For now, potential cryptocurrency looks like another chapter in the chronicles of crowd psychology: Our view

all through history, funding bubbles have emerged round things together with tulips, uranium, real estate, dot-coms and housing debt. but perhaps none is crazier than the current panic shopping for of bitcoin.

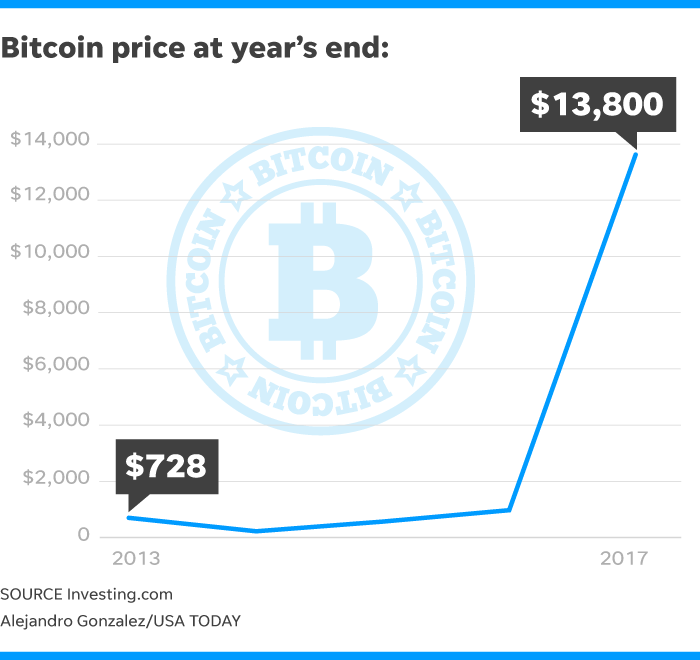

Even after a late-December swoon, the fee of a unmarried bitcoin ended 2017 at nearly $14,000. That’s a fourteenfold growth from wherein it commenced the 12 months, this at a time whilst utilization of bitcoin for its supposed purpose — as a automatic approach of moving value — turned into up handiest modestly.

with the aid of Wednesday nighttime, bitcoin become lower back to about $15,000 amid word that a project-capital firm co-based by way of Peter Thiel, one in every of Silicon Valley's biggest names, had placed a major bet on the cryptocurrency.

OPPOSING VIEW: Blockchain technology behind bitcoin is worth it

Do investors, if that is the proper phrase, understand the value of what they are shopping for? Do they even know the character of what they are shopping for? Gauging from the run-up, the solution to both questions seems to be no.

Their call however, bitcoins aren’t definitely a currency. They lack the only aspect common to currencies: extensive acceptance. additionally they lack the tangible characteristics which are the hallmark of commodities.

They characteristic as a method of exchanging real currencies in a way that bypasses the confiscatory fees of banks and the prying eyes of governments. They behave like stock in a crimson hot organization whose sole product is an stylish form of encryption that keeps bitcoins from being counterfeited or stolen.

simply how beneficial bitcoins might be in the future is everyone’s bet. they may properly have a cause in competing with banks and restricting the strength of governments.

at the moment, but, they are most beneficial to drug dealers, tax evaders and people who stay in nations with hard capital controls.

considering this constrained utilization, and the reality that there may be nothing to stop competitors from emerging, the notional price of all bitcoins ($250 billion) appears quite steep.

As a factor of reference, the organization that owns the ny stock change and more than one other exchanges global is well worth $41 billion.

Why are humans bidding up bitcoins to such absurd degrees? many of the same old rationales are in play. within the past 30 years, fortunes were made by using pouring money into organizations that have been poorly understood or struck traditional buyers as overpriced. And to many speculators of nowadays, bitcoins appear like the modern-day on this fashion. however bitcoins additionally offer something unique: a (erroneous) sense of reason.

among those snapping them up are traders who suppose they are doing the arena a favor. They see bitcoins gaining enormous popularity and sooner or later changing conventional currencies, eroding the electricity of governments and ushering in a brand new libertarian technology. All we can say is, right good fortune with that.

The future of bitcoins is murky. What isn't always so tough to peer is that they make other investing crazes appearance tame. Even in case your idiot neighbor claims he made a bitcoin killing, we'd advocate opportunity investment vehicles for the family nest egg.

united states of america modern editorial opinions are determined with the aid of its Editorial Board, cut loose the information personnel. most editorials are coupled with an opposing view — a completely unique usa these days feature.

To study greater editorials, go to the Opinion front web page or sign up for the daily Opinion e mail newsletter. To respond to this editorial, submit a remark to