Grayscale Bitcoin Cash Trust Trading at a 500% Premium!

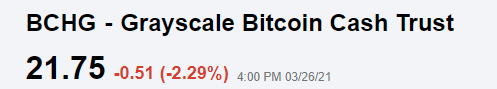

Grayscale Bitcoin Cash Trust (BCHG) is a trust that holds Bitcoin Cash and is tradeable on the stock market. However, they are now trading at a MASSIVE 500% premium to their net asset value, or NAV.

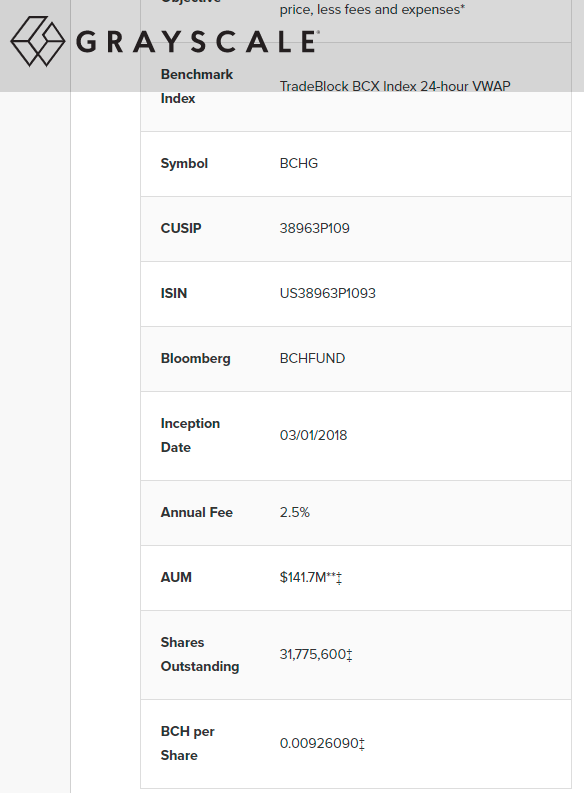

As you can see in the picture above, they have 31,775,600 shares outstanding and the price closed for the day at 21.75.

Well, multiply the shares by the price and you get $691,119,300.

The trust holds .00926090 BCH coins per share. That's 294,270 coins. With Bitcoin Cash trading at about $500 per coin, that is a value of just over $148 million!

They will soon be forced to create and SELL BCHG shares and buy up to $500 million worth of Bitcoin Cash. Bitcoin cash is around a $10 billion market cap - so they will have to buy up to 5% in a short period of time when they reorganize their assets.

This could send BCH from $500 to $800-$1000 or higher in short order.

It's already attracting the attention of some very well-known names.

Hey buddy! Long time no see, great to see you again.

Posted Using LeoFinance Beta

Glad to be back :D

I do not understand. Many stocks are trading above the intrinsic value. Why the have to buy BCH? Also the tweets are not about BCH?

I think he is saying the flux of stock market money into the BCH fund is causing them to be very short. They will need to cover the BCH shortage either with actual crypto or enough options to cover the investors influx of cash.

This big of a move will likely cause the price to increase on the exchanges where the market is thin to start.

The tweet is showing the market is starting to see BCH as a way to digital spend crypto over btc due to fee and trx time supporting the theory that the influx into the fund is enthusiasm for BCH

OK I will read again (I am slow)

I think he is saying the flux of stock market money into the BCH fund is causing them to be very short. They will need to cover the BCH shortage either with actual crypto or enough options to cover the investors influx of cash.

This big of a move will likely cause the price to increase on the exchanges where the market is thin to start.

The tweet is showing the market is starting to see BCH as a way to digital spend crypto over btc due to fee and trx time supporting the theory that the influx into the fund is enthusiasm for BCH

Stocks do trade above intrinsic value all the time, but they are companies that invent and grow. This is a trust that only holds Bitcoin Cash. They don't have revenues or invent new technology. They just hold BCH. For it to trade at over 500% of NAV is incredible.

I forgot to mention that the trust will review and reblance at the end of every quarter. Well, the end of this quarter is on 3/31/2021, which is this Wednesday.

Congratulations @getonthetrain! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 18000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Yo man, where are you, why no posting anymore haha

This year's hivefest is in Mexico, pretty close to you, are you going? Would be awesome to meet again after 6 years since we met!