Thank you for this post I look forward to part 2. Tom Lee has invented the Bitcoin Misery Index which currently stands at 28 which is in 'misery' territory. Tom Lee has pointed that on every occasion Bitcoin has been in misery territory it has rebounded back into a bull market within 12 months.

We have also to look at other factors driving crypto towards mass adoption. The millennial generation in America, which is by far the biggest generation numerically, is driving the crypto market there.

Numerous reports have come out suggesting that up to a quarter of students are using their student loans to buy crypto.

Tom Lee has identified that one third of Millennials (about 30 million people), who have little trust in banks after the 2008 financial crash, are entering their peak earnings period meaning that they will have up to $1 trillion a year for investment purposes. Only a small portion of that has to go into crypto to drive up the markets.

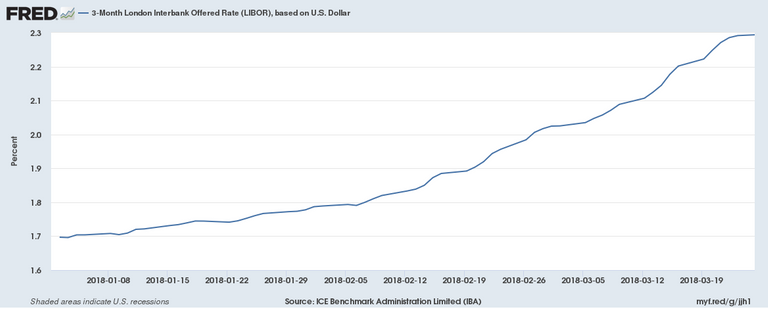

One last issue. The global economy is on the edge of a massive financial precipice. The current volatility in stock and bond markets has been driven by the spike in 3 month Libor rates. See the chart below from the Fed for the period from January to March of this year. Morgan Stanley and the New York Times have warned about the dangers of this spike in the cost of private borrowing for banks and corporations.

If the Fed and other central banks keep raising interest rates this will push the global economy over the edge into a new recession which is long overdue anyway. In this situation as investors scramble to get out of the stock and bond markets then many will consider putting capital into crypto as part of a strategy to diversify their risk.

And that is good. May fiat jump off and die as Bitcoin continues in rising.