A lot has been said and written about the Bitcoin Halving event, which took place early this week. Most people argue that it is positive for the price, but I have always been lacking true fundamental arguments, why this is the case and which impact exactly it could have.

The Stock-to-Flow model is often used to argue why the halving has a strongly positive effect on the pricing of Bitcoin - but while I believe in the general argument that scarcity has the potential to drive value - I think that the derivative of a concrete value forecast is simply not feasible.

Therefore, I have though about an alternative model, which tries to build on conventional economic theory:

Supply, Demand and the Market Clearing Price

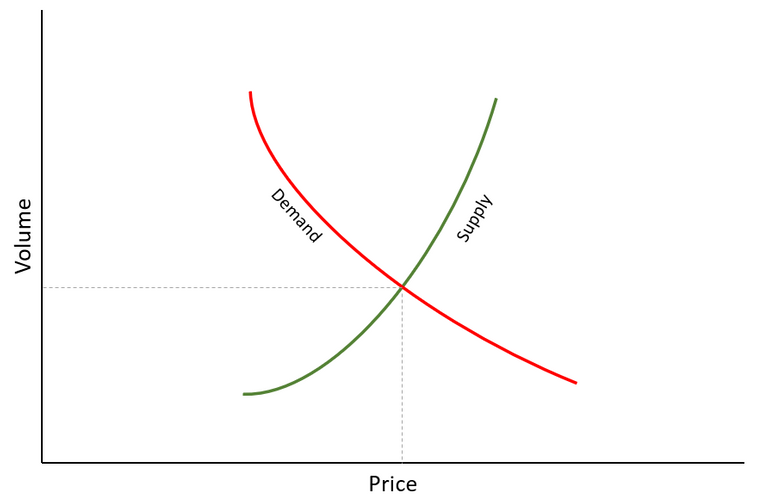

Let's start with the classical supply and demand model, which was first described by Antoine-Augustin Cournot (1801-1877) and later made popular by the British economist Alfred Marshall (1842-1924).

The theory states that the supply of any given goods and services will increase with a rising price. For produced goods this is mainly related to the expected return a producer will generate on producing the goods, which results in an increased volume being offered. For securities and cryptocurrencies the argument is that more people will be willing to sell their holding when the price increases.

For the demand side, the opposite is true. With a falling price, demand tends to increase. This is due to the fact that for consumers, goods become more attractive relative to others at a lower price. Demand for securities and cryptocurrencies on the other hand increases as more investors consider the price as attractive when the price falls and are thus willing to buy.

According to this theory, the price for goods and services should be the one, which brings supply and demand into equilibrium. This is what economists call the market clearing price.

What impact does the Halving have on Supply and Demand

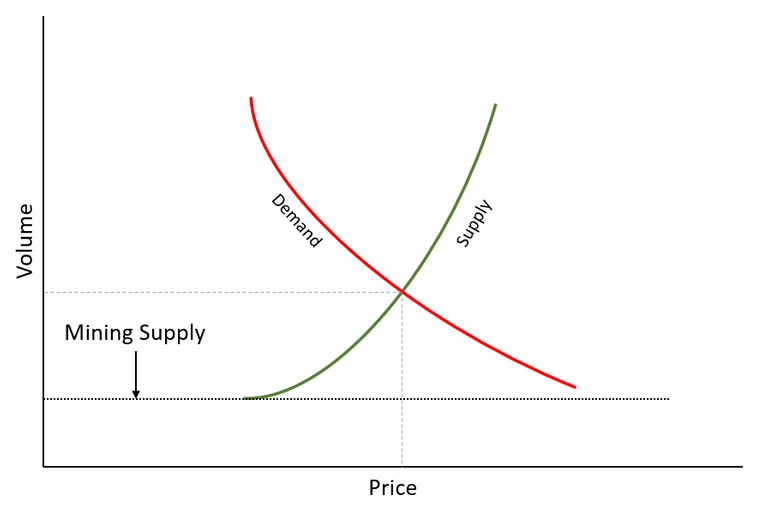

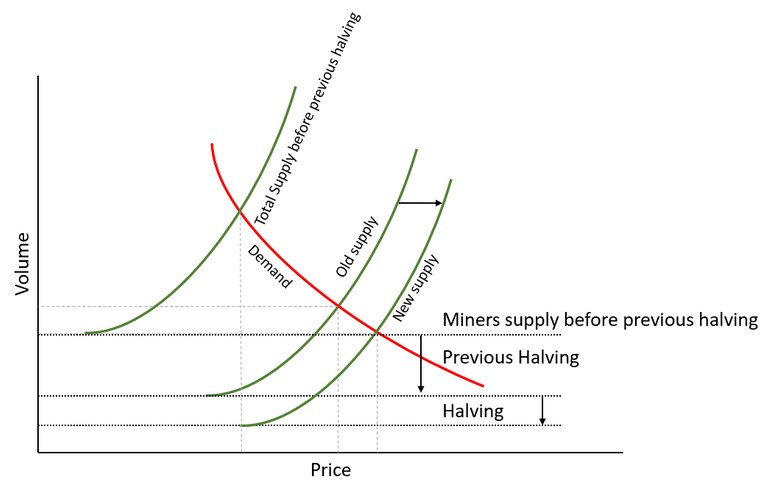

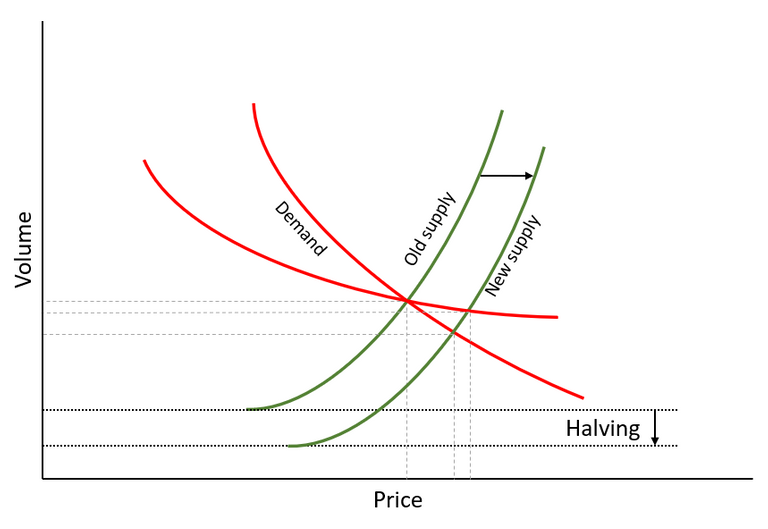

Most miners will likely be short term oriented businesses, which are targeting to make a profit in FIAT currency instead of HODLing what they mine. The vast majority of the mined coins is thus likely being being sold - no matter what the current price is. This supply is thus what is called inelastic. In the diagram, the price elasticity of supply and demand can be seen by observing the steepness of the curve. The steeper the curve, the more elastic supply or demand react to price changes.

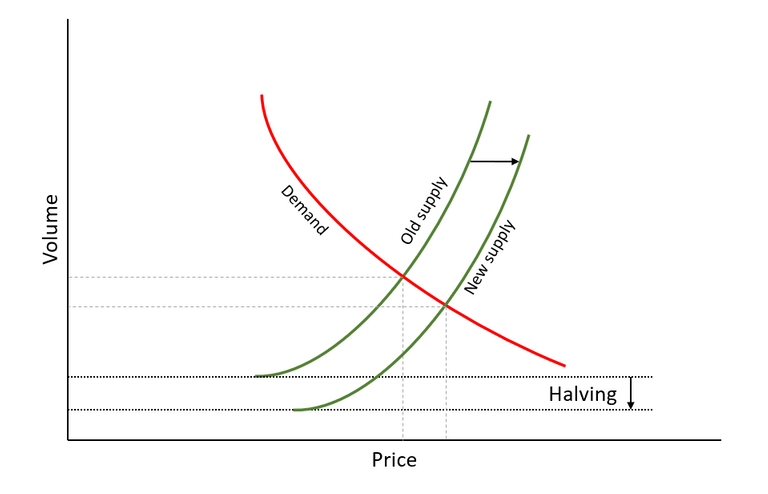

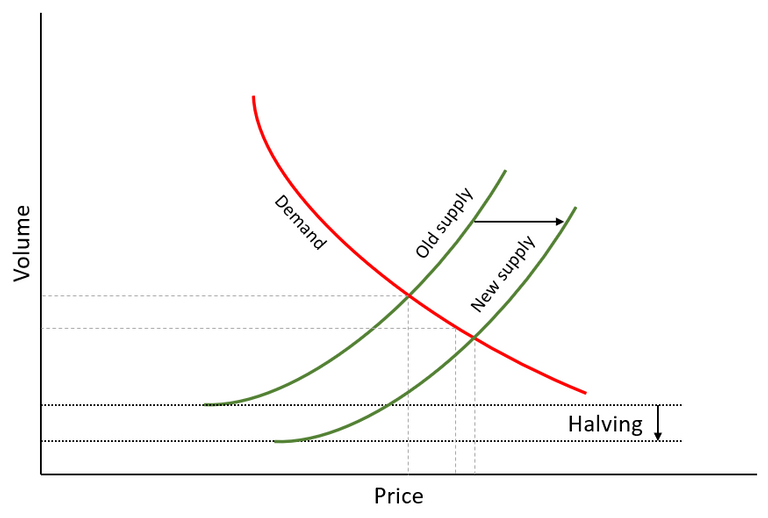

Cutting the supply from miners by half will result in a parallel shift of the supply curve to the right. This means that the new equilibrium price should rise. But by how much?

Which factors influence the magnitude of the positive price impact of the Halving?

Price elasticity of supply

One important driver of the price impact is the steepness of the remaining supply - or in other other words the price elasticity of supply. The lower the price elasticity of demand, the higher the positive effect on the new equilibrium price. HODLer are by definition extremely price inelastic - they do not sell no matter what the price is. While reality has shown that even HODLer typcially have a threshold at which they will eventually sell, I would still argue that these investors are very price inelastic. The higher the share of HODLer in the investor base one could thus argue the higher the positive price impact.

The share of miners of total supply

The higher the share of the miners of the total supply, the higher the impact on pricing will be. Given that this ratio should decrease with each Halving event, the positive impact of each Halving should decrease over time.

Price elasticity of demand

Finally, the price elasticity of demand also influences the impact of the Halving on pricing. Again, the flatter the curve, the stronger will be the positive impact.

The equivalent to the HODLers on the supply side are on the demand side the steady investors, which invest a more or less equal amount on a regular basis - no matter what the price is. The higher their share of the total demand, the lower the price elasticity of demand tends to be - and the higher would be the positive impact of a shift in supply.

Momentum investors driven by FOMO

Economic theory assumes that humans act rationally - unfortunately, in reality they tend to be the opposite. This prove true especially in the world of cryptocurrencies, where we continue to lack a sound fundamental framework on how to value cryptos. This results in the fact that investor are willing to change their assumptions of a fair price drastically withing a very short time frame. Additionally, any large change in prices is likely to attract a lot of media attention, which in turn attracts new investors. This often leads to exaggerated price developments - driven by what is referred to as FOMO - Fear Of Missing Out.

Conclusions for the Bitcoin price

Based on this analysis I would conclude that the Halving is for sure positive for the Bitcoin price in the medium term. However, deriving any forecasts from historic events is in my view leading to exaggerated expectations, as the impact from the reduction in inflation should decline over time. Also, it is far from clear that the positive impact will also materialize in the short term. The Halving was known in advance and for sure some investors have bought before the event to benefit from the future positive effects. Some of the recent price increase might thus be related to this pre-buy effect, which could normalize again in the next weeks.

That being said, the reduction of inflation is only one factor influencing the price of Bitcoin - but there are also many other driving forces. Especially the current tendency observed in many countries to finance the costs of the COVID-19 pandemic with the banknote press is in my view a key driver for the acceptance of a digital currency, which is completely independent of any political intervention.

What can we learn for HIVE

The inflation if hive is still relatively high - more than 7% p.a. compared to Bitcoin's current inflation rate of 1.8%. Including also the proceeds from the Hive DAO, this rate is increased even further. While I would argue that the share of inflation going directly to the market is lower than in the case of Bitcoin, still a fair share is being sold immediately. If we were to cut the inflation by 50% I would thus expect the Hive price to react much more positively than the Bitcoin price. In the past, we have seen already which negative impact the constant selling of Steem by STINC had on the Steem price and I am convinced that the fact that this is now over on Hive is one of the reasons why the Hive price is significantly above the price of Steem some months ago. Reducing the inflation could result in an additional boost to the Hive price, which would likely attract new investors and users. Indeed, I remain convinced that halving the inflation could result in an increase of the Hive price, which would over time for content producers more than compensate the loss from lower inflation.

Disclaimer: This is no financial advice, I am merely offering my own opinion.

Any PoS shitcoin is capable of low inflation. That doesn't automatically translate into a higher market cap.

I would be surprised if Steemit, Inc were still selling at the rate it was before February. Three of the most highly paid employees of Steemit, Inc quit: all the developers they had on board as well as the head of communications. As far as I know, they haven't hired replacements.

That would also consolidate the top heavy stake distribution. The impact on network security would be negative as we learned or at least should've learned from the Justin Sun debacle. The only people benefiting from a lower inflation but higher token price would be the current whales.

Besides, altcoin speculators do not care about which single digits the inflation rate of a coin is. Not at all. And this is demonstrably true. Consider the fact that STEEM went from 7 cents to $8.5 from March 2017 to January 2018. The price went up by over two orders of magnitude in less than a year! An annual inflation rate of 8.5% is absolutely nothing compared to that.

Altcoins are quasi-derivatives of Bitcoin. Their own exact inflation rates are meaningless from a speculative point of view. Sentiment and hype are everything. When it comes to the use case of HIVE, a "high" inflation rate of 8% makes it possible to put the coin into the hands of a lot of people. HIVE has one of the best distributions in the entire industry. Let's not ruin that by shutting down the inflation.

Sure, it does not mean that this will happen automatically. But it does shift the supply curve and would thus result in a higher price - all else being equal. How much higher - this would need to be seen.

Unfortunately, there is still a lot of circle and buddy voting - so I am not sure on that. If all the inflation would go to good content producers, I would be with you. I am afraid, though, that this is not the case.

This is for me a sign that the supply curve of Steem and now Hive is rather flat as supply is rather flat. Either people sell at any price anyway or they do not sell at all as their Hive is powered up. This shows me that a small shift in the demand curve might result in a huge price increase.

Most STEEM and most HIVE and are on exchanges. 220 million HIVE are liquid (including HBD). The vesting fund is only about 150 million HIVE. There is, in fact, so much liquidity on the markets that even if all of the inflation were sold immediately, the difference between inflation rates of 8% and 4% per year would be practically insignificant.

There is A LOT of dumb money on the cryptocurrency markets. The last big bull run of STEEM too took place after Bitcoin had rallied first. People who either made big fat profits on Bitcoin got greedy and some people were late for the Bitcoin train bought SBD and STEEM hoping for a pump, which took place. That's how the altcoin market works. In a way, they are a means to making leveraged plays on Bitcoin. There is so much volatility in HIVE that most holders prefer not to power up their coins. A whopping 200 million are kept on exchanges. Inflation rates simply don't matter much. Altcoins are not digital gold.

Well, a price increase would be appreciated now.

That'll make all the hodling worthwhile.

We will see where the halving takes us eventually.

The difference in the inflation between Hive and BTC will be reduced over time:

Coins like BTC can afford to live with a limited supply because of their fee model but since Hive relies on a zero fee structure it will always need inflation to pay block producers.

Instead of reducing the issuance rate what we need to strive for is to create use-cases that require burning Hive to reduce the impact of inflation on the price. In another words we need to increase the proportion of inelastic demand. Although as a stake holder I wouldn't mind accelerating the reduction of the inflation rate at some point.

I agree - a certain part of the inflation is needed to pay the witnesses and this needs to be enough to make sure that witnesses do their job properly.

Your level lowered and you are now a Red Fish!

Support the HiveBuzz project. Vote for our proposal!