Bladetec, a British hardware supplier, has recently announced plans to build a Bitcoin farm (BTC) in the southeastern United Kingdom, the Sunday Telegraph reported on 17 March.

The project called Third Bladetec Bitcoin Mining Company Ltd (TBBMC) aims to raise £ 10 million (about $ 13.9 million) from investors to build and operate the farm over the next two to three years. The developers then plan to sell mined coins and mining equipment to generate returns, says the project's funding platform, Envestry.

Bladetec founder John Kingdon says investors "are not likely to lose money". According to his calculations, the sale of mining equipment would generate profits; it is unclear whether factors such as declining equipment prices and increased mining costs have been taken into account that require more electricity and computing power each year.

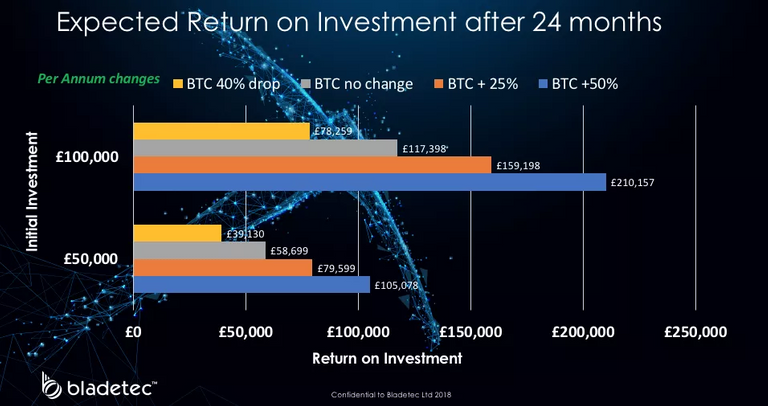

TBBMC expects investment returns to follow one of four scenarios according to Bitcoin's value over the next two years. The scenarios range from a 40% drop in prices per year to an increase of more than 50% per year.

Founded in 2002, Bladetec provided IT support, procurement and consulting services to organizations such as the UK Department of Defense, NATO and The National Grid. According to Evenstry, TBBMC will be the first Bitcoin mine in Europe funded by investors in a UK-protected limited liability company.

According to the project, the TBBMC facility will cover 320 m² in three locations in London, Surrey and Suffolk. Considering the high price of bitcoin mining in the United Kingdom of about $ 8,400, most of the funds raised would be spent on energy costs, as the company plans to operate 1,280 bitcoins, wrote The Telegraph.