Can bitcoin and ethereum challenge the traditional world of fiat currencies?

THEIR price may be volatile, they may be used by a few rogue elements and lack traceability, yet cryptocurrencies such as bitcoin are all the rage now.

Going by some reports, there are more than 900 cryptocurrencies based on blockchain technology today, but the market is led by the main ones such as bitcoin and ethereum.

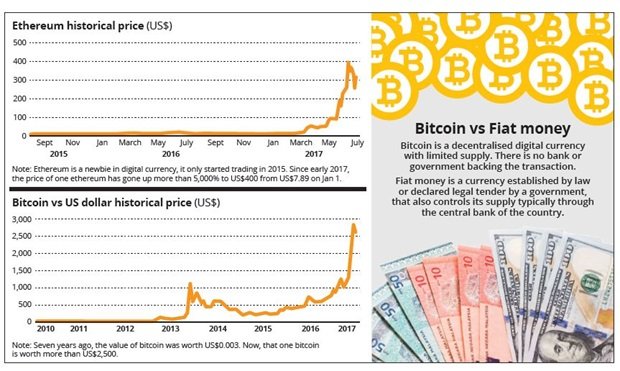

Bitcoin has risen by some 771% over the last three years to hit an all-time high of US$2,871 recently. Notably, it started seven years ago at a value of almost nothing. Newcomer ethereum has seen its price spike by more than 5,000% year-to-date.

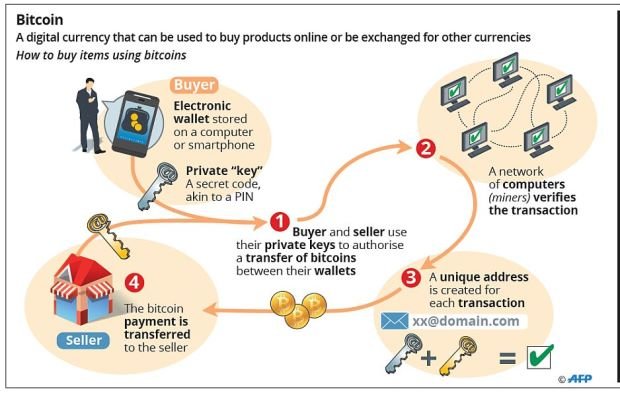

The interest of many Malaysians has been piqued, wondering if they should jump on the bandwagon. The talk is that there are a few Malaysians who have become bitcoin millionaires, as they had invested in them early. Some are bitcoin miners, a process of verifying transactions in the system, which pays in bitcoins.

But cryptocurrencies lie largely in a grey area of the law. Their actual usage is limited. So, why are people rushing to buy them?

“It is mostly (buying on) speculation and to some extent a hedging mechanism,” says an investor.

A much-written phrase on the Internet today is this: “If you bought US$5 of bitcoin seven years ago, you’d be US$4.4mil richer”. A single bitcoin was then worth a quarter-of-a-US cent.

Investors can buy these currencies through exchanges spread across the globe, including some in Malaysia.

One such exchange is called Luno, which describes itself as a global company with a local presence. On its website, it says you can buy bitcoins by transferring money into its Maybank or CIMB accounts. It provides a price list of its bitcoins and charges a fee to buy and sell bitcoins via its exchange.

Another is CoinHako, a Singapore-based cryptocurrency exchange that allows the trading of bitcoin and ethereum.

Its CEO and co-founder Yusho Liu says it started the exchange three years ago, after discovering that there was no easy way to trade in these currencies in this part of the world. Malaysian users can use the ringgit to purchase these cryptocurrencies on this exchange. CoinHako charges a fee of 0.9% for every transaction and RM2 for every withdrawal into ringgit or Singapore dollars, which will take two days to process. However, CoinHako places a trading limit of RM30,000 per user per day.

Liu says there are more than 10,000 Malaysian users of his exchange to date.

The app also allows users to use their bitcoins stored in the CoinHako wallet to buy goods and services in outlets where they are accepted.

Given that there are not that many outlets that accept bitcoins, Liu points out that a cafe called Jeq In The House in Section 17, Petaling Jaya, accepts bitcoins. The legality of these exchanges, though, is not clear.

In Malaysia, the trading of bitcoins and other cryptocurrencies remains largely an unregulated activity.

On Jan 2, 2014, Bank Negara issued this statement: “The bitcoin is not recognised as legal tender in Malaysia. The central bank does not regulate the operations of bitcoin.

“The public is therefore advised to be cautious of the risks associated with the usage of such digital currency.”

It has not issued further statements on the matter. This essentially means that Malaysians buying and selling bitcoins are doing so at their own peril. They have no claim against the authorities if the value of their bitcoins one day plummets, or the exchange in which they store their cryptocurrencies is shut down or gets hacked.Most countries have yet to determine the legality of bitcoin.

The philosophy behind cryptocurrencies

So, are bitcoins and cryptocurrencies a huge threat to traditional finance? To be sure, while a lot has been written about this digital currency, they still do not make up a huge amount of value. Bitcoin, the biggest of them, has a total market capitalisation of a mere US$42.3bil (RM181bil). In comparison, the market capitalisation of Malayan Banking Bhd alone is RM101bil, while Apple Inc’s market value is almost 18 times bigger than bitcoin’s at US$749bil.

There are some notable peculiarities about cryptocurrencies and the technology of blockchain that enables them.

For one, its creator and participants love the idea that this is a currency (if you can even call it that) that is solely based on the principles of supply and demand, minus the involvement of any central governing authority.

A second key aspect is that it is a secure set-up, the blockchain technology not only being immutable but also close to impossible to be hacked.

“My bet is that bitcoin is here to stay. It has been about eight years now, and no one has been able to hack it and no governing body has been able to shut it down,” quips one ethereum investor who spoke on the condition of anonymity.

Still, there is frenzied growth in cryptocurrencies. The total market capitalisation of cryptocurrencies now stands at around US$100bil and bitcoin’s market share has slipped down to around 40%.

Initial coin offerings (ICO) or new issuances of cryptocurrencies are spiking up, unnerving regulators.

This year alone, some 65 ICOs have raised US$500mil. There is at least one surfacing from Malaysia.

Some observers are beginning to draw parallels between the concept of ICOs and the many unauthorised investment schemes that have sprouted up in Malaysia which have been red-flagged by the central bank this year such as JJ Global Network, JJ Poor To Rich, JJPTR and MBI International Sdn Bhd.

But while some of these schemes had issued digital currencies, none of them operated on blockchain technology and thus cannot be said to be in the same category, cryptocurrency enthusiasts argue, adding that any digital currency not running on blockchain is open to manipulation by the issuers.

It has been reported that the US Securities and Exchange Commission is taking a hard look at the use of ICOs and how they might be a tool to circumvent securities laws.

Another troubling aspect of bitcoin is the increased reported usage of this currency by rogue elements. This is due to the anonymity element in its usage.

For example, the recent ransomware crisis impacting parts of the world saw its perpetrators demanding ransom in bitcoin. Other reports indicate payments for illegal goods and services that take place in the “dark web”.

The dark web is described as a part of the Internet only accessible through special software that allows users to remain anonymous and untraceable. It is also a place where a plethora of illegal transactions take place, such as the buying and selling of drugs.

“Anyone can use bitcoins, for good and for bad,” notes one investor, adding, however, that “so it is with other currencies such as your ringgit and US dollar”.

The difference then is the fact that illegal usage of a certain country’s currency enables that country’s authorities to take action. But no one presides over bitcoins and cryptocurrencies.

Another concern is the lack of anti-money laundering (AML) and know-your-customer (KYC) application in the buying and selling of bitcoins.

It is understood that a number of exchanges trading in bitcoins do try to implement this in their systems, but there is no standardisation of this and no central authority overlooking it.

Another concern is the unreported outflow of money. For example, a Malaysian buyer of bitcoins could cash out his bitcoins in an overseas exchange, and do so likely at a much higher value.

Bitcoin transactions are also tax-free at the moment, at least in Malaysia, considering that the authorities do not deem it a currency or an asset.

But some authorities are beginning to legitimise the use of bitcoin. Japan, for example, has recognised the cryptocurrency as a payment method, while the Philippines is recognising bitcoin exchanges as remittance companies.

Still, investing in the highly-priced bitcoin today takes some nerve. But consider this: an analyst called Kay Van-Petersen of Saxo Bank is now forecasting that the price of bitcoin could touch US$100,000 apiece in 10 years’ time.

It may seem outrageous, but Van-Petersen had in late 2016 (when the price of bitcoin was at the US$750 range) correctly predicted that the price would surpass US$2,000 in 2017.

The high price of bitcoin isn’t dissuading some investors. Ben Jern, a former radio DJ, has been actively investing in bitcoin and bought RM5,000 worth of the cryptocurrency when it was priced at around US$400 last year.

He sees investing in bitcoin as investing in technology. “I am making a bet that this technology will be widely used in the future. So, I’m not griping about its value and neither am I selling my bitcoins at these prices.”

Related story: