main points that are made in this piece:

- Iran has recently announced that it plans to launch its own cryptocurrency: https://www.coindesk.com/iran-plans-national-cryptocurrency-as-new-us-sanctions-loom/ ; which is somewhat bullish, all things considered. However, the bias of Western media (as you see from the title of the Forbes article), has branded this to be an extreme negative despite the fact that there was an actual agreement between Iran and the United States, among other countries, just a few short weeks ago.

- The article mentions that this has been done in response to sanctions that the United States leveled against Iran, which is a fact.

- The article’s bias comes in full force via this statement here that, “Like with the regime in Venezuela, which tried to launch its own cryptocurrency earlier this year, this appears to be a desperate attempt by Tehran to defy Washington while trying to usurp the burgeoning growth of Bitcoin in Iran.” Desperate? Defy? When did the United States become the ultimate arbiters over what sovereign nations are allowed to do? And why is this move seen as something that is bad? We won’t delve too deep into politics here though (I’m lying, we will).

- The article then mentions that this move came after President Trump (of the United States) announced that they would be withdrawing from the Iran Nuclear deal (somehow, this is tacitly condoned despite the fact that reneging on an agreement in any other context would be frowned upon tremendously — not to mention the fact that it was heavily discouraged by American allies).

- The article then mentions that Iranian citizens have been looking to “prevent capital flight” via discouraging the use of the cryptocurrrency, bitcoin, by restricting access to foreign websites that presumably sell the cryptocurrency. This makes sense given the countries sensitive (and increasingly so) economic status on the international stage. Especially given its position in a politically volatile climate (i.e., the Middle East).

- The article mentions that Iran has been doing a substantial sum of academic research into the history, origin and underpinnings of blockchain technology.

- The academic research that Iran has been doing (and proof that they have been doing it) into cryptocurrency is cited here: https://financialtribune.com/articles/sci-tech/91002/tapping-blockchain-technology-iran-national-library-archives-to-go-online

- The article then states that, “ In early July, Iran’s official department for science and technology signed an agreement to work closely with the central bank on cryptocurrency technology.”

- “ Weeks later, Iran’s Information and Communications Technology ministry signed an MOU with Iran’s national library to use blockchain technology to digitize the country’s archives. Iran clearly is bullish on crypto/blockchain tech.”

- For some reason, the article then extrapolates the idea that Russia is somehow responsible for Iran’s most recent foray into cryptocurrency. The evidence cited for this is the fact that Iranian and Russian economic officials recently convened in Moscow. However, it is known that the two countries are ‘allies’ in the sense of “the enemy of my enemy [America] is my friend”.

- The article then goes on to state, “ Details on how the Iranian cryptocurrency would work are unclear except for officials saying the token will be backed by the rial and launched in three months, initially for use by domestic banks.” This is pretty big news that can’t be understated or undersold. The fact that this cryptocurrency is slated to launch in the imminent future means that the world may get its first glimpse at how a state-backed cryptocurrency will really look. Venezuela was a poor example because of their extraordinarily poor financial management. However, Iran has the natural resources (oil) and infrastructure necessary to potentially make this pilot a success.

- For some reason, the author of this Forbes article insists that pegging the cryptocurrency to the Rial [Iran’s native currency] (essentially creating a Rial-tether state run token), would be a futile effort because the Rial itself is “unattractive”. However, the Rial’s valuation has plummeting value in recent months is primarily due to the economic sanctions imposed by the United States. Thus, if Iran is able to create a structure that can allow them to potentially circumvent said sanctions, then this could actually improve the currency’s valuation, and subsequently, the economic situation in Iran. For some reason, this is a consideration and possibility that the author did not take into account…at all.

- The article then devolves into a tailspin of nauseating state propaganda (pretty much how it reads), with statements such as, “These authoritarian regimes are looking to build an alternative financial system where there will be no repercussions for funding corruption, oppression and other malfeasance. U.S. sanctions are not perfect, nor exhaustive, instruments of foreign policy, but they are important for enforcing global standards of accountability to check nuclear proliferation, human rights abuses and terrorism.”

Clarifying My Views on The Forbes Piece

If you have read this far, my comments may seem almost ‘anti-American’. However, this is not the case.

For those that do not know, I am an American. As such, I have a sworn allegiance to my country by default. If I didn’t, I would have defected. I support the United States as a country because I am its citizen.

However, I do not support the United States at the sake of other nations and I do not believe that the autonomy of other nations decreases the security of myself and others as American citizens. In addition, I am knowledgeable enough to know that the trope of, “America, the super hero is out fighting crime around the world by crushing oppressive communist/authoritarian regimes!” is a crock of shit, and anyone that’s over the age of 15 should have come to the same realization at this point.

The fact is that the United States engages itself in foreign affairs at its sole discretion based on where and how it thinks it can further its interests. This does not make the United States any better or worse than any other nation and, when evaluating international actors (i.e., countries/nations around the world), they are all ruthlessly self-interested and if you give them an inch, they’ll take a mile.

This is evidenced by the fact that multiple treaties, nuclear proliferation contracts, etc., are needed just to stop the international stage from devolving into perpetual World Wars.

Imperialism will never die.

But, that’s all I want to say about that, because this isn’t a political science article. So, let’s address the primary issue at hand being discussed in this Forbes article, which is the potential increased adoption of cryptocurrency as a form of usurping government regulations.

Why Would Cryptocurrency Need to be Used to Avoid Sanctions?

This is a logical question for anyone to ask that’s not quite familiar with how international trade works.

However, in order to answer that question, we need to take a small trip down memory lane.

Recounting History

This all starts with the ‘gold standard’ that was adopted by the United States (on a world stage) in 1944 via the Bretton Woods system.

More or less, this was a coordinated decision between the United States and other European nations (allies) following World War II to adopt a ‘central’ sort of currency, or one that would be distributed to other countries that was pegged to gold.

Given America’s economic strength at that period of time, those at the conference decided that the United States would be the best option moving forward.

Thus, it came to pass that France decided that they would ‘come to collect’ on their debt by trading in the dollars they had been given for some of the United States’ gold reserves.

This action triggered a wave of several of other nations looking to do the same. Eventually, the United States began to realize that its vast gold store was rapidly depleting. This then triggered the U.S.’s decision to abandon the gold standard entirely in 1971.

Almost simultaneously, the United States had reached out to oil-rich nations, such as Saudi Arabia, in order to ink a deal where Saudi Arabia would promise to price their oil in dollars (exclusively) in exchange for regular disbursements for weapons, military, infrastructural upgrades, etc.

The United States inked this deal with other countries, but there is a conflicting and twisting history with some of those other OPEC nations.

The major point is that the United States did so because they knew that this would allow the dollar to retain its dominance on the international stage. The reason why the dollar would retain dominance is because, if all the major oil suppliers only accept dollars for oil, then countries must stock up on a supply of dollars in order to receive said oil.

This is the case because oil is the foundation of modern industry and is involved in just about every product that we make on planet earth (in some way, shape or form).

United States’ Debt Soars

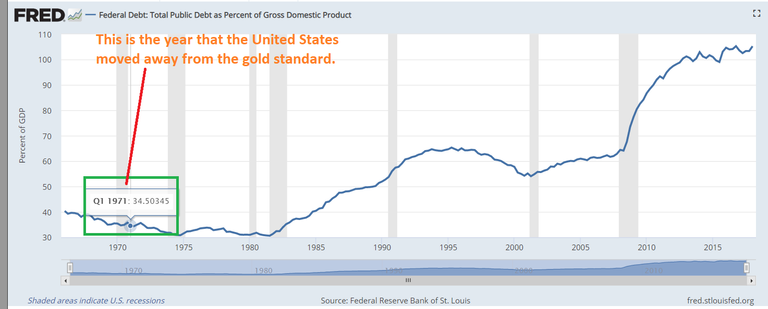

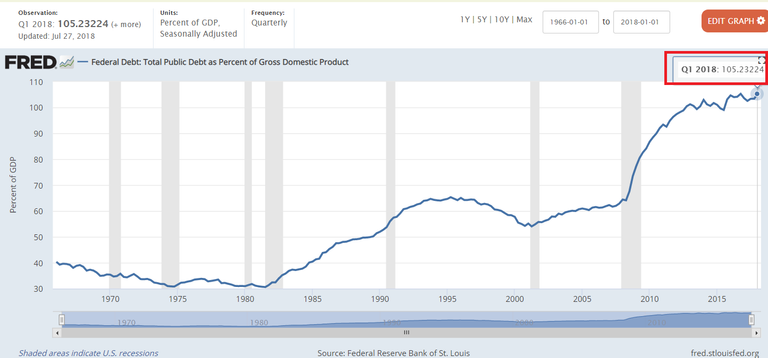

As you can see from the chart posted above, the debt financing of the United States (as a nation) shot straight through the roof.

In fact, at this point in time, it currently exceeds the total GDP of the nation.

This can be seen in the graph above, because the number that is displayed is the ‘Total Public Debt as Percent of Gross Domestic Product [GDP]’

"What’s the Point? I Thought We Were Discussing Crypto"

We are.

The main point here is that, once the U.S. government moved from the golden standard, but then inked out these agreements with various OPEC nations (Iran isn’t one of them; surprise, surprise) — the U.S. essentially had a get out of jail free pass to loan out as many dollars as they wanted to. And, of course, since the dollar was no longer backed by the golden standard (and still isn’t), nations have no other way to “collect” on this debt other than to…(you guessed it), receive more dollars.

This is probably the scheme that libertarians are referring to when they say that there is nothing underpinning fiat currencies. However, we won’t litigate that issue here in this article.

The main point that should be taken from this section is that the dollar dominance has not only helped America, it has also allowed the nation to hurt its enemies via economic sanctions.

Since the dollar is so prevalent and powerful on the international trade stage, countries that have had sanctions imposed upon them (i.e., Venezuela, North Korea, Russia, Iran, etc.) are essentially locked out of international trade to a major extent (contingent upon the severity of said sanctions). Therefore, many nations must either bend to the whim of the United States or get rocked with sanctions.

So, when you hear the word ‘sanctions’ on television or the news, understand that they are powerful despite the fact that they seem to be overused (they are), and increasingly less effective the more that they are imposed (this is also true).

Moving onward —

U.S.-Iran Relations

For some reason, this isn’t oft-spoke about in political discourse, but what kicked off the tensions/negative energy/bad blood between the United States and Iran was the military coup that the United States essentially orchestrated in the 50’s against Iran’s democratically elected leader at that time.

This was actually detailed by the United States itself via the CIA (Central Intelligence Agency; spy agency) in documents that it released in 2017.

The event in which the Iranian leader was overthrown, is known as the 1953 Iranian coup d’etat.

An article in ForeignPolicy magazine summarizes the core purpose (in accordance with what was released into public record by the CIA itself) of U.S. involvement/orchestration of the coup.

In the article it states,

“Known as Operation Ajax, the CIA plot was ultimately about oil. Western firms had for decades controlled the region’s oil wealth, whether Arabian-American Oil Company in Saudi Arabia, or the Anglo-Iranian Oil Company in Iran. When the U.S. firm in Saudi Arabia bowed to pressure in late 1950 and agreed to share oil revenues evenly with Riyadh, the British concession in Iran came under intense pressure to follow suit. But London adamantly refused.

So in early 1951, amid great popular acclaim, Mossadegh nationalized Iran’s oil industry. A fuming United Kingdom began conspiring with U.S. intelligence services to overthrow Mossadegh and restore the monarchy under the shah. (Though some in the U.S. State Department, the newly released cables show, blamed British intransigence for the tensions and sought to work with Mossadegh.)”

In essence, this is what essentially precipitated a series of events that ended up politically destabilizing several nations in the Middle East and eventually leading to the recent advent of the ‘Arab Spring’.

However, this should not come as a surprise to anyone that understands how politics and international affairs work, because the removal of a leader (especially by a foreign influence), often creates a vacuum in which chaos, terrorism, and other ills may prosper.

Unfortunately, this is just what happened in Iran.

Fast Forward to the Present

So, let’s fast forward to today.

Given the history between the two nations, it should be more than obvious why the tensions between the United States and Iran are at an all-time high.

Iranian citizens understand the United States was behind the overthrow of their democratically elected leader in 1953 and that this precipitated a series of events that essentially derailed the country from reaching its true potential (among several other neighboring nations).

Given this fact, it makes sense that Iran would be apprehensive about any potential relationship/collaboration with the United States.

However, somehow, this barrier was lowered and an agreement was struck between the two nations (among others) for the alleged sake of nuclear proliferation.

However, when analyzing the series of events that precipitated the U.S.’s departure from the Iran Nuclear Deal, there is a credible alternative theory to the one given by President Trump for his abandonment, even against the behest of allies.

The logic given by the president for reneging on this deal (with a timing that seems somewhat arbitrary) can be found here:

Read the Full Transcript of Trump's Speech on the Iran Nuclear Deal

_WASHINGTON - President Trump announced on Tuesday that the United States will withdraw from the Iran nuclear deal and…_www.nytimes.com

Here is a quote of the essential reason that was given by the president,

The New York Times also reported that,

“The Europeans had already agreed to a significant compromise: to reimpose sanctions if there were a determination that the Iranians were within 12 months of producing a nuclear weapon. But officials said that still did not satisfy Mr. Trump, and the Europeans were not willing to go any further.

By Monday, the White House began informing allies that Mr. Trump was going to withdraw from the deal and reimpose sanctions on oil and impose new sanctions against the Central Bank of Iran.”

The Potential Real Reason for the Re-imposition of Sanctions

What makes the timing of the United States’ self-removal from the Iranian deal intersting is that it came less than a month after Iran had announced that it was making the decision to, “Start reporting foreign currency amounts in euros rather than U.S. dollars.”

Reuters and other news outlets had reported this around April 18th, 2018, which is less than three weeks from the time that the United States had pulled out of the Iranian deal.

This is Why the State-Backed Cryptocurrency is a Major Deal

If Iran is somehow successful in this state-backed cryptocurrency and is able to usurp U.S. sanctions imposed upon them, then this would essentially revolutionize global economics.

It doesn’t take a rocket science to put two and two together and see that the major significance here is the fact that cryptocurrency would essentially be at the center of an unprecedented economic revolt in the timeline of human history.

Conclusion

While the vast majority of this article did not even mention cryptocurrency,it brought up a number of points that should make the implications of this announcement immediately obvious.

This is something that the entire community should be watching with keen eyes.

Right step for this country - Right step for any country!

Nice work man, I hope everybody could undestrand the importance of this.

When all the people will know that standard fiat, based on debt and USD-centric system could be defeated for a free and equal global currencies we could say that satoshi has reached is goal, in my opinion

Intersting! Resteemed

Resteemed

Wow, you're a rare breed @proofofresearch : an utterly aware and critically thinking American. Be blessed on your journey brother, your country needs more of you breed...quite desperately. Following you, with pleasure.