Cryptocurrency investors understand how much the market discounts good news and plays out to the sentiment of traders and other market participants. Ignorance of fundamentals and focus on sentiment is not something limited to Bitcoin. In fact, it was always there in financial markets. The problem is that people refuse to understand the underlying psychology and behavioral patterns that drove markets. Overlooking the several orders of thinking we go through as humans are the biggest flaw of any market analyst. While humans go through various orders of thinking, not everyone is able to identify it and use this to their advantage.

By fundamentals, I’m talking about the performance of an asset, be it a stock, commodity, real estate, cryptocurrency, or any other investable asset. For a stock, it’s the financials and for commodities and real estate its supply and demand. For cryptocurrencies, it’s a wide range of new concepts as it’s a completely new asset class.

Behavioural Analysis of Fundamentals

Wall Street consensus says NVIDIA has underperformed. Drop in revenues growth, margin contraction, and forecasting volume decline of graphic cards sold for mining rigs are a few fundamental concerns analysts have pointed out for the company. There is a solid argument backed by this evidence, so where exactly does the concept of market behavior enter? After seeing a decline in the sale of NVIDIA cards owing to Crypto Winter, the fundamentals play out like a story. We believe in the story that volume will decline and profit margins will contract further. We believe in the story that this will play out and it was so widely circulated it turned into reality with NVIDIA declining 45.5% as of today (peaked at 57%).

This could’ve played out another way. If they wanted to, Wall Street analysts could’ve decided to push a narrative that with crypto prices so cheap, miners will want to accumulate more Bitcoin, so they’ll buy more graphic cards to power up their rig or even increase the efficiency of their rigs by replacing worn out cards. This definitely seems like a long shot, but it could’ve happened.

If you aren’t convinced of the role behavior plays yet, let’s take a situation that actually occurred. In August 2018, CEO and Chairman of Tesla Motors, Elon Musk, tweeted “Am considering taking Tesla private at $420”. This is not a key fundamental factor, yet it still drove the price of Tesla stock from $344 to $387 (12.3%) in a single day. During the time the SEC investigation was happening and they had decided to fine Musk, Tesla shares declined by 20.7%.

Now you could argue that this was a corporate governance concern and it contributes to the fundamentals. You would also happen to be absolutely correct. But what you shouldn’t discount is that this kind of immediate action following a tweet isn’t something that was factored into a valuation metric. While an analyst, later on, could factor this in, the market itself reacted to the news and immediately took action. So could this be a valuation anomaly that was set correctly or a market acting on its emotion and instinct when something impromptu happened?

Was Apple announcing they will not reveal unit sales a fundamental or valuation concern? What was the fundamental reason for Amazon dipping 35% before it finally recovered?

When you break into orders of thinking and really look deep into valuation and fundamental analysis, you can see it’s merely a behavior driver i.e. it puts your sentiment in a particular direction and you make decisions based on that. Hypothetically, if a company was about to see its worst quarterly results in a decade, and Wall Street analysts for some reason were not able to foresee this happening and were expecting regular growth to continue, they would issue a ‘buy’ or ‘accumulate & hold’ call for it. They start to all add a bit more to their portfolio and retail investors see bullish media coverage, so they buy in too. All of this buying pressure moves price into the green. Once the price is in the green, the FOMO investors jump in and start to accumulate. Then when the actual tragedy hits and they all realize there was a detail they overlooked and the company is actually going downhill, it is too late. So if fundamental were the real driver, the stock would’ve fallen anyway. But since fundamentals are just another driver of behavior, the stock price followed the narrative the analysts created for it. This shows fundamentals are drivers of price, but only because they indirectly influence behavior.

The Crypto Factor

It’s no surprise that cryptocurrency markets are not immune to sentiment, in fact, they’re more sentiment driven than stocks or commodities. With a company, you have so much financial information and future expansion plans to evaluate. With cryptocurrency, fundamentals are news coverage (hacks, announcements, airdrops, etc), usage, development progress, and spreading awareness.

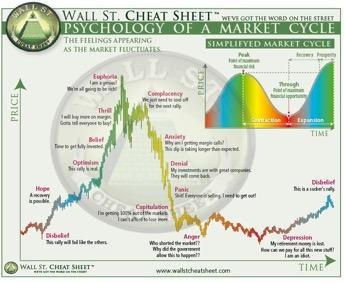

The most intriguing thing with the current cryptocurrency market is that sentiment and price continue to drop lower despite fundamentals getting stronger every day. Network fees are reducing, there are more and more legitimate projects, the weak projects are being dumped and phased out, awareness is growing, and security is improving. All of these are positives from a fundamental viewpoint, but Bitcoin continues to make lower highs and lower lows. This is the bubble effect from the famous ‘Psychology of a Market Cycle’ chart.

The crypto market is currently in the ‘anger’ phase, where the majority have lost confidence and sold their holdings at a great loss fearing their investment would soon be worth nothing. Two points worth noting are that the Bitcoin/Ethereum chart look similar but have a longer capitulation phase and even in the anger stage, it isn’t the complete bottom yet.

The real question is why are fundamentals growing stronger, yet Bitcoin price continues to decline? The sole answer to this is market behavior and manipulation. The reason fundamentals push stocks higher is because it creates a story that can be sold and accepted under the narrative of ‘logic’. It’s ‘logical’ to buy a stock when the company’s revenue is growing, profit margins are expanding, and debt is reducing. It’s logical to buy real estate when prices are starting to pick up and supply is contracting in comparison to demand. But when is it ‘logical’ to buy Bitcoin?

There’s the argument that it’s only of late that the fundamentals are really strengthening, Bitcoin is gearing up for its next leg upward. But let’s be honest, fundamentals we’re developing day in, day out, when the bubble was being created and when it was bursting. But it was the panic and emotion of seeing 10-20% daily moves that made people enter and exit the market. Certain events like airdrops, partnership announcements, and hacks have had a proven impact on prices. But despite building long term value and having continuous development, Bitcoin has only fallen lower in the last 1 year. All of this further builds into the point that value and fundamentals are both driven by behavior.

The ‘Psycle’ of Markets – Conclusion

When people analyze markets, more often than less, they discount the role crowd psychology and sentiment plays. They indulge in many methods of behavioral analysis without even realizing so. By taking a step back from technical data and looking at the intrinsic nature of markets, you can revolutionize your perspective when it comes to understanding why the price is doing what it is. Technical analysis is in some way a behavioral study as it tracks historical price movement and finds patterns to ascertain how investors reacted at certain price levels. Leaving the technical part aside, sentiment analyses are probably the most effective gauge of market movement. In the age of social media, use the unfathomable amount of sentiment data provided by real life humans to develop a perspective on how participants are viewing current market conditions and what decisions they’re taking.

Behavior is an incredibly tricky concept to get correct, but it is the real fundamental way to analyze markets and see the different perspectives that exist with various participants.

AB

ReverseAcid Monthly Recap

- ReverseAcid Monthly Recap - November 2018 (Vol 1)

- ReverseAcid Monthly Recap - December 2018 (Vol 2)

- ReverseAcid Monthly Recap - January 2019 (Vol 3)

Crypto Analysis Series

- Part 1 - Basic Attention Token and How It's Revolutionizing the Internet

- Part 2 - Golem Network Token as a Potential Giant Killer

- Part 3 - Augur and the Future of Decentralized Predictions Markets

- Part 4 - Dogecoin - Such Meme, Much Value

- Part 5 - Zilliqa

- Part 6 - IOTA

Previous posts:

- Ujo as a Platform for Music Revamping - An Innovation Review

- Transforming Real Estate Investment on the Blockchain

- Determining the Role of Clearing and Settlement Houses

- Crypto Analysis Series - Part 6: IOTA

- The Stablecoin Ecosystem and It’s Importance to Digital Payments

- Looking Back at the Ethereum Hard Fork Timeline - A Precursor to Constantinople

- Gold Making A Rebound

- Blockchain Patents Race

- XRP-USD Chart Breakdown: Daily Timeframe

- Governmental Incentives for Implementing Distributed Databases

About Reverse Acid

Be a part of our Discord community to engage in related topic conversation.

Follow our Instagram and Twitter page for timely market updates

Interesting article.

Will read the entire masterpiece lauter.

But now... resteem

Posted using Partiko Android

Feedback is very much appreciated. Thanks for the resteem @chappertron !

No trouble ;-)

Interesting post. Upvoted and followed.

Much appreciated @zuerich !

Congratulations @reverseacid! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness and get one more award and increased upvotes!

Thank you for using Resteem & Voting Bot @allaz Your post will be min. 10+ resteemed with over 13000+ followers & min. 25+ Upvote Different account (5000+ Steem Power).

Very interesting, thanks!

Posted using Partiko Android

Glad you liked it @luegenbaron !