Blockchain continues to act as major drivers of social and economic change, creating new opportunities and disrupting existing business models. By introducing cryptocurrencies like Bitcoin or Ethereum, startups now have the option to raise capital through an Initial Coin Offering (ICO) instead of the traditional Initial Public Offering (IPO). This provides investors with new opportunities to back promising startups with minimal barrier to entry. The catch is—they can only exit by selling or exchanging their crypto assets on volatile exchanges.

In the current market, investors don't have a way to effectively manage their crypto assets. If you're a seasoned crypto investor, you should have experienced the crazy price movements that are driving the community from euphoria to dysphoria in a vicious cycle. Investors have to rely on their discipline to closely monitor prices for a profitable exit. But, not many could tolerate this volatility swings on their respective holdings. This was why traditional asset management became popular among investors. They offer investors:

- greater management of portfolio

- better chance to maximise capital value of their investments

- less risk exposure through portfolio diversification

As the market becomes more regulated, institutional investors are more likely to take advantage of these new opportunities, which will also increase demand for new investment funds to manage crypto assets and cryptocurrency portfolios.

So, how will this affect the investment industry?

Because of these technological disruptions, the investment landscape is rapidly changing. So, it doesn't matter how fast you run if you're on the wrong track. We must acknowledge that the rules of the game have been rewritten with blockchain, and to survive, fund managers must transform the way they work. They need to take advantage of the technology innovation to differentiate themselves and improve operational efficiency, managing costs on a structural basis.

As many investors move towards investing in funds for convenience, fund managers need to reshape their business to focus on the evolving needs of their clients, which will look very different in the near future. They're much more mobile and global, more connected to many different communities, through social media and other networks. All together, they're a far more diverse demographic than today's clients.

Now, more than ever, managers have to find the right balance, get closer to their clients, and anticipate their needs. Thankfully, Nousplatform provides the secret recipe to winning this battle.

The Open Investment Ecosystem

With traditional investment funds, trust is absolutely key, and that needs to be earned because they operate in a centralised manner. But at Nous, trust is embedded into Smart Contracts, which will support a new financial ecosystem for investors and decentralised investment funds.

The Nous Platform allows existing companies, as well as newly established startups to tokenise their assets for investments. Fund managers operating on the platform can create and manage investment funds within a few clicks. Most profitable funds will be listed in the top rating and investors can easily track the activities of each fund to decide whether to buy or sell their assets.

Here are the three major components:

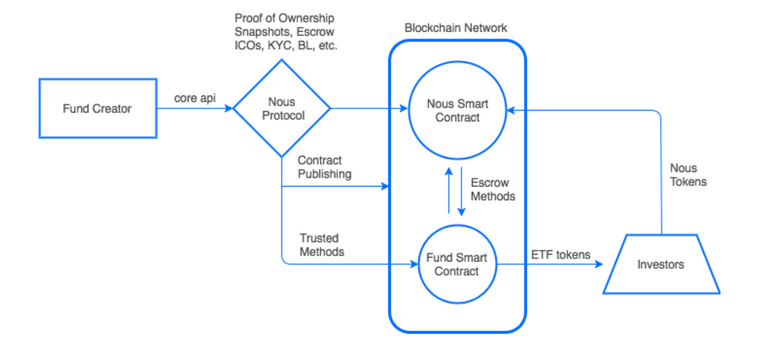

Nous Protocol

A framework that employs smart contracts to set the rules of on-chain collaboration between investors and projects. Protocol sets the terms for interactions of the parties and can be adopted according to the type and the functionality of the project.Auditing Oracle

It's the on-chain and off-chain integrated solution consisting of smart contracts, and API that allows access to certain data of the investment project such as gathering statistics, order books, exchange rates, etc.Nous Platform

The web front-end interface that allows managers to create an investment project and deploy it on a blockchain. Functionalities of the platform includes, but not limited to: KYC process, acquisition and liquidation of the assets of the investment projects in the form of ERC-20 tokens.

Nous will issue a utility token (NSU) for use in the Nous Platform. NSU will act as one of the in-platform currencies to establish functionalities like:

- Acquisition of tokens of open-ended crypto funds

- Acquisition of tokenised assets of companies

- Participation in ICOs of closed-ended funds or startups

- Payment of dividends of closed-ended funds

- Establishment of reserves of open-ended funds to increase liquidity

- Platform for Commissions payout

- Use of tokens to pay for goods and services

NSU tokens initially will be made available once the Nous Platform is completed. The NSU token will be based on ERC-20 token standard, with a total supply of 2.5 billion.

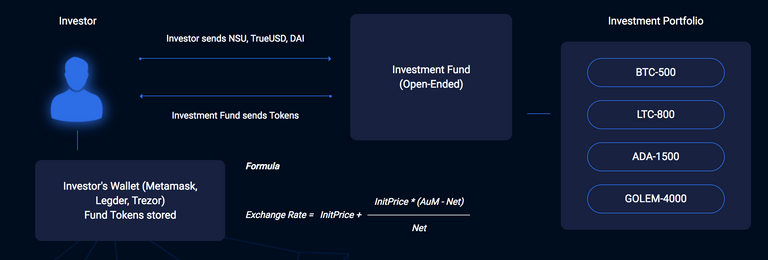

In addition to NSU, Nous Platform will also allow the use of USD pegged tokens such as TrueUSD, DAI and some others for acquisition of fund assets.

So, how it works?

Fund managers can select the type of project to create. In the first release, there are six types of investment projects:

- Open-Ended Fund

- Closed-Ended Fund

- Venture Capital Fund

- Charity Foundation

- Family Fund

- Business/Startup

For more information of each types of projects, you can read their whitepaper. The types of projects could also be extended in the subsequent releases.

In the Nous Platform, manager (a.k.a fund creator) will provide the terms and conditions of the project, as well as parameters of the token. Each project will issue its own token that's backed by real asset. These information will be passed to Nous Protocol via API, which will then publish the smart contract on the blockchain. The fund smart contract will delegate a part of the authority over the investment project to Auditing Oracle through trusted methods such as verification of asset ownership, identification of fund managers, and much more.

After the contract is deployed, the manager goes through a setup process to configure wallets and exchanges' API for Auditing Oracle to track and make snapshots of the trading statistics and recalculates the price of the token. If the manager ignores Auditing Oracle and tempers with the collection of statistical data, Auditing Oracle may remove the project from the listing at its own discretion.

By and large, Nous Platform approach will ensure fairness and transparency for both parties and will help protect investors from any manipulation by fund managers. All together, these mechanisms make the investment more trustworthy and attractive.

As for investors, they will be able to invest in any project at any time by purchasing the project's assets as ERC-20 tokens. If the investor wants to liquidate all or some of the assets, he/she would receive NSU at the current exchange rate at the time of the transaction.

The Nous Platform will provide tools for analysing and evaluating funds based on various statistical data collected by the Auditing Oracle. These unaltered real data reports will be available for any user to review. The main advantages for investors are:

- simplicity

- transparency

- ability to diversify

- quick deposit or withdrawal of funds

- no bureaucracy

- set rules of participation for all the parties involved

- no minimum amount entry requirements

- unaltered and accurate data

In the future, there will be a merchant portal for the Nous Platform, which will allow investors to pay for goods and services using their assets.

Is Nous Platform only for investors or fund managers?

Not really. The Nous Platform is versatile enough to support the following user groups:

- Companies that haven't passed an IPO

- Crypto Investors

- Business/Startups

- Investment Funds

- Charitable Foundations

- Venture Capital Funds

Who are the competitors?

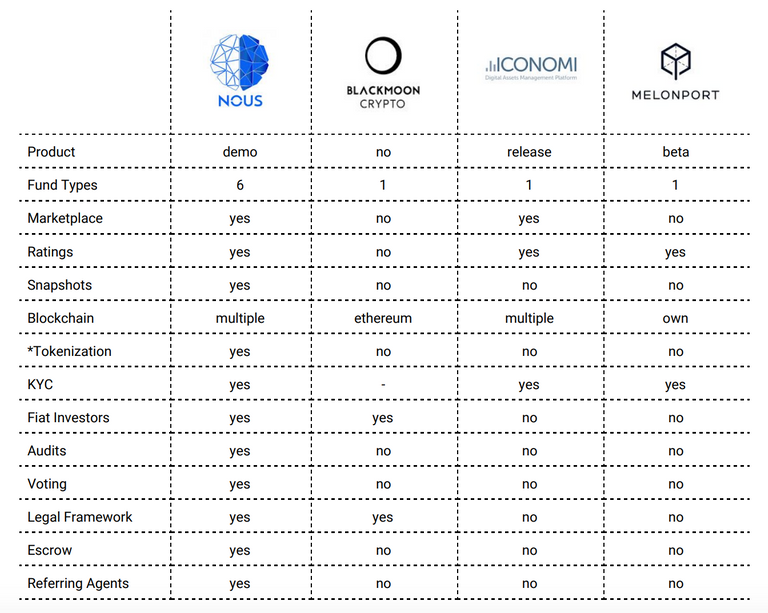

Nous Platform has a very limited number of direct competitors developing solutions to integrate investment management with blockchain technology. Here's a graphic that describes the competitive analysis done by the team:

Is this legal?

Absolutely, 100 percent. In the investment industry, legal framework is one of the most critical aspects of the business. Nous Platform provides services to investment funds and investors, and by doing so, the team is obligated to maintain appropriate compliance to operate its business.

Nous Platform started their operations under the jurisdiction of the United Kingdom and is in the process of reorganising to operate via a Gibraltar entity that's a wholly-owned subsidiary of a British Virgin Islands limited company.

The funds created on Nous Platform will similarly be controlled by additional terms and conditions included in each fund's smart contract, depending on the jurisdiction. Nous Platform will actively monitor compliance of the funds' activities, and acts as a due diligence provider to verify the license of the fund to ensure operation within the legal framework. These include know your client (KYC) and anti-money laundering (AML) procedures as mandated by the laws, rules and regulations.

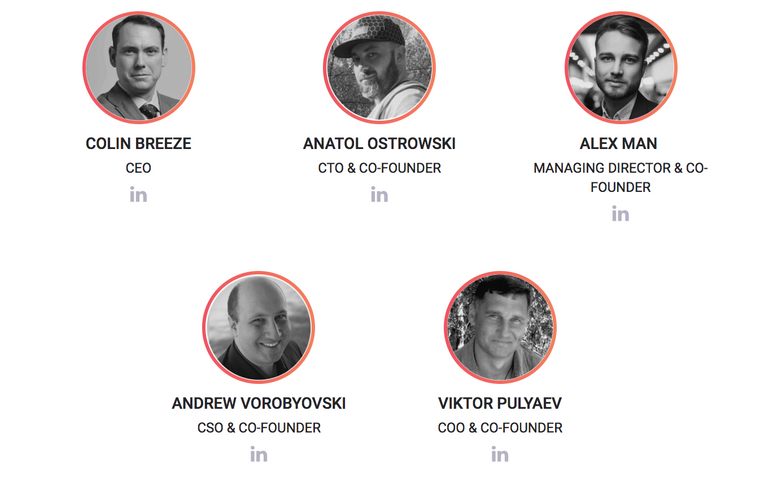

The Team

Colin is the CEO, whose over 20 years of professional experience adds additional value to the project in terms of technology, fund formation and regulatory oversight. He joined forces with four other co-founders (Anatol, Alex, Andrew, Viktor) and together as a team, they're well versed in many aspects of fund management and asset trading, including operations, legal & compliance expertise.

The development team consists of 10 professionals with diversified skillset:

- 1 Blockchain Full Stack Developer

- 1 Back-end Developer

- 2 Front-end Developers

- 1 UI/UX Designer

- 1 UI/UX Coder

- 1 Project Manager

- 1 HR Manager

- 1 Marketing Strategist

- 1 Business Assistant

They also have a solid team of advisors as well, all experts in their respected field. I don't feel it's the strongest support but they all have defined roles as advisors which I do like. I believe some of these advisors are seed investors for the project, so it's in the best interest they succeed.

Strategic Partners

What's Next?

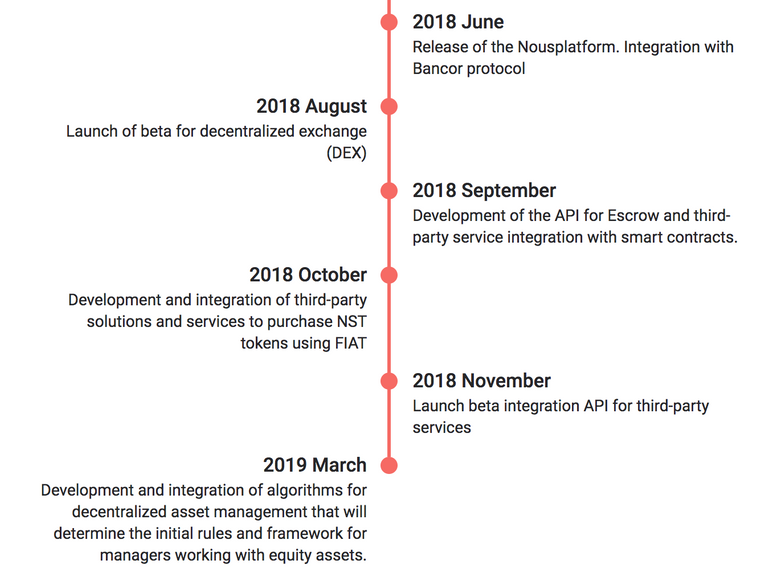

At the time of writing, a lot has already been accomplished by the team:

- Beta Version in May-June 2018

- Nousprotocol

- Smart Contracts

- Nous API

- Insight API

- Ethereum Parser

What's left on the roadmap is:

In Summary

- Tokens sold for equity or other real assets

- Integration of legaltech

- Attraction of investors

- Elimination of intermediaries

- Opportunity for small investors

- Real time statistical data based on blockchain

- Reduction of the fees, deposit and withdrawal timeframe

- Increase in safety and security of investments

- Direct interaction between funds and smart contracts

- Quick acquisition/liquidation of fund shares or any assets

- Rating list of the best performing funds

Investors can:

- Buy Tokens of the best performing funds or projects based on Nousplatform

- Limit risks by choosing top funds or projects with different portfolios

- Use blockchain-confirmed reports to analyse funds or projects performance

- Use 0x Relayer to trade tokens issued on Nousplatform

Fund managers can have:

- Technical framework for creating and managing investment funds or other projects

- Possibility for projects to issue tokens to their investors

- Possibility of tokenisation of assets of the tangible sector of economy

- Automated reports of the fund's performance

- Possibility of dividend payouts

- Automated calculation and payment of commissions to fund managers

- Connection to Nousplatform investors community who can participate in any fund or project

Verdict

Today, we're experiencing a much greater pace of change in almost everything that we do. And most of that is driven by new technology - they enable us to do things more differently, more quickly, more efficiently. Because of this, we need to be far more agile, to respond to changes more quickly than we ever have before in the world of investment management.

I think a really good path to success for investment managers, investors and other businesses is their ability to think quickly on their feet, and that requires a degree of agility which Nousplatform provides. The Auditing Oracle does all the dirty work of project research, and we only have to review and analyse at any time of our convenience. The platform simplifies all the technical bits so that managers can enjoy a complete set of tools that make their job easier and more fun. Less work equals more fun, isn't it?

As an investor, I certainly look forward to the launch of Nousplatform so that I can leverage on this interesting technology to better diversify my portfolio and maximise my investment returns.

Project Website: https://nousplatform.com/

Whitepaper: https://nousplatform.com/whitepaper

Lightpaper: https://nousplatform.com/presentation

Onepager: https://nousplatform.com/docs/nousplatform-onepager.pdf

Telegram: https://t.me/nousplatformEng

Twitter: https://twitter.com/nousplatform

Facebook: https://www.facebook.com/nousplatform

Github: https://github.com/nousplatform