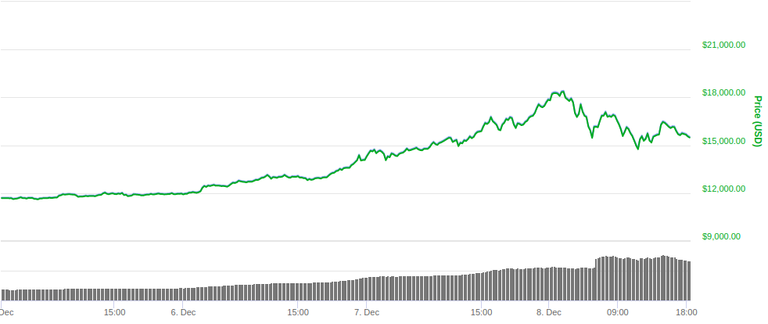

Let's start this article with a chart. Specifically, a Bitcoin price chart within the last three days.

Within the last three days, the price of one Bitcoin exploded from $12,000 to over $18,000. Actually, the hike only took half a day, with some $1,000 mark achieved in just an hour or two. On the largest exchange in the US, GDAX, Bitcoin surpassed $19,000, which brought down the exchange temporarily.

Why did this happen? Is it normal for an asset to rise more than 33% in such a short amount of time? Should you sell off all your cryptocurrency holdings or should you sell your house and your car and your toaster to buy more Bitcoin?

Before you do anything, it is important to understand the recent price rally. Here are some possible explanations.

The opening of Bitcoin future markets

Futures market is a market for futures, which are essentially contracts for goods/services at a fixed price delivered some time in the future.

Futures don't need the actual ownership of an asset to be traded for actual cash.

Investors could make a lot of money by buying an asset some time in the future at a lower price. In this case, if Bitcoin's price is lower in the future, they could profit greatly from it.

Two large regulated futures exchanges have gained the right to trade Bitcoin futures and will begin doing so on December 10th and 18th.

A lot of speculators believe that this caused professional investors who have a lot of money to be buying up Bitcoin only to dump them when futures market opens.

In short, people believe that professional trading involvement in Bitcoin has caused the price to rise.

(Source: https://www.coindesk.com/threat-bitcoin-futures/ )Bitcoin trending on social media

No one is sure where it started, but Twitter is experiencing a trend of people claiming to have a lot of Bitcoin and offering to give them out in the spirit of the holiday.

A simple search for #Bitcoin returns numerous random accounts that urge readers to retweet and reply with their public address to receive free Bitcoin.

Whether anyone actually received any coin or not is unanswerable, but the #Bitcoin trend certainly spread to many people. Together with the skyrocketing price, many people felt the pressure to ride the price train and bought in, which drove the price up even more.

(Source: https://cointelegraph.com/news/twitter-trolls-riding-bitcoin-train )Cannibalization of other cryptocurrencies

While the rise in the price of Bitcoin is great, the number of people who actually own and who actively trade Bitcoin is not. The overall size of the cryptocurrency market is around $400 billion. In comparison, the global gold market is worth $6.3 trillion.

Given its small size, the cryptocurrency's market is susceptible to mind-boggling price swings as only a small number investors need to trade from cryptocurrency to cryptocurrency to influence the demand of the market.

After price slowly rose these past few days, investors in other cryptocurrencies noticed Bitcoin price. They pulled out of other cryptocurrencies, which quickly pushed Bitcoin price. Other cryptocurrencies decreased in value, which made Bitcoin even more appealing.

During the three day price rally, Bitcoin got fueled by resources that would have been put into other cryptocurrencies otherwise, pushing the price of most top cryptocurrencies down 20%, 30%, and even 40%.

(Source: https://www.cryptocoinsnews.com/bitcoin-price-goes-parabolic-cannibalizes-crypto-market/ )

The futures market promises to either stabilize Bitcoin price or completely tank its price. The trending #Bitcoin is short-lived. The movement between cryptocurrency is a normal occurence.

Generally, I think Bitcoin will continue to rise in price as more people know about it and use it as a first step into the cryptocurrency world. However, sudden price burst like the past three days is alarming. When my professor's spouse bought Bitcoin in the past few days, I realize that many who don't know about the extreme volatility of the asset are buying into it. They will be disappointed when its price decreased. As always, invest with caution, don't just follow the crowd, and make sure to study the actual usage of the asset you're buying.