Ever since bitcoin there have been a myriad of different alternative distributed digital assets to invest in. There is no doubt that peer-to-peer distributed ledgers are here to stay, but which of these shall dominate them all, or should there be many different technologies to choose from, like your choice of cars or computers? If investing in a technological asset, it makes sense to invest in the most current and utilius advancement, or perhaps there are several different options with different advantages, but when investing in a currency, the most advantageous utility is that it is accepted by most people, and most people are not active traders.

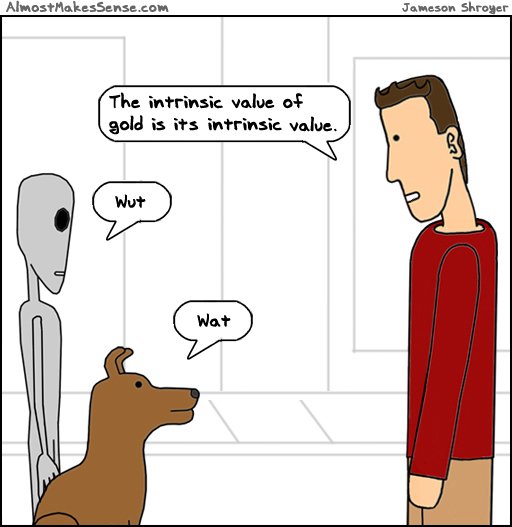

Peter Schiff has made many disparaging conclusions about cryptocurrencies, claiming they are digital fiat. He has said that they have no intrinsic value and that they are not actually limited in supply because there are 100s of them. Clearly, I disagree with his conclusion that cryptocurrencies don't have "intrinsic" value, I think their value lies in their open-source, peer-to-peer, decentralized, trustless, ledger accounting, which can be managed to execute automatically when certain conditions are met, cutting out several third-parties and middlemen, saving people a ton of money. This is clearly a value add, and it is not a matter of whether people will adopt it or not, it is when.

Peter Schiff has also been a well-respected economist in the libertarian and austrian-school thought circles. He has correctly predicted bubbles of the past, including the housing bubble. I started listening to him around this time and only recently stopped when it became clear that he was unwilling to see the value that cryptocurrencies add to the economy. So while I disagree with his conclusions, I think he makes a valid point. He says that cryptocurrencies aren't scarce, "There are already a 1000 other cryptocurrencies;" he then postures the question, what if someone comes out with a better bitcoin and now everyone wants to switch to that one? Suddenly, the price would drop significantly, he claims.

When investing in a new car or a new smart phone, the functionality of either phone or car is not affected by your change. You can buy the phone and get whatever measure of functionality you were looking for right out of the box, and the function of the other phone remains the same. You are not considered an "active trader" for switching phone companies. However when investing in a decentralized, consensus-driven, open-source, updatable, scarce, peer-to-peer blockchain currency, your functionality changes as you switch between different blockchains. You have become an active trader and it is now necessary to spend a significant portion of your time analyzing the markets. If the changes are not significant and drastic, or they can be integrated into your current blockchain, becoming an active trader is not wise unless that's your profession or passion.

Unlike private companies where the user directly benefits from the competition as the companies are forced to lower prices and innovate, separate competing blockchains lower each others functionality as scarcity decreases, and uncertainty and volatility increase, and because the vast majority of these blockchains are open-source and updatable, any new innovation can be integrated into any other chain. Blockchains don't require a company or competition to innovate; its users directly benefit from innovations and are therefore motivated to integrate them. Instead of competing blockchains, there should be competing groups of developers for the same blockchain.

It's a bit difficult to wrap around this concept, but Bitcoin's blockchain is kept honest by its users and miners: competing factions. Anyone with a computer and a technical mind can audit the system. There is no entrance gate; there are no leaders. Multiple blockchains do not keep each other honest, as competing companies do, they only decrease each others functionality as a currency and store of value. Unless everyone wants to spend a significant portion of their time actively researching the next change, or trusting investment firms to do it for them (which defeats the purpose of a trustless currency), one dominant blockchain is all that is necessary or desirable in a functioning currency.

I think one of the reasons we haven't seen this so far is because of the large number of users who are looking for astronomical increases in price in short periods of time, and developers who also want the quick short term gains of creating a new blockchain or token. In other words the vast majority of the cryptocurrency space is a speculators market, otherwise known as a bubble.

But as with the dotcom bubble, there will be many in the space who not only survive the burst but also thrive during and after. Unless something significant and drastic happens Bitcoin will be the dominant blockchain. First mover advantage in a technology that is decentralized, open-source, and consensus-driven, is not only a slight advantage, it is the only real significant advantage to have. Unless coins start creating closed-source software, they have no leverage, and with closed source software, they would be no better than government fiat.

Cool! I follow you.

Congratulations @volyntaryist! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!