Why investors should consider re-balancing their crypto portfolios: First, there are several questions associated with this initial question. What does re balancing mean? What are the other crypto assets out there? Why would I diversify my bitcoin when it’s doing so well?

This piece will attempt to answer all of those questions. Seeing as the investment acumen of readers can vary, we will begin begin broadly and then get narrower by answering the following questions:

- What is diversification? Why is it important?

- How can one achieve diversification in a crypto portfolio?

- Why should she?

Diversification

The concept of diversification in investing was brought to the fore by Harry Markowitz in his 1952 paper ‘Portfolio Selection’, formulating the basis for what has since been coined Modern Portfolio Theory. To summarize his work: generating a return is not possible without taking risk. Therefore, the quality of an investment cannot be measured simply by how much of a return it might generate, but must also take into account the risk necessary to achieve that return.

Consider: winning a $500 million mega ball lottery with a $7 ticket seems great, until you realize that your chances of doing so are approximately 1 in 175 million. Your expected return in this case is -$4.14, or -60%. Knowing that, would you invest your life savings into lottery tickets?

Continuing with this line of thinking, risk in a portfolio can be lowered by investing in a broad array of assets, or by diversifying (don’t hold all of your eggs in one basket). The benefits of diversification are especially pronounced when assets in a portfolio exhibit low correlation to one another. Even assets that are inherently risky in isolation might not be so risky when held in a portfolio with other uncorrelated assets.

Through diversification, investors who lower their risk without eroding much expected return will create higher quality portfolios (remember, to assess quality, return must be understood within the context of risk).

This argument has been used by many in crypto land to encourage investors to invest at least part of their savings in bitcoin. Because it has exhibited low correlation to conventional investment assets, an allocation to bitcoin might reduce rather than increase the portfolio’s risk despite the fact that bitcoin itself is an extremely risky investment (the volatility of its price is quite high).

While that may be true, the purpose of this piece is not to encourage readers to diversify by allocating to crypto. Rather, it is to encourage those who already have invested in crypto to diversify within that crypto allocation.

How can one achieve diversification in a crypto portfolio?

First off, for those less familiar with the space, Bitcoin is not the only crypto asset out there – far from it. There are thousands in existence. Bitcoin’s code is open sourced, meaning anyone who doesn’t like some aspects of bitcoin’s functionality has the freedom to pull the source code, make the changes they want, and launch their own crypto asset. Investors can then vote with their feet on which asset generates the most utility. This has created a fast moving, highly innovative environment from which some very interesting projects have emerged (beyond just Bitcoin).

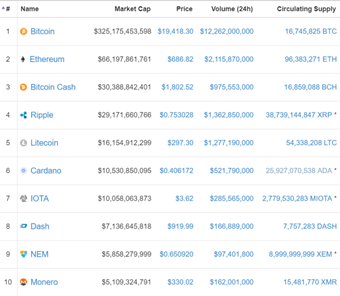

The top 10 crypto assets by market cap are listed in the chart to the right (data from coinmarketcap.com). I am going to touch on a few I find interesting: Ethereum, Ripple, and Litecoin, assessing each asset’s team, technology, and target market (I’m an MBA, so I can’t help myself from using alliterative frameworks numbering in 3’s). Please note that the purpose of this article is not to take a deep dive on any one crypto, but rather to quickly describe them before demonstrating why it makes sense for those who want to invest in crypto assets to diversify when doing so.

Ethereum ($66bn market cap)

• Team: Ethereum was launched in 2015 by a team spearheaded by the crypto legend / child prodigy Vitalik Buterin. Because Ethereum’s application potential is so vast, it has attracted many of the best and brightest minds in blockchain tech. Ethereum has attracted interest from many of the world’s leading businesses including JPMorgan, Intel, and Microsoft in the Ethereum Enterprise Alliance, a group that seeks to employ Ethereum for the enterprise.

• Tech: Ethereum is different from Bitcoin because its purpose is not to be a digital currency, but to be the world’s super computer. The Ethereum blockchain supports more than just a distributed ledger of ownership, it supports code or “smart contracts” written in Ethereum’s own programming language Solidity. Developers can build and publish distributed applications (DApps) which are sustained by Ether, or the ‘currency’ of Ethereum. Ether is the incentive for those contributing the computational power to maintain the network, and is used by individuals leveraging Ethereum smart contracts.

• Target market: because it aims to be a platform for any and all applications of blockchain technology, Ethereum has more potential applications than nearly all other crypto assets. Developer teams are attempting to use it to disrupt everything from the pension industry, to supply chain management, to contract law.

Ripple ($29bn market cap)

• Team: Ripple is an open source network, but also has a management company behind it. Ripple’s leadership is anything but the eccentric computer geeks crypto skeptics might assume are behind the blockchain movement. CEO Brad Garlinghouse is a Harvard MBA with experience in VC/PE and in operating roles in some of the world’s largest tech companies. His management team is littered with high octane tenured professionals from finance and tech. It is important to note that while Ripple is a company, its network (explained below) is decentralized and can operate without the Ripple company behind it. Enterprise users of Ripple include UBS, RBC, Banco Santander, Standard Charter, and other large financial companies.

• Tech: Ripple is different from bitcoin because it is a centralized transaction network rather than a core blockchain platform. Ripple provides a peer-to-peer platform connecting banks, payment providers, and digital asset exchanges via its network to provide frictionless transfers of currency. In those transfers, the digital currency of Ripple (XRP) acts as a bridge currency to other currencies. Transactions in XRP are verified by consensus among members of the network, rather than the proof-of-work “mining” process used by bitcoin. Consequently, payments on the Ripple network are significantly faster and cheaper than those facilitated by traditional banks or by bitcoin.

• Target market: Ripple has the most defined and tangible target market, being focused solely on business to business currency transfers. With over $155 trillion transferring across boarders each year, Ripple’s total addressable market is substantial. However, it is commonly critiqued for its centralization, and lack of full blockchain implementation.

IOTA ($10bn market cap)

• Team: IOTA was founded by the visionary David Sonstebo with the goal of formulating the backbone to the Internet of Things (IoT). Large companies who have entered into cooperation agreements with IOTA include Microsoft, Accenture, Fujitsu, and Bosch.

• Tech: IOTA’s technology aims to connect machines rather than people. IOTA creates an incentive for owners of data to share it through zero-fee transactions. Its decentralized ledger ensures the integrity of that data. Rather than a blockchain, IOTA uses a directed acyclic graph (DAG) or “tangle,” allowing IOTA necessary scalability to address the IoT market, and remove reliance on miners to verify transactions.

• Target market: The Boston Consulting Group estimates that the Internet of Things market will reach nearly $270 billion by 2020. Should IOTA’s developer community continue its progress, it could be a meaningful part of the future of IoT.

The benefits of diversification:

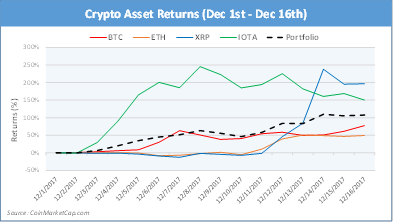

Whether you are only investing a small amount of money in crypto assets, or you are a substantial investor, diversifying pays. To demonstrate the benefits, we analyzed pricing data from the beginning of December through the 16th (hardly a substantial sampling, we know, but important given the crazy month in crypto). We then plotted the returns of a portfolio allocated 30% to BTC, 30% to ETH, 20% to XRP, and 20% to IOTA.

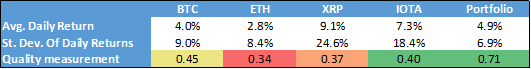

All of the investments had incredible returns, but the returns of the diversified portfolio were highest quality, or were the best when adjusted for risk. To demonstrate this, we created a table showing the average daily return of each asset, the standard deviation of daily returns (or “volatility”), and then a metric where we divided the average return by the standard deviation to measure quality. The Portfolio’s quality is the highest by a significant margin; meaning it had the highest return relative to its risk.

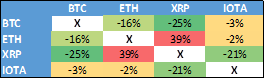

A major factor playing into its risk is the correlation of the portfolio’s components. As mentioned earlier, a portfolio’s volatility can be limited if its components are uncorrelated. Despite the strong performance in each of the analyzed crypto assets, their returns exhibited low (and even negative) correlation. As a result, the portfolio’s volatility was lower than any of the underlying assets in isolation by a significant margin.

In closing, we want to impress upon anyone reading that any investment in crypto is extremely risky. While some still tout crypto as a good investment in portfolios, others dismiss the space as the largest speculative bubble ever (see Zerohedge). There are very smart people on both sides of the isle. Neither is entirely wrong, and neither is entirely right. The purpose of this article is merely to point out that there are other cryptos out there, and that it is always prudent to be diversified, even if your investment in cryptos is small.

--

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes tax, legal, insurance or investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of Crescendo Financial Planners just by virtue of access to this website.