A Report from the McKinsey Global Institute titled "The new dynamics of financial globalization" By Susan Lund, Eckart Windhagen, James Manyika, Philipp Härle, Jonathan Woetzel, and Diana Goldshtein wrote:

[...] In the future digital platforms, blockchain (PDF), and machine learning may transform financial markets and create new channels for cross-border capital flows. These technologies are enabling faster, lower-cost, and more efficient international transactions, and will further broaden participation in global finance to more firms, investors, and countries.

Banks and regulators must respond to several aspects of the new era.

Also read their full pdf report: How digital finance could boost growth in emerging economies

The video below is a reminder about the digital trends and the emerging digital economy. Remember the G20's Vow That ALL Citizens Will Be Digitally Connected By 2020...

Title: FIRST BIO-PAY BY HAND STORE OPENS UP IN SOUTH KOREA(RFID AKA MARK OF TE BEAST)

Video posted 27 May 2017 by GmsYaibataza Yachaazaqahla

After you read the source documents for the globalization script (from influential institutions such as: CFR, BIS, OECD, IMF, et al.), their deceptive plans are in full focus and are totally contrary to the mass media promotional narrative.

A few of the scripted and engineered products/events are:

- Digital finance to micro, small, and midsize businesses in emerging economies that lack access to savings and credit.

- BEPS (base erosion and profit shifting) aka, Global Taxation - have you ever heard of taxation without representation?

- Banks adopt "approved" virtual currencies, aka cryptocurrencies or digital tokens.

- Delivering financial services by mobile phone - recall the G20 vowed to have all citizens digitally connected by 2020.

- Digital finance for all: Powering inclusive growth in emerging economies.

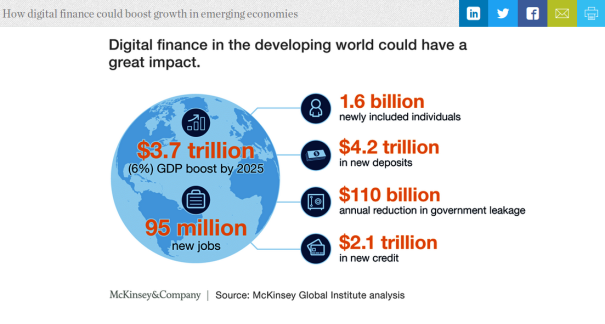

- Digital finance could provide access to 1.6 billion unbanked people, more than half of them women and a wider pool of borrowers.

- "Lower-income countries such as Ethiopia, India, and Nigeria have the largest potential, with the opportunity to add 10 to 12 percent to their GDP, given low levels of financial inclusion and digital payments today."

- Providers of financial services would save $400 billion annually in direct costs by shifting from traditional to digital accounts, which can be 80 to 90 % less expensive to service.

- Call these necessary REFORMS...

- Governments could gain $110 billion per year by reducing leakage in public spending and tax collection. Imagine 100% Tax Compliance!

- Capture Regulators: "policy makers should continue refining regulation and supervision of financial markets." (i.e. prompt reaction to dynamic markets; "new tools for managing volatility in capital flows and in reducing capital- and financial- account imbalances are needed"; "in the eurozone, further development of the banking union and establishment of a capital markets union is warranted and could help promote a return to growing intraregional investments."

- "Continued innovation in digital technologies requires favorable regulatory climate to allow experimentation, but also could create new market dynamics and risks."

Video was posted 28 May 2010

Do You Remember India's Demonetization Policy?

A very interesting read is from the website of Norbert Häring: Indian ministers and CEOs flock to the US to report to the digital colonizers March 5, 2017 - I'll share a few excerpts, but encourage you to read the full post.

Developing counties run by authoritarian governments under weak legal restraints are great places to try out disruptive technological plans for changing the social landscape. As Bill Gates said in 2015 at the “Financial Inclusion Forum” in Washington, countries like India can transit to full digitalization of the economy faster than the USA, inter alia, because there are much less restrictions from legal mandates to protect people’s privacy and data.

“Notebandi”, the sudden banning of banknotes representing over 80 percent of Indian cash in circulation, which happened in November 2016, was such a disruption on the way to full digitalization, which could not possibly have taken place in the US, but in India it could.

...

In the words of the organizers of the MIT-conference, the speakers will “explore disruptive innovations ideas and practical solutions adopted by different entities - government, big corporations and emerging start-ups - to empower the country with increased access to different technologies, services and information to make the vision of Digital India a reality.”

It is a vision that has been expressed long before Narendra Modi came to power in Washingtonian IT and national security circles.

§

It is NOT an Accident, It Is Policy

Title: RFID hand implants: 3,000 Swedish commuters are using microchips to pay for tickets - TomoNews

Video posted 17 Sep 2017 by TomoNews US

Title: NFC Chip Implant Bitcoin Payments in Paralelni Polis

Video posted 31 Jan 2016 by Jan Hubík

A.I. & the Digital Economy: VR & the Blockchain

This is all related and engineered within the globalization script.

Consider cultural engineering, human experimentation, wars, climate manipulation (aka, geoengineering and terraforming) and Full-spectrum dominance.

With unlimited capital (the central bank cartel create as much money as they require) they fund abominable experiments, regional development, massive secret projects and operations – yet refuse to abolish starvation/malnutrition and homelessness. Indeed, policy makers in think tanks and institutions are scripting and engineering civilization.

Read about 7 Human Organs on One Chip…

Organs on chips: The DARPA-backed project mimicking the human body on a tiny scale

The Wyss Institute at Harvard is creating miniaturised versions of human organs

If you are not at least a bit concerned about what is happening, you are ‘not’ paying attention.

TED Talk “What would happen if we uploaded [human] brains to computers?” by Robin Hanson:

The Human Emulates of Ems are poised to become the bane of humanity in the very near future.

An Economist and social scientist Robert Hanson outlines his analysis of Ems in his TED talk titled, ‘What would happen if we upload our brains to computers?’

His projection of what’s to come sounds eerily similar to the familiar prophecies of an image of the beast, and mark of the beast, surrounded by the number of a man 666.