INTRODUCTION

The importance of security all around the world cannot be overemphasized. A safe and secured environment breeds peace, success, innovations and all positive things. The same can be likened in the blockchain and cryptocurrency environment. Every crypto investor puts security as a foremost consideration. Most crypto exchangers are prone to cyber hacks both internally and externally. Various security measures have been sorted in place to mitigate these threats, but to some extent, these measures have not been enough to put a stop to the threat plaguing the cryptocurrency world.

It is to this concern that the DAEX foundation devised the DAEX solution poised to eliminate all issues of security threats that cryptocurrency investors go through in their transactions.

To bring forth these blockchain solutions, it was paramount for the DAEX to indepthly scrutinize and analyze the current clearing problems faced by exchangers and platforms.

Some of the issues raised by the DAEX foundation included:

• Most exchanges, especially centralized, withholds the assets of their customers, and this make them open and vulnerable to attacks and hacks both internally and externally.

• Exchanges make use of man-power which leaves transactions susceptible to human errors.

• Centralized models and devices does not 100% guarantee security.

• Due to the fact that exchanges make use of human effort, the mechanisms and methods will surely have some level of bias and partiality, which does not sit well for investors.

The issues mentioned above are definitely avoidable and solutions are what is being initiated by DAEX. DAEX aims to use all the advantages of the distributed ledger technology to create and promote a flexible and adaptable infrastructure that brings a halt to all insecurities in the crypto currency trading industry.

Hence the clearing includes the way towards arranging, negotiating, exchanging and trading esteems in light of market and prearranged principles and convention, the DAEX clearing arrangement at that point assumes responsibility of the unified clearing administrations so as to ensure sheltered and redress transactions, in other words the centralized trades gives their exchanging administrations while the DAEX arrangement fills in as a clearing specialist or record administrator that effectively clear and settles a clients exchange utilizing the DAEX dispersed record.

DAEX mission

To separate clearing and trading into individual entities, it also makes multi-asset wallets for companies and traders.

DAEX goal

The aim of DAEX is to alleviate centralized exchange responsibilities by providing them with identity authentication, asset registration, asset clearing and asset settlement services.

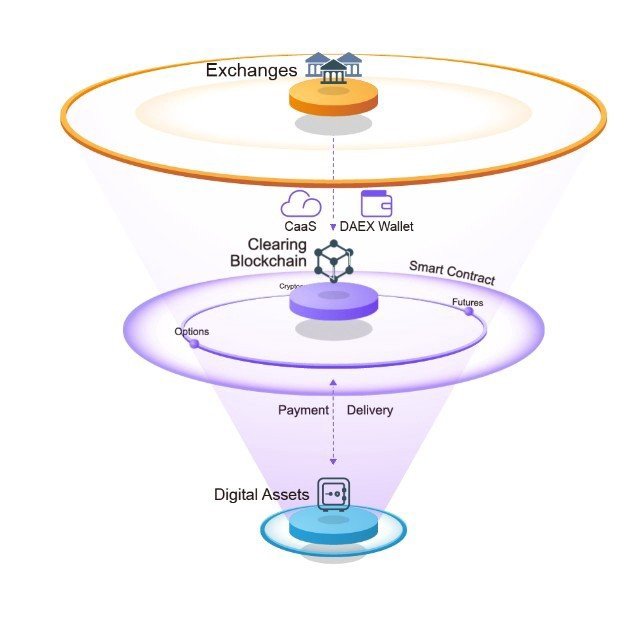

DAEX ECOSYSTEM

DAEX consists of clearing services based on ledger technology that is distributed and centralized

Aman - A joint custodian organization for all assets registered in the DAEX ecosystem. Multi-level encryption mechanism for DAEX Wallet.

Transparent - A public clearing network that allows transparent accounting information. Allows everyone to witness and share the benefits of the DAEX clearing ecosystem.

Open - Open an ecosystem that supports trade and clears infrastructure that supports derivative businesses in the future.

Security Issues

Hacking is still common in some exchange companies. This is difficult to avoid because of the lack of additional security on each platform. After hacking often occurs, many exchanges must reach consensus that general clearing and asset custodial services are needed to protect markets and ensure sustainable market growth. The rapid development of cryptocurrency trading requires a more effective and safer clearing service. Therefore DAEX is the answer to the needs of this market.

Profit

- Securing

Participating exchanges must meet the business and technological requirements of the ecosystem, so that the quality of trade services is maintained. All assets are owned by blockchain. Assets cannot be moved without user permission. Multi-part private keys better protect user assets and also a safe recovery mechanism if the user loses his private key. Smart contracts and blockchain technology guarantee the truth of clearing and settlement. - Trust

Decoupling between trading and clearing is the best way to ensure the security of a customer's trading assets. Insurance funds donated by participating exchanges provide another layer of security. The DAEX ecosystem provides a trustworthy environment for exchanges and traders. - Open

First of all, the DAEX ecosystem is open and welcomes new exchanges. Exchange that participates in the DAEX ecosystem can use all products and services provided by DAEX, including wallets and clearing. Second, participating exchanges can expect to use more DAEX value-added services to be provided, including cryptocurrency derivative trading.

Characteristics of DAEX

- Safe - Joint custodial organization for all registered assets in the DAEX ecosystem. Multi-level encryption mechanism for DAEX Wallet.

- Transparent - A public clearing network that allows transparent accounting information. Allowing everyone to witness and share the benefits of the DAEX clearing ecosystem.

- Open - Open ecosystems support trade and clean up infrastructure that supports derivative businesses in the future.

Centralized exchange has a long history of being the main target for hacking groups. It seems like a weekly event where thieves can access and steal funds from these entities, with stolen amounts ranging from hundreds of millions of dollars.

Similar to a bank, this centralized entity has complete control over funds when a trader makes a deposit on the exchange. They also act as clearing houses that provide order matching, clearing and settlement services. With this infrastructure, traders must fully trust the exchange to not only keep their assets safely from external and internal threats, but also facilitate the trade that occurs. The hot wallet they use to store their customer's digital assets allows hacking.

DAEX wallet

supports many assets, which are accessed using multi-segment keys. Double encryption makes your wallet safe and protected. End users have complete control and ownership of their assets.

DAEX CLEARING CHAIN

is the core product of the DAEX ecosystem. This provides individual institutions and customers with integrated clearing and settlement services using distributed ledger technology.

DAEX FUND

Support investment in currency and wallet exchange, cross-chain solutions and asset management projects.

TOKEN

Token used on the ecosystem is known as DAX. They are built on the ERC20 smart contract and help to facilitate cooperation among the different parts of the Daex ecosystem. The tokens would serve as a form of reward for opening an account on Daex platform, for inviting others to participate and for actual participation by utilizing the clearing services during trading. They would also serve as means of payment of clearing and settlement fee.

The DAX tokens are current being traded on:

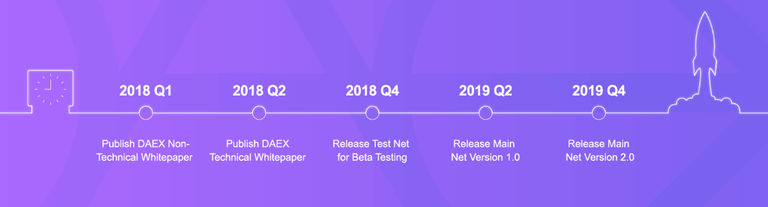

ROADMAP

TEAM

BENJAMIN GU - Foundation Chairman

Benjamin has extensive experience in Chinese and US financial service and enterprise software companies. He worked at Hua Tai United Securities for more than 5 years as associate CIO, where he was responsible for building industry-leading investment bank support systems. At Options Clearing Corporation, he worked directly on the development and operation of ENCORE—the system used in the US for options clearing. He holds an MBA from the University of Texas in Austin, an MA degree from the University of Notre Dame and is a master graduate from the University of Science and Technology of China.

HANA ZHANG - Co-Founder

Hana Zhang is an investor of several exchange platforms and is an initial member of IDEL (International Digital Economic League). After being a successful entrepreneur in blockchain and digital assets since 2014, Hana is regarded as an opinion leader in blockchain applications and technology development for digital assets trading. She worked as a strategic consultant for multiple fortune 500 enterprises such as A.T. Kearney, Dun & Bradstreet and Euromonitor International, where she engaged in consulting work for the fields of finance, payment and engineering.

LOIS SHEN - COO

Lois has several years of experience in business development and marketing roles for Fintech and SaaS enterprises. She is a former senior business development manager at Tencent, where she won the award of “Most Outstanding Employee” in 2014. In this role, she was responsible for forming strategic partnerships for WeChat Pay/TenPay with other Fintech enterprises. She has also helped several Fintech clients enter the App Store with a top 10 ranking.

JASON TANG - Chief Architect

Mr. Tang has been focusing on Fintech products design and application research for years, with landing products ranging from blockchain, machine learning, knowledge graph to Robo-Advisor. He used to work for the State Street Bank of the United States and served several central bank customers including MAS, BOK and HKMA. Later he worked for CZBANK (China Zheshang Bank) as a product manager in its Fintech Application Research Center and took charge of the first blockchain project which applied to the core system in domestic commercial banks, and the first enterprise account receivables platform based on the blockchain technology. Up till now, he owns two patents in blockchain.

STONE ZHOU - Wallet Architecture Scientist

Mr. Stone Zhou has more than 10 years of internet project management and development experience. He has a full stack development background and is a wallet architecture expert for digital assets.

PARTNERS

CONCLUDE

DAEX solution brings about many advantages for any player in the cryptocurrency industry. This distributed ledger technology-based system assists digital asset users not only in lowering transaction costs an accelerating transaction speed but also increasing security and transparency level. Generally, it effectively removes trader’s asset risks in currently centralized exchanges.

Website | Whitepaper | ANN Thread | Telegram

Author: Dinh Van Tuyen

Bitcointalk username: dvtuyen

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=2114926