I tend to agree with you friend...one thing we have going for us is that the percentage decline on this correction was already at one point around 70%...to me i look at this as the 0.786 retrace , so this could be the bottom...the only thing we can do is watch the indicators such as volume and MACD to see what type of action we are getting at around the possible Wave B projection area...I've talked to haejin about this and he is very aware of the possibility, but we just have to take it step by step...great chart

You are viewing a single comment's thread from:

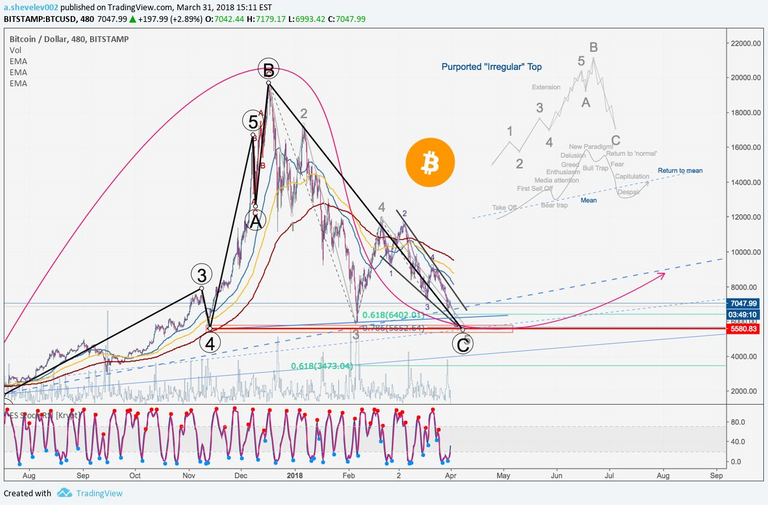

Thanks man. I need more feedback from people. You are correct it has retraced 70% at $5900 but this bull run started in Sep 2015. So I would assume a minimum of 78.6% is quite probable which could be completed by a downward wave C. Again in 2014 we had close 88% retracement. many has marked the whole ABC correction as shown below- which I believe is flawed for the reasons-

So when current assumptions are wrong it makes my case that stronger. I just want to warn people so they can collect their profit ( whatever they get at B) on time instead of waiting and losing it all.

Yeah you bring up a good point...this is the count that i came up with...this wasn't posted by me, but i came up with this a long time ago and saw this on twitter..if you notice, the last thrust up last year was only a 3 wave format...IMHO.....just more food for thought...but your post is definately something to keep in the back of our minds

This post was by a.shevelev002 on trading view