Do you currently hold Bitcoin and are wondering what’s going to happen its price in the near future, what is the Bitcoin price prediction 2020? Or have you heard about it and would like to know whether it’s a good investment or not over the long term? Well, if your answer is yes to either of these questions then you’ve come to right place!

Quick fact: Did you know that Bitcoin increased its price by more than 2000% in 2017!?

Price Predictions and What You Should Consider

In reality, nobody can predict the future of a cryptocurrency, but if we could, we would all be billionaires. In the cryptocurrency world, prices are very volatile. This means that the value of a coin can go up or down really quickly, with often no explanation as to why. This makes predicting prices much more difficult than traditional markets.

The most important thing is that you always perform your own independent research before making an investment. Never buy a cryptocurrency just because a price prediction excites you, or because your favorite YouTuber told you to! At the end of the day, everyone has a different opinion and there is no guarantee that anyone will get it right.

So, now that you know what to consider when reading predictions, the next part of my Bitcoin price prediction 2020 is going to analyze some well-known Bitcoin predictions.

Bitcoin Price Prediction 2020:

McAfee:

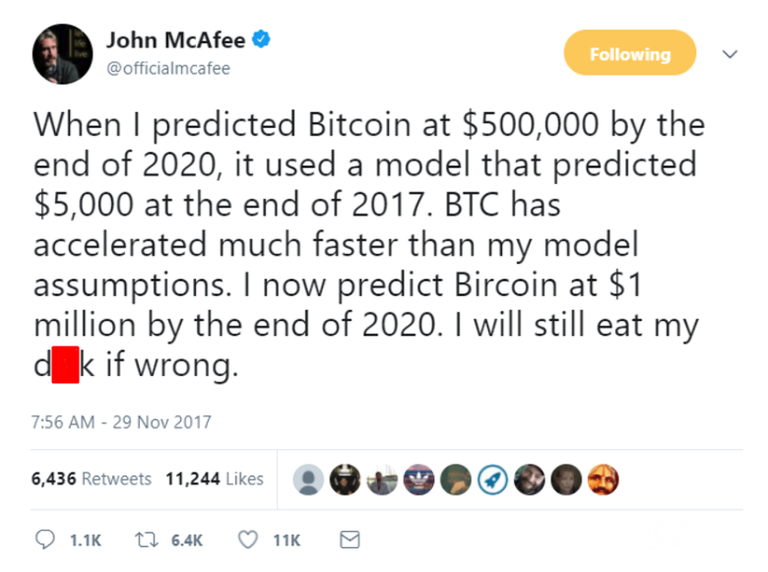

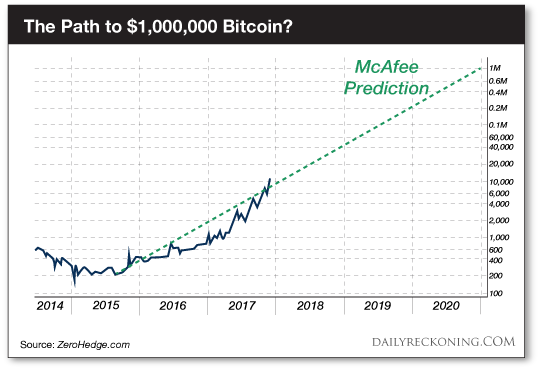

The first Bitcoin forecast that I want to discuss with you is by John McAfee, the creator of the popular anti-virus software McAfee. McAfee is well-known in the cryptocurrency industry because he makes lots of insane price predictions on Twitter, however, it has since been revealed that crypto projects pay him more than $100,000 to do so.

Anyway, in 2017, MacAfee said that Bitcoin would reach $500,000 in 2020, and if it didn’t, he would eat his private parts live on TV! If you didn’t think this was crazy enough, McAfee then increased his Bitcoin price prediction of 2020 to $1 million! To be honest, he seems rather confident to me.

Prediction 1:

" $500,000" if bitcoin becomes a widely used currency

Well, $501,493 to be exact. This figure is based on seeing bitcoin surge in popularity to the point where it makes up 10% of the global money supply.

To achieve this ultra-optimistic valuation. Bitcoin would need to become widely used as a currency -- not just as a speculative instrument, or even as a store of value. And there's a lot standing in the way before that could happen.

For example, bitcoin would need to become far more user-friendly for people who aren't tech-savvy. In other words, it would need to become as easy as swiping a debit card at a payment terminal, or its road to widespread adoption will be very difficult. In addition, bitcoin's value will need to stabilize, which admittedly is contradictory to a prediction of a $500,000 value.

Perhaps most importantly, the traffic capacity of the blockchain network will need to be greatly improved. Today, the entire bitcoin network is capable of processing only about three transactions per second, less than 1% of what it would need to process if it were being used constantly in payment transactions all over the world.

Could it happen? Sure. Is it likely? Not by 2020.

Prediction 2:

$113,433 If bitcoin becomes a widely used store of value

Someone recently told me that I was thinking of bitcoin all wrong when describing it as a currency. Instead of a payment mechanism, bitcoin's real use is as a store of wealth, like gold, this individual claimed.

That certainly makes some sense. After all, a finite number of bitcoins will ever be created, and it's possible to make bitcoin holdings just as secure as physical gold, if not more so.

As of this writing, the market value of all the gold that's ever been mined is roughly $7.6 trillion. And to be clear, I don't think bitcoin will ever come close to replacing gold as the world's preferred non-currency value storage mechanism.

However, let's say bitcoin achieves one-fourth of the popularity as gold as a wealth storage vehicle. That would translate to a value of about $1.9 trillion for all bitcoins in existence, which is about $113,433 per coin.

Prediction 3: $100 (or less) if bitcoin fails to overcome its challenges

Since bitcoin is not yet a widely accepted form of payment, nor so many people use it as a store of wealth, it's fair to assume that this is a speculative rally and that some level of future success is priced into bitcoin at this point.

Therefore, if enough time passes and bitcoin's progress toward mainstream acceptance is slow or non-existent, speculators could begin to head for the exits. In addition, there are several negative catalysts that could lead to a bitcoin crash. Just to name a few:

• A major bitcoin hack occurs, similar to the infamous Mt. Gox exchange's breach a few years ago.

• Selling pressure in bitcoin futures puts sustained, downward pressure on bitcoin.

• The problem of the network's capacity remains unsolved, and the bitcoin transaction times get even worse. (They're taking several hours now.)

Why these will probably be wrong

In a nutshell, the first two predictions are different variations of ideal scenarios, and the third one is if bitcoin crashes. In reality, the price of bitcoin is governed by lots of factors, the combination of which is impossible to accurately predict, and the reality of what will happen is probably somewhere in between.

And this is probably the biggest takeaway for prospective bitcoin investors. Buying an asset that could conceivably be worth either $100 or $500,000 within a couple of years is speculation, not investing.

“Keep this in mind, and don't buy bitcoin with any money you can't afford to lose.”