When you find an ICO you like, it’s time to fork over some of that ETH, or another cryptocurrency, to help bring it to life! But how do you know the developer isn’t going to run off with all of your money, as so many others have done before?

Hopefully the ICO you’re interested in has an escrow system in place to help gain investors’ trust. Although it doesn’t entirely prevent exit scams, as a developer could always build the project to completion and then abandon it after he has been paid, having an escrow system in place does suggest that an ICO has been more thought out and taken seriously by the team.

An escrow system involves a third-party smart contract system. Investors send their ETH tokens to the escrow company, who creates a smart contract that will only distribute a certain amount of funds raised during different road map milestones. The conditions of the escrow payments will be transparent for all to see. In order to trigger an escrow payment, multiple members of the team and the escrow company have to sign for it.

Escrow can also provide for helpful financial management. Traditionally, ICOs do not use escrow services. Initial Coin Offerings (ICOs) allow for substantial amounts of funding for a company to be raised in what is normally a short period of time, and is collected from participants up front throughout the span of their ICO. This is, on average, between one and two months.

Many crypto developers want to do good in the world, and have contributed a lot of their time and energy to the open source community for free, and are not motivated by the idea of becoming as rich as possible.

ICOs have collected, for some companies and individuals, massive amounts of money. A huge haul north of $10 million dollars suddenly meant everyone was rich, and there was little incentive to still work another day in their lives. Many people who began with noble intentions just abandoned their ideas for a life at the beach. There have been many instances of major fraud where amounts collected during an ICO, along with the founding team, have disappeared.

Sometimes, there are situations where individuals within a team, and not the whole team, are the instigators. A co-founder, who is often a businessman rather than a developer, and only interested in the money side of the ICO, can run off with the funds raised, or hold the funds hostage unless their ideas are implemented.

A good example of this is the Tezos project. Tezos had a well-documented fight between the founders, and their billion-dollar ICO haul was locked up for over a year while legal battles for control over it raged on. Eventually, the guy who had control of the money agreed to leave the company and return the money, which only he had access to (after reaching a settlement which meant that Tezos will buy his resignation). An escrow system would have prevented this from happening.

Another benefit of using escrow, aside from insuring against greed or other illegal or immoral motives, is to allow for the transition of payments to be distributed over time, ensuring there will be no issues with regards to overspending, which for many new businesses is often the case. As the value of the collected ETH goes up or down, the smart contract can compensate to pay out more or less, depending on needs.

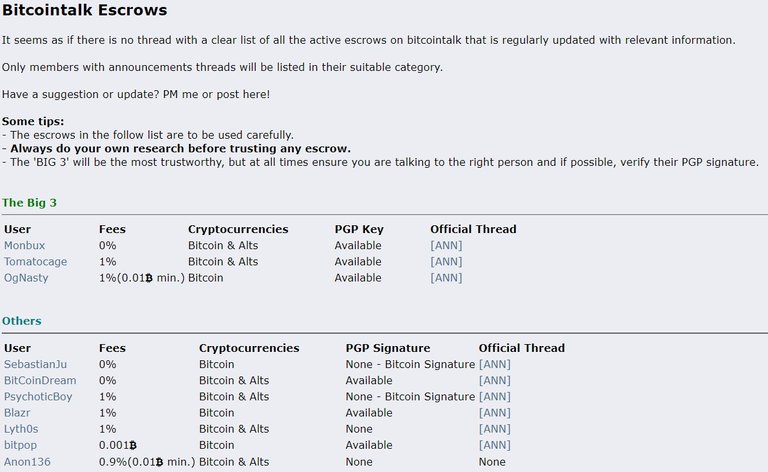

Escrow companies have earned the trust of the community over time, proving they are honest and secure. Originally, individual people provided escrow services. Their trustworthiness documented simply on the bitcointalk forums, as seen below:

Now, there are established companies which handle escrow for ICOs. Just a few of the more well-known ICO escrow companies include 99bitcoins, IBC Group, and Descrow. Essentially, these escrow providers are just third-party smart contracts providers.

If you find a project you have researched thoroughly and want to invest in it, don’t let the lack of an escrow service scare you away, but if one is, you can perhaps sleep a little easier at night.

Originally published at cryptofinance24.com.