Disclaimer: This article reflects my own views and I try to be as objective as possible. None of what I write here is in any kind a financial advice. With those moving markets anything I claim probably turns out to be false and things come as unexpected as always.

Introduction

I watch Richard Heart's videos ever since he had a good argument with Roger Ver on his stream. Especially at that occasion, I was very surprised on how well he can lay out his argumentation and leaves no space to his opponents. Despite the fact, that he does this with various (maybe unfair) rhetorical techniques, he is ahead in most of his disputes. His knowledge is both economic and technical is certainly very deep and his very critical attitude about the utility of cryptocurrency is certainly easily defendable since 2018.

Unfortunately, since several weeks, the channel lacks any interesting content and turned into a shilling contest about his new project called "BitcoinHEX". The channel lacks any interesting discussion partners and he talks solely to a bunch of puppets who are asking (probably ex ante scripted) easy questions about BitcoinHEX. No challenges whatsoever. His channel and content changed from disputing about interesting topics to promoting his own product. And whenever this is the case, I immediately get careful and try to understand the underlying incentives.

I took a closer look on the coin and asked myself whether I should participate or not. By doing so, I tried to proceed very rational and during the process I figured, that my approach might be beneficial for other people, too. In the following I will shortly state the idea behind BitcoinHEX, provide arguments why one should or shouldn't claim and finally provide some calculations in order to help everyone make some educated choices.

What is BitcoinHEX?

Without going into too much detail, BitcoinHEX is a new ERC-20 token running on the ETH blockchain. The general idea is that you can stake your coins for rewards and the longer you lock in your coins, the more interest you get. It has no ambition to function as a currency but rather aims to provide a storage of value. The utility of the coin is solely determined by its limited supply.

In that sense, BitcoinHEX has nothing to do with Bitcoin aside from the fact that you can claim 10000 BitcoinHEX per Bitcoin held on a snapshot yet to be announced. The value of a coin is, as usual, derived from demand of people who buy it. Everyone who holds BTC to the time of the snapshot can claim BitcoinHEX. For more details you can check out the homepage and all of his recent videos.

Why shouldn't I claim BitcoinHEX?

If everybody receives free coins, why should I not claim BitcoinHEX, right? Well, as always things come at a trade-off and nothing in live is free. In order to claim BitcoinHEX you need your BTC on a legacy address (starting with "1"), because you can only sign messages from those addresses. Other addresses (especially P2SH, starting with "3") are not supported. Why is this important? Because most likely your cold storage (hardware wallets such as Ledger or Trezor) are storing your coins under a segwit address and therefore are not eligible. This means that you will have to transfer your funds from your cold storage to a new address. This is always a hassle and bears a risk of doing something wrong by e.g. sending it to a wrong address. No problem, you think? Well here is the second and most important reason: Privacy. If you value privacy, you probably store your BTC in various addresses. In order to claim BitcoinHEX, you need to sign the message with each of those addresses. But this is not enough, because you would need also various ETH addresses such that you do not reveal that all those different BTC addresses belong to one entity. Therefore, you will probably take the easy choice and send all funds to one Bitcoin legacy address and sign to one ETH address. This obviously compromises your privacy the most. A third reason is that in order to sell your tokens, it needs to be listed on an exchange. How and when this happens remains unknown. Richard Heart and his team, however, have the highest incentive to get it listed somewhere. It probably will be some shady small exchange instead of one of the bigger reputable exchanges.

Why should I claim BitcoinHEX?

As we experience the cryptocurrency space many coins are valued at a positive price which probably shouldn't. It is not that I say, that BitcoinHEX should be valued at zero but rather that it does not matter whether this project really lives up to the promise or not. The probability that you receive a positive price per coin is rather high. Therefore, it is likely that you can make a profit. In addition, there is also the positive probability of this project really taking up traction, I guess.

When should I claim BitcoinHEX?

Now we turn to the interesting part of this article: We evaluate the trade-off of claiming your BitcoinHEX. I propose that one should claim BitcoinHEX once the expected utility exceeds the expected dis-utility from doing so. Keeping things simple I would suggest that the utility is simply a linear function of the profit, say the profit itself. The expected dis-utility, on the other hand, is rather hard to compute for each individual. This depends on your individual probabilty to lose coins, being attacked because you compromised your privacy and your opportunity costs of moving around coins, signing messages etc.

Therefore, I suggest you calculate the expected profit and try to "feel" whether this is worth all the hassle. I provide you with a tool and simple calculations from which you can derive your own expected profit. This depends heavily on the assumptions but I try to make them as flexible as possible.

What determines your profit?

I will derive a simple formula to calculate your own profit. Unfortunately, Steemit does not provide a proper way to incorporate formulas (or I did not find it). Still, I claim that your profit equals to:

Profit = yourAmount_BitcoinHEX * price_BitcoinHEX

This makes sense, right? Let's further break up the variables:

Profit =(your_BTC * 10000 * 1.44) * (marketCap_BitcoinHEX / TotalSupply_BitcoinHEX)

The amount you get for your Bitcoin is perfectly known such that you receive 10000 BitcoinHEX for each BTC and I assume you are smart enough to self-refer and gain an 20% bonus and claim in the first week to get an additional 20% speed bonus. This leaves you with 14400 BitcoinHEX per BTC claimed. The price is simply a function of the marketCap and the TotalSupply of BitcoinHEX. We could model the price in various ways but you will see shortly why this comes in handy. Let us further split up the variables:

Profit = (your_BTC * 10000 * 1.44) * (marketCap_BitcoinHEX / (TotalBTCSupply * 10000 * perc_cl))

As we know, the TotalSupply of BitcoinHEX is every BTC * 10000. However, they penalize some BTC holder (rich addresses, MtGox, Exchanges etc.) so that the total BTC supply does not reflect the propoer amount which can be claimed. Therefore I checked https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html and summed up the BTC from addresses until from 0.001 - 100 BTC. At the time of writing this leaves 6.650.777 BTC. The new formula is:

Profit = (your_BTC * 10000 * 1.44) * (mCap_BitcoinHEX / (6.650.777 * 10000 * perc_cl))

The perc_cl is your estimate of how much percent of all the eligble BTC are signed and produced to BitcoinHEX during the 50 weeks period. To keep things simple, we assume that almost everything is claimed instantly. Note further, that you could multiply the supply of BitcoinHEX with 44.4% (referral + speed) since the currency is inflated by the referral bonus. However, making assumptions about how many claimees use referral intertwines with our assumptions on the total eligble BTC, anyway. Therefore, I see no need to adjust the total supply of BitcoinHEX.

As you can see now, this leaves us with a very nice function where we can insert our own assumptions and calculate the profit. Feel free to try it yourself.

Example Assumptions

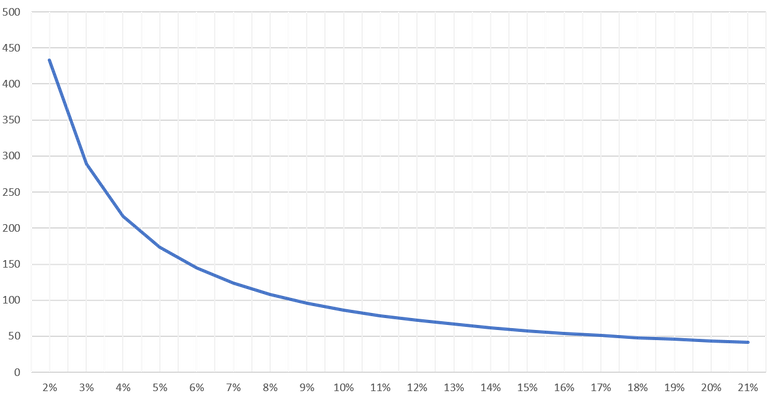

To do some work for you, I simulate the profit on the example of having 1 BTC and future valuation of 40 million USD (market cap) for various values of claim percentages. I chose 40 million, because from looking at the coinmarketcap.com rank list, BitcoinHEX fits in nicely with the coins in that area. Before we dive into the calculation, I would like to state some very important assumptions:

- BitcoinHEX is listed on an exchange in order to get a price for each coin.

- The market needs to have sufficient liquidity so that it reflects a reasonable price and such that the books can take your selling order without crushing the price.

- The code of BitcoinHEX is as described and works properly.

- The (micky mouse) model I develop is static and therefore implies that you claim and dump your coins immediately. A combination of holding and/or selling would complicate the model, because we would need to add a time variable with price movement, stake rewards etc.

- The calculation depends heavily on your specification. You could easily tweak the numbers such that you are becoming a millionaire or that your profit is just dust. Therefore you have to take my calculation just as an example and acknowledge that it is probably inaccurate a.f.

Without further due, let us dive into some numbers and graphs:

As you can see from the graph, your expected profit depends strongly on how many people claim their tokens. If you think this through, one can see counter-factual effects here. On the one hand your profit depends on how well people think about the project. On the other hand, this also determines how many people claim, which then drives down your profit.

Corresponding to the graph, I provide the value table for you and rounded up the numbers.

| Claimed | 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 11% |

|---|---|---|---|---|---|---|---|---|---|---|

| Profit | 433 | 289 | 217 | 173 | 144 | 124 | 108 | 96 | 87 | 79 |

And the second part:

| Claimed | 12% | 13% | 14% | 15% | 16% | 17% | 18% | 19% | 20% | 21% |

|---|---|---|---|---|---|---|---|---|---|---|

| Profit | 72 | 67 | 62 | 58 | 54 | 51 | 48 | 46 | 43 | 41 |

The table tells us, for example, if you sign the message on an address with 1 BTC, the market cap of BitcoinHEX is 40 million USD and 18% of those 6.650.777 BTC are claimed, you earn 48 USD. As you can infer from the formula, the profit depends linearly on the market cap and the amount of BTC you use to claim. This means that e.g. you can multiply every profit value by if you claim with 2 BTC or believe that the market cap is twice as large. You cannot do this with the claiming percentage.

My personal opinion on BitcoinHEX

I have several issues with this project but I agree on some parts of Richard's ideas. Aside from one remark, I focus on judging what I can observe from the project and abstain from making too many assumptions about the underlying motives of Richard Heart and his team. Only he and his team know whether they really believe in what they say and whether they will stage a pump and dump (with possible following exit) or take it seriously.

Cons

- I detest that Richard Heart is constantly bragging about the "game theory" behind his coin and that it is so good. For example: When you "try to understand" and check how good the game theory is, you fail to find any formal model whatsoever. At no point do they provide any calculation of equilibria and corresponding equilibrium strategies. Because this is what you do in game theory. In contrast, he keeps using this expression as synonym for "I really think the qualitative arguments make a lot of sense" and exploits its appealing sound to the ordinary listener. A formal model would have the benefits of making it easy to test their assumptions and show clearly under which conditions his coin works or not.

- He abandoned his former project about a coin to provide computing power for differential equations, which are commonly used to simulate liquid flows (correct me if that is wrong) in favor of a simple smart contract with staking properties. This could indicate that Richard Heart and his team is looking to make a quick buck. I guess nobody doubts that this project is aimed to increase the profit of the founder team and at least Richard Heart is honest enough that he would not disagree. However, there are still enough scenarios where the only one's who profit are the insiders. I guess one could add additional points with regard to ethics and so on, but due to my economic schooling, I personally do not have a problem with trying to make money and being honest about how you do it.

Pros

- The project runs on the ETH Blockchain with a reviewable smart contract which cannot be changed in the future. The project is what it is and there is no expectations about future developement (which is nice in contrast to most coins who promise you a world where their coin will eventually solve some made up problem).

- If you do it properly and don't speculate by buying BitcoinHEX, the downside potential is limited to the individual risks described in the previous section about why you shouldn't claim. If you feel comfortable handling coins and privacy, you should be fine.

- Choosing to use the method of signing the message is the best way to claim safely. You will not have to download any shady wallet where you need to import your private keys.

- Personally, I agree about the fact that (currently) Bitcoin is mainly used for a store of value and that the ability of a deflationary commodidy to be a proper currency might be problematic. There are theories (I don't remember the name) that a bad currency always drives out the good currency, because nobody wants to hold on to the bad currency and therefore only use the bad currency. In addition, from personal experience you do not want to spend Bitcoin if you believe that next year you can buy a car instead of a bicycle.

Conclusion

In this article I tried to provide you with objective arguments in favor and against claiming BitcoinHEX. Furthermore, I laid out one approach how you can calculate the expected profit of claiming BitcoinHEX, flexible to your own endowment of BTC and beliefs about market cap and claiming percentage. As always it is unpredictable how the price will evolve but at least you can now play around with the numbers and decide for yourself. Personally, I think that, given that you decide to claim, the best strategy is diversification. This basically means that one sells a proportion (say 50%) immediately to realize some profit and the remaining 50% you can play Richard's game and either become a millionaire or get some worthless BitcoinHEX. All in all, I am looking very much forward to see what the market thinks about Richard Heart's idea of a better Bitcoin with the sole purpose of storing value. Now there is no more cheap talk but hard valuation. That being said, if I claim, I use it to maximize my BTC rather than BitcoinHEX.

If ever Richard Heart reads this, I ask you: What do you do with your BitcoinHEX? Will you lock up your coins for 50 years? (I can imagine him laughing and saying that he will not make it another 50 years, but 15 years would also be a statement, Richard).

Leave me some comments about what you think about BitcoinHEX, my article or which specifications you think are reasonable for this project. Let's have a nice discussion.

If you chose to claim and want to use my referral code use http://bitcoinhex.com/?r=0xd0E4dBe97a6553FC056D9B2D9EE9745660B7f715

EDIT: I edited the article in various ways after I received feedback from Richard in

- I included the speed bonus in my calculations and updated the numbers.

- Richard said that in total 12.000.000 BTC can claim BitcoinHEX. I stayed with my calculations since I would have to analyze how many of that would be penalized etc. etc. In my opinion it is also very unlikely that a whale will claim his tokens.

- On my question about how long he will lock up the coins he answered: "Personally I wouldn't lock up my coins for 50 years, because I'd be around 90 years old then, and I'd rather have money available earlier to fund the medical technology to make my 60's nice."

PS: For a very critical view on the project, see https://cryptoinsider.com/why-richard-hearts-bitcoin-hex-is-a-scam/

Great article! I'll need to go over it again but without coming off as snarky I would add...

The pool that the staker's share in is funded by coins that haven't claimed or cannot e.g. Mt. Gox trustee, satoshi's et al.

Stakers are receiving a dividend at the completion of a staked period of Hex but this dividend would not be considered interest, as you mention in the article but a yield. Which is dependent on the staked period and the compounding accumulative effect of each minimum staking period which checking now, since I don't know is.... 7 days....

I forgot where I was going with this but your post was great.

His first post too... are you on Twitter or YouTube?

Hi m-dpt

Thanks a lot for your feedback. I have to go over your comment again and after I understood it, I will edit the article :). I tried to stay away from calculating staking, because the dynamic of such a model would exceed the purpose (since there would be too many assumptions). But maybe I did not understand you correctly.

I don't have a twitter or youtube, I am staying under the radar ;)

Hello @thecryptoj! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko

Congratulations @thecryptoj! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!