Bitcoin's rampant inflation in 2017 makes it impossible for us to worry about the virtual bubble's bursting. If that happens, many millionaires going up from Bitcoin will suffer heavy losses and governments will come up with more stringent virtual currency regulations.

Bitcoin drops to 35% of value, down to below $ 13,000: Christmas sad for investors?

South Korea fears mass suicide due to Bitcoin

According to Wired technology , many media and financial experts often call Bitcoin's recent hike in price as a bubble. However, this really sounds weird. Financial bubbles are usually not called when it has happened. As defined by the Rumpelstiltskins financier, when you call a thing or phenomenon a bubble, it must be nearly broken.

" The financial bubble is often determined when we look at the past, " said William Derringer, an economics historian with the Massachusetts Institute of Technology. " We can only be sure Bitcoin is a bubble. It really broke . "

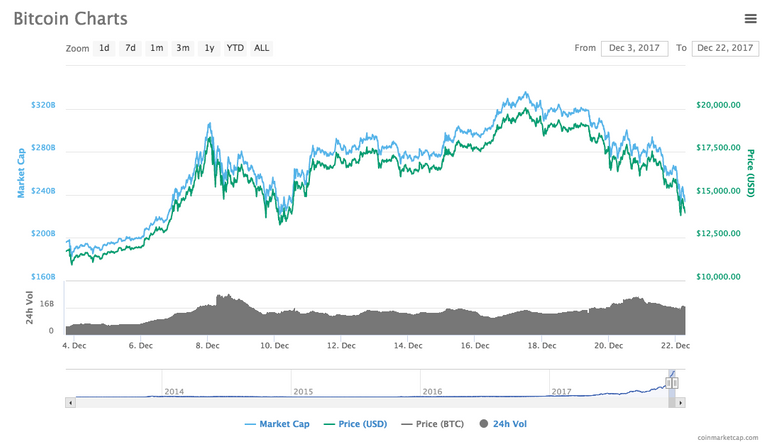

However, the fluctuations of Bitcoin in December, reaching a peak of more than $ 19,000 and bottoming out to just under $ 10,000 in two weeks, made the virtual currency in the list of potential bubbles. happening. In other words, Bitcoin is not a bubble but the risk is huge.

" Just as Bitcoin, most bubbles in the past after the technological improvements (like the dotcom bubble at the back in the 2000) and coupled with the form of new financing ," Mr. Derringer said, " Apart Bubbles are also the result of uncontrolled reporting by the media, which has led many to regard it as a new investment trend and to pour money in. Since then, the value of an asset has grown. It's a very high price, but for Bitcoin it's quite complicated because we do not know the exact value of a blockchain . "

Investors today do not seem to care about the warning. Bitcoin prices have climbed from $ 800 in early 2017 to $ 17,000 in recent days. The US government's permission for Bitcoin to trade on both CME and CBOE in early December was expected to help reduce Bitcoin prices by boosting supplies. However, Bitcoin's enhanced legality has the opposite effect, with more and more people pouring money into the virtual currency.

The collapse of the chain

The price fluctuation of Bitcoin makes it impossible for us to question what will happen if Bitcoin prices fall dramatically. In other words, if Bitcoin fell to a record low for some reason (hack, bankruptcy or market manipulation), what would be the worst?

Some say that, like previous bubbles, the effects of Bitcoin may be limited. Although the number of Bitcoin investors has grown dramatically recently, most of Bitcoin's $ 366.8 billion is in the hands of very wealthy individuals , from early Bitcoin investors, Silicon Valley to the virtual money companies.

" Most of Bitcoin is in the hands of a few thousand very, very wealthy people, so if the bubble breaks, these people are just a little bit poorer, I do not think it will cause a lot of big impact. " , analyst Ari Paul from BlockTower Capital said.

Chart of the unusual downturn of Bitcoin just before Christmas 2017.

However, financial losses will certainly occur on a certain level. The sudden drop in Bitcoin prices could make it hard for companies specializing in Bitcoin to cash in. The collapse of the companies could make the liquidity of the Bitcoin market weak and severely impact the investors.

" The Bitcoin bubble could be broken by 2020 ," said University of Cambridge currency researcher Garrick Hilerman. " The biggest investors will continue to consolidate their positions and boost their investment in the market. However, many Bitcoin exchange providers and providers will have to shut down . "

Virtual cashmere hardware companies will be severely affected by Bitcoin bursts.

The collapse of Bitcoin will inevitably cause a chain collapse across the entire virtual currency system. In Bitcoin's unusual drop before Christmas holidays , many virtual currencies such as Litecoin, Ethereum and Monero also had similar falls. Companies that provide hardware to dig up Bitcoin and other virtual currencies may find it difficult to crack a virtual money bubble.

" Nvidia, Intel and other chip makers are likely to be affected, " Hileman said. " This could cause many people to be unemployed ."

Borrow money to buy Bitcoin and bitter for investors?

Many economists agree with the view that a collapse similar to the 2008 financial crisis is likely to occur. Many financial systems have collapsed due to many debtors and are unable to pay after the investment failed. " A large financial bubble has always been built on a myriad of loans and mortgages, " Hileman said.

Things are getting worse as cyberspace companies are beginning to refer to terms like " financial leverage ," " lending, " and " credit ." Just a few days ago, Financial Times reported that the company's BitFlyer virtual currency trading company had lent 15 times more money to Bitcoin.

Selling a home for Bitcoin is a real risk for many Japanese.

What happens if Bitcoin goes down and makes investors unable to pay their debts? These people will be financed by banks and finance companies with all available assets, including the home they live in. Bigger bubbles, many people borrow money to invest, burst bubbles, many white-handed. It is a vicious circle that can make experienced investors make mistakes.

Even in Korea, the specter of the 1998 financial crisis and the threat of mass suicide due to bankruptcy are haunting the people of the country in the turmoil of the Bitcoin exchange rate. "How cold is the Han River today? " Is the phrase used by many Koreans to indicate the risk of Bitcoin bursting.

Government tightens regulations

There will be more pressure on governments to tighten virtual currency management.

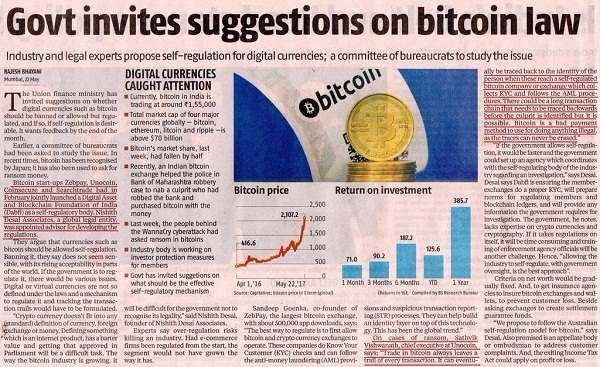

No matter how big the consequences, the bursting of the Bitcoin bubble will inevitably lead to more stringent regulations by governments. As more and more people, including Wall Street investors, poured money into Bitcoin, governments were unable to sit still. In fact, this has actually happened, the South Korean Ministry of Finance asked the G20 countries to discuss more stringent regulations for managing virtual money.

" The collapse of Bitcoin will end what is happening, " said Brent Goldfarb, a professor at the University of Maryland. " This will put pressure on changing virtual currency regulations, like the way the Commission The US Securities and Exchange Commission was established in 1929 to manage the stock market . "

However, it is difficult to make the rules for buying and selling virtual currency, which is traded globally and completely anonymously. This would require tremendous efforts by the government to avoid the speculation of bitcoin prices as we see them today.

Bitcoin will be another tulip?

Those who have studied economics will surely know the story of the tulip bubble. In 1630, many people in the Netherlands believed that tulips were worth the investment. The 17th century was the time when flower markets exploded and the beauty of tulips made it an attractive commodity.

Many Dutch people, from businessmen, bricklayers, lawyers to farmers, poured money into buying tulips. However, they did not bring the tulips to plant and put them in the glass. This caused the supply to exceed the demand and cause a high price for a tulip, even more expensive than a house. The strong belief of many Dutch at that time was that the price of tulips would increase forever.

After a period of mad rush, the price of the tulip unexpectedly plummeted in February 1637. There is no apparent reason for this, but it is likely that the demand for tulips has increased. This makes the price of tulips drastically reduced to less than 1% compared to before. Virtual profits on paper are wiped clean and many people empty handed. Economists call this the tulip bubble, the first serious financial bubble to be known.

Once the bubble burst, Bitcoin could return to a price under $ 1,000 as early as 2017 or be replaced by a more reliable virtual currency or financial method. However, like tulips, Bitcoin will not die. Despite being the cause of the crisis, tulips are still loved by many Dutch people and are an important part of the economy. Bitcoin will always be mentioned as a symbol of virtual currency fever in 2017. Tulips are still beautiful and Bitcoin will still have investors.

Resteemed by @resteembot! Good Luck!

The resteem was payed by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

Hi. I am @greetbot - a bot that uses AI to look for newbies who write good content.

I found your post and decided to help you get noticed.

I will pay a resteeming service to resteem your post,

and I'll give you my stamp of automatic approval!