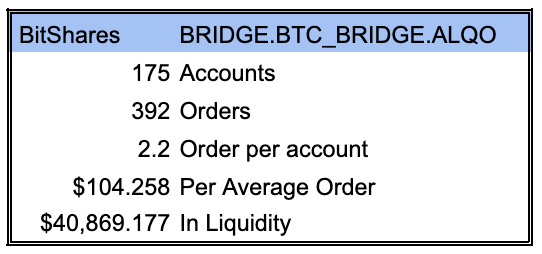

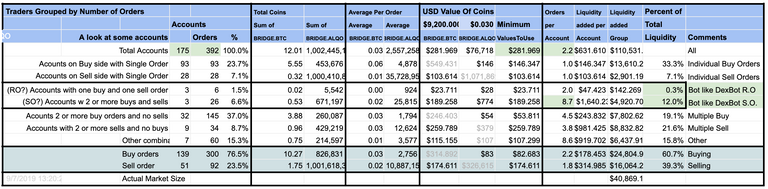

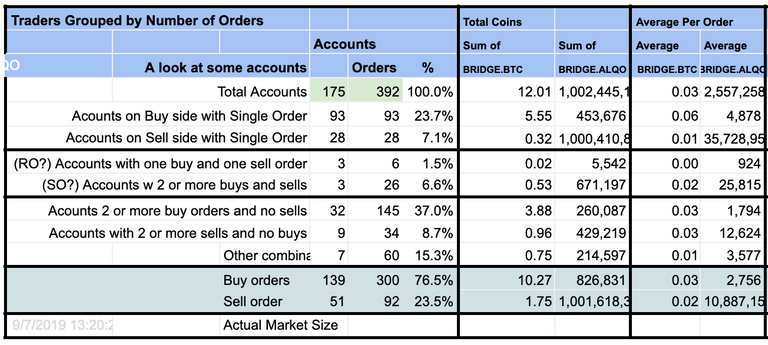

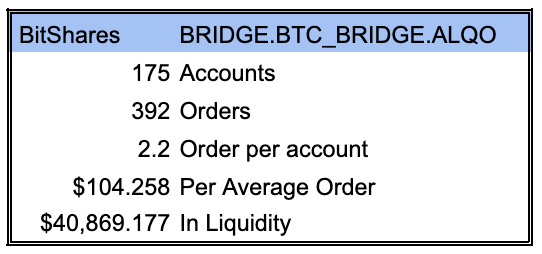

The BRIDGE.BTC and BRIDGE.ALQO market has 175 accounts with 392 orders at an average size of $104.26.

This report continues my look into some market statistics around BitShares.

Liquidity is an important part of any market.

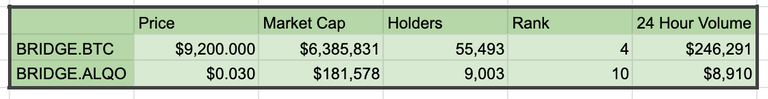

Let's take a look at the markets, it is important to have good perspective.

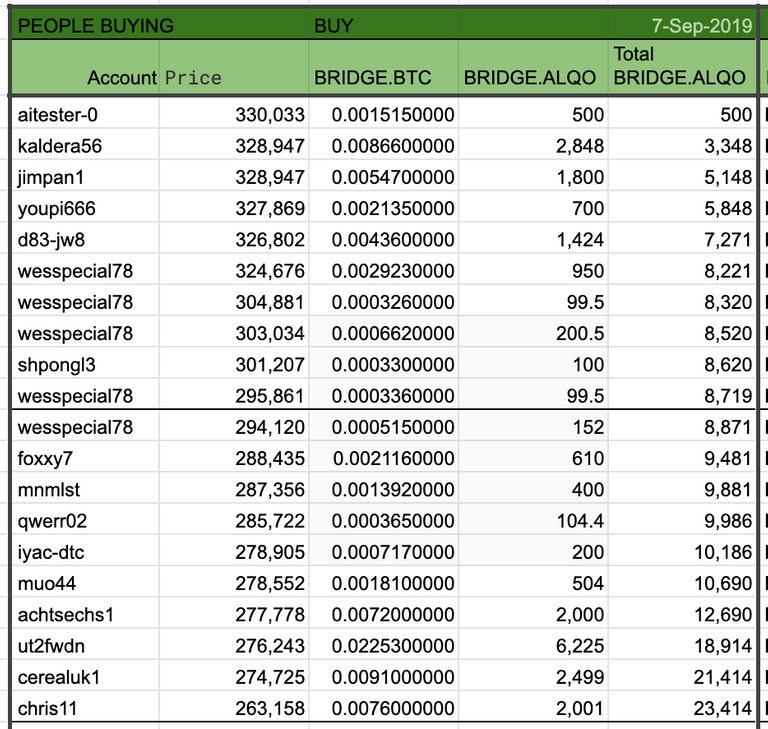

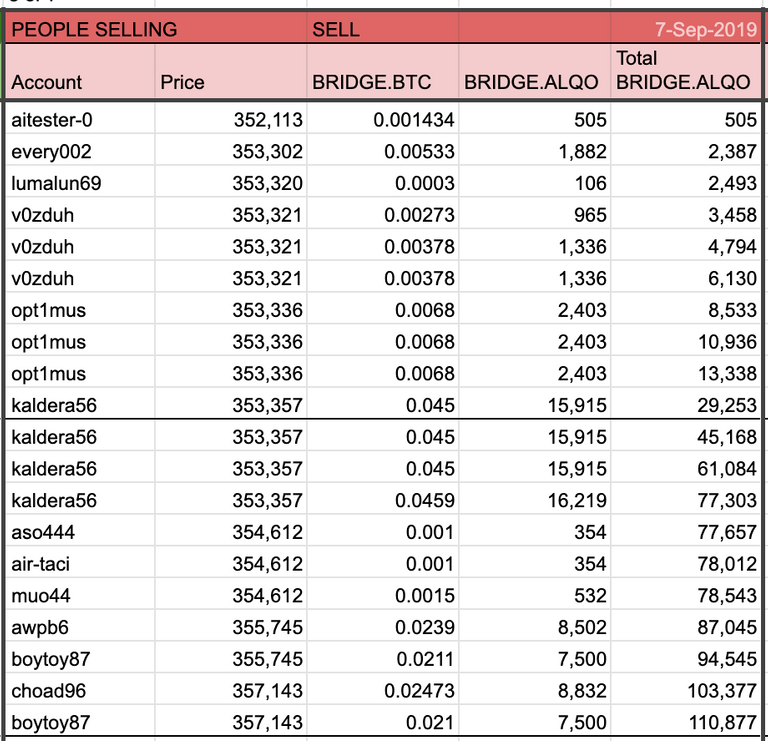

Let's take a look at some of the individual orders on the books.

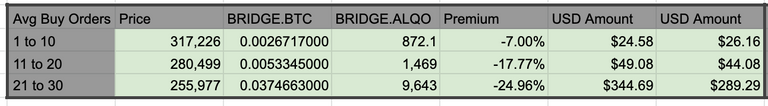

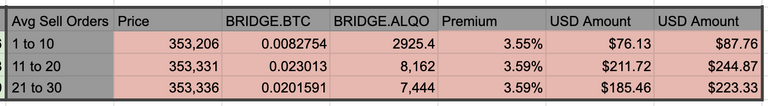

To get a better understanding of these numbers lets group the orders by ten at a time and take on average of them.

This shows the ability to buy and sell into the market.

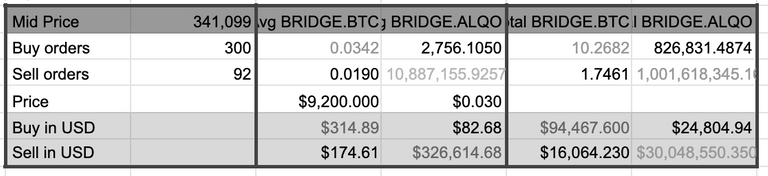

Now that we have seen the top layer of the market, let's look at statistics on the whole thing.

We need to understand the total size and amount on offer.

This data is limited to the top 300 orders on both sides of the market.

How many people or accounts make up the market?

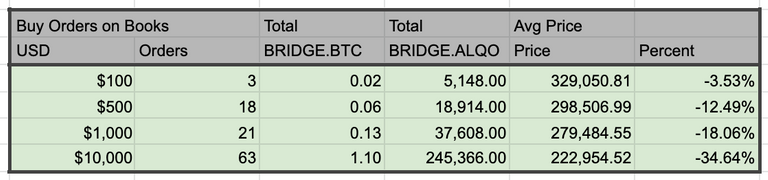

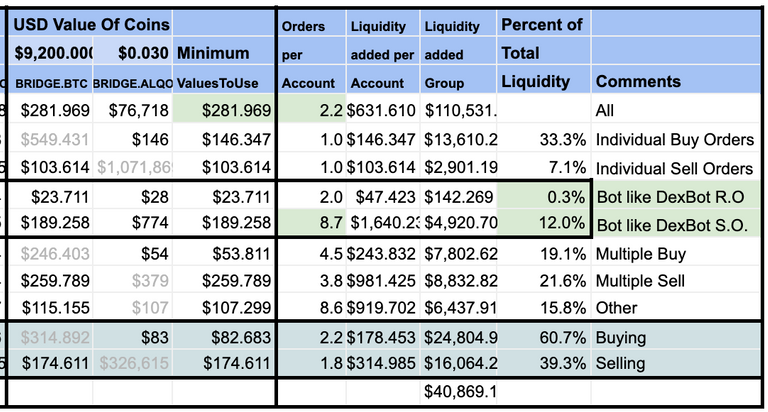

So how liquid is the market?

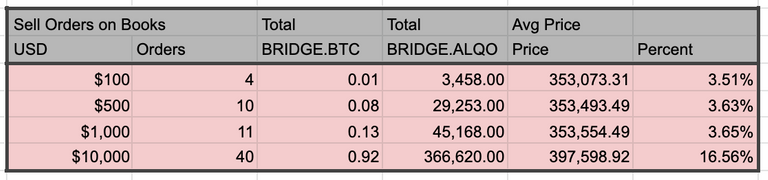

If you wanted to buy and sell a set amount of money, how much price premium would you pay?

This table uses USD to compare buying or selling into the market.

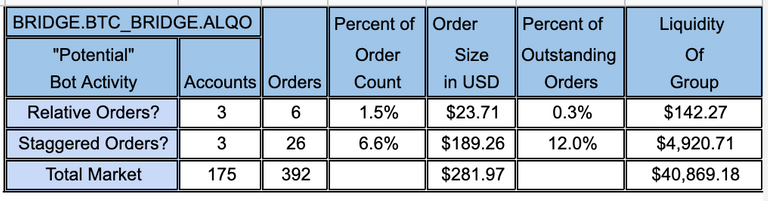

Another thing, we want to look at is who is buying and selling.

It can be helpful to look through the market, and divide the orders by the number of orders per account.

This will show us how much might be individuals and how much might be bots.

Of interest to the DEXbot group is the number of bots that are making up the market.

"Staggered Orders" counts those accounts that have multiple orders on both sides of the market.

Full Disclosure: This is all an educated guess. We don't exactly know if these are bots, or humans, but bots typically have orders on both sides of the market.

We also do not know which Bot software is being used. Both Rudex, and DEXbot have publically available bots and there are multiple others at work in the market.

One strategy that is sort of easy to pick out is the DEXbot Staggered Orders Strategy, it has numbers orders spaced apart.

I believe, all this data is correct, but you are advised to investigate any questionable findings yourself. If you find some errors let me know and I will try to fix them.

That chart is rather big, so let's break in two.

Here is a chart that simplifies the Bot Activity

While DEXbot makes it easier to trade it is important to point out this is a decentralized exchange. All liquidity is provided by traders who are trying to profit for their own accounts. This is a free market, anyone worldwide can participate in it. As a blockchain project, anyone can use the various block chain explorers to see what is going on in the market, and who is trading what. This makes it more fair and transparent than a lot of exchanges that run their own bots to trade with customers.

BitShares is a Decentralized Exchange where you can buy and sell various cryptocurrencies.

The DEXbot is a free market making software where you can run your own bots on the BitShares exchange.

As a decentralized organization, people in the BitShares community step up as needed.

Once you own own BitShares you can participate in the community, and vote for worker proposals or set a proxy to vote for your interests.

Business analytics and the ability to know what is happening inside the markets is very important to people at BitShares.

Seeing a need for better analytics and understanding of the market dynamics, these reports were launched.

https://www.dexbot.info/

Data is pulled from the block chain explorer https://www.cryptofresh.com/

https://www.bitshares.org/

I believe, all this data is correct, but you are advised to investigate any questionable findings yourself. If you find some errors let me know and I will try to fix them.

The DEXbot Liquidity reports are brought to you by Cryptick1 as part of the BitShares DEXbot Worker Proposal.