Bitcoin (BTC)

Bitcoin (BTC) was the first Cryptocurrency in existence. It was created in late 2008 by an anonymous developer under the pseudonym of ‘Satoshi Nakamoto’. Its initial purpose was to be a peer-to-peer electronic cash system which is decentralised and trust-less. It utilises distributed ledger technology, which we now know as ‘blockchain’. Bitcoin’s popularity has grown substantially since its inception and it remains the most valuable Cryptocurrency on the market in coin value and overall market cap, with its limited supply of 21 million.

For many years, Bitcoin was neglected by the masses and not considered a legitimate form of currency or an asset. In 2017, this changed. On January 2nd of 2017, Bitcoin was valued at approximately $1,025 USD. By the end of 2017, that value reached almost $20,000 USD. 2017 was a huge year for Cryptocurrency adoption and it was highly popular in the media.

Although 2017 was a great year for Bitcoin, some strong competitors have been looking to take over the top spot, and one of those is Bitcoin Cash (BCH).

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) was introduced to the world on the 1st August 2017. Bitcoin Cash was created from of a hard fork of the Bitcoin network. It is run by multiple independent developers and the most renown advocate is Rodger Ver. Bitcoin Cash was introduced following the belief that Bitcoin was unable to grow and scale its transaction capabilities to cater for adoption of the masses and it had already been struggling to do so.

Bitcoin Cash has been recognised as a successful fork of the network and is tradable on several exchanges. On August 1st, 2017, Bitcoin Cash launched into the market with an initial value of around $300 USD. During the large growth period in Q4 of 2017, it seen highs of around $4,000. Since then, its value has cooled down again to around $850.

The adoption of Bitcoin Cash has been somewhat limited as its use case is debatable. With the intention of overthrowing Bitcoin and becoming the new peer-to-peer digital cash, many Bitcoin enthusiast are still against the movement.

Technical Comparison

Some prefer Bitcoin, some prefer Bitcoin Cash. Do we need both? Which one is better? Well as discussed, the purpose of Bitcoin Cash was to improve the scalability of Bitcoin and create a Cryptocurrency that is more practical for mass adoption and can be used as a currency for years to come. Bitcoin has made its vulnerabilities visible with transaction fees reaching $50+ USD and transaction times reaching 24+ hours during its peak period of use in 2017.

The technical specifications of each coin are presented below for comparison:

BITCOIN (BTC) BITCOIN CASH (BCH)

TOTAL SUPPLY 21 Million 21 Million

ALGORITHM Proof-of-work (POW) Proof-of-work (POW)

MAX BLOCK SIZE 1MB 32MB

TECHNOLOGY Segwit SecureSig

Performance Comparison

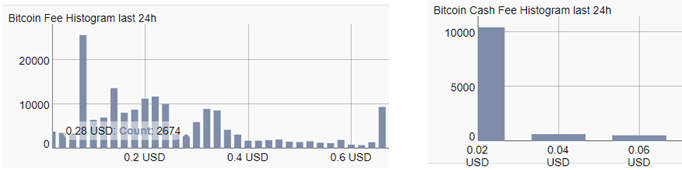

Bitcoin Cash ultimately claims to be cheaper and more efficient. A fee price and block confirmation comparison uncover the reality. The average fee for a Bitcoin and Bitcoin Cash transaction in 2018 is very similar at approximately $0.2 USD (Bitinfocharts.com).

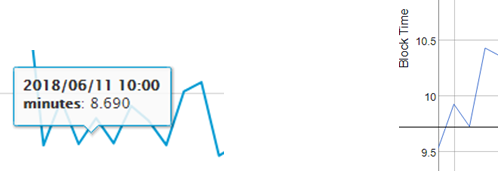

The average confirmation time for a Bitcoin and Bitcoin Cash transaction is also very similar at approximately 10 minutes (Bitinfocharts.com & Blockchain.info).

Community News

Bitcoin (BTC)

Despite the six-month bear market throughout Q1 and Q2 of 2018, the community support behind Bitcoin has still been quite strong. There have been various developments happening around Bitcoin which will bring positive sentiment to the markets once the bear cycle is over. The Bitcoin hash rate has been at an all-time-high in Q2 of 2018 with the network being more secure than ever. There has been plenty of talk around the lightning network integration and how Bitcoin will facilitate super-efficient microtransactions. Regarding improvements to the protocol, Bitcoin Core V 0.61.1 software has been released with new features and performance upgrades.

Bitcoin Cash (BCH)

The community support around Bitcoin Cash has been fairly consistent with the latest piece of development being the hard fork on May 15th, 2018, where the block size of was increased from the original 8MB to 32MB. The coding for Bitcoin ABC 0.17.0 has been made available which details the change to the consensus. Several bitcoin script operation codes (op-codes) were also implemented during the upgrade which look to bring smart-contract capabilities to the network.

Conclusion

As seen from the technical comparison, the main difference between the two coins is the increased block size from 1MB to most recently 32MB. This means that more transaction data can be processed in each block on the Bitcoin Cash blockchain.

While this seems like a benefit, lately the transaction throughput, fees, and hash rate have been very comparable between both coins as seen in the performance comparison. It should be considered that the potential reasoning for Bitcoins’ struggles in late 2017 were not its inability to scale, but because of the exponential growth that occurred in such a short time.

This raises the question, it Bitcoin Cash necessary? If Bitcoin Cash cannot prove to be a better payment solution, its chances of being adopted and potentially overthrowing Bitcoin are minimal. Personally, I have never been a strong supporter of Bitcoin Cash because I feel it’s an unnecessary coin. With the integration of segregated witness and the lightning network, I am confident that Bitcoin can scale and facilitate global transactional needs.

Make sure to Subscribe to my YouTube channel: http://www.youtube.com/c/thecryptogod