Good day everyone

Herewith this morning's Bitcoin price chart, as well as a few projections from some of the best guys around:

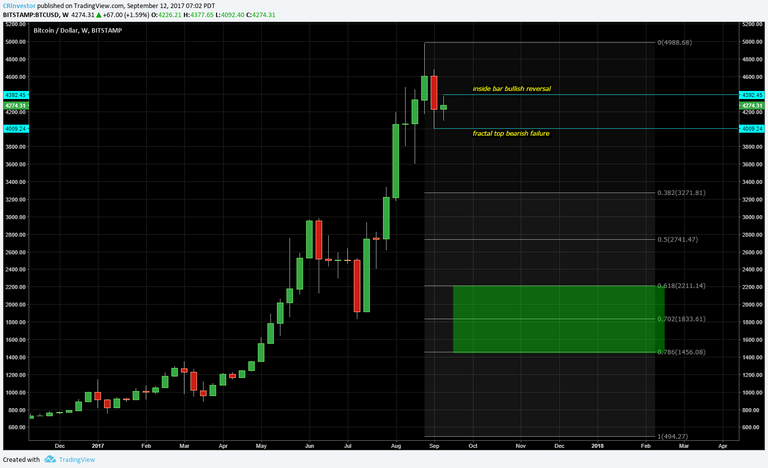

As you can see, the market is correcting itself after the massive rally, but as China banned ICOs and trading a lot of the asset was sold off from just under $5000. China has done this before, banning Bitcoin in 2013 and my guess is that they know how to manipulate it on a grand scale in order to buy back when it has reached a low. By distributing any asset, it loses value for a while until the market corrects itself. This is just the way it works. It's about balance.

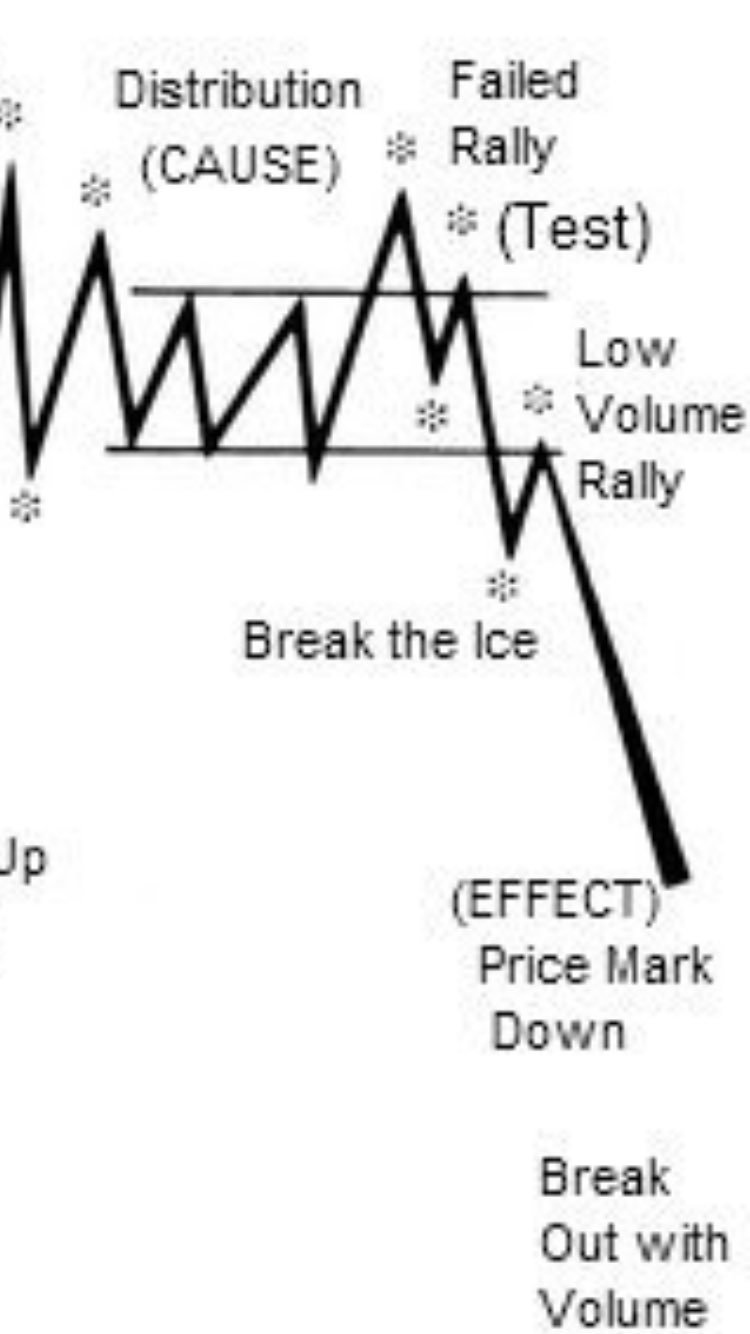

As per Wyckoff cycle, we are in this region right now:

So there has been alot of FUD, and in our view there will be some more as the market continues on course of the correction. Peter Brandt, as per classic charting principles, aims for a recovery around the $3150 mark, shown here:

He states that a descending triangle pattern should replicate the downward move by its height. If you look at Fibonacci reload zones on the bigger move, Brian Beamish thinks it could potentially move even lower:

Interesting times indeed! A gold hedge at Vaultoro would have secured your capital like so (image from Zerohedge):

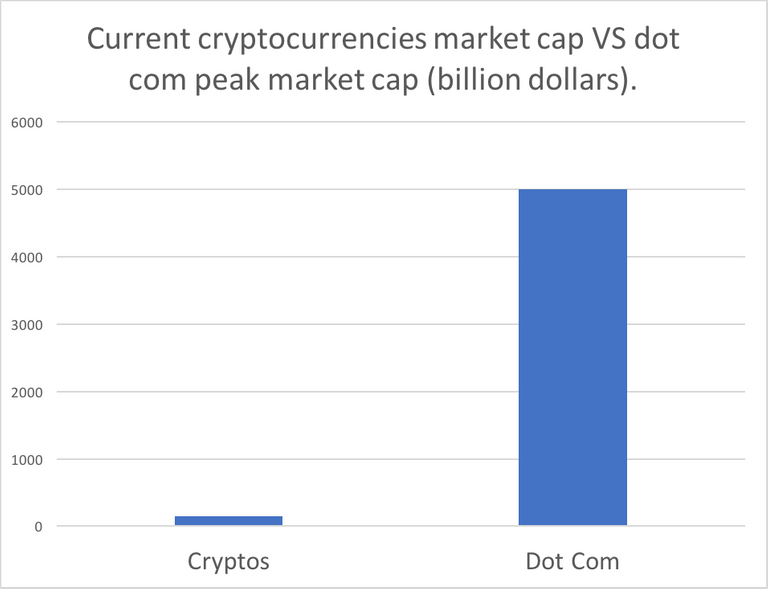

Nevertheless, there will be a lot of talk about Bitcoin being in a bubble as per usual uneducated guess. Here's what the dotcom bubble looked like in comparison from 1999 to about 2003:

I can't help but grin. Anyway, this what the real bubble looks like in terms of stock markets:

That's the S&P 500 from 1971, wasn't the Dollar removed from the Gold standard in '72 by Nixon? So all that money - which has lost 99% of it's purchasing power in a century - isn't backed by any form of energy?

In order to help put things into perspective, Mike Maloney released a video this week:

Download his free book, I know we've sent copies out on the newsletter before, so pop us a mail at evo_temp@protonmailcom if you would like to receive it.

Here's another interesting video by Bix Weir regarding JP Morgan Chase & Co's view on the 'Bitcoin bubble'.

Have a fantastic day, trade safely and remember those stop losses.

Rgds,

EscapeVelocityOrdinance