In a recent Huffington Post article that is catching fire throughout cryptodom, John Gotts outlines a brilliant plan to protect the new industry from the falling dominoes of unqualified and overreaching outside regulation. At stake is the freedom of most digital tokens to remain free of burdensome requirements that historically apply to true securities.

This article talks about a new movement in which John Gotts has enlisted many crypto industry leaders to seize the initiative and self-regulate, rather than leave that option open to other regulatory bodies who may feel tempted to extend their dominion over that function if a vacuum is left for them.

Key to the process is the differentiation between tokens that represent securities (Security Tokens, aka "Stokens") and those that are clearly NOT securities and therefore not subject to regulation under securities law.

Here are examples of non-security coins:

- Charity – Coins used to raise money for a cause

- Games – In-game purchases for magic swords, gaming…

- Reward for Work – Utility for getting someone to test, mine, refer…

- Software/Site Access – Provides Access to something of value

- Coupon – A digital coupon, redeemable for something of current value

- Currency – A digital token tradable for goods or services

- Network of Physical Access – Provide access to somewhere that is valued (i.e., an altcoin sale or nightclub)

- Fat Protocol – The software becomes more valuable the more apps and businesses are built on top of it. Union Square Ventures posted a great article about fat protocols here.

This is particularly important to the BitShares community with its rich selection of all these types of tokens. It is also exciting because John plans to introduce dozens of high-quality Stokens to the BitShares platform, making it a shining example of how tokens and stokens can exist on a common decentralized exchange superhighway.

John's article is a great read, and Cryptonomex supports his initiative.

Cheers!

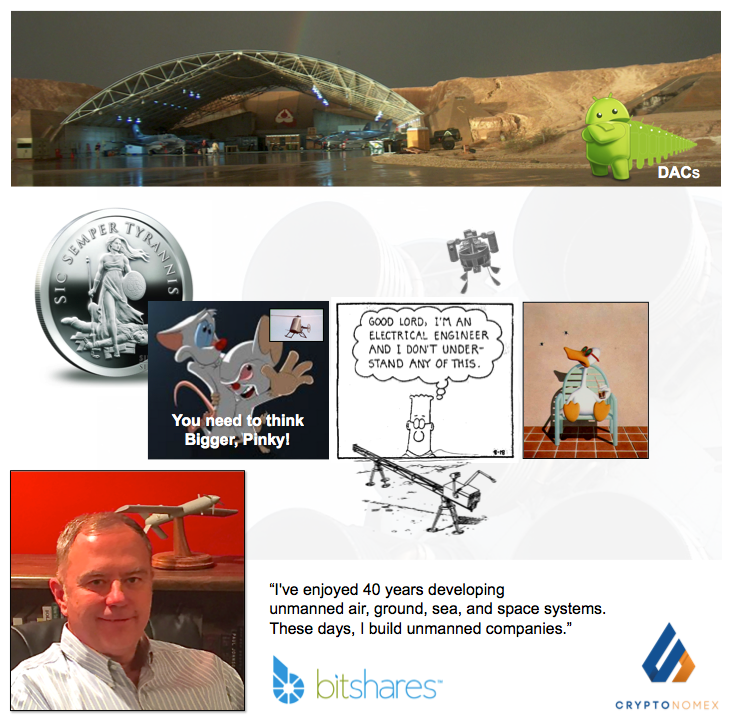

Stan Larimer, President

Cryptonomex

The Godfather of BitShares, Fast Bitcoin, and the HERO

About the Author -- Stan Larimer

Follow Me On Steemit - The Social Media Platform That Pays

Please Connect To Me On Linkedin!

Greatest Hits

Bitcoin and the Three Laws of Robotics

Engineering Trust with Charles Hoskinson

The Origin of BitShares

The Hero from BitShares Island

So, have to ask, since it jumped out at me, what were you doing reading Huffington Post ??? LOL

We just publish there. Write-only memory.

W'RIGHT angle MemorY - ))

ha ha - ))

GreaT PosT ! - )))

and .. a 'very' enCOURAGinG art-ic-le !!! - )))

Nice to k'NOW .. "big brains" .. have "HUMAN(i)TIES" BACK !! !!

.. thank YOU ! - ))

lovelovelove )))

greb'Z )

@stan,

Thanks for sharing this interesting news! Actually this is a very useful article for all crypto lovers! Your post are always adding true value to the community! So here again a new one! I really like that non-security token details!

Really appreciate your effort!

(My upvote power was drained and still not well recovered. Please allow me two more days to give you 100% upvotes)

Cheers~

The alternative: https://www.coindesk.com/australia-weighs-jail-time-cryptocurrency-exchange-offenders/

I would rather not give the SEC, FINRA and US Gov't the keys to this Ferrari we built. Call me crazy, but no way Jose.

Thanks, I will read the article in the morning.

Quite interesting. I will need to follow up and read that article in full, but it sounds familiar to what we do in the CPA profession in the US, to which I belong. Or at least that is what the CPA profession has tried to accomplish.

In essence, we are self-regulating - which works sometimes and fails spectacularly other times. But it manages to keep the SEC out of the lion share of our overall rule-making and business practices in areas that are clearly outside of SEC regulatory control.

At least I have the choice to do work outside of the reach of the SEC. And I definitely and intentionally make that choice.

Very interesting that new coins are coming and the classification of what are security coins and non-security coins.

I think self regulating is critical to the future success of digital currencies. Not giving governments a reason to step in and start messing with crypto as long as possible is for the best. The "Wild West of free market is always preferable.

good

bitcoin poloniex steem.Bitcoin's price has jumped again, breaking the 3,750 USD mark, with 4k in sight.

nice post ...i upvoted you plz upvote me ??

Not how it works here.