After failing to stop the increasing popularity of cryptocurrencies through their warnings, central banks have placed anti-crypto campaigns down for funds. This step will reduce confidence among central banks and encourage new investors to enter the crypto world.

At the same time, the Venezuelan government is planning to introduce a new cryptrocortage, called Petro. Each new coin will roughly support a barrel of oil. However, there is a big question on the credibility of the central bank, which is issuing petrochemicals. Analysts believe that Petro did not bring the expected results.

On the other hand, Bitcoin continues to attract big ticket investments. After the recent fall, there is news of a trader who has bought about 400 million US dollars of Bitcoin from February 09 to February 12.

People are slowly making positive again on Vitcoine. Robert Hargevek of Shark Tank believes that Bitcoin will be in the short term in the period of approximately 20,000 dollars in the highest period of mid-2017.

Let's see what the chart pattern predicts?

BTC / USD

Traders who follow us are taking a long position starting on February 15. We recommended 50 percent profit booking in 50-day SMA, and should be sold to most traders, when Bitcoin sold at a high interval of $ 11,348.99, yesterday, February 19.

We also recommended the remaining position with a suitable stop loss. As every trader has a different business strategy, we have not provided any special follow-up loss.

The BTC / USD pair is doing business inside an ascending channel. Until it trades over the channel's support line, it can reach the level of $ 12,000.

In the case of decline, the ascending channel and the 20-day EMA support line will work as a strong support. If these two levels are broken, then the price can fall to $ 8,400, therefore, traders who are still left with 50% posts should keep the stop lodge at $ 9,800.

We did not recommend shutting down the whole situation because once it remained above the descending channel, the bitcoin will become positive.

ETH / USD

Atrem, bringing the closer to the 50-day SMA yesterday, to reach a high level of about $ 97 for our target target of February 18, $ 1,000. It is expected that the merchants will book profits on 50% positions.

For the past four days, the ETH / USD pair is taking support at $ 900. Therefore, we recommend increasing the stop loss from the remaining position of $ 775 to $ 900. The goal objective is a step to the resistance line of the descending channel.

If bulls are able to break out of the channel, then there is a possibility of a $ 1,200 move. On the other hand, if the bear falls below $ 900, then the level of $ 780 can fall.

BCH / USD

Our goal objective on Beet Cone Cash was a 50-day SMA, $ 1800 dollar rally, however, yesterday, February, 188, it decreased from $ 1,639.251 level.

Our initial stop loss was kept at $ 1,100, we want to increase this stop lodge to $ 1,400, because if most of the cryptooconcans go down from their resides, then BCH / USD can follow the pair suit.

So do not lose money on it.

At the top, please book partial profits above $ 1,750 and keep the rest with a last stop loss for the purpose of $ 2,000.

XRP / USD

Contrary to our expectation, the wave continues to trade in a tight range. He has not taken part in the pullback like the other top cryptoconucleans, the only consolation is that it has remained above the 20-day EMA for the past four days.

We suggested the initial stop loss of $ 0.86, but we should increase this stop because if the top currencies are closed, then the XRP / USD pair will also decrease rapidly. Please stop the full position to $ 0.95

If the tight range solves upwards, please book profits at 50 percent position for $ 1.45. Mark the remaining position for the second goal objective of $ 1.74

XLM / USD

Stellar has also been trapped in a tight border for the past four days. It is trading close to our recommended levels of $ 0.45

We look forward to reaching the upper end of the border at $ 0.63. But for this, the XLM / USDPair will have to break out of the 50-day SMA.

On the negative side, supports 20-day EMA, horizontal line in $ 0.41, and $ 0.38 on the channel line.

For now, please maintain a stop loss of $ 0.30 (according to UTC) on daily closing basis. We should consider increasing it in a few days

LTC / USD

In our previous analysis, we had recommended bookings of 50 percent of the profits at $ 240, and Lightkone reached a high interval of $ 9.95 on February 16. We expect merchants to sell half their positions set at $ 180.

For the past four days, the LTC / USD pair is trading between $ 208 and $ 240. A breakout of this category will be a positive move, and we look forward to a rally for $ 270 and then $ 307.

Our stop loss is currently in Breckeven, we want to reduce our risk and want to pocket some paper benefits. That's why we should stop the remaining 50 percent of the long positions to $ 200.

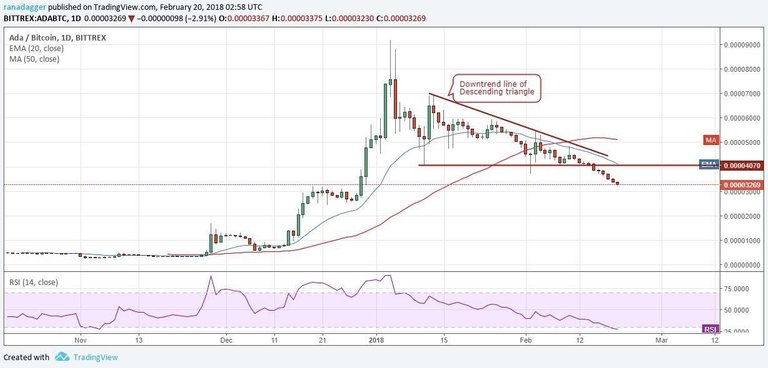

ADA/ BTC

We were due to the recession on Cardano for the past few days because it is broken down by recessive descending triangle pattern of recession. Although a pullback is possible at the breakdown level of 0.00004070, cryptocarjensis remains negative, as long as it is below the downtrend line of the descending triangle.

The ADA / BTC pair is expected to reach the next support level of 0.0000246. If digital currency breaks down from the downtrend line, then our recession will be invalid, because the failure of the recession patterns is a sign of the speed.

NEO / USD

As the NEO is trading inside the descending triangle pattern, we recommended quick business with a long time in $ 121, and a goal objective of a rally for the downtraded line of descending triangle pattern.

The NEO / USD pair reached our target objective on February 17, which reached $ 138.35, where traders had to close their position.

An attempt by the bear to siege the cryptrocessor failed on 18 February. It is currently trying to exit the downtraded line of the descending triangle, which will cancel the recession pattern. If bulls maintain breakouts, then we can see a rally at $ 169

On the negative side, the moving average and horizontal line can work as strong support at $ 120.33

EOS / USD

Expectedly, EOS came out of the downtraded line on February 18. The 20-day EMA is $ 9.76 and the 50-day SMA is $ 10.8.

We believe that the price of bulls will face stiff resistance between $ 9.77 and $ 10.8. Therefore, if the pair of EUS / US Dollar maintains a level of up to four hours, then traders can start a longer than $ 11 position. The goal of the goal above is a rally at the level of $ 15

Stop losses can be kept at $ 8.8.

please follow and upvote

digital currency awareness is increasing and people are investing money into it too, thanks for awareness

Hi, great post, have followed you. What do you think of the current state of the Bitcoin market?

Wooow great information about digital currency

nice post

This post has received a 0.04 % upvote from @speedvoter thanks to: @ramkishun.